Unfolding Bond Crisis: A Deeper Look At The Risks

Table of Contents

Rising Interest Rates and Their Impact

Rising interest rates are a primary driver of the current bond market anxieties. This has a significant impact on both existing and future bond investments.

Eroding Bond Values

Rising interest rates directly impact existing bond prices. Newly issued bonds offer higher yields, making older bonds with lower coupon rates less attractive, leading to decreased value. This inverse relationship between interest rates and bond prices is a fundamental principle of fixed-income investing.

- Inverse relationship between interest rates and bond prices: When interest rates rise, the value of existing bonds falls, and vice versa.

- Impact on fixed-income portfolios: Investors holding fixed-income portfolios are particularly vulnerable to interest rate increases, potentially experiencing significant capital losses.

- Strategies for mitigating interest rate risk: Several strategies can help mitigate this risk, including:

- Laddering: Investing in bonds with varying maturities to reduce exposure to interest rate fluctuations.

- Shorter-term bonds: Opting for shorter-term bonds reduces the duration of the investment and limits the impact of rising rates.

- Interest rate swaps: Utilizing derivative instruments like interest rate swaps to hedge against interest rate risk.

Increased Borrowing Costs

Higher rates increase the cost of borrowing for governments and corporations. This impacts economic growth and increases the risk of defaults.

- Implications for government budgets: Governments may face increased difficulty servicing their debt, potentially leading to austerity measures or further borrowing, exacerbating the situation.

- Impact on corporate investment and expansion plans: Higher borrowing costs can stifle corporate investment and expansion, slowing economic growth and potentially increasing unemployment.

- Potential for increased bankruptcies: Companies with high debt loads may struggle to meet their obligations, leading to an increase in bankruptcies.

Inflationary Pressures and Their Role

Persistent inflation significantly impacts bond investments, eroding their real returns and adding to the unfolding bond crisis.

Reduced Purchasing Power

High inflation erodes the real return on bond investments. The fixed income generated is outpaced by rising prices, diminishing the investment's purchasing power.

- Impact of inflation on bond yields: Investors demand higher yields to compensate for inflation, putting upward pressure on interest rates.

- Real vs. nominal returns: It's crucial to differentiate between nominal returns (the stated return) and real returns (nominal returns adjusted for inflation). Real returns reflect the actual increase in purchasing power.

- Strategies for inflation hedging: Investors can employ strategies to hedge against inflation, including:

- TIPS (Treasury Inflation-Protected Securities): These bonds adjust their principal value based on inflation, protecting investors from purchasing power erosion.

- Inflation-linked bonds: Similar to TIPS, these bonds offer returns that are linked to an inflation index.

Central Bank Response and its Uncertainties

Central bank actions to combat inflation, such as raising interest rates, can inadvertently trigger a bond market crisis, increasing economic uncertainty.

- The delicate balance between inflation control and economic stability: Central banks face the challenging task of controlling inflation without triggering a recession.

- The potential for unintended consequences of monetary policy: Raising interest rates too aggressively can lead to a sharp economic slowdown or even a recession.

- The role of quantitative tightening (QT): The reduction of central bank balance sheets through QT can also exert downward pressure on bond prices.

Geopolitical Instability and its Influence

Geopolitical instability significantly influences the bond market, increasing volatility and investor uncertainty, thereby contributing to the bond crisis.

Global Uncertainty and its Impact on Bond Markets

Geopolitical events, such as wars and trade disputes, increase market volatility and negatively impact investor sentiment, leading to bond sell-offs.

- Impact of geopolitical risks on risk premiums: Investors demand higher returns (risk premiums) to compensate for increased uncertainty, pushing bond yields higher.

- Flight to safety and its effects on bond markets: During times of geopolitical uncertainty, investors often flee to safer assets like government bonds, potentially distorting market prices.

- Diversification strategies to manage geopolitical risk: Diversifying across different bond markets and asset classes can help mitigate geopolitical risk.

Sovereign Debt Concerns

Geopolitical tensions can exacerbate existing sovereign debt concerns, potentially leading to increased borrowing costs and defaults for vulnerable nations.

- Assessing the creditworthiness of sovereign bonds: Investors must carefully assess the creditworthiness of sovereign bonds, considering factors such as the country's economic stability and political risks.

- The impact of sanctions on bond markets: Sanctions imposed on certain countries can significantly impact their ability to service their debt, potentially leading to defaults.

- The role of international organizations in managing sovereign debt crises: International organizations like the IMF play a crucial role in providing financial assistance and restructuring debt for struggling nations.

Conclusion

The unfolding bond crisis presents significant risks to investors and the global economy. Rising interest rates, persistent inflation, and geopolitical uncertainties are creating a complex and challenging environment. Understanding these interconnected risks is crucial for effective portfolio management and navigating the potential volatility ahead. By carefully considering interest rate sensitivity, inflation hedging strategies, and geopolitical factors, investors can better protect their investments and mitigate the potential impact of this unfolding bond crisis. Proactive monitoring and diversification remain key strategies to manage your exposure to the evolving bond crisis. Stay informed and adapt your investment strategies to navigate this challenging market environment.

Featured Posts

-

Offre Limitee Galaxy S25 Ultra 256 Go A 1196 50 E Vente Flash

May 28, 2025

Offre Limitee Galaxy S25 Ultra 256 Go A 1196 50 E Vente Flash

May 28, 2025 -

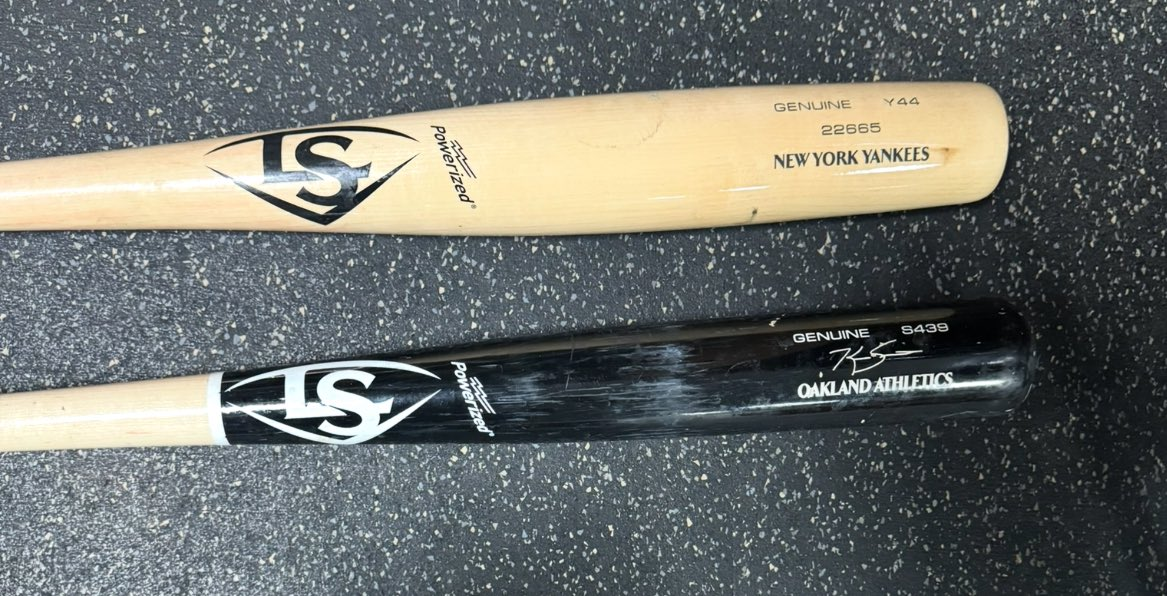

Marlins And Torpedo Bats A Growing Trend

May 28, 2025

Marlins And Torpedo Bats A Growing Trend

May 28, 2025 -

Happy 6th Birthday Psalm West A Look At Kim Kardashians Sons Celebration

May 28, 2025

Happy 6th Birthday Psalm West A Look At Kim Kardashians Sons Celebration

May 28, 2025 -

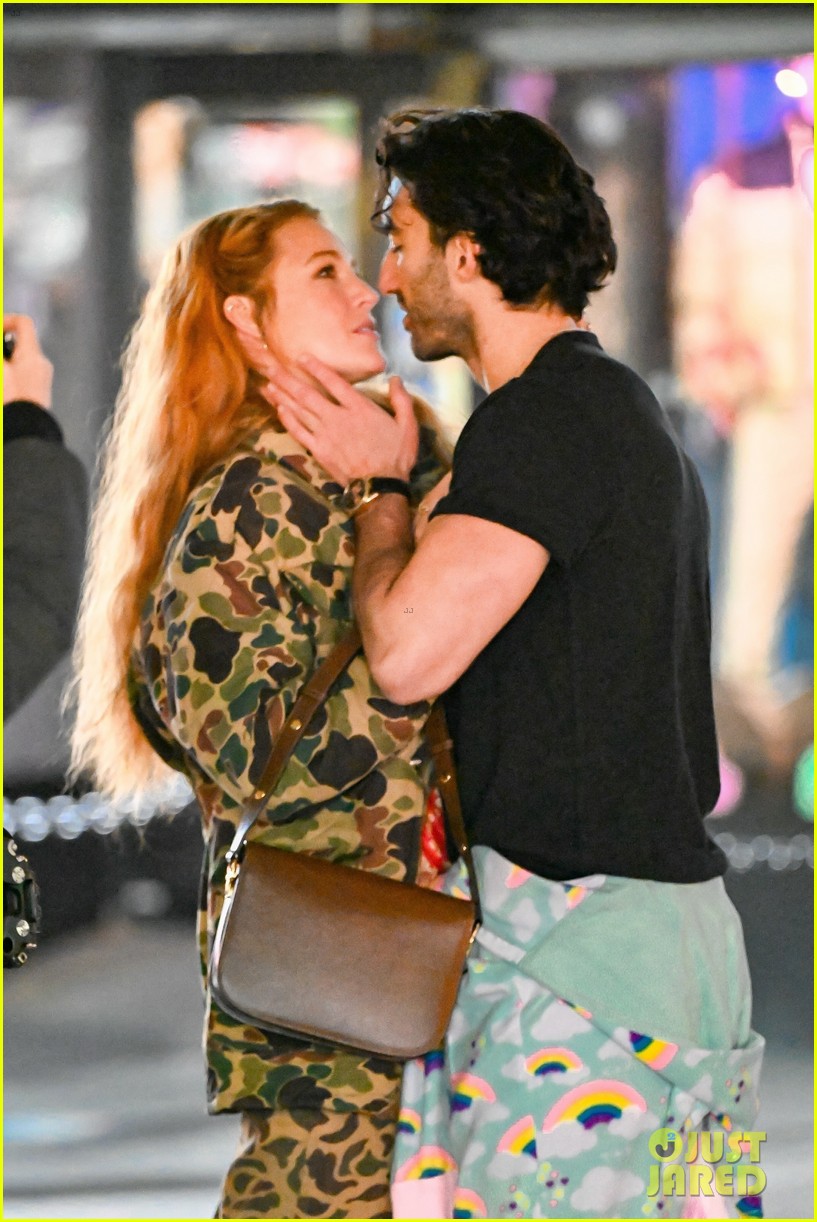

Blake Lively Justin Baldoni And A Third A Lister The Expanding Legal Saga

May 28, 2025

Blake Lively Justin Baldoni And A Third A Lister The Expanding Legal Saga

May 28, 2025 -

Gyoekeres Atigazolas Az Arsenalhoz Teljesitmenymutatok Es Elemzes

May 28, 2025

Gyoekeres Atigazolas Az Arsenalhoz Teljesitmenymutatok Es Elemzes

May 28, 2025