US Tariffs Prompt Brookfield To Re-evaluate Manufacturing Investments

Table of Contents

The Impact of US Tariffs on Manufacturing Costs

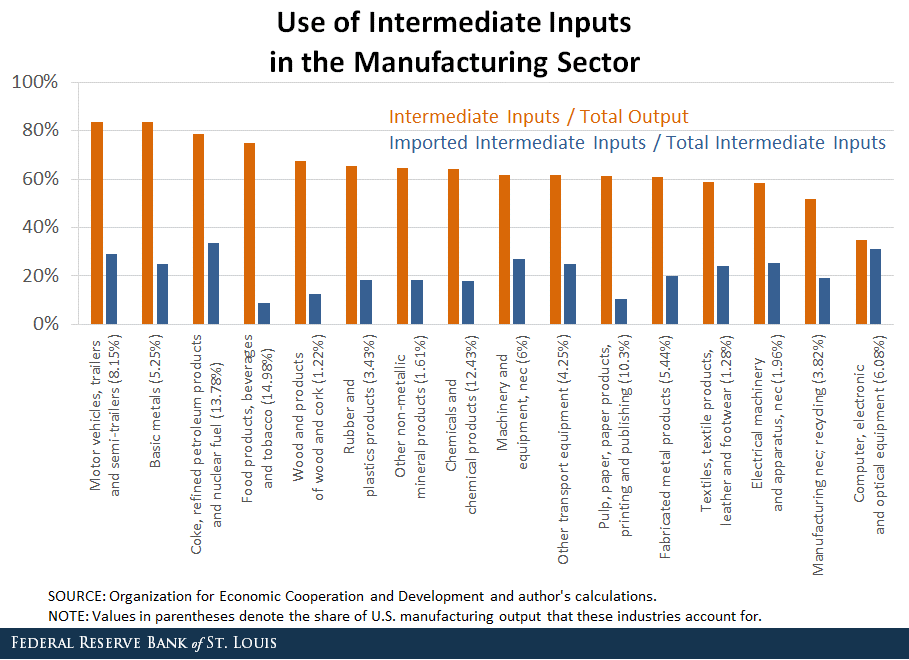

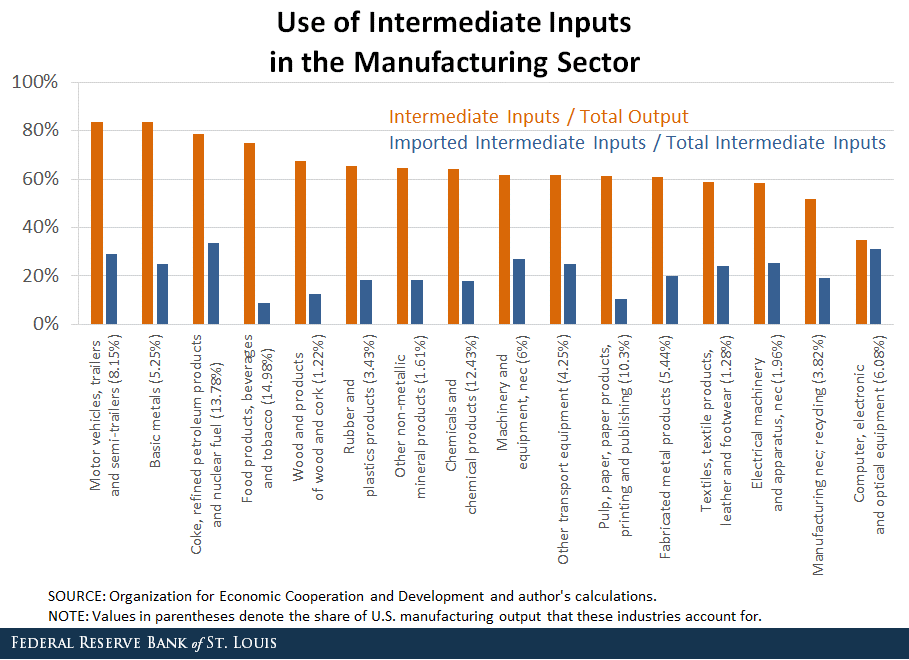

US tariffs directly impact manufacturing costs by increasing the price of imported goods and raw materials. These tariffs, implemented as part of the US government's trade policy, act as a tax on imports, raising the cost of production for companies relying on foreign-sourced components or materials. This effect is particularly pronounced in sectors where imported inputs constitute a significant portion of production costs. For example, if Brookfield holds investments in a US-based electronics manufacturer heavily reliant on imported chips from Asia, the tariffs imposed on these chips would directly increase their production costs.

This translates to several significant challenges:

- Increased input costs for raw materials: Higher import duties translate to higher costs for raw materials, squeezing profit margins.

- Higher production costs leading to reduced profit margins: Increased input costs inevitably lead to higher overall production costs, reducing the profitability of manufacturing operations.

- Loss of market share due to higher prices: To maintain profitability, manufacturers may pass on increased costs to consumers, leading to higher prices and potentially loss of market share to competitors in countries with lower production costs.

- Supply chain disruptions: Tariffs can disrupt supply chains, forcing manufacturers to seek alternative, potentially more expensive, suppliers.

These factors collectively create an environment of increased uncertainty and risk for manufacturing investors like Brookfield.

Brookfield's Investment Strategy and Risk Assessment

Brookfield Asset Management is known for its long-term investment approach and diversified portfolio. Its investment strategy typically involves thorough due diligence, a focus on risk mitigation, and a long-term view on returns. However, the volatility introduced by fluctuating US tariffs significantly alters their risk assessment process. The uncertainty surrounding future tariff policies makes long-term projections more challenging and increases the risk associated with manufacturing investments.

Brookfield’s reevaluation process likely involves:

- Diversification strategies: Assessing the geographical diversification of its manufacturing investments to mitigate the impact of US-centric tariff changes.

- Due diligence processes and risk mitigation: Conducting more rigorous due diligence on potential investments, factoring in potential tariff impacts and exploring risk mitigation strategies.

- Long-term vs. short-term investment horizons: Re-evaluating the time horizon for specific investments, potentially favoring short-term investments in more stable markets.

- Potential for divestment from certain sectors: Considering divestment from manufacturing sectors particularly vulnerable to tariff fluctuations.

Potential Outcomes and Implications for the Manufacturing Sector

Brookfield’s reevaluation of its manufacturing investments could have significant consequences for the US manufacturing sector. Reduced investment from a major player like Brookfield could lead to:

- Job creation and economic growth implications: Decreased investment may lead to slower job creation and hinder economic growth in regions dependent on manufacturing.

- Impact on regional economies heavily reliant on manufacturing: Areas with significant manufacturing presence could experience economic hardship due to reduced investment and potential plant closures.

- Potential shifts in global supply chains: Companies might shift production to countries with more favorable trade policies, altering global supply chains.

- Long-term effects on US manufacturing competitiveness: The reduced investment could negatively impact the long-term competitiveness of the US manufacturing industry on the global stage.

Other investors, observing Brookfield's response, might adopt similar cautious approaches, potentially leading to a broader slowdown in manufacturing investment across the US.

Conclusion: Navigating the Future of Manufacturing Investments in the Face of US Tariffs

Brookfield's decision to re-evaluate its manufacturing investments highlights the significant impact of US tariffs on global investment decisions. The increased uncertainty and risk associated with fluctuating trade policies are prompting a reassessment of investment strategies across the manufacturing sector. This reevaluation carries potential negative consequences for US manufacturing, including reduced investment, job losses, and diminished global competitiveness. Understanding the impact of US tariffs on manufacturing is crucial for investors, businesses, and policymakers alike. To learn more about the intricacies of US tariff impact, manufacturing investment strategies, Brookfield's response, and global trade analysis, further research into these critical areas is strongly recommended. Navigating this complex landscape requires a comprehensive understanding of the interplay between trade policy, investment strategies, and the future of manufacturing.

Featured Posts

-

Superkrispiga Kycklingnuggets Majsflingor And Fraesch Asiatisk Sallad

May 02, 2025

Superkrispiga Kycklingnuggets Majsflingor And Fraesch Asiatisk Sallad

May 02, 2025 -

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025

Official Lotto Lotto Plus 1 And Lotto Plus 2 Results

May 02, 2025 -

Avrupa Is Birligi Potansiyel Ve Zorluklar

May 02, 2025

Avrupa Is Birligi Potansiyel Ve Zorluklar

May 02, 2025 -

Kashmir Gets Railway Connection Pm Modis Inaugural Train Date Announced

May 02, 2025

Kashmir Gets Railway Connection Pm Modis Inaugural Train Date Announced

May 02, 2025 -

Two Stars Exit Celebrity Traitors Uk What Happened

May 02, 2025

Two Stars Exit Celebrity Traitors Uk What Happened

May 02, 2025