US-China Trade Talks: Market Reaction Will Determine Success

Table of Contents

Immediate Market Volatility and Investor Sentiment

The immediate aftermath of any US-China trade agreement announcement will be a period of intense market volatility. Analyzing this volatility is crucial to understanding the market's confidence in the deal's long-term impact.

Stock Market Fluctuations

Stock markets worldwide will keenly react to news and announcements related to the trade talks. The reaction won't be uniform; different sectors will experience varied impacts.

- Short-term gains vs. long-term impact: Initial positive news might lead to short-term rallies, but sustained growth depends on the agreement's overall effectiveness.

- Sector-specific responses: The technology sector, heavily impacted by previous trade disputes, will likely show significant fluctuation. Similarly, the agricultural sector, particularly soybean and pork producers, will experience price changes based on tariff adjustments.

- Volatility indices (VIX): The VIX, a measure of market volatility, will provide valuable insights into investor anxiety and uncertainty surrounding the trade deal.

Investor confidence, the driving force behind stock market performance, will be heavily influenced by the perceived success or failure of the agreement. Positive news fostering trust will likely boost markets, while negative developments or ambiguous outcomes will trigger sell-offs.

Currency Exchange Rate Shifts

Changes in the US dollar and Chinese Yuan exchange rates are another key indicator of market sentiment.

- Impact on import/export costs: Fluctuations affect the cost of goods traded between the two nations, impacting both businesses and consumers.

- Implications for multinational corporations: Companies with operations in both countries will be particularly vulnerable to currency shifts, necessitating adjustments to their pricing and operational strategies.

- Speculation and trading strategies: Currency traders will actively speculate on the outcome of the trade talks, leading to significant short-term volatility in exchange rates.

The direction and magnitude of currency fluctuations will reflect market assessments of the long-term economic consequences of the trade agreement. A strengthening dollar relative to the Yuan might indicate confidence in the US economy’s resilience, while the opposite could suggest concerns about the long-term impact on Chinese growth.

Impact on Specific Sectors and Industries

The impact of the US-China trade talks extends beyond general market indicators, significantly affecting individual sectors.

Technology Sector's Reaction

The technology sector is particularly sensitive to trade negotiations, due to the intertwined nature of innovation and intellectual property rights.

- Impact on US tech giants operating in China: Companies like Apple, Google, and Microsoft will closely watch for changes in regulations and tariffs that could impact their operations and market share in China.

- Chinese tech companies expanding globally: The success of Chinese tech giants like Huawei and Tencent in global markets will be influenced by the resolution of intellectual property disputes and trade barriers.

- Potential for regulatory changes: The agreement might include provisions impacting data security, technology transfer, and other regulatory aspects, creating significant uncertainty for tech companies.

The technology sector's reaction will be a barometer of how effectively the deal addresses issues of intellectual property theft, technology transfer, and market access.

Agricultural Sector's Response

The agricultural sector has been significantly impacted by previous trade disputes, and its response to the new agreement will be closely watched.

- Changes in trade volumes: The volume of soybean and pork exports from the US to China, and vice versa, will fluctuate based on tariff levels and market access.

- Price fluctuations: Changes in trade volumes will directly affect prices for agricultural commodities, impacting farmers and producers in both countries.

- Impact on farmers and producers: Farmers and producers will be particularly vulnerable to price volatility, making their response a critical indicator of the deal’s success.

The agricultural sector’s reaction will demonstrate the practical impact of the agreement on trade flows and the ability of the deal to address concerns about market access and price stability.

Long-Term Economic Projections and Growth Forecasts

The long-term economic implications of the US-China trade talks will shape global economic growth forecasts and impact inflation.

Global Economic Growth

Economists and financial institutions will adjust their global growth forecasts based on the outcome of the trade talks.

- Impact on GDP growth in the US and China: The agreement's success or failure will directly impact GDP growth predictions for both nations.

- Ripple effects on other economies: The US and China's economic performance influences global growth, so the agreement's impact will spread across the world.

- Revision of global trade projections: The agreement will lead to revisions in global trade projections, reflecting changes in trade flows and investment patterns.

The interconnectedness of the global economy means that even a seemingly bilateral agreement between the US and China will have significant ripple effects.

Inflationary Pressures

The trade deal's structure can influence inflationary or deflationary pressures in both economies.

- Impact of tariffs on consumer prices: Tariffs can directly increase the price of imported goods, impacting consumer prices.

- Potential for supply chain disruptions: Trade disruptions can lead to supply chain bottlenecks, impacting the availability and cost of goods.

- Effects on monetary policy: Central banks might adjust monetary policy (interest rates) in response to inflationary or deflationary pressures stemming from the agreement.

The impact on inflation will be a key indicator of the deal's sustainability and its broader impact on consumers and businesses.

Conclusion

The success of US-China trade talks will ultimately be judged by the market’s reaction. A sustained period of positive market sentiment, reflecting confidence in the long-term benefits of the agreement, will signal its success. Conversely, persistent market volatility or negative trends could indicate underlying flaws and the potential for future trade tensions. Careful monitoring of market indicators, such as stock prices, currency exchange rates, and economic forecasts, is vital to assess the true impact of these crucial negotiations. To stay informed about the latest developments and their market impact, continue following updates on US-China trade talks and related developments in global economics.

Featured Posts

-

Haly Wwd Astar Tam Krwz Pr Mdah Ka Hmlh Swshl Mydya Ka Rdeml

May 12, 2025

Haly Wwd Astar Tam Krwz Pr Mdah Ka Hmlh Swshl Mydya Ka Rdeml

May 12, 2025 -

Payton Pritchards Nba Sixth Man Award Victory

May 12, 2025

Payton Pritchards Nba Sixth Man Award Victory

May 12, 2025 -

Alex Winters Lost Mtv Show A Deep Dive Into His Early Comedy

May 12, 2025

Alex Winters Lost Mtv Show A Deep Dive Into His Early Comedy

May 12, 2025 -

Yankees Magazine Aaron Judges Historic 2024 Season

May 12, 2025

Yankees Magazine Aaron Judges Historic 2024 Season

May 12, 2025 -

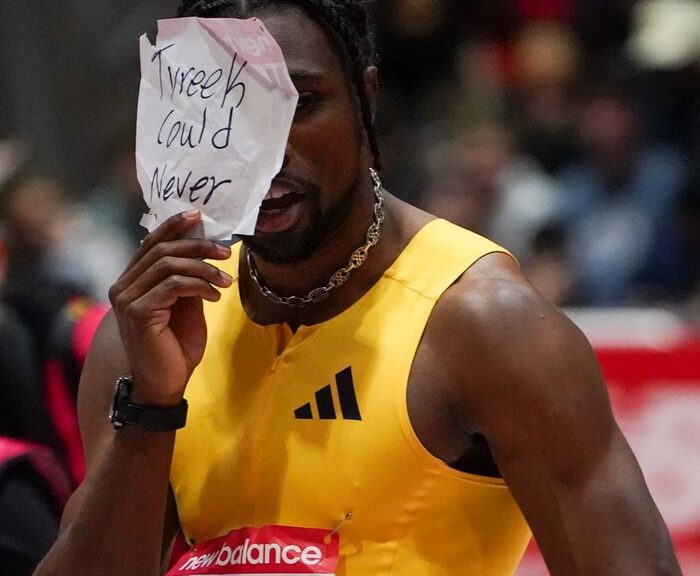

Olympic Legend Michael Johnson Tyreek Hill Vs Noah Lyles Isnt A Fair Race

May 12, 2025

Olympic Legend Michael Johnson Tyreek Hill Vs Noah Lyles Isnt A Fair Race

May 12, 2025