Understanding Today's Personal Loan Interest Rates: A Comprehensive Guide

Table of Contents

Factors Influencing Personal Loan Interest Rates

Several key factors influence the interest rate a lender offers on a personal loan. Lenders assess these factors to determine your creditworthiness and the risk associated with lending you money. A higher perceived risk translates to a higher interest rate.

Credit Score: The Cornerstone of Your Interest Rate

Your credit score is arguably the most significant factor influencing your personal loan interest rate. Lenders use your credit score, a three-digit number reflecting your credit history, to assess your reliability in repaying borrowed funds. A higher credit score indicates lower risk, resulting in more favorable interest rates.

- 750+ Credit Score: You're likely to qualify for the lowest interest rates available, often in the range of 6-10% APR.

- 600-699 Credit Score: Expect higher interest rates, potentially ranging from 10-25% APR, depending on other factors.

- Below 600 Credit Score: Securing a personal loan might be challenging, and the interest rates, if approved, will likely be significantly higher, possibly exceeding 25% APR.

Ways to improve your credit score before applying:

- Pay all bills on time.

- Keep credit utilization low (ideally under 30%).

- Maintain a diverse mix of credit accounts.

- Dispute any credit report errors.

Free credit score checking services like Credit Karma and AnnualCreditReport.com can help you monitor your progress.

Loan Amount and Term: The Size and Duration Matter

The amount you borrow and the length of your repayment term also impact your interest rate. Generally:

- Larger loan amounts: Often come with slightly higher interest rates due to increased risk for the lender.

- Longer loan terms: While resulting in lower monthly payments, they usually lead to higher overall interest paid because you're borrowing the money for a longer period.

Examples:

- A $5,000 loan over 2 years might have a lower interest rate than a $20,000 loan over 5 years.

- A 36-month loan will generally have a higher interest rate than a 12-month loan for the same amount.

Debt-to-Income Ratio (DTI): Balancing Your Income and Debt

Your debt-to-income ratio (DTI) represents the percentage of your gross monthly income that goes toward debt payments. A high DTI indicates a greater financial burden, making lenders hesitant to offer favorable rates.

Tips for improving your DTI:

- Reduce existing debt.

- Increase your income.

- Consolidate high-interest debt.

Lender Type: Banks, Credit Unions, and Online Lenders

Different lenders offer varying interest rates.

- Banks: Often have competitive rates but may have stricter requirements.

- Credit Unions: May offer lower rates to their members due to their not-for-profit nature.

- Online Lenders: Can offer convenient applications and potentially competitive rates, but always thoroughly research their legitimacy and fees.

How to Find the Best Personal Loan Interest Rates

Securing the best personal loan interest rate requires proactive research and comparison shopping.

Shop Around and Compare: The Power of Comparison

Don't settle for the first offer you receive. Compare offers from multiple lenders.

Reputable online loan comparison websites:

- NerdWallet

- Bankrate

- LendingTree

Using a loan broker can also simplify the process, though they may charge a fee.

Negotiate with Lenders: Don't Be Afraid to Ask

Don't hesitate to negotiate with lenders, especially if you have a strong credit score and other desirable characteristics. Highlight your positive financial history and express your willingness to consider different loan terms.

Check for Fees and Charges: Avoid Hidden Costs

Be wary of hidden fees, which can significantly impact your loan's overall cost.

Common fees to watch for:

- Origination fees

- Prepayment penalties

- Late payment fees

Understanding APR and Other Key Terms

Understanding key terms is crucial for comparing loan offers effectively.

-

Annual Percentage Rate (APR): The APR reflects the total annual cost of your loan, including interest and fees. It's the most important factor to compare when evaluating loan offers.

-

Fixed vs. Variable Interest Rates: Fixed rates remain constant throughout the loan term, while variable rates fluctuate with market conditions.

-

Loan Amortization: A schedule detailing your monthly payments, interest paid, and principal reduction over the loan's life.

Example: A $10,000 loan with a 10% APR over 3 years will cost you significantly more in total than the same loan with a 5% APR.

Current Market Trends in Personal Loan Interest Rates

Current personal loan interest rates are heavily influenced by prevailing economic conditions, such as inflation and the Federal Reserve's monetary policy. Keep an eye on financial news sources for up-to-date information and trends.

Conclusion

Securing the best personal loan interest rates involves understanding the key factors influencing rates, actively comparing offers from multiple lenders, and negotiating effectively. By carefully considering your credit score, debt-to-income ratio, and loan terms, and by being aware of hidden fees, you can significantly reduce the overall cost of borrowing. Start your search for the best personal loan interest rates today! Understanding your personal loan interest rate is crucial – compare offers now! Remember, careful consideration before taking out a personal loan is essential for responsible financial management.

Featured Posts

-

Wes Andersons Cinematic Worlds New Exhibition At The Design Museum

May 28, 2025

Wes Andersons Cinematic Worlds New Exhibition At The Design Museum

May 28, 2025 -

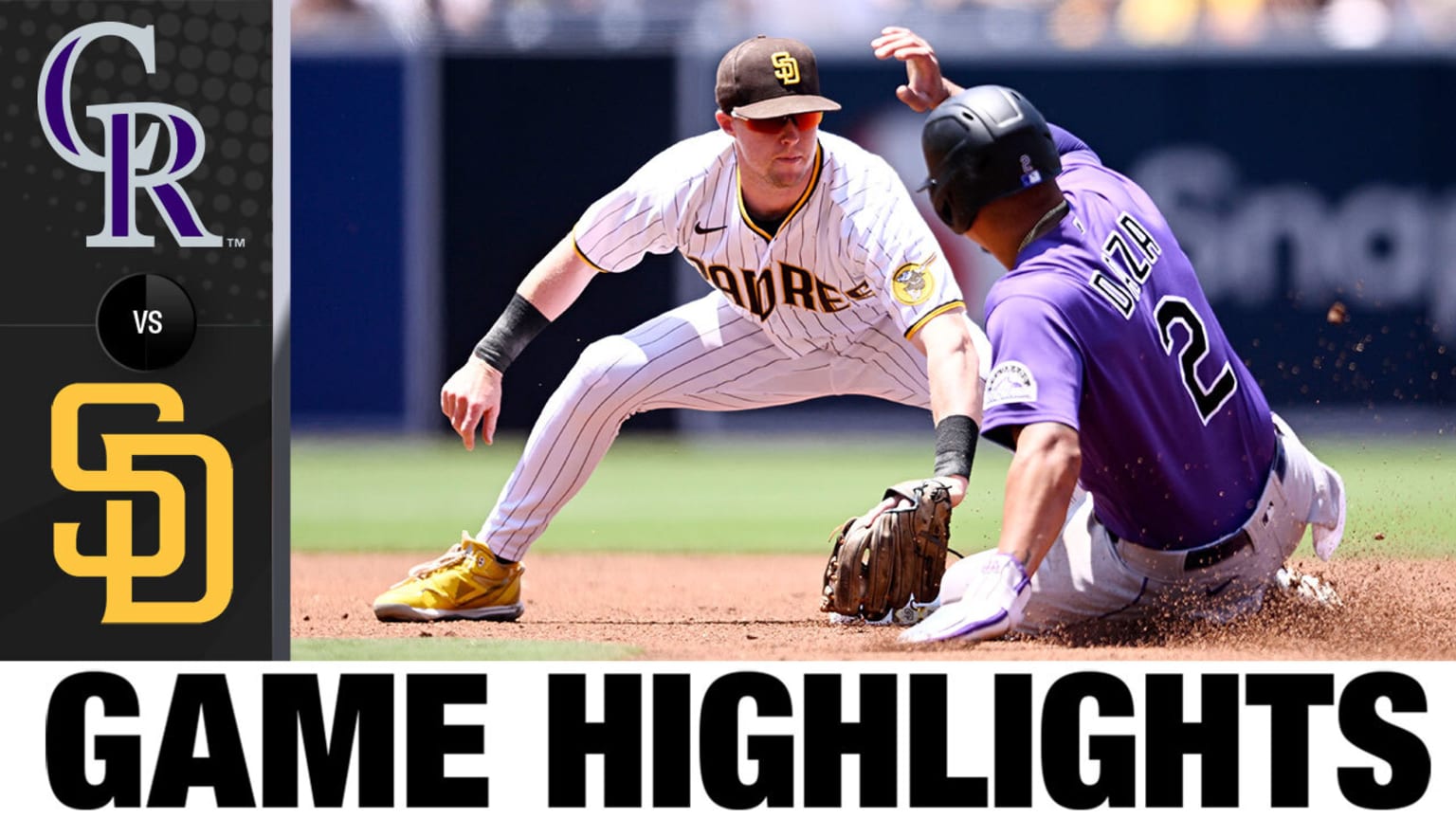

Padres Aim To Dominate Rockies In Upcoming Games

May 28, 2025

Padres Aim To Dominate Rockies In Upcoming Games

May 28, 2025 -

Liburan Ke Bali Jangan Lewatkan 8 Oleh Oleh Kuliner Unik Ini

May 28, 2025

Liburan Ke Bali Jangan Lewatkan 8 Oleh Oleh Kuliner Unik Ini

May 28, 2025 -

Minister Signals Possible Changes To Affordable Rent Protection Schemes

May 28, 2025

Minister Signals Possible Changes To Affordable Rent Protection Schemes

May 28, 2025 -

Assessing The Blue Jays Trade Vlad Jr S Performance And Future

May 28, 2025

Assessing The Blue Jays Trade Vlad Jr S Performance And Future

May 28, 2025