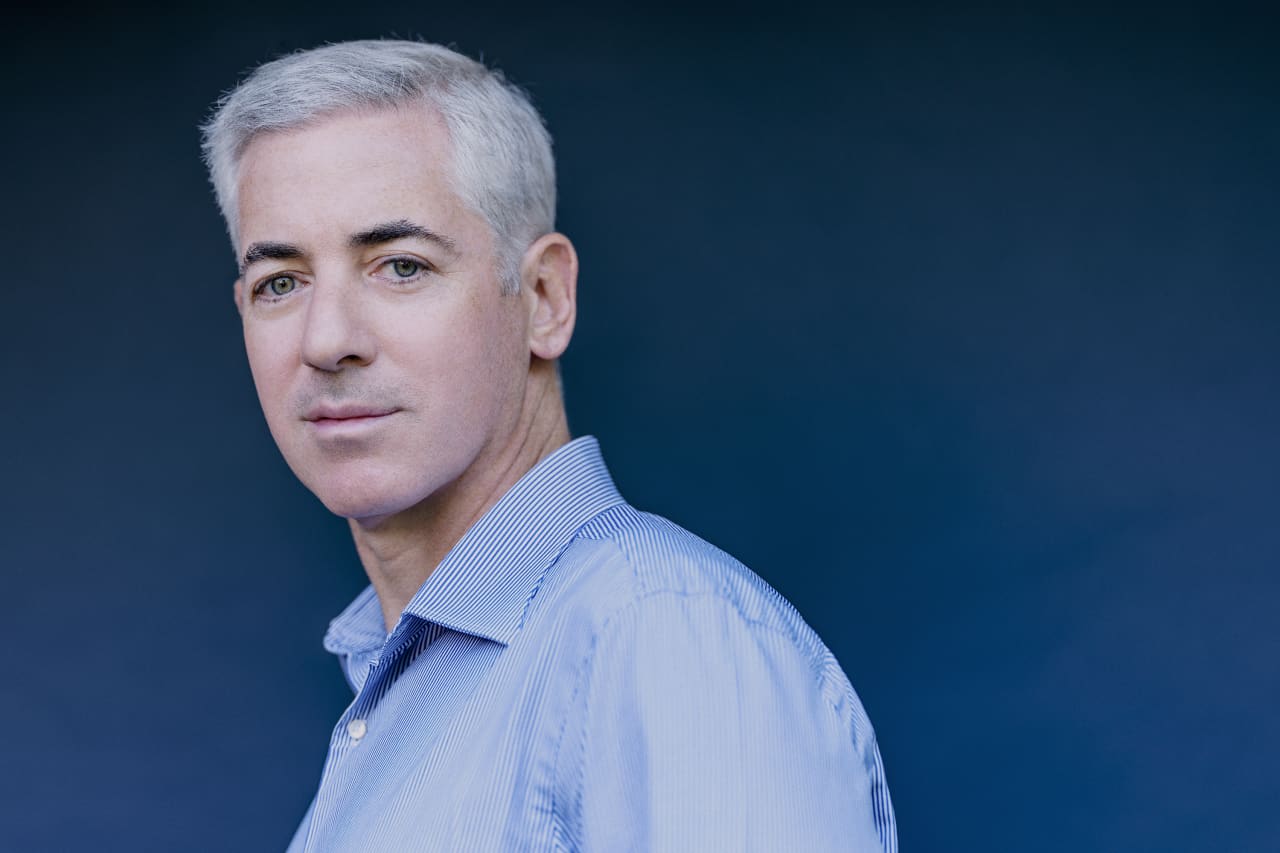

US-China Trade War: Bill Ackman's Assessment Of Time's Impact

Table of Contents

Bill Ackman's Initial Stance on the US-China Trade War

Early Predictions and Investment Strategies

At the outset of the US-China trade war, which officially began in 2018 with the imposition of tariffs, Bill Ackman, like many others, likely attempted to predict the market's reaction. While precise details of his early strategies regarding the trade war aren't always publicly available, we can analyze his general approach. His investment philosophy often focuses on identifying undervalued assets and long-term growth opportunities. It's reasonable to infer that his initial response to the trade war may have included:

- Hedging against uncertainty: Protecting his portfolio from potential market downturns caused by the escalating trade tensions. This could have involved diversifying investments across different asset classes or sectors less exposed to the direct effects of the trade war.

- Identifying undervalued companies: Seeking out opportunities in companies negatively affected by the trade war, betting on their eventual recovery or potential for strategic restructuring.

- Focusing on domestic companies: Shifting investment towards companies less reliant on trade with China to reduce exposure to the conflict's immediate impact.

His rationale would likely have been based on assessing the potential economic impacts, considering factors like supply chain disruptions, inflation, and consumer confidence. These factors all played a significant role in the trade war's economic repercussions.

Impact on Specific Sectors

Ackman likely recognized that the US-China trade war wouldn't impact all sectors equally. His analysis may have focused on sectors like:

- Technology: The tech sector, particularly those involved in the production of semiconductors and telecommunications equipment, was heavily impacted by the trade war. Ackman may have anticipated challenges for US companies reliant on Chinese manufacturing or facing increased competition from Chinese firms.

- Manufacturing: The manufacturing sector, particularly those involved in producing goods subject to tariffs, would have been directly affected by the increased costs. Ackman's analysis might have focused on identifying winners (companies that could adapt quickly) and losers (companies unable to adapt to the new trade landscape).

- Agriculture: The agricultural sector was significantly affected, with certain agricultural exports facing retaliatory tariffs. Ackman’s assessment of this sector’s resilience and potential for government support could have influenced his investment strategies.

The Evolving Landscape and Ackman's Shifting Perspective

The Unexpected Developments

The US-China trade war unfolded in unexpected ways. Initial predictions often underestimated its complexity and duration. Key events that likely altered Ackman’s perspective include:

- Escalation and de-escalation cycles: The trade war saw periods of intense escalation, followed by periods of relative calm as negotiations progressed. These cycles created uncertainty and volatility in the markets.

- Unforeseen geopolitical events: Other global events, like the COVID-19 pandemic, likely influenced the trajectory of the trade war and its economic consequences.

- Changes in government policies: Changes in the policies and approaches of both US and Chinese governments significantly impacted the trade environment.

Long-Term Consequences and Adaptations

As the trade war continued, Ackman’s initial assessments likely needed adjustment. His long-term perspective might have incorporated:

- Reshoring and near-shoring: The increased costs and uncertainties associated with global supply chains likely led him to reconsider the advantages of reshoring (bringing manufacturing back to the US) or near-shoring (moving production to nearby countries).

- Technological decoupling: The trade war accelerated the trend of technological decoupling between the US and China. Ackman would need to account for this in his assessment of technology companies' long-term prospects.

- Geopolitical risks: The ongoing trade tensions and their geopolitical implications would necessitate a greater focus on assessing the stability and risks in the global investment landscape.

Key Takeaways from Ackman's Assessment

Lessons Learned from the US-China Trade War

By studying Ackman's actions and statements, we can extract several crucial lessons:

- Geopolitical risk is a significant factor: The US-China trade war underscored the importance of considering geopolitical factors when making investment decisions.

- Supply chain resilience is paramount: The disruption of global supply chains highlighted the need for companies to develop more resilient and diversified supply chains.

- Adaptability is key: Companies and investors who were able to adapt quickly to the changing trade environment were better positioned to succeed.

The Future of US-China Relations and Investment Strategies

Ackman's implied and explicit predictions regarding the future of US-China relations, even if not explicitly stated, would likely inform his investment strategies. We might expect him to:

- Continue diversifying investments: Maintaining a diversified portfolio to mitigate risks associated with continued trade tensions or unexpected geopolitical events.

- Invest in companies with strong domestic focus: Prioritizing companies that are less exposed to disruptions caused by trade conflicts or global supply chain instability.

- Evaluate long-term trends: Focusing on trends that are not significantly affected by the short-term fluctuations caused by trade wars, such as technological advancements or demographic shifts.

Conclusion: Understanding the US-China Trade War's Enduring Legacy

Bill Ackman's perspective on the US-China trade war offers valuable insights into the complexities of this geopolitical event and its long-term impacts on the global economy. His initial assessments, and subsequent adaptations demonstrate the importance of flexibility and adaptability in navigating the uncertainties of the international trade landscape. By understanding the lessons gleaned from his analysis, investors can better position themselves to weather future geopolitical storms. Learn more about the impact of the US-China trade war and how to develop informed investment strategies by researching Ackman's publicly available analysis and staying informed on the evolving US-China trade relations.

Featured Posts

-

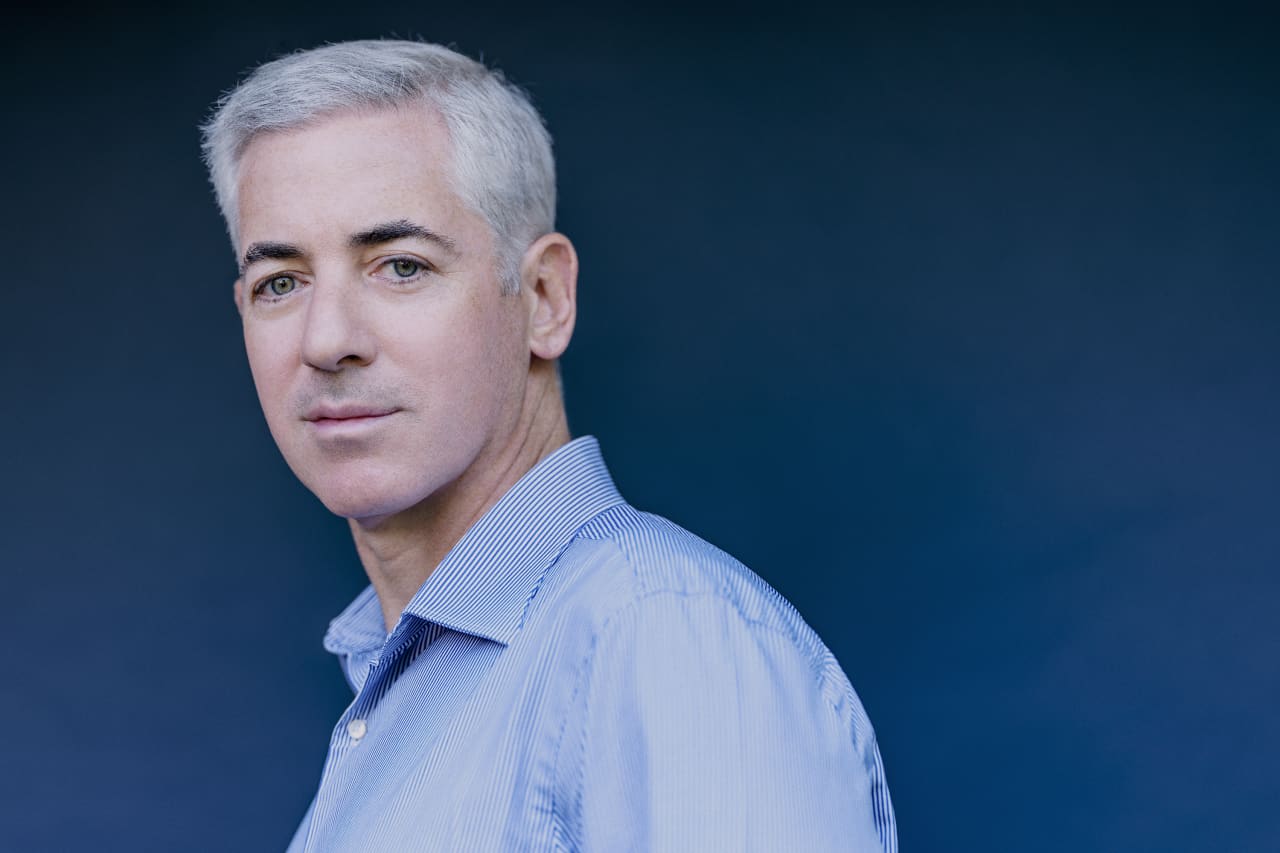

Planning For A Happy Day February 20 2025

Apr 27, 2025

Planning For A Happy Day February 20 2025

Apr 27, 2025 -

The Imminent Arrival Of A Fifth Champions League Spot For The Premier League

Apr 27, 2025

The Imminent Arrival Of A Fifth Champions League Spot For The Premier League

Apr 27, 2025 -

Trumps Tariff Threat Inevitable Job Losses In Canadas Auto Industry

Apr 27, 2025

Trumps Tariff Threat Inevitable Job Losses In Canadas Auto Industry

Apr 27, 2025 -

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 27, 2025

Chargers To Kick Off 2025 Season In Brazil With Justin Herbert

Apr 27, 2025 -

Bencic Claims Abu Dhabi Open Title

Apr 27, 2025

Bencic Claims Abu Dhabi Open Title

Apr 27, 2025

Latest Posts

-

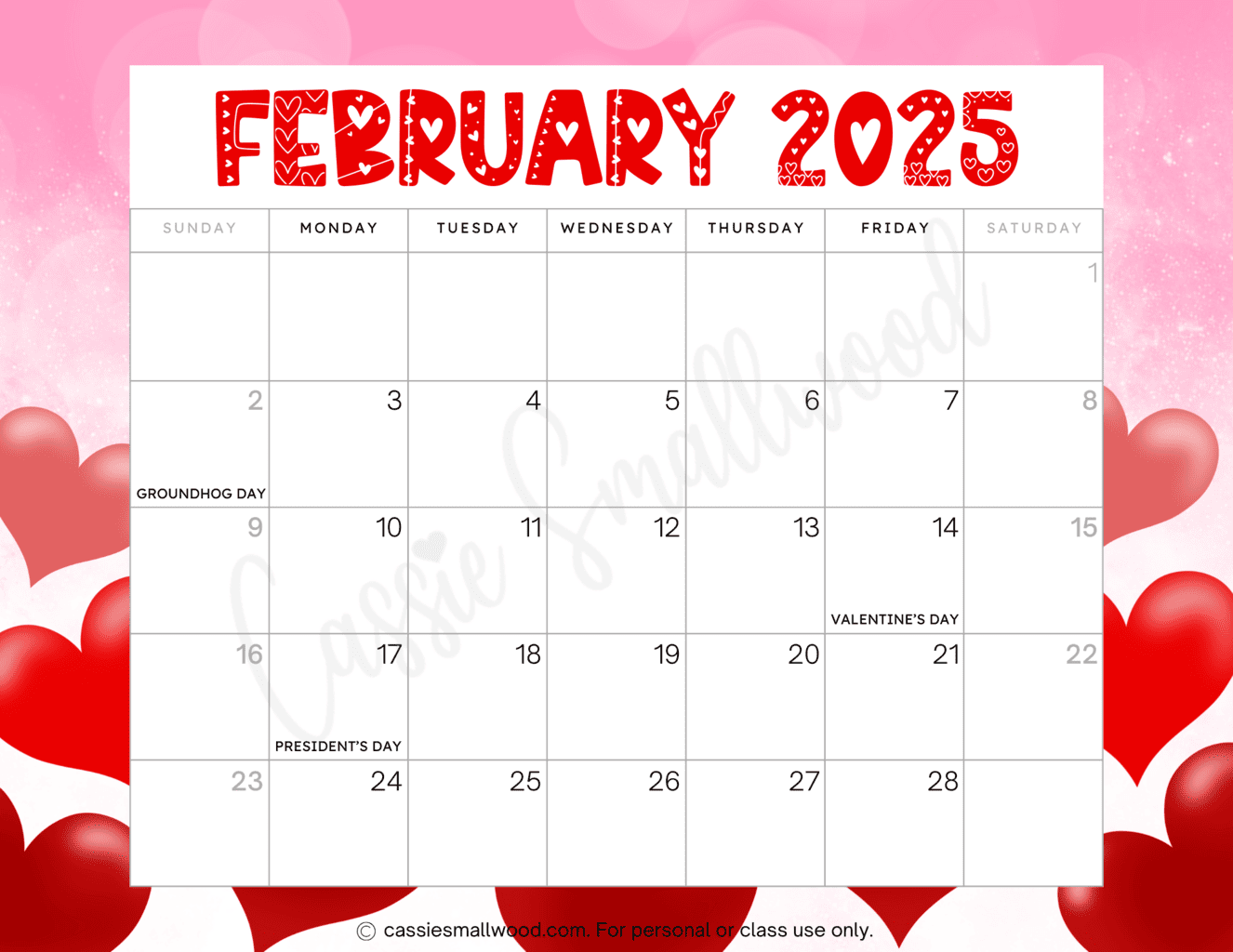

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025 -

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025

Analysis Red Sox Lineup Changes Following Outfielders Return And Casas Demotion

Apr 28, 2025 -

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025

Updated Red Sox Lineup Casas Position Change And Outfielders Reinstatement

Apr 28, 2025 -

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025

Red Sox Lineup Outfielder Returns Casas Moves Down In The Order

Apr 28, 2025 -

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025

Triston Casas Continued Slide Red Sox Lineup Adjustment And Outfielders Return

Apr 28, 2025