US Economic Trends And Their Influence On Elon Musk's Fortune

Table of Contents

The Impact of Stock Market Fluctuations on Elon Musk's Net Worth

Elon Musk's net worth is heavily tied to Tesla's stock performance. Therefore, understanding the forces driving Tesla's stock price is key to understanding fluctuations in Musk's wealth.

Tesla's Stock Performance and its Correlation to Economic Indicators

Tesla's stock price, a major component of Elon Musk's net worth, is directly correlated with broader economic indices like the S&P 500 and Nasdaq. When these indices perform well, indicating a healthy economy, investor confidence tends to rise, boosting demand for Tesla stock and, consequently, Musk's net worth. Conversely, during economic downturns, Tesla's stock price tends to suffer.

-

Investor Sentiment and Economic News: Positive economic news, such as low inflation and strong job growth, generally leads to increased investor confidence, driving up Tesla's stock price. Conversely, negative news like rising interest rates or recession fears can trigger sell-offs, impacting Musk's net worth.

-

Consumer Confidence and Spending: Strong consumer confidence and increased spending directly translate into higher demand for Tesla vehicles. This increased demand boosts Tesla's sales and profits, positively impacting its stock price and, ultimately, Elon Musk's net worth.

-

Economic Events and Their Impact: Significant economic events have demonstrably impacted Tesla's stock and Musk's wealth. The 2020 pandemic market crash initially caused a sharp decline, while recent inflation spikes have created uncertainty, leading to stock price volatility.

The Role of the Federal Reserve's Monetary Policy

The Federal Reserve's monetary policy significantly influences investor behavior and the valuation of growth stocks like Tesla.

-

Interest Rate Hikes and Inflation: When the Federal Reserve raises interest rates to combat inflation, it can decrease investor appetite for riskier assets like Tesla stock, leading to price declines. High inflation also erodes consumer purchasing power, potentially affecting Tesla sales.

-

Interest Rates and Tesla's Expansion: Changes in interest rates impact borrowing costs for Tesla. Higher rates increase the cost of borrowing for expansion projects, potentially slowing growth and impacting the company's valuation.

-

Economic Uncertainty and Investor Risk Appetite: Periods of economic uncertainty often lead to investors seeking safer investments, reducing demand for growth stocks like Tesla and negatively impacting Musk's net worth.

Influence of the Global Supply Chain and Commodity Prices

Tesla's production and profitability are significantly influenced by global supply chain dynamics and commodity prices.

Raw Material Costs and Tesla's Production

Fluctuations in the prices of lithium, nickel, cobalt, and other raw materials crucial for EV production directly impact Tesla's profitability and, consequently, Elon Musk's net worth.

-

Geopolitical Events and Material Availability: Geopolitical events, such as the war in Ukraine, can disrupt supply chains and lead to shortages of crucial materials, increasing prices and squeezing Tesla's profit margins.

-

Supply Chain Disruptions and Production Capacity: Supply chain disruptions due to pandemics, natural disasters, or geopolitical instability can reduce Tesla's production capacity and negatively impact its financial performance, thus impacting Musk's net worth.

-

Alternative Sourcing Strategies: Tesla is actively pursuing alternative sourcing strategies to mitigate supply chain risks and ensure a stable supply of raw materials.

The Impact of Global Economic Slowdowns on EV Demand

Global economic slowdowns negatively affect demand for luxury goods, including Tesla vehicles, impacting Musk's wealth.

-

Global GDP Growth and Tesla Sales: A strong correlation exists between global GDP growth and Tesla's sales figures. During economic expansions, demand for Tesla vehicles tends to be higher.

-

Recessions and Consumer Spending: During economic recessions, consumers tend to cut back on discretionary spending, including purchases of luxury vehicles, impacting Tesla's sales and ultimately Musk's net worth.

-

Maintaining Sales During Economic Uncertainty: Tesla employs various strategies to maintain sales during periods of economic uncertainty, such as offering financing options and focusing on cost-effective production.

The Influence of Government Regulations and Policies

Government regulations and policies significantly impact Tesla's operations and Elon Musk's net worth.

Government Incentives for EV Adoption

Government policies supporting EV adoption in the US and globally play a critical role in shaping Tesla's market position and Musk's wealth.

-

Tax Credits and Subsidies: Government tax credits and subsidies for EV purchases significantly boost demand for Tesla vehicles.

-

Emissions Standards and EV Demand: Stringent emissions standards encourage the adoption of EVs, benefiting Tesla's market share.

-

Changes in Government Policies: Any significant changes in government policies regarding EV incentives or emissions standards can significantly affect Tesla's future prospects and Musk's net worth.

Regulatory Scrutiny and its Potential Impact

Regulatory investigations and changes in regulations can impact Tesla's operations and Musk's wealth.

-

Lawsuits and Fines: Lawsuits or fines levied against Tesla can negatively impact its financial performance and Musk's net worth.

-

Regulatory Oversight and Innovation: Increased regulatory oversight can affect Tesla's innovation and expansion plans, potentially slowing growth.

-

Navigating the Regulatory Landscape: Effectively navigating the complex regulatory landscape is crucial for Tesla's continued success and, consequently, for maintaining Elon Musk's substantial net worth.

Conclusion

Elon Musk's extraordinary net worth is not solely a reflection of his entrepreneurial success but is significantly shaped by prevailing US economic trends. Fluctuations in the stock market, global supply chain dynamics, commodity prices, and government policies all play crucial roles in influencing his wealth. Understanding these interdependencies provides valuable insight into the complex relationship between macroeconomic factors and the fortunes of prominent business leaders like Elon Musk. To stay updated on how these factors continue to shape Elon Musk's net worth, continue following the latest news on economic indicators and Tesla's performance. Keep researching the impacts on Elon Musk's net worth to stay informed on the ever-changing landscape of business and finance.

Featured Posts

-

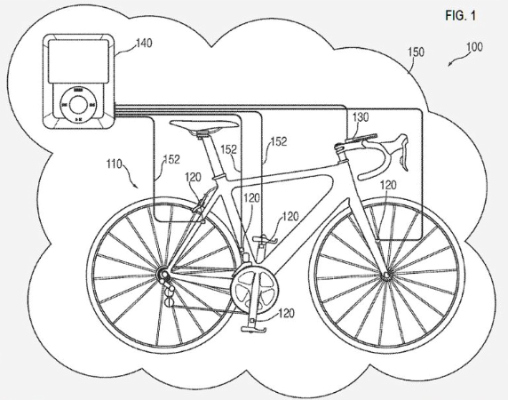

The Crossroads Of Ai Apples Next Move

May 09, 2025

The Crossroads Of Ai Apples Next Move

May 09, 2025 -

Indian Insurers Lobby For Less Stringent Bond Forward Rules

May 09, 2025

Indian Insurers Lobby For Less Stringent Bond Forward Rules

May 09, 2025 -

Trump Supporter Ray Epps Defamation Case Against Fox News

May 09, 2025

Trump Supporter Ray Epps Defamation Case Against Fox News

May 09, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Review

May 09, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Comprehensive Review

May 09, 2025 -

27 Saves By Hill Golden Knights Triumph Over Blue Jackets

May 09, 2025

27 Saves By Hill Golden Knights Triumph Over Blue Jackets

May 09, 2025

Latest Posts

-

Snls Failed Harry Styles Impression How He Really Felt

May 09, 2025

Snls Failed Harry Styles Impression How He Really Felt

May 09, 2025 -

Snls Failed Harry Styles Impression The Singers Response

May 09, 2025

Snls Failed Harry Styles Impression The Singers Response

May 09, 2025 -

Farcical Conduct Proceedings In Nottingham Families Seek Postponement

May 09, 2025

Farcical Conduct Proceedings In Nottingham Families Seek Postponement

May 09, 2025 -

London Outing Harry Styles Rocks A Retro Mustache

May 09, 2025

London Outing Harry Styles Rocks A Retro Mustache

May 09, 2025 -

Harry Styles New Mustache A 70s Vibe In London

May 09, 2025

Harry Styles New Mustache A 70s Vibe In London

May 09, 2025