US Economic Data Weighs On Dollar, Spurs Gold (XAUUSD) Price Increase

Table of Contents

Weakening US Dollar: The Impact of Economic Indicators

The relationship between the US dollar and gold prices is inversely correlated. A weakening dollar generally leads to a rise in gold prices, and vice versa. Several recent economic indicators point to a weakening US dollar, contributing to the XAUUSD price increase.

- Lower-than-projected GDP growth: Slower-than-anticipated GDP growth reduces investor confidence in the US economy, making the dollar less attractive. This prompts investors to seek alternative assets, including gold.

- Persistently high inflation: High inflation erodes the purchasing power of the dollar. As the dollar's value diminishes, investors seek assets that retain their value, such as gold, which is often seen as a hedge against inflation.

- Rising unemployment claims: A surge in unemployment claims signals potential economic slowdown, further dampening investor confidence in the US economy and strengthening the appeal of safe-haven assets like gold.

[Insert chart here showing correlation between GDP growth, inflation, unemployment claims, and the US Dollar Index (DXY)]

Safe-Haven Demand for Gold (XAUUSD): A Flight to Safety

Gold is a classic safe-haven asset. During times of economic uncertainty or geopolitical instability, investors flock to gold as a hedge against risk. This "risk-off" sentiment drives up demand for gold, pushing its price higher.

- Gold's inherent value and historical performance: Gold has held its value throughout history, acting as a store of value during periods of economic turmoil. This historical performance reinforces its safe-haven status.

- Increased demand for gold as a store of value: When investors are concerned about the stability of other assets, they often turn to gold as a reliable store of value to preserve their wealth.

- Diversification strategies utilizing gold: Many investors incorporate gold into their portfolios as a means of diversification to mitigate overall portfolio risk.

[Insert chart here showing gold price increases during periods of market uncertainty]

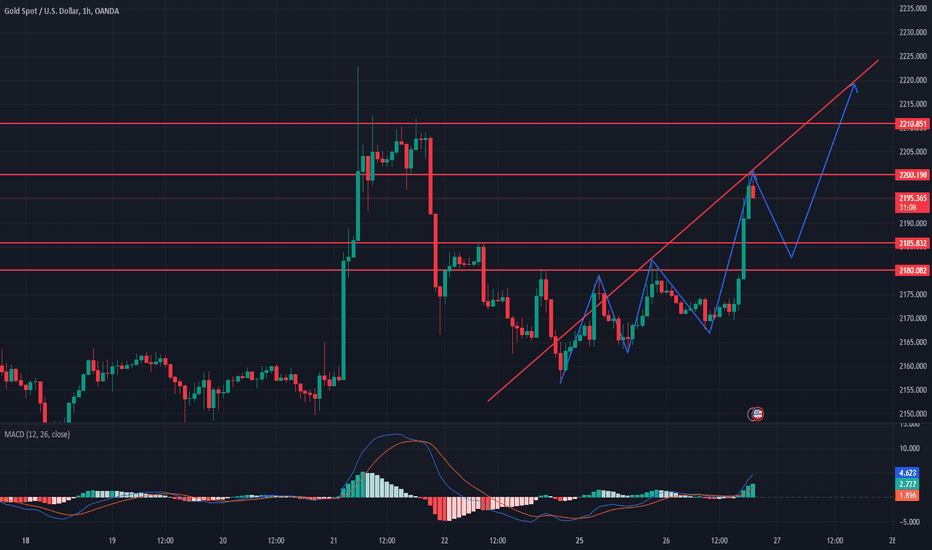

Technical Analysis of XAUUSD Price Movement

Analyzing the XAUUSD price chart reveals interesting patterns. Technical indicators offer further insights into potential price movements.

- Key resistance levels: Identifying key resistance levels on the chart helps predict potential price corrections. A break above these levels could signal further upward momentum.

- Support levels: Support levels indicate potential buying opportunities. A bounce off these levels could suggest a renewed upward trend.

- Technical indicators: Indicators such as moving averages and the Relative Strength Index (RSI) can provide signals about the strength and direction of the trend. For example, a rising RSI above 70 might suggest the market is overbought.

[Insert chart here showing XAUUSD price chart with key support and resistance levels, moving averages, and RSI]

Future Outlook for XAUUSD and the US Economy

Predicting the future price of XAUUSD requires careful consideration of several factors. The current economic climate suggests continued upward pressure on gold prices. However, several factors could impact this outlook:

- Future economic data releases: Upcoming reports on inflation, GDP growth, and employment will significantly influence market sentiment and XAUUSD price movements.

- Influence of central bank actions: Changes in monetary policy, particularly interest rate adjustments by the Federal Reserve, will have a direct impact on the dollar and consequently, gold prices.

- Geopolitical events: Global geopolitical events can create uncertainty, increasing the demand for safe-haven assets like gold.

Conclusion: Understanding the Interplay Between US Economic Data and XAUUSD

Weakening US economic data has undeniably exerted downward pressure on the US dollar, leading to increased demand and higher prices for gold (XAUUSD). Monitoring US economic indicators is crucial for understanding their influence on the gold market. Staying updated on the latest US economic data is essential for effectively managing your XAUUSD investments and navigating the complexities of the gold market successfully. Understanding the correlation between US economic data and the XAUUSD price is paramount for making well-informed investment decisions.

Featured Posts

-

Anchor Brewing Companys Closure What Happens Next

May 17, 2025

Anchor Brewing Companys Closure What Happens Next

May 17, 2025 -

Affordable Goods That Dont Disappoint

May 17, 2025

Affordable Goods That Dont Disappoint

May 17, 2025 -

Mariners Bryce Miller 15 Day Il Stint For Elbow Problem

May 17, 2025

Mariners Bryce Miller 15 Day Il Stint For Elbow Problem

May 17, 2025 -

Tom Thibodeaus Knicks Redemption Overcoming A Career Long Weakness

May 17, 2025

Tom Thibodeaus Knicks Redemption Overcoming A Career Long Weakness

May 17, 2025 -

Ftc To Appeal Microsoft Activision Merger Decision

May 17, 2025

Ftc To Appeal Microsoft Activision Merger Decision

May 17, 2025

Latest Posts

-

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025

Comprehensive Moto News Gncc Mx Sx Flat Track And Enduro Coverage

May 17, 2025 -

Your Guide To Moto News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025

Your Guide To Moto News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025 -

Get The Scoop Moto News From Gncc Mx Sx Flat Track And Enduro Events

May 17, 2025

Get The Scoop Moto News From Gncc Mx Sx Flat Track And Enduro Events

May 17, 2025 -

Motocross News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025

Motocross News Gncc Mx Sx Flat Track And Enduro Racing

May 17, 2025 -

All The Moto News You Need Gncc Mx Sx Flat Track And Enduro

May 17, 2025

All The Moto News You Need Gncc Mx Sx Flat Track And Enduro

May 17, 2025