UTAC Chip Tester: Chinese Buyout Firm Explores Sale Options

Table of Contents

H2: The UTAC Chip Tester and its Market Significance

H3: Technological Capabilities and Market Position: The UTAC chip tester boasts cutting-edge technology, establishing it as a significant player in the semiconductor testing market. Its capabilities are highly sought after due to its precision and speed.

- Specific testing capabilities: High-speed testing of various memory chips (DRAM, NAND Flash), advanced logic chips (microprocessors, ASICs), and other integrated circuits. It offers superior fault detection rates compared to older generation testers.

- Target semiconductor types: The UTAC tester is compatible with a broad range of semiconductor types, catering to a substantial portion of the global market. This versatility is a key factor in its market success.

- Market share: While precise figures are proprietary, industry analysts place the UTAC tester among the top performers in the high-speed chip testing segment, commanding a significant portion of the advanced semiconductor testing market. Its high precision testing equipment makes it a preferred choice for manufacturers.

H3: Financial Performance and Market Valuation: The UTAC chip tester business demonstrates strong financial health, boasting impressive revenue figures and robust profitability.

- Revenue figures (past and projected): While exact figures are confidential, industry sources suggest consistent year-over-year revenue growth, indicating high demand and market stability. Future projections indicate continued growth, driven by the increasing demand for advanced semiconductors.

- Profitability margins: The UTAC tester business enjoys healthy profit margins, a testament to its efficient operations and premium pricing strategy. This high profitability contributes to its attractive market valuation.

- Market capitalization estimates: Based on its financial performance and market position, the UTAC chip tester business commands a substantial market capitalization, making it an attractive asset for potential acquirers. The Return on Investment (ROI) for this technology is considered high.

H2: The Chinese Buyout Firm's Strategic Considerations

H3: Reasons for Exploring a Sale: The Chinese buyout firm's decision to explore a sale likely stems from a combination of factors.

-

Potential reasons for the sale: The firm may be pursuing a strategy of portfolio restructuring, focusing resources on other high-growth areas within its investment portfolio. Financial constraints, while unlikely given the UTAC tester's profitability, could also be a contributing factor. Changing market dynamics, such as increased competition or shifts in technological trends, may also influence the decision.

-

Keyword Integration: This strategic divestment could be part of a broader market exit strategy for the firm, allowing it to consolidate its holdings and maximize returns.

H3: Potential Buyers and Acquisition Targets: Several potential buyers could be interested in acquiring the UTAC chip tester business.

- Types of potential buyers: Competitors in the semiconductor testing equipment market are likely candidates, aiming to expand their market share and product portfolio through this strategic acquisition. Private equity firms seeking high-return investments or large technology corporations looking to vertically integrate their semiconductor supply chains are other potential acquirers.

- Their likely interests and acquisition strategies: The motivations of potential buyers range from gaining access to advanced technology and intellectual property to consolidating market power and improving their competitiveness in the mergers and acquisitions (M&A) landscape.

H2: Impact on the Semiconductor Industry

H3: Consequences of a Sale or Acquisition: The sale or acquisition of the UTAC chip tester will significantly impact the semiconductor industry.

- Impacts on competition: The transaction could reshape the competitive landscape, leading to increased concentration among semiconductor testing equipment providers. This may affect pricing, innovation, and the availability of testing services for smaller chip manufacturers.

- Technological advancements: Depending on the acquirer, the sale could either accelerate or slow technological advancements in semiconductor testing. A strategic buyer focused on innovation could further enhance the UTAC tester's capabilities, while a less technologically driven buyer might prioritize cost reduction over innovation.

- Supply chain dynamics: The transaction could impact the semiconductor supply chain, potentially creating new dependencies or shifting the balance of power among industry players.

H3: Geopolitical Implications: The potential sale of a key piece of semiconductor testing equipment from a Chinese buyout firm to a foreign entity carries significant geopolitical implications.

- Potential impacts on international trade: The transaction could influence international trade relations and raise questions about technology transfer and national security concerns.

- Technological dominance: The sale's impact on global technological dominance will depend on who acquires the UTAC tester and their respective strategies. This aspect could influence the global semiconductor market dynamics.

3. Conclusion:

The potential sale of the UTAC chip tester marks a pivotal moment in the semiconductor industry. The Chinese buyout firm's strategic considerations, driven by factors such as market dynamics and financial goals, will determine the ultimate buyer and the subsequent impact on competition, technological innovation, and geopolitical stability. The ramifications extend beyond the immediate players, potentially influencing the global semiconductor market and shaping the future of semiconductor testing equipment.

Stay updated on the latest developments regarding the UTAC chip tester and the future of semiconductor testing equipment. Further research into semiconductor supply chains and the evolving geopolitical landscape will provide a more comprehensive understanding of the long-term implications of this potential sale.

Featured Posts

-

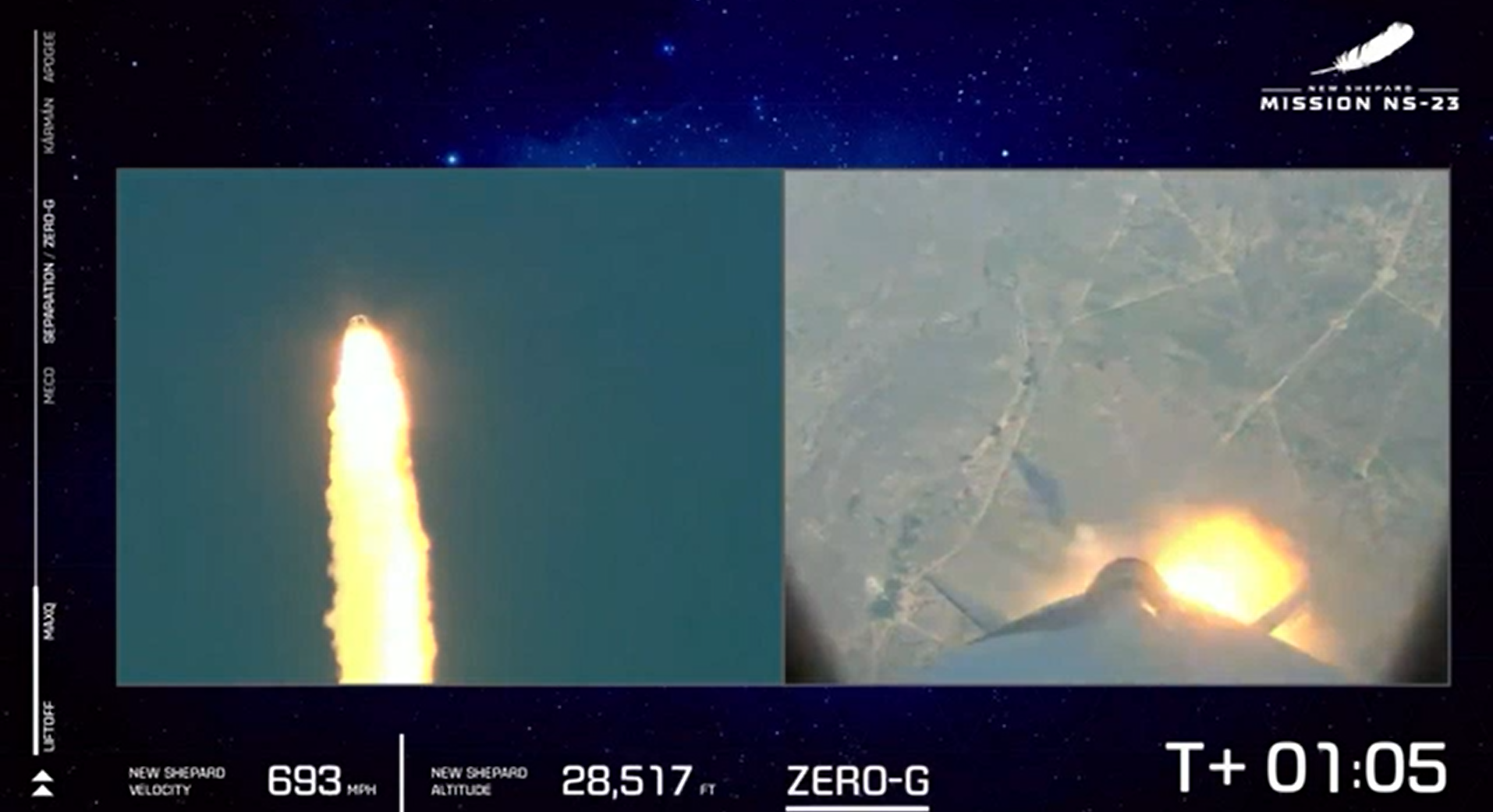

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025

Blue Origins Launch Abort Details On The Subsystem Failure

Apr 24, 2025 -

Abrego Garcia Judge Orders End To Stonewalling By Us Lawyers

Apr 24, 2025

Abrego Garcia Judge Orders End To Stonewalling By Us Lawyers

Apr 24, 2025 -

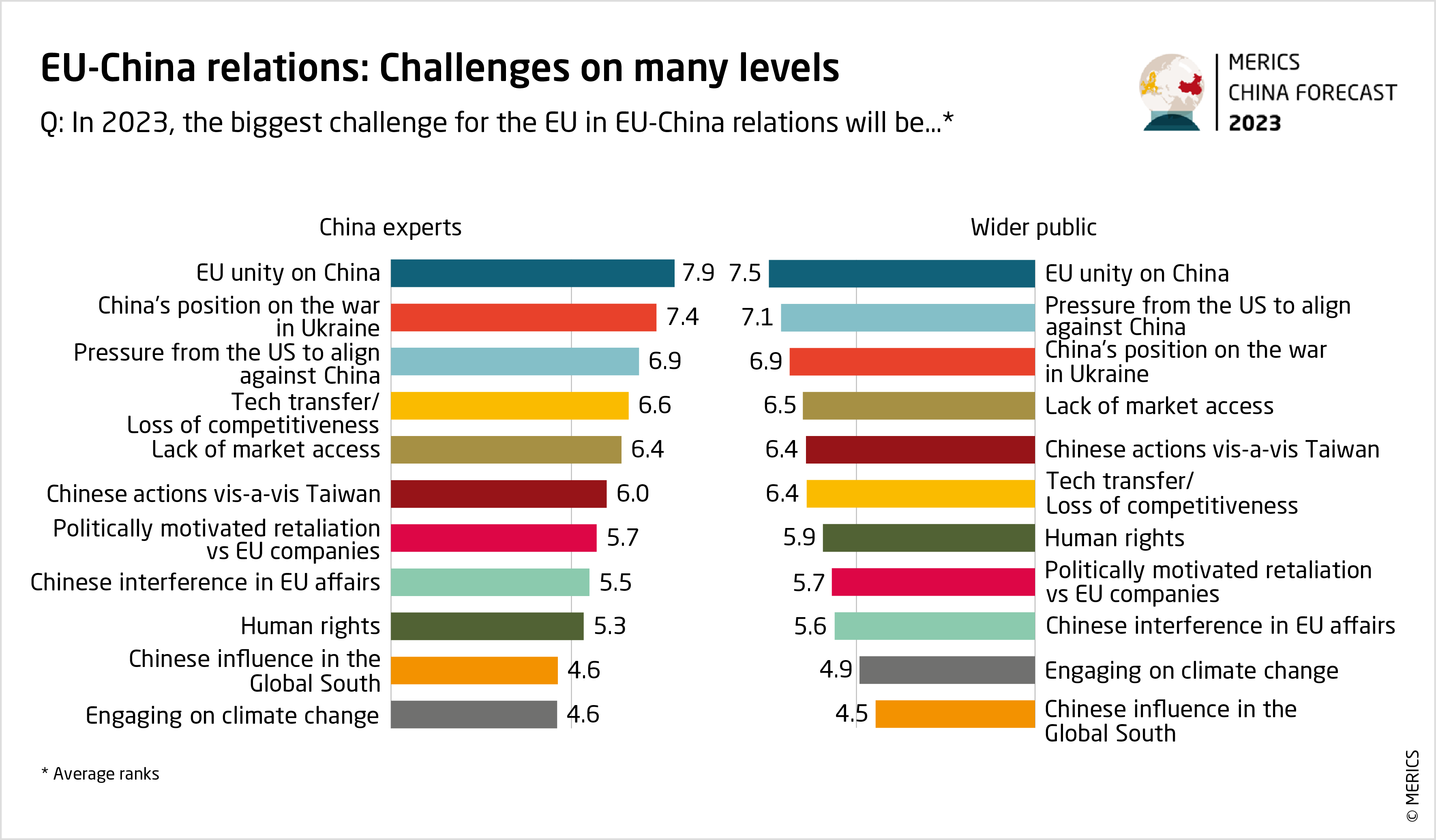

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 24, 2025

Bmw And Porsches China Challenges A Growing Trend In The Auto Industry

Apr 24, 2025 -

Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 24, 2025

Subsystem Issue Forces Blue Origin To Postpone Rocket Launch

Apr 24, 2025 -

Is Instagrams New Video App A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video App A Tik Tok Killer

Apr 24, 2025