US Credit Rating Cut By Moody's: White House Response And Market Impact

Table of Contents

Moody's Downgrade: The Rationale Behind the Decision

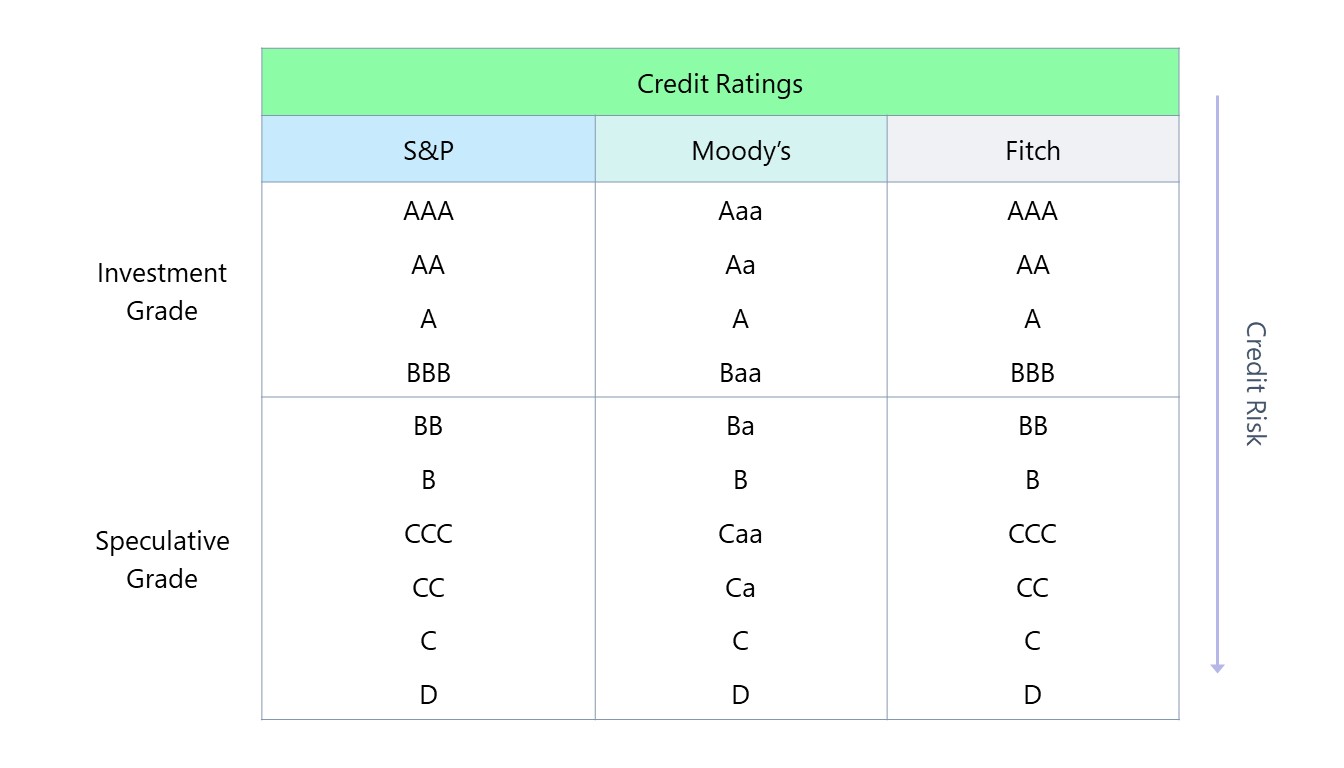

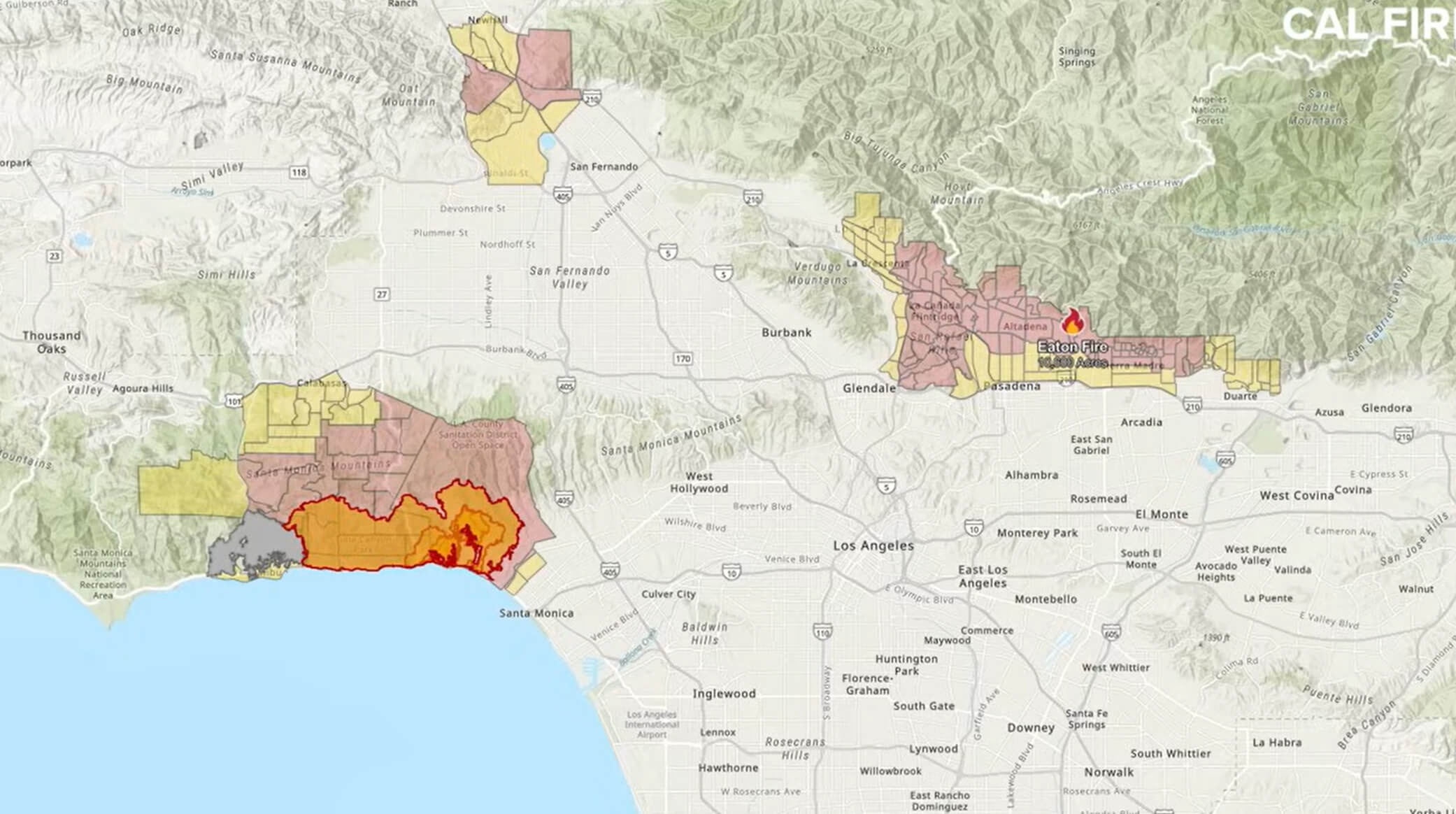

Moody's, a leading credit rating agency, cited several key factors in its decision to downgrade the US government's credit rating. These factors point to a weakening of the US fiscal strength and increasing concerns about its long-term economic outlook. The keywords driving this section are: Moody's rating agency, fiscal strength, government debt, political stalemate, and debt ceiling crisis.

-

Erosion of Governance: Moody's highlighted the repeated political standoffs surrounding the debt ceiling as a primary reason for the downgrade. The agency emphasized the erosion of governance and the increasing risk of a future default, as evidenced by the near-misses in recent years. This political stalemate significantly impacts investor confidence and the perception of the US's ability to manage its debt effectively.

-

Rising Government Debt: The steadily increasing US government debt burden played a significant role in Moody's decision. The agency expressed concerns about the trajectory of the debt, particularly the projected increase in the coming years, even with the debt ceiling increase agreed upon earlier this year. This mounting debt places pressure on the US's long-term fiscal sustainability.

-

Rating Change: The specific rating change was from AAA to Aa1, representing a significant, albeit not catastrophic, drop. This downgrade reflects a decline in the perceived creditworthiness of the US government, relative to its previous top-tier rating.

-

International Comparison: While still holding a high rating, the downgrade places the US on par with or slightly below several other developed nations. This change in relative standing on the global stage highlights the increasing challenges to the US's fiscal dominance. The last time a similar downgrade occurred was in 2011, following a similar debt ceiling crisis.

The White House's Response to the Credit Rating Cut

The Biden administration responded to Moody's downgrade with a mixture of defiance and a pledge to continue working on fiscal responsibility. Keywords for this section include: White House statement, Biden administration, fiscal responsibility, economic policy, and political fallout.

-

Official White House Statement: The White House issued a statement criticizing Moody's assessment, arguing that it did not fully reflect the strength of the US economy and the efforts of the administration to reduce the deficit. The statement emphasized the administration's commitment to fiscal responsibility.

-

Political Implications: The downgrade has significant political implications, potentially impacting the upcoming 2024 presidential election and legislative efforts to address the nation's fiscal challenges. Republicans are likely to use the downgrade to criticize the administration's economic policies, while the Democrats will likely argue for continued investment in social programs.

-

Proposed Policy Changes: While no immediate dramatic policy shifts have been announced, the administration may face pressure to implement more aggressive fiscal austerity measures to reassure investors and improve the nation's fiscal outlook.

-

Counter-Arguments: The White House countered Moody's concerns by highlighting positive aspects of the US economy, such as job growth and low unemployment. However, these arguments did little to counter the underlying concerns about the country's debt trajectory and political dysfunction.

Market Impact and Economic Consequences of the Downgrade

The market reacted swiftly to Moody's downgrade, with immediate and potentially long-term consequences. Keywords for this section are: market volatility, stock market reaction, bond yields, interest rates, inflation, and economic growth.

-

Immediate Market Reaction: Following the announcement, the US stock market experienced a period of volatility, with initial declines followed by a partial recovery. Bond yields, reflecting borrowing costs, increased, indicating a shift in investor sentiment.

-

Long-Term Economic Consequences: The downgrade could lead to higher interest rates, impacting borrowing costs for both businesses and the government. This could potentially stifle economic growth and contribute to inflation. The increased cost of borrowing could also slow down investment and economic expansion.

-

Impact on the Dollar: The downgrade could potentially weaken the value of the US dollar, though the effect remains to be seen. This could affect international trade and the competitiveness of US exports.

-

Increased Borrowing Costs: The increase in interest rates makes it more expensive for the US government to borrow money, exacerbating the very fiscal problems that led to the downgrade. This creates a vicious cycle that could further hinder economic growth and fiscal responsibility.

Global Implications of the US Credit Rating Downgrade

The downgrade of the US credit rating has significant implications that extend far beyond US borders. Keywords for this section include: global economy, international markets, investor confidence, and geopolitical stability.

-

Ripple Effects on Global Markets: The downgrade has created uncertainty in global financial markets, as the US economy plays a crucial role in the international financial system. Investors may become more risk-averse, potentially affecting investment flows globally.

-

Impact on Investor Confidence: The downgrade could erode investor confidence not only in the US but also in the global economy, potentially impacting investment decisions and economic growth worldwide.

-

Geopolitical Implications: The downgrade could also affect the geopolitical landscape, potentially impacting US influence and its ability to lead on global issues.

Conclusion

The Moody's downgrade of the US credit rating is a significant event with far-reaching consequences. The White House's response, while defensive, will need to be followed by concrete actions to address the underlying fiscal issues highlighted by the rating agency. The market reaction underscores the seriousness of the situation, and the long-term economic and geopolitical ramifications remain to be seen. The potential for further downgrades or negative economic developments remains a significant concern.

Call to Action: Stay informed on the evolving situation surrounding the US credit rating and the ongoing response from the White House. Continue to follow our coverage for updates on the US credit rating and its impact on the global economy.

Featured Posts

-

India Turns Away From Pakistan Turkey And Azerbaijan Economic Impact

May 18, 2025

India Turns Away From Pakistan Turkey And Azerbaijan Economic Impact

May 18, 2025 -

Israel And The Arab World Assessing The Impact Of Trumps Visit

May 18, 2025

Israel And The Arab World Assessing The Impact Of Trumps Visit

May 18, 2025 -

Where To Invest Mapping The Countrys Rising Business Centers

May 18, 2025

Where To Invest Mapping The Countrys Rising Business Centers

May 18, 2025 -

Why Red Carpet Rules Are Broken A Cnn Perspective

May 18, 2025

Why Red Carpet Rules Are Broken A Cnn Perspective

May 18, 2025 -

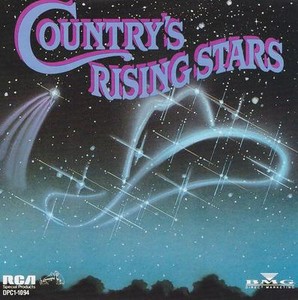

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025

Latest Posts

-

Close Game Jose Soriano And The Angels Defeat The White Sox 1 0

May 18, 2025

Close Game Jose Soriano And The Angels Defeat The White Sox 1 0

May 18, 2025 -

Red Sox Trade With Cardinals A Perfect Solution For The Bullpen

May 18, 2025

Red Sox Trade With Cardinals A Perfect Solution For The Bullpen

May 18, 2025 -

Los Angeles Angels Win 1 0 Jose Sorianos Stellar Performance

May 18, 2025

Los Angeles Angels Win 1 0 Jose Sorianos Stellar Performance

May 18, 2025 -

Boston Bullpen Bolstered Analyzing The Red Sox Cardinals Trade

May 18, 2025

Boston Bullpen Bolstered Analyzing The Red Sox Cardinals Trade

May 18, 2025 -

Red Sox Cardinals Trade Solving Bostons Bullpen Woes

May 18, 2025

Red Sox Cardinals Trade Solving Bostons Bullpen Woes

May 18, 2025