US Stock Market Attracts Record Canadian Investment: Trade War Impact Analyzed

Table of Contents

H2: The Rise of Canadian Investment in US Equities

The increasing appeal of the US stock market to Canadian investors is a compelling trend fueled by several key factors.

H3: Favorable US Market Conditions

The US market's inherent attractiveness is undeniable. Its sheer size, coupled with its diverse range of sectors and substantial growth potential, makes it a compelling investment destination.

- Stronger Economic Growth: The US economy has historically demonstrated robust growth, offering investors the potential for higher returns compared to some other markets.

- Technological Leadership: The US is a global leader in technological innovation, with numerous high-growth companies driving significant market gains. Investing in US equities provides exposure to this dynamism.

- Established Companies: The US market boasts a large number of established, blue-chip companies offering stability and consistent dividend payouts, appealing to risk-averse investors.

- Diverse Sectors: The US market's diversity across sectors – from technology and healthcare to finance and energy – allows for strategic portfolio diversification, minimizing overall risk.

Statistics consistently highlight the strong performance of US equities, with the S&P 500 index frequently outperforming other major global indices, demonstrating the potential for substantial returns on investment.

H3: Seeking Diversification

Canadian investors are increasingly leveraging US stocks to diversify their portfolios and mitigate risks associated with over-reliance on the Canadian economy.

- Reducing Dependence on the Canadian Economy: By investing in US equities, Canadian investors reduce their exposure to fluctuations in the Canadian economy and related sectors.

- Hedging Against Currency Fluctuations: Investing in US dollars can act as a hedge against the fluctuations of the Canadian dollar, potentially protecting against currency exchange losses.

- Access to Different Investment Opportunities: The US market offers access to a broader range of investment opportunities compared to the Canadian market, allowing for greater portfolio diversification and strategic asset allocation.

Popular sectors among Canadian investors include technology (driven by the growth of Silicon Valley giants), healthcare (attracted by innovative biotech and pharmaceutical companies), and consumer staples (offering relative stability during economic uncertainty).

H3: Impact of a Lower Canadian Dollar

A weaker Canadian dollar relative to the US dollar has significantly enhanced the affordability of US investments for Canadian investors.

- Purchasing Power Increase: A lower Canadian dollar effectively increases the purchasing power of Canadian funds when investing in US equities.

- Increased Returns When Converting USD Back to CAD: While initial investments may be made at a favorable exchange rate, returns in USD can translate to even greater profits when converted back to CAD.

Historical exchange rate data clearly illustrates how periods of a weaker Canadian dollar have coincided with increased Canadian investment in the US stock market.

H2: Trade War Influence on Investment Decisions

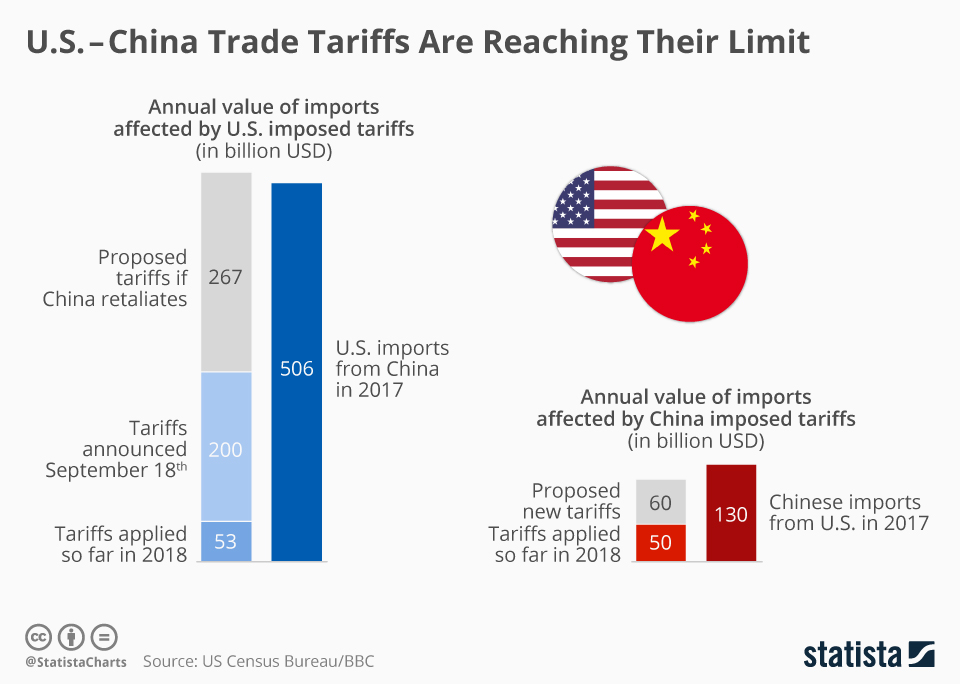

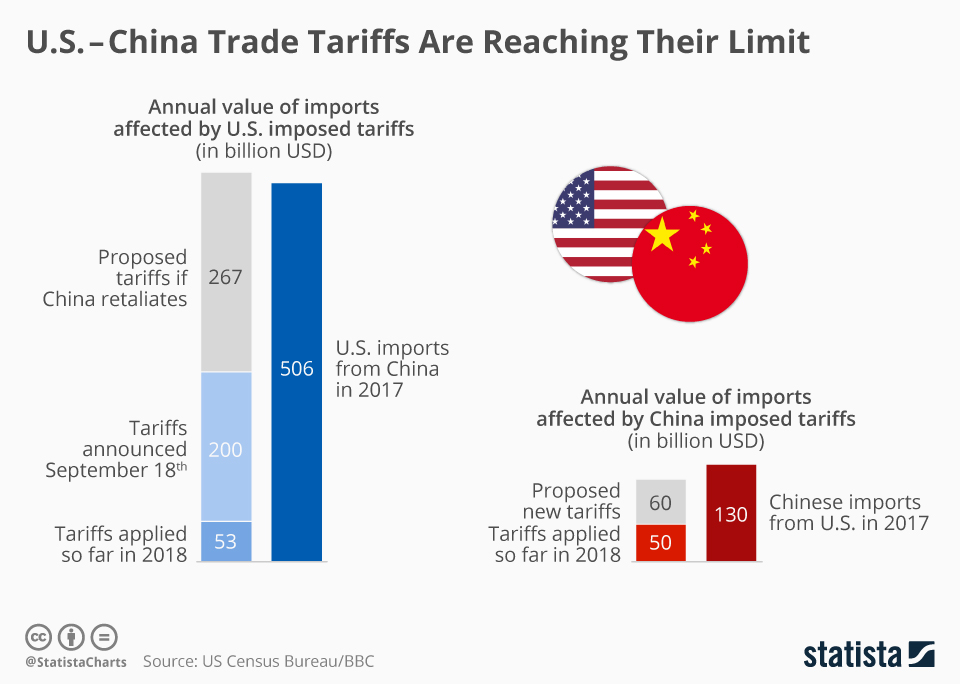

The ongoing trade tensions between the US and other countries, including Canada, have introduced both uncertainty and strategic opportunities for investors.

H3: Uncertainty and Opportunities

Trade wars create an environment of uncertainty, leading some investors to seek safe-haven assets, while others identify sector-specific opportunities.

- Safe Haven Assets: During periods of trade war uncertainty, investors often gravitate toward established, large-cap US companies perceived as less vulnerable to trade-related disruptions.

- Sector-Specific Impacts: Some sectors may benefit from trade policies, attracting investment. For example, domestic manufacturing sectors might see increased investment as import competition decreases.

- Strategic Re-allocation of Assets: Investors may strategically reallocate assets, shifting investments away from sectors directly impacted by trade wars and into those deemed more resilient.

Specific trade policies, such as tariffs or sanctions, have directly impacted investment decisions, causing shifts in capital allocation across various sectors.

H3: Hedging Strategies

Canadian investors utilize US investments as a hedging strategy against potential negative impacts of trade wars on the Canadian economy.

- Diversifying Away from Impacted Sectors: Investors reduce their exposure to sectors heavily dependent on trade with the US or other countries affected by trade disputes.

- Strategic Investment Choices: They may invest in companies with diversified global supply chains or those less susceptible to trade-related disruptions.

Careful analysis of trade policy implications and their potential effect on different sectors are vital components of effective hedging strategies.

H2: Implications for the US and Canadian Economies

The surge in Canadian investment in the US stock market has broad implications for both economies.

H3: Boosting US Economic Growth

The influx of Canadian capital contributes positively to the US economy.

- Increased Capital Inflow: Canadian investment provides significant capital inflow, fueling growth and expansion in US companies.

- Support for Company Growth and Expansion: This capital influx allows US companies to invest in research and development, expansion projects, and job creation.

- Creation of Jobs: Investment in US companies often translates to new jobs, stimulating economic activity and overall growth.

Data on foreign direct investment (FDI) and its contribution to US GDP growth clearly demonstrates the significant economic benefits.

H3: Portfolio Diversification for Canadians

The benefits of diversifying into the US stock market are substantial for Canadian investors.

- Risk Reduction: Diversification minimizes exposure to risks associated with over-reliance on a single market.

- Improved Portfolio Returns: Access to a wider range of investment opportunities often leads to improved overall portfolio returns.

- Access to a Wider Range of Investment Options: The US market provides access to companies and sectors unavailable or less prominent in the Canadian market.

Long-term financial planning for Canadian investors should seriously consider the strategic inclusion of US equities.

3. Conclusion

The record-high Canadian investment in the US stock market is a multifaceted trend driven by attractive US market conditions, a desire for portfolio diversification, the influence of trade wars, and a favorable exchange rate. This surge in investment benefits both economies, bolstering US growth and enhancing the investment strategies of Canadian investors. To effectively navigate the complexities of cross-border investment, it's crucial to consider professional financial guidance. Invest wisely in the US stock market; explore opportunities in the US stock market today, and remember that diversifying your portfolio with US equities is a strategic move to enhance your investment potential.

Featured Posts

-

Uk Diy Retailers The Best And Worst Revealed

Apr 23, 2025

Uk Diy Retailers The Best And Worst Revealed

Apr 23, 2025 -

Rpl Spartak Oderzhal Krupnuyu Pobedu Nad Rostovom V 23 M Ture

Apr 23, 2025

Rpl Spartak Oderzhal Krupnuyu Pobedu Nad Rostovom V 23 M Ture

Apr 23, 2025 -

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 23, 2025

E Bay Faces Legal Reckoning Section 230 And The Sale Of Banned Chemicals

Apr 23, 2025 -

Analyzing The Economics Top 5 Takeaways From The English Leaders Debate

Apr 23, 2025

Analyzing The Economics Top 5 Takeaways From The English Leaders Debate

Apr 23, 2025 -

Yankee Broadcaster Faces Backlash Over Mariners Comment

Apr 23, 2025

Yankee Broadcaster Faces Backlash Over Mariners Comment

Apr 23, 2025

Latest Posts

-

Examining The Relationship Between Us Economic Performance And Elon Musks Net Worth

May 10, 2025

Examining The Relationship Between Us Economic Performance And Elon Musks Net Worth

May 10, 2025 -

Elon Musks Wealth A Study Of Us Economic Influence On Teslas Success

May 10, 2025

Elon Musks Wealth A Study Of Us Economic Influence On Teslas Success

May 10, 2025 -

Fluctuations In Elon Musks Net Worth A Correlation With Us Economic Trends

May 10, 2025

Fluctuations In Elon Musks Net Worth A Correlation With Us Economic Trends

May 10, 2025 -

How Us Politics And Economy Shaped Elon Musks Fortune

May 10, 2025

How Us Politics And Economy Shaped Elon Musks Fortune

May 10, 2025 -

The Trump Administrations First 100 Days And Elon Musks Net Worth

May 10, 2025

The Trump Administrations First 100 Days And Elon Musks Net Worth

May 10, 2025