US-China Trade Talks And Their Effect On Copper Commodity Prices

Table of Contents

China's Role as a Major Copper Consumer

China's massive appetite for copper is a cornerstone of the global copper market. Its booming construction sector, rapid industrialization, and ambitious infrastructure projects, including the Belt and Road Initiative, create an enormous demand for this vital metal. Understanding China's copper consumption is crucial to comprehending price fluctuations.

- China's share of global copper consumption: China accounts for approximately half of the world's refined copper consumption, making it the undisputed king in this market. This dominance means any shift in Chinese demand directly impacts global copper prices.

- Sectors driving copper demand in China: Copper's use spans various sectors in China. Construction utilizes vast quantities for wiring, plumbing, and roofing. The manufacturing sector, particularly electronics, appliances, and automotive production, is another major consumer. Furthermore, China's ongoing investments in renewable energy infrastructure, including solar panels and wind turbines, further fuel copper demand.

- Copper imports and domestic production in China: While China is a significant copper producer, its domestic output doesn't meet its massive demand. This necessitates substantial copper imports, making the country heavily reliant on global supply chains. Any disruption to these supply chains, often caused by trade tensions, directly impacts prices. Keyword Optimization: China copper consumption, Chinese copper demand, copper imports China.

Impact of Trade Tariffs and Sanctions on Copper Prices

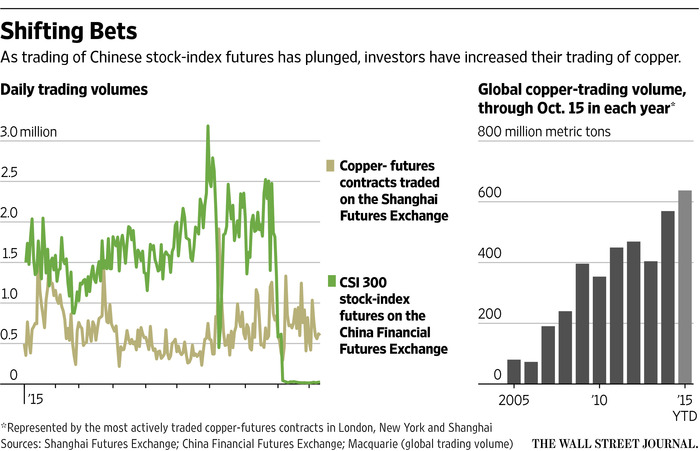

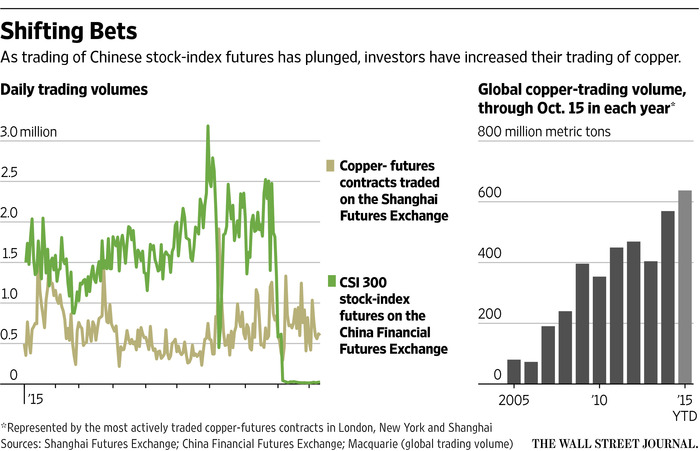

Trade disputes between the US and China introduce uncertainty and volatility into the copper market. Tariffs and sanctions significantly influence copper pricing by impacting the cost and availability of copper-containing goods and materials.

- Impact of tariffs on imported goods containing copper: Tariffs on imported goods, such as electronics and machinery containing copper, increase the final cost to consumers. This can, in turn, reduce demand and put downward pressure on copper prices, although the effects are complex and can be offset by other factors.

- Effect of sanctions on Chinese companies involved in copper production or trade: Sanctions imposed on Chinese companies involved in copper production or trade can disrupt supply chains, impacting availability and driving up prices. The uncertainty surrounding sanctions can also lead to price volatility as businesses adjust to the changing landscape.

- Uncertainty around trade policies impacts investor confidence and copper futures: The ever-shifting nature of US-China trade relations creates uncertainty for investors. This uncertainty often manifests as price volatility in copper futures markets as investors adjust their positions based on perceived risk. Keyword Optimization: copper tariffs, trade war copper prices, US-China trade impact copper, copper price volatility.

How Trade Agreements Affect Copper Supply Chains

Trade tensions between the US and China frequently lead to disruptions in global copper supply chains. These disruptions manifest in various ways, all impacting copper prices.

- Potential delays and increased costs associated with transporting copper: Trade disputes can cause delays in shipping and increase transportation costs due to sanctions, tariffs, or bureaucratic hurdles. These increased costs eventually filter down into the final price of copper.

- Trade restrictions limiting access to specific copper sources: Trade restrictions can limit access to specific copper sources or processing facilities, leading to shortages and higher prices. Diversification of supply chains becomes crucial for mitigating this risk.

- Impact on copper processing and refining facilities: Trade tensions can create uncertainty for copper processing and refining facilities, impacting their operations and leading to potential supply bottlenecks. Keyword Optimization: copper supply chain disruption, global copper trade, copper logistics, trade agreements copper.

The Role of the US in Global Copper Markets

While China dominates copper consumption, the US remains a significant player, influencing global prices through its substantial demand.

- US copper consumption in key sectors: The US consumes large quantities of copper in sectors like construction, manufacturing, and transportation. Changes in US demand can influence global copper prices.

- Interplay between US demand and global copper prices: The US's role as a significant copper consumer means that fluctuations in its demand can influence global copper prices, creating an interconnected global market.

Forecasting Copper Prices Based on Trade Relations

Predicting copper prices is challenging due to the numerous factors at play, including the dynamic US-China trade environment.

- Factors beyond trade influencing copper prices: Beyond trade relations, global economic growth, mining output, technological advancements, and even speculative investment all impact copper prices.

- Use of futures markets and economic indicators in forecasting: Copper futures markets and economic indicators like the Purchasing Managers' Index (PMI) provide insights into future copper demand and price movements. Careful analysis of these indicators is essential.

- Monitoring US-China trade negotiations for copper market insights: Closely monitoring US-China trade negotiations and related announcements is essential for making informed decisions in the copper market. Any significant shift in trade policy can trigger substantial price fluctuations. Keyword Optimization: copper price prediction, copper market forecast, copper futures trading, economic indicators copper.

Conclusion

US-China trade talks are a significant factor impacting copper commodity prices. China's dominant role as a consumer, the influence of tariffs and sanctions, and disruptions to global supply chains all contribute to copper's price volatility. Predicting copper prices requires considering multiple factors, but the trade relationship remains a critical element. Stay informed about US-China trade developments to effectively navigate the volatile copper market. Monitor trade negotiations and economic indicators to make informed decisions regarding copper investments and commodity trading. Understanding the intricate relationship between US-China trade talks and copper commodity prices is crucial for success in this dynamic market.

Featured Posts

-

Fortnite Sabrina Carpenter Event New Skins Songs And In Game Items

May 06, 2025

Fortnite Sabrina Carpenter Event New Skins Songs And In Game Items

May 06, 2025 -

Shopify Developer Program Update A New Revenue Share Structure

May 06, 2025

Shopify Developer Program Update A New Revenue Share Structure

May 06, 2025 -

Us Israel Azerbaijan Cooperation Benefits Challenges And Future Prospects

May 06, 2025

Us Israel Azerbaijan Cooperation Benefits Challenges And Future Prospects

May 06, 2025 -

Analyzing The Spike Lee X Supreme 40 Acres And A Mule Partnership

May 06, 2025

Analyzing The Spike Lee X Supreme 40 Acres And A Mule Partnership

May 06, 2025 -

Arnold Schwarzenegger Bueszke Fianak Joseph Baenanak Az Utja A Sikerhez

May 06, 2025

Arnold Schwarzenegger Bueszke Fianak Joseph Baenanak Az Utja A Sikerhez

May 06, 2025