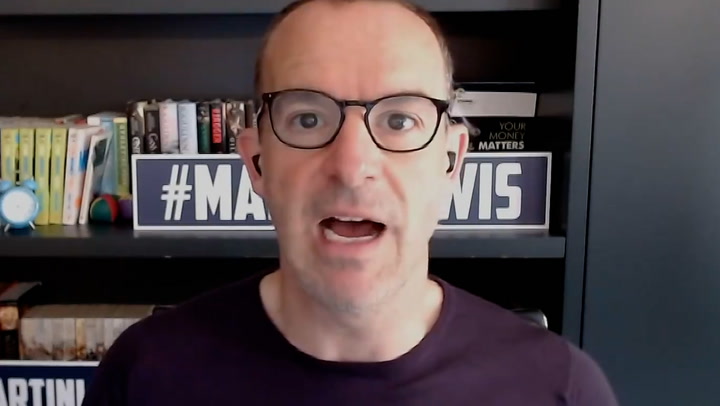

Urgent HMRC Child Benefit Update: Important Messages To Act On

Table of Contents

Changes to Child Benefit Eligibility Criteria

HMRC has recently implemented several changes to the eligibility criteria for Child Benefit. Understanding these alterations is crucial to ensuring you remain eligible for this vital financial support. These changes impact income thresholds, residency requirements, and the definition of a "qualifying child."

- Increased Income Thresholds: The income threshold at which the High Income Child Benefit Charge applies may have increased. This means that higher-earning families might now be subject to this charge, where a portion of the Child Benefit received is clawed back through the tax system. It's essential to check the updated thresholds on the HMRC website to determine your eligibility.

- New Residency Requirements: New or stricter residency requirements may have been introduced. You may need to provide additional documentation to prove your ongoing residency in the UK. This might involve providing updated proof of address or other supporting evidence.

- Changes in the Definition of a "Qualifying Child": The definition of a "qualifying child" might have been adjusted. This could affect children who previously qualified but may no longer meet the updated criteria. Carefully review the updated guidelines on the official HMRC website to ensure your children still qualify.

For verified information and the latest details, please refer to the official HMRC website: [Insert Link to Relevant HMRC Page Here].

Updates to the Child Benefit Application Process

The application process for Child Benefit may have undergone modifications. Whether you're a new applicant or need to update your existing claim, understanding these changes is crucial for a smooth and efficient process.

- New Online Application Portal: HMRC might have launched a new, improved online portal for applying for or managing your Child Benefit claim. This updated portal aims to streamline the application process and make it more user-friendly.

- Required Supporting Documentation: Ensure you have all the necessary documentation readily available before starting your application. This may include payslips, birth certificates, and proof of address. Having these documents prepared will significantly speed up the process.

- Simplified Application Forms: HMRC has potentially simplified the application forms, making the process quicker and easier to complete. Familiarize yourself with the updated forms to ensure a seamless application.

For detailed instructions and access to the online application portal, visit the official HMRC website: [Insert Link to Relevant HMRC Application Page Here]

Important Tax Implications and Reporting Requirements

Changes to Child Benefit also affect your tax obligations. Accurate reporting is critical to avoid penalties. Staying informed about these changes is vital for responsible tax compliance.

- Changes to the High Income Child Benefit Charge: As mentioned earlier, the income threshold for the High Income Child Benefit Charge might have changed. Understand how these changes might impact your tax liability.

- New Deadlines for Submitting Tax Information: Be aware of any updated deadlines for submitting tax information related to your Child Benefit claim. Missing these deadlines can result in penalties.

- Penalties for Non-Compliance: Failure to comply with the updated reporting requirements can lead to penalties. Understanding your responsibilities ensures you avoid any potential financial repercussions.

Consult the HMRC website for detailed information on tax implications and reporting requirements: [Insert Link to Relevant HMRC Tax Page Here]

Contacting HMRC for Assistance and Support

If you have any questions or require assistance with your Child Benefit claim, HMRC provides various channels for support.

- HMRC Helpline Phone Number: Contact the HMRC helpline for immediate assistance. [Insert HMRC Helpline Number Here]

- Online Contact Form: Use the online contact form on the government website for non-urgent inquiries. [Insert Link to HMRC Online Contact Form Here]

- Address for Written Correspondence: For formal written communication, use the appropriate postal address. [Insert HMRC Postal Address Here]

Act Now on Your Urgent HMRC Child Benefit Update

This article highlighted crucial changes to Child Benefit eligibility, application processes, and tax implications. It's imperative to review your Child Benefit status immediately and update your information with HMRC to avoid potential disruption to your payments. Failure to act promptly could result in missed payments, delays, and penalties. Don't delay! Check your eligibility for Child Benefit today and update your information with HMRC to ensure the continued smooth processing of your payments. Visit the HMRC website ([Insert Link to Main HMRC Child Benefit Page Here]) for all the latest information and updates.

Featured Posts

-

D Wave Quantum Computing Accelerating Drug Discovery With Ai

May 20, 2025

D Wave Quantum Computing Accelerating Drug Discovery With Ai

May 20, 2025 -

Prima Poza Cu Nepotelul Lui Michael Schumacher

May 20, 2025

Prima Poza Cu Nepotelul Lui Michael Schumacher

May 20, 2025 -

Circulation 2 Roues Et 3 Roues Boulevard Fhb Interdite A Partir Du 15 Avril

May 20, 2025

Circulation 2 Roues Et 3 Roues Boulevard Fhb Interdite A Partir Du 15 Avril

May 20, 2025 -

Sasol Sol A Deep Dive Into The Updated Corporate Strategy

May 20, 2025

Sasol Sol A Deep Dive Into The Updated Corporate Strategy

May 20, 2025 -

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025