US$9 Billion Parkland Acquisition: June Shareholder Vote To Decide Fate

Table of Contents

The Proposed Parkland Acquisition: A Deep Dive

Details of the Acquisition: What companies are merging? What are the terms of the deal? What are the intended benefits?

This US$9 billion deal involves [Company A's Name] acquiring [Company B's Name, which is Parkland]. The terms include [Specific details of the acquisition agreement, e.g., a cash and stock deal, the exchange ratio, etc.]. The intended benefits include:

- Synergies: Combining the strengths of both companies, leading to [Specific examples, e.g., expanded market reach, improved operational efficiency, cost savings].

- Increased Market Share: The combined entity will hold a larger share of the [Specific market segment] market, potentially leading to increased revenue and profitability.

- Enhanced Services: Integration of services and technologies to provide a more comprehensive range of healthcare solutions to patients.

- Acquisition Price and Payment Structure: The acquisition price is US$9 billion, payable through a combination of [Specify payment method, e.g., cash and stock].

Key Players Involved: Who are the major stakeholders in this acquisition?

The key players include:

- [CEO of Company A's Name]: Driving the acquisition strategy and leading the integration process. [Link to relevant bio]

- [CEO of Parkland/Company B]: Leading Parkland's efforts during the transition. [Link to relevant bio]

- [Major Investors/Financial Institutions Involved]: [List names and links to relevant information]

The June Shareholder Vote: What to Expect

Importance of the Shareholder Vote: Why is this vote crucial for the success of the acquisition?

The shareholder vote is paramount. A majority vote is required for the acquisition to proceed. If the vote fails, the deal will collapse, potentially resulting in:

- Significant financial losses for [Company A].

- A negative impact on the share price of both companies.

- Uncertainty and disruption for employees and patients.

Arguments For and Against the Acquisition: What are the key arguments supporting and opposing the merger?

Arguments for the acquisition: Proponents highlight the potential for significant synergies, increased market share, and enhanced services, leading to long-term shareholder value. [Include supporting quotes from company statements and analyst reports].

Arguments against the acquisition: Opponents may express concerns about [potential issues, e.g., integration challenges, potential job losses, regulatory hurdles]. [Include quotes from sources opposing the deal].

Potential Outcomes of the Vote: What are the possible scenarios after the June shareholder vote?

A successful vote leads to the completion of the US$9 billion deal, integrating both companies and realizing the projected benefits. A failed vote means the deal is off, resulting in market uncertainty and potentially impacting the share price of both involved companies.

Market Analysis and Predictions

Expert Opinions: What are leading analysts predicting about the outcome of the vote?

Leading analysts are [Summarize analyst predictions, including quotes and links to reports]. The general sentiment seems to be [positive/negative/mixed], with key factors influencing the predictions being [mention key influencing factors].

Market Impact: How might the acquisition affect the broader healthcare market?

The Parkland acquisition could significantly impact the healthcare market by [Analyze potential impacts, e.g., increasing competition, altering pricing strategies, influencing innovation within the sector]. Potential regulatory hurdles and antitrust concerns also warrant attention.

Conclusion: The US$9 Billion Parkland Acquisition: What Happens Next?

The US$9 billion Parkland acquisition hinges on the crucial June shareholder vote. This decision will determine the future of both companies and have a significant impact on the healthcare market. Understanding the details of the deal, the arguments surrounding it, and the potential outcomes is vital for stakeholders and industry observers alike. Stay tuned for updates on the US$9 billion Parkland acquisition and the crucial June shareholder vote. This landmark healthcare merger will shape the future of the industry, so stay informed! [Include links to relevant resources]

Featured Posts

-

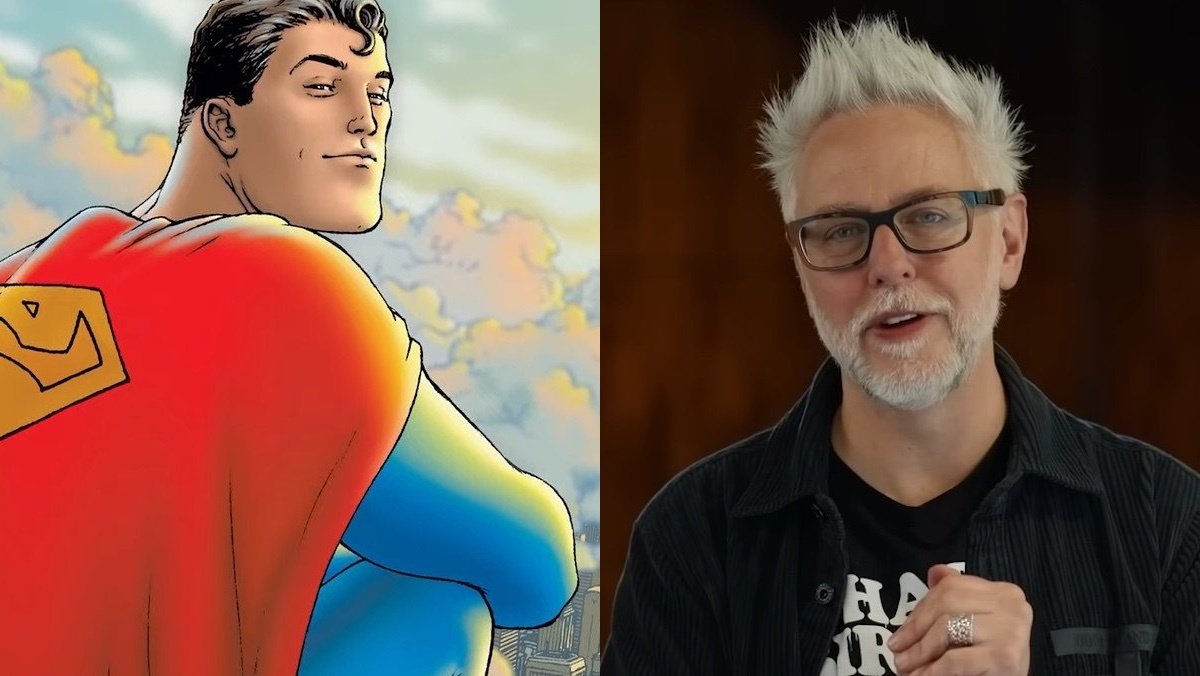

James Gunn Reveals Crucial Hawkgirl Wing Detail In Superman Movie

May 07, 2025

James Gunn Reveals Crucial Hawkgirl Wing Detail In Superman Movie

May 07, 2025 -

Zvabliva Rianna Fotosesiya U Nizhnikh Rozhevikh Tonakh

May 07, 2025

Zvabliva Rianna Fotosesiya U Nizhnikh Rozhevikh Tonakh

May 07, 2025 -

Sondaz Zaufanie Polakow Do Dzialan Trumpa Wobec Ukrainy Wyniki Zaskakuja

May 07, 2025

Sondaz Zaufanie Polakow Do Dzialan Trumpa Wobec Ukrainy Wyniki Zaskakuja

May 07, 2025 -

Zendayas Thigh High Slit Gown Turns Heads In The South Of France

May 07, 2025

Zendayas Thigh High Slit Gown Turns Heads In The South Of France

May 07, 2025 -

Wnba Free Agency Aces Gamble On Parker Tyus And Evans

May 07, 2025

Wnba Free Agency Aces Gamble On Parker Tyus And Evans

May 07, 2025