Up 40% In 2025? Evaluating The Investment Opportunity In Palantir Stock

Table of Contents

Palantir's Business Model and Competitive Advantage

Palantir Technologies, Inc. is a data analytics company offering two core platforms: Gotham, primarily targeting government clients, and Foundry, focused on commercial clients. Its business model revolves around providing sophisticated data integration and analytics capabilities to help organizations make better decisions. Palantir's competitive advantage stems from its proprietary technology, which allows for seamless integration of disparate data sources, and its ability to extract meaningful insights from complex datasets. This positions Palantir as a leader in the big data analytics space.

- Strong government contracts and revenue stream: Palantir enjoys significant revenue from long-term contracts with various government agencies, providing a stable foundation for its business.

- Expanding commercial clientele and market penetration: Palantir is actively expanding its commercial footprint, targeting various industries like finance, healthcare, and energy. Increased market penetration in the commercial sector is key to future growth.

- Proprietary technology and data integration capabilities: Palantir's unique technology gives it an edge over competitors, offering superior data integration and analytics solutions.

- Potential for growth in emerging technologies (AI, IoT): Palantir is well-positioned to leverage advancements in artificial intelligence and the Internet of Things to further enhance its offerings and expand into new markets.

Analyzing Palantir's Financial Performance and Growth Prospects

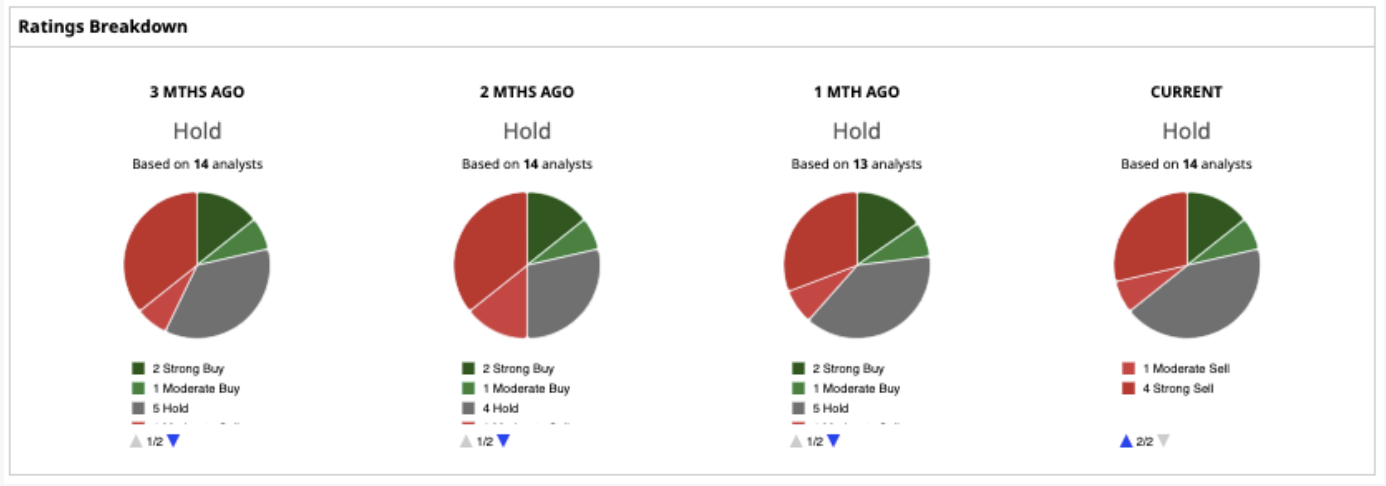

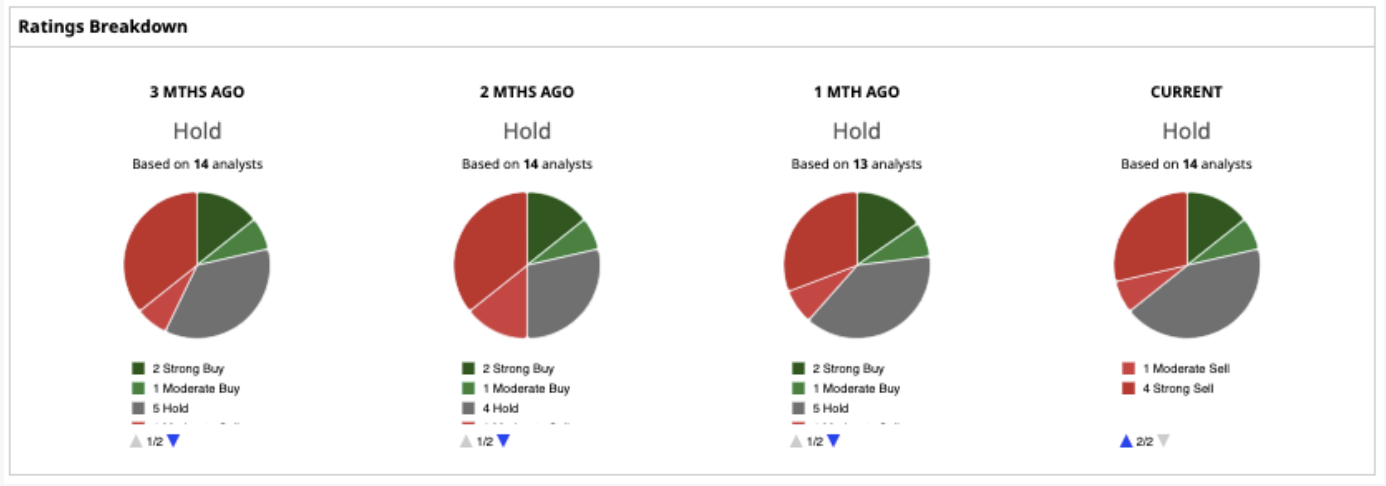

Examining Palantir's recent financial reports reveals a company with significant growth potential, although profitability remains a key focus. Investors should carefully analyze revenue growth, profit margins, and cash flow trends. Key financial metrics such as the P/E ratio and revenue growth rate provide insights into its valuation and future performance. Analyzing historical stock price performance and reviewing analyst predictions and ratings adds further perspective.

- Current market capitalization and valuation: Understanding Palantir's current market cap is essential for assessing its valuation relative to its peers and future growth expectations.

- Historical stock price performance: Studying the past performance of Palantir stock helps to understand its volatility and identify potential trends.

- Analyst predictions and ratings: Consulting analyst reports provides valuable insights into expert opinions and future forecasts for Palantir's stock performance.

- Factors influencing future financial performance: New contract wins, successful product launches, and technological advancements are significant factors influencing Palantir’s financial performance.

Assessing the Risks Associated with Investing in Palantir Stock

While Palantir presents exciting growth potential, investors must acknowledge several inherent risks before investing in Palantir stock. These risks need to be carefully evaluated to make an informed decision.

- Competition from established tech giants: Palantir faces competition from larger, more established companies in the data analytics market.

- Concerns regarding data privacy and security: Given the sensitive nature of the data Palantir handles, data privacy and security are paramount concerns.

- Potential for fluctuations in government spending: Palantir's reliance on government contracts makes it susceptible to fluctuations in government spending.

- Dependence on a small number of large clients: Concentration of revenue from a few key clients increases the risk of significant financial impact if these relationships are disrupted.

Comparing Palantir to Competitors in the Data Analytics Market

Palantir competes with several established players in the data analytics market, including Databricks, Snowflake, and Tableau. Each has its own strengths, weaknesses, and market share. Understanding Palantir's competitive positioning is crucial for assessing its long-term prospects. Analyzing future market trends and their potential impact on Palantir is also critical.

- Market share comparison: Comparing Palantir's market share to its competitors provides context for understanding its current position and future growth potential.

- Competitive advantages and disadvantages: Identifying Palantir's unique selling points and comparing them to its competitors’ strengths and weaknesses is crucial for a thorough analysis.

- Future market trends and their impact on Palantir: Analyzing emerging trends in the data analytics market, such as the increasing adoption of AI and cloud-based solutions, is vital for assessing Palantir's future prospects.

Developing an Investment Strategy for Palantir Stock

Investing in Palantir stock requires a well-defined strategy. This strategy should be tailored to individual risk tolerance and investment goals. Consider both long-term and short-term investment approaches.

- Diversification strategies: Diversifying your portfolio to reduce risk is a fundamental aspect of any investment strategy.

- Dollar-cost averaging: Investing a fixed amount at regular intervals can help mitigate the risk associated with market volatility.

- Setting realistic expectations for returns: It's important to set realistic expectations for potential returns when investing in Palantir stock.

- Importance of thorough due diligence: Before investing, conduct thorough research, considering all aspects of the company, its market, and its potential risks.

Conclusion: Is Palantir Stock a Worthwhile Investment?

This analysis reveals that Palantir stock presents a compelling investment opportunity, with significant growth potential driven by its innovative technology and expanding market reach. However, the potential for a 40% increase in 2025 is subject to various market factors and inherent business risks. The company's dependence on government contracts and competition from established tech giants are key considerations.

While the possibility of Palantir stock reaching a 40% increase by 2025 is exciting, remember to thoroughly investigate before investing. Assess your risk tolerance and conduct your own due diligence to determine if Palantir fits your investment strategy. Careful consideration of the potential rewards and the inherent risks is essential before making any investment decisions regarding Palantir stock.

Featured Posts

-

Stephen King On Stranger Things The It Connection

May 10, 2025

Stephen King On Stranger Things The It Connection

May 10, 2025 -

Soyuzniki Ukrainy I 9 Maya Kto Priedet V Kiev A Kto Net

May 10, 2025

Soyuzniki Ukrainy I 9 Maya Kto Priedet V Kiev A Kto Net

May 10, 2025 -

Stock Market Update Sensex Nifty 50 Close Flat Despite Bajaj Twin Losses

May 10, 2025

Stock Market Update Sensex Nifty 50 Close Flat Despite Bajaj Twin Losses

May 10, 2025 -

Deutsche Bank Bolsters Defense Finance Expertise With Dedicated Team

May 10, 2025

Deutsche Bank Bolsters Defense Finance Expertise With Dedicated Team

May 10, 2025 -

John Roberts Mistaken Identity Incident With Gop Leader

May 10, 2025

John Roberts Mistaken Identity Incident With Gop Leader

May 10, 2025