US Credit Downgrade: Impact On Dow Futures And Dollar — Live Analysis

Table of Contents

Understanding the US Credit Downgrade

The US credit downgrade, recently announced by [Insert Rating Agency Name], lowered the US government's credit rating from [Previous Rating] to [New Rating]. The reasoning behind this downgrade cited [Insert key reasons given by the rating agency, e.g., increasing national debt, political gridlock hindering fiscal responsibility]. This is a significant event, marking the first time in [Number] years that the US has received a credit downgrade and carrying substantial implications for the nation's economic stability.

-

Impact on US government borrowing costs: A downgrade increases the perceived risk associated with lending to the US government. Consequently, the government will likely face higher interest rates when issuing new debt, increasing the cost of borrowing and potentially impacting future government spending.

-

Effect on investor confidence in US Treasury securities: The downgrade may erode investor confidence in the safety and reliability of US Treasury securities, potentially leading to reduced demand and lower prices. This could trigger capital flight from US assets.

-

Potential impact on the US dollar's reserve currency status: While the US dollar is likely to remain a dominant global currency, a prolonged period of uncertainty could potentially weaken its standing as the world's primary reserve currency, leading to shifts in global financial power dynamics.

Impact on Dow Futures

The immediate reaction to the US credit downgrade was a significant [increase/decrease] in Dow futures. This reflects the market's immediate assessment of the risks associated with the downgrade. Several factors influenced the Dow's response, including prevailing investor sentiment, market psychology, and the anticipated impact on corporate earnings. Fear and uncertainty, often driving "flight to safety" behavior, played a major role.

-

Short-term vs. long-term implications for Dow futures: The short-term impact is likely to be characterized by increased volatility. Long-term implications depend on the government's response, the overall economic outlook, and the extent to which the downgrade affects investor confidence.

-

Potential for further volatility in the futures market: Market uncertainty will likely persist until a clearer picture of the economic and political landscape emerges, leading to sustained volatility in Dow futures.

-

Key indicators to watch for future Dow movements: Key indicators to monitor include interest rate changes, inflation data, consumer confidence indexes, and any announcements regarding government fiscal policies.

Sector-Specific Impacts on Dow Futures

The US credit downgrade will have a disproportionate impact on different sectors within the Dow Jones Industrial Average.

-

Impact on tech stocks due to increased interest rates: Higher interest rates, a likely consequence of the downgrade, could negatively impact tech companies, many of which rely on borrowing for expansion and innovation. This impact is likely to be felt across growth stocks.

-

Impact on financial stocks due to credit market uncertainty: Financial institutions will be particularly sensitive to the downgrade, facing increased uncertainty in the credit markets and potential increases in their cost of borrowing.

-

Effect on consumer discretionary stocks due to potential economic slowdown: A credit downgrade can trigger a broader economic slowdown, reducing consumer spending and negatively impacting companies in the consumer discretionary sector.

Impact on the US Dollar

The initial impact on the US dollar was a [strengthening/weakening] against other major currencies. This reflects the complex interplay of factors such as "flight to safety" dynamics and decreased investor confidence in US assets.

-

Short-term and long-term forecasts for the US dollar: Short-term forecasts predict continued [strengthening/weakening], dependent on market sentiment. Long-term forecasts are highly uncertain and hinge on the government’s actions and global economic conditions.

-

Geopolitical implications of a weaker US dollar: A weaker US dollar could shift global economic power dynamics and potentially trigger competitive devaluations by other countries.

-

Impact on international trade and capital flows: Fluctuations in the US dollar's value will have far-reaching implications for international trade, affecting the prices of imported and exported goods and influencing capital flows across borders.

Potential Mitigation Strategies and Future Outlook

The US government may respond to the downgrade through various fiscal and monetary policies, including [mention potential government responses such as budget cuts, tax increases, or monetary policy adjustments]. The success of these responses will significantly impact the future outlook.

-

Strategies for investors to mitigate risks: Investors should diversify their portfolios, consider hedging strategies, and monitor economic indicators closely to adjust their investment strategies accordingly.

-

Opportunities arising from the market volatility: While the downgrade presents significant risks, it also creates opportunities for savvy investors who can identify undervalued assets or capitalize on short-term market fluctuations.

-

Long-term economic implications of the US credit downgrade: The long-term effects of the US credit downgrade will depend on the effectiveness of government responses and the resilience of the US economy. Sustained fiscal responsibility is crucial for restoring investor confidence.

Conclusion

The US credit downgrade represents a significant event with far-reaching consequences for Dow futures, the US dollar, and the global economy. While the short-term impact is characterized by heightened volatility and uncertainty, a thorough understanding of the underlying factors and potential mitigation strategies is crucial for navigating this turbulent period. Stay informed about further developments regarding this crucial US Credit Downgrade and its ongoing impact on global financial markets. Continuously monitor the news and consult financial experts for the most up-to-date analysis and guidance. Understanding the intricacies of this US Credit Downgrade is key to making informed investment decisions.

Featured Posts

-

Dusan Tadic In Sueper Lig Yolculugu 100 Macin Hikayesi

May 20, 2025

Dusan Tadic In Sueper Lig Yolculugu 100 Macin Hikayesi

May 20, 2025 -

Eksereynontas Ta Tampoy Erotas Apodrasi Kai Oi Synepeies

May 20, 2025

Eksereynontas Ta Tampoy Erotas Apodrasi Kai Oi Synepeies

May 20, 2025 -

2023 F1 Season Comparing Hamilton And Leclercs Performance Discrepancies

May 20, 2025

2023 F1 Season Comparing Hamilton And Leclercs Performance Discrepancies

May 20, 2025 -

Zachary Cunha A New Chapter In Private Practice After Us Attorney Role

May 20, 2025

Zachary Cunha A New Chapter In Private Practice After Us Attorney Role

May 20, 2025 -

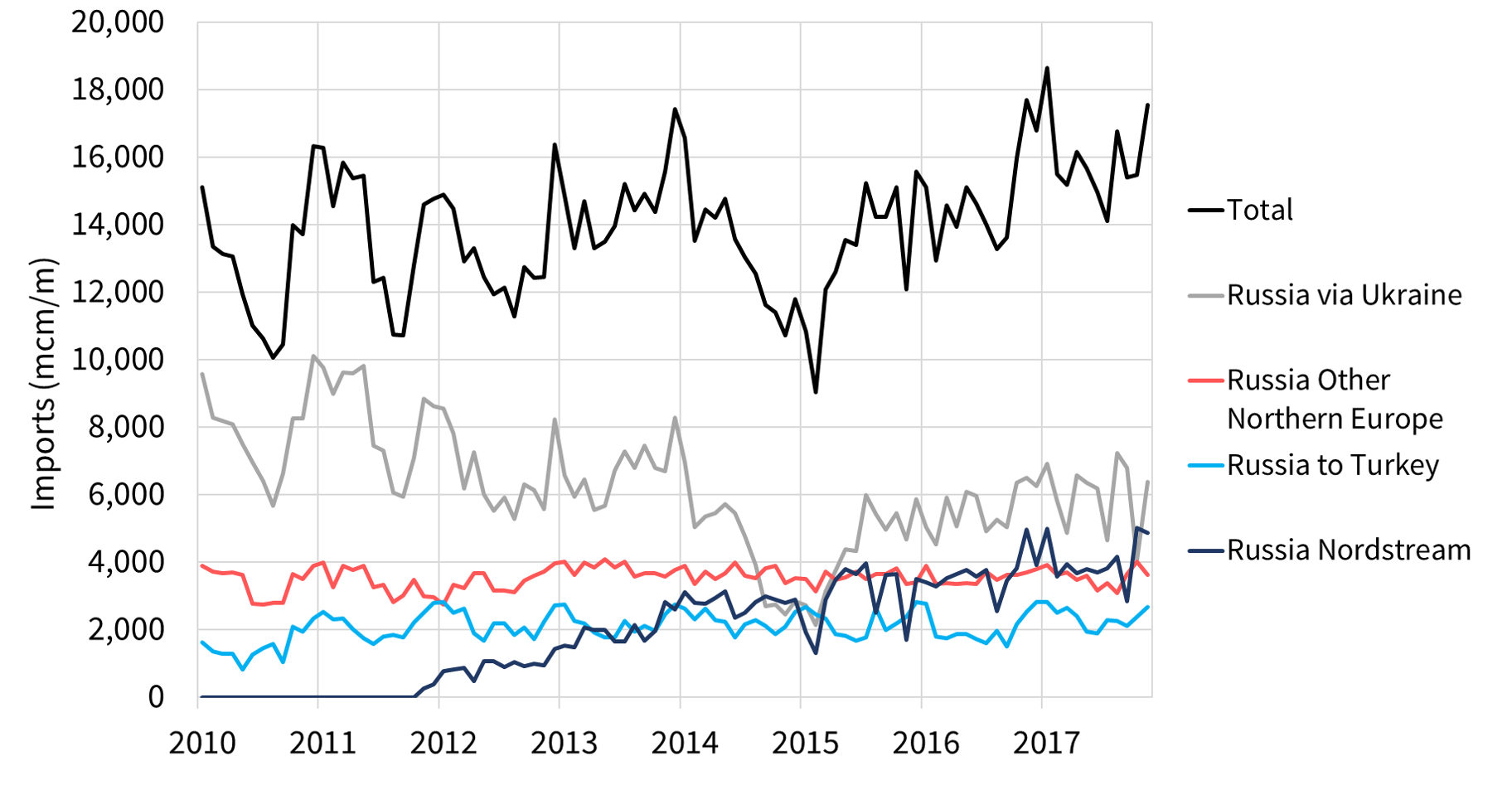

Addressing Taiwans Energy Needs The Importance Of Lng Imports

May 20, 2025

Addressing Taiwans Energy Needs The Importance Of Lng Imports

May 20, 2025