US Stock Market: Dow Futures Decline Amidst Trade Concerns

Table of Contents

Escalating Trade Tensions and Their Impact on Dow Futures

The ongoing trade disputes, particularly the US-China trade war, are the primary drivers of the current market anxiety. Increased tariffs and the threat of further trade restrictions significantly impact business confidence, leading to decreased investment and subsequently, lower stock prices. This uncertainty creates a ripple effect throughout the global economy.

- Analysis of recent trade negotiation developments and their market impact: Recent stalled negotiations and the imposition of new tariffs have sent shockwaves through the market, triggering immediate sell-offs. Any news regarding trade policy changes is closely scrutinized by investors, leading to significant daily fluctuations.

- Explanation of how tariffs affect corporate profitability and investor sentiment: Tariffs directly increase the cost of goods, impacting corporate profitability. This erodes investor confidence, leading to a decrease in stock valuations as future earnings are predicted to be lower. Companies heavily reliant on global supply chains are particularly vulnerable.

- Examples of specific companies heavily affected by trade tensions: Companies in sectors like technology and manufacturing, heavily reliant on international trade, have experienced significant stock price drops. For example, companies with significant manufacturing operations in China have seen their share prices decline due to increased tariff costs.

- Discussion of the ripple effect on global supply chains: Trade wars disrupt global supply chains, causing delays, increased costs, and shortages. This uncertainty creates further instability in the market, affecting companies across various sectors.

Market Volatility and Investor Sentiment

The current market volatility reflects a significant increase in investor risk aversion. Uncertainty surrounding trade issues fuels this fear, leading to sell-offs as investors seek to protect their capital. This heightened sense of unease is driving investors towards safer assets.

- Analysis of recent market trends and indicators of investor fear: The VIX volatility index, a key measure of market fear, has seen a noticeable increase, reflecting growing investor anxiety. This is further evidenced by the decline in various market indices.

- Discussion of safe-haven assets (e.g., gold, bonds) and their appeal during times of uncertainty: Investors are flocking to safe-haven assets like gold and government bonds, perceived as less risky during periods of economic uncertainty. These assets offer a degree of protection against market downturns.

- Explanation of how media coverage influences investor psychology: Negative media coverage of trade disputes can amplify investor fear and contribute to market volatility. Sensationalized reporting can exacerbate existing anxieties, leading to herd behavior and sell-offs.

- Overview of various market indices besides the Dow (e.g., S&P 500, Nasdaq) and their performance: While the Dow Jones Industrial Average is a key indicator, it's important to consider other major indices such as the S&P 500 and Nasdaq to get a more comprehensive picture of market performance. These indices often show similar trends, though with varying degrees of impact across different sectors.

Impact on Specific Sectors

Trade tensions disproportionately affect certain sectors. Technology stocks, heavily reliant on global supply chains and international markets, are particularly vulnerable. Manufacturing stocks are also significantly impacted due to increased tariff costs and disrupted supply chains. Consumer discretionary stocks, representing goods and services sensitive to economic downturns, also experience considerable volatility.

- Details of the performance of specific sectors within the Dow Jones index: Analysis of the Dow Jones components shows significant variations in performance across different sectors. Technology and manufacturing companies tend to experience the most significant drops during trade disputes.

- Explanation of the connection between trade policies and specific industry performance: The direct relationship between trade policies and industry performance is evident in the current market downturn. Increased tariffs directly translate into higher costs, impacting profitability and stock prices.

- Examples of companies whose stock prices have been significantly impacted: Specific examples of companies experiencing significant stock price declines due to trade tensions would further illustrate this impact and solidify the connection.

Strategies for Navigating Market Uncertainty

Navigating market uncertainty requires a robust risk management strategy and a long-term investment perspective. Diversification is key to mitigating losses during market downturns.

- Recommendations for diversifying investment portfolios: Investors should diversify their portfolios across different asset classes, sectors, and geographies to reduce their exposure to any single risk factor. This includes holding a mix of stocks, bonds, and other assets.

- Discussion of risk management techniques for mitigating losses during market downturns: Risk management techniques such as stop-loss orders and hedging strategies can help limit potential losses during market declines.

- Advice on staying informed about market developments and trade news: Staying informed about market developments and trade news is crucial for making informed investment decisions. Reliable financial news sources are essential.

- Importance of consulting a financial advisor: Seeking professional advice from a qualified financial advisor is highly recommended, especially during periods of market volatility.

Conclusion

The decline in Dow futures highlights the significant impact of escalating trade concerns on market volatility and investor sentiment. The uncertainty surrounding trade negotiations, coupled with increased risk aversion, is driving market fluctuations. To navigate this uncertainty, investors should focus on diversifying their portfolios, employing robust risk management techniques, and staying informed about market developments. Understanding the factors influencing Dow futures and other market indices is crucial for effective long-term investment planning. Continuously monitor the US Stock Market and adjust your strategies accordingly.

Featured Posts

-

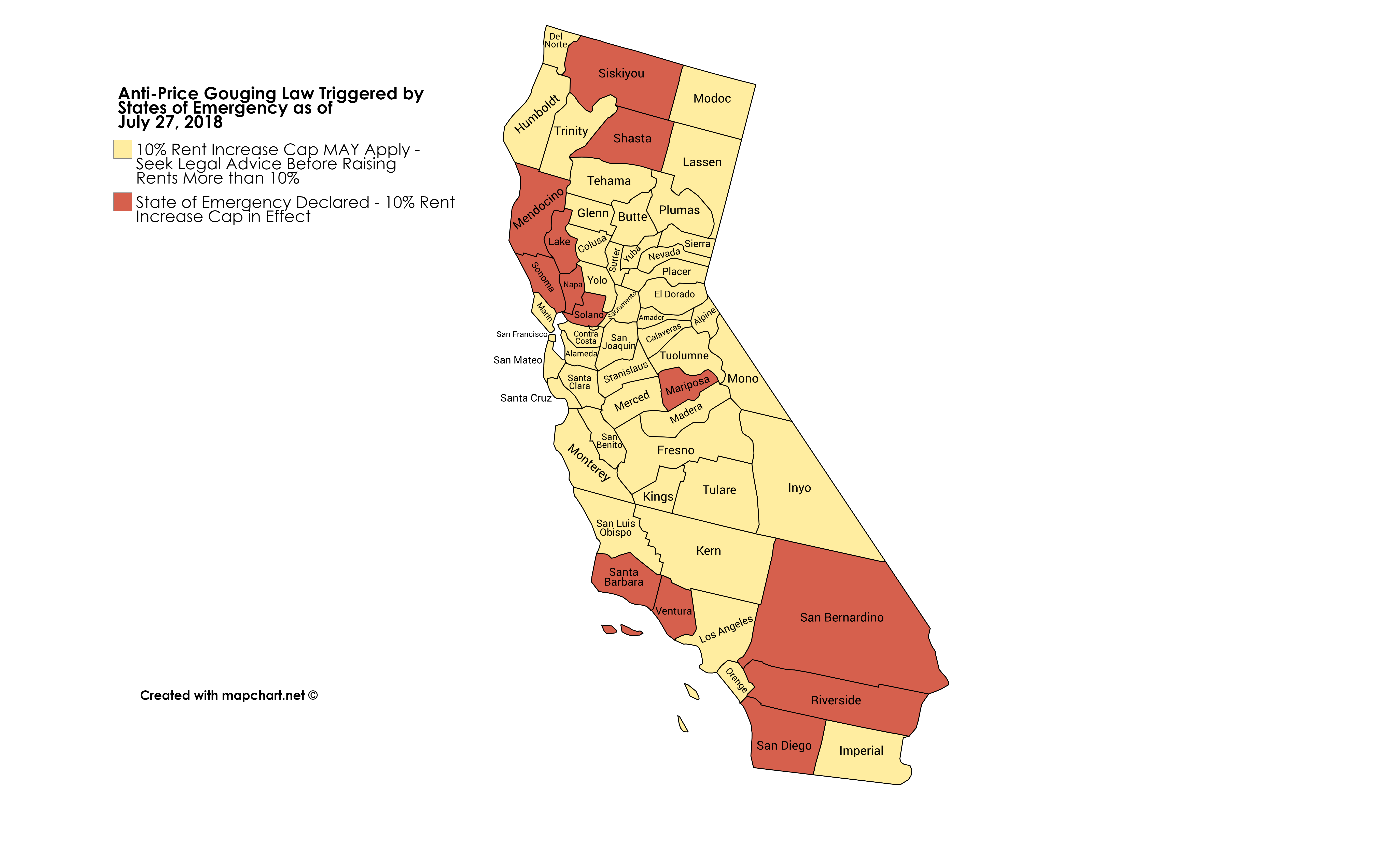

La Fires Fuel Landlord Price Gouging A Selling Sunset Star Speaks Out

Apr 22, 2025

La Fires Fuel Landlord Price Gouging A Selling Sunset Star Speaks Out

Apr 22, 2025 -

Stock Market Live Tracking Dow Futures Dollar And Trade Tensions

Apr 22, 2025

Stock Market Live Tracking Dow Futures Dollar And Trade Tensions

Apr 22, 2025 -

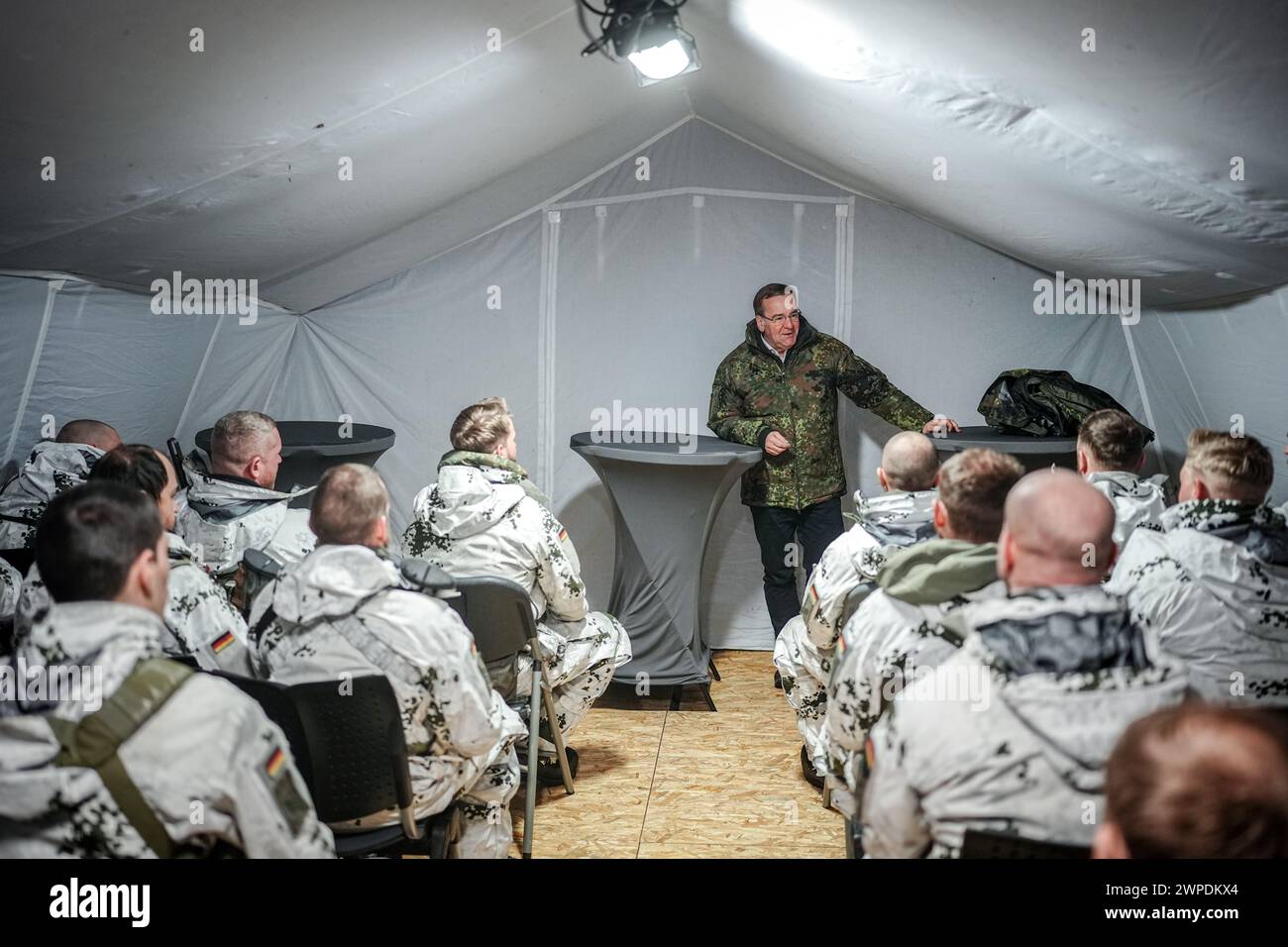

Swedens Tanks Finlands Troops A Pan Nordic Defense Force

Apr 22, 2025

Swedens Tanks Finlands Troops A Pan Nordic Defense Force

Apr 22, 2025 -

Strengthening Nordic Security The Potential Of A Combined Swedish Finnish Force

Apr 22, 2025

Strengthening Nordic Security The Potential Of A Combined Swedish Finnish Force

Apr 22, 2025 -

Cassidy Hutchinsons Fall Memoir Inside The January 6th Hearings

Apr 22, 2025

Cassidy Hutchinsons Fall Memoir Inside The January 6th Hearings

Apr 22, 2025