Venture Capital Secondary Market: A Hot Investment Opportunity

Table of Contents

1. Understanding the Venture Capital Secondary Market

What is the Secondary Market?

The Venture Capital Secondary Market differs from the primary market, where investors initially commit capital to venture capital funds. In the secondary market, investors buy and sell existing stakes in venture capital funds or individual portfolio companies within those funds. This allows for the transfer of ownership of these illiquid assets, creating a much-needed liquidity mechanism within the venture capital ecosystem. Think of it as a marketplace for already-existing venture capital investments.

Why Invest in the Secondary Market?

The Venture Capital Secondary Market offers several compelling advantages:

- Liquidity: Unlike traditional venture capital investments, which typically have lock-up periods of several years, the secondary market provides access to liquidity, allowing investors to exit positions sooner than expected.

- Diversification: Investing in the secondary market allows for diversification beyond a portfolio’s primary venture capital investments. This can reduce overall portfolio risk by spreading investments across a wider range of funds and asset classes.

- Higher Returns: Historical data suggests the potential for higher returns compared to traditional investment avenues, although it's crucial to remember that returns are not guaranteed and involve risk.

- Reduced Risk (Potentially): While risk remains inherent in any investment, carefully selected secondary market opportunities can offer a potentially lower risk profile than directly investing in early-stage companies. This is because the underlying assets have already undergone a period of evaluation and growth.

- Access to Experienced Funds: Investing in the secondary market gives access to top-performing venture capital funds, allowing participation in established portfolios that have already demonstrated a successful track record.

Types of Secondary Market Transactions

Several types of transactions characterize the Venture Capital Secondary Market:

- Direct Sales: These involve the direct sale of limited partner (LP) interests from one investor to another.

- Fund-to-Fund Transactions: These involve the sale of a portion of a fund's portfolio to another fund.

- Portfolio Company Sales: These transactions focus on the sale of equity stakes in specific portfolio companies within a fund. These often involve later-stage companies closer to an exit event.

2. Identifying Promising Investment Opportunities in the Venture Capital Secondary Market

Due Diligence and Valuation

Thorough due diligence is crucial when investing in the secondary market. This involves:

- Fund Performance Analysis: Evaluate the historical performance of the fund, including its investment strategy, portfolio company performance, and management team expertise.

- Portfolio Company Valuation: Assess the individual valuations of companies within the fund's portfolio, considering their growth trajectory, market position, and competitive landscape.

- Market Conditions: Analyze prevailing market trends and economic factors that may influence valuations and returns. Consider macroeconomic factors as well as sector-specific trends.

Market Trends and Analysis

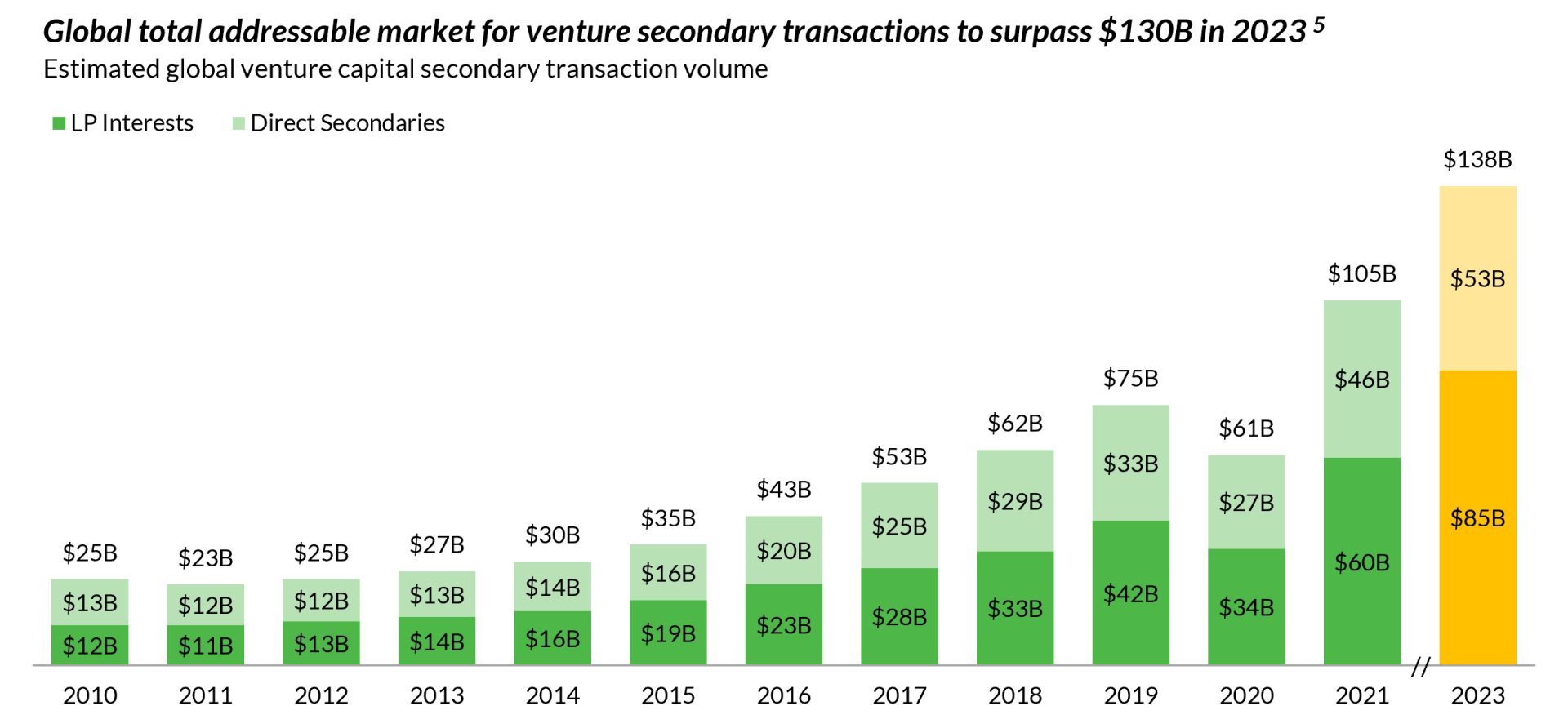

The Venture Capital Secondary Market is experiencing robust growth, driven by:

- Increased Institutional Investment: Pension funds, endowments, and other institutional investors are increasingly allocating capital to the secondary market to gain exposure to private equity and venture capital.

- Technological Advancements: Platforms and technologies are streamlining the transaction process, making it more efficient and accessible.

- Demand for Liquidity: The demand for liquidity from existing LPs is driving the growth of the secondary market.

Finding Deals

Locating promising investment opportunities requires a strategic approach:

- Specialized Brokers and Platforms: Utilize platforms and brokerage firms specializing in secondary market transactions.

- Networking: Attend industry events, and build relationships with other investors and fund managers.

- Direct Engagement: Directly approach fund managers to explore potential secondary market opportunities.

3. Navigating the Challenges of the Venture Capital Secondary Market

Liquidity Concerns

While the secondary market offers increased liquidity compared to primary VC investments, it's not entirely liquid. Transactions can take time, and finding suitable buyers may be challenging for certain assets. Strategies to mitigate this include diversifying investments and having a long-term investment horizon.

Valuation Challenges

Valuing private company stakes presents a unique challenge. Methods include:

- Discounted Cash Flow (DCF) Analysis: Projecting future cash flows and discounting them back to their present value.

- Comparable Company Analysis: Comparing the valuation multiples of publicly traded companies with similar characteristics.

- Precedent Transactions: Analyzing previous transactions involving similar companies or fund stakes.

Regulatory and Legal Considerations

Navigating the regulatory and legal landscape is essential. This includes understanding:

- Securities Laws: Ensure compliance with relevant securities laws and regulations governing the sale and purchase of securities.

- Partnership Agreements: Review the terms and conditions of the underlying fund's partnership agreement.

- Legal Counsel: Seek advice from experienced legal counsel to ensure compliance and protect your interests.

Conclusion

Investing in the Venture Capital Secondary Market presents a unique opportunity for sophisticated investors seeking liquidity, diversification, and potentially higher returns. While challenges exist, careful due diligence, strategic investment selection, and a thorough understanding of the market dynamics can significantly increase the likelihood of success. Don't miss out on this exciting opportunity— explore the Venture Capital Secondary Market today and unlock significant returns. Contact us to learn more about accessing these unique investment opportunities.

Featured Posts

-

Pete Rose Pardon Trumps Post Presidency Announcement Explained

Apr 29, 2025

Pete Rose Pardon Trumps Post Presidency Announcement Explained

Apr 29, 2025 -

Spain Vs Usa An Americans Tale Of Two Very Different Lives

Apr 29, 2025

Spain Vs Usa An Americans Tale Of Two Very Different Lives

Apr 29, 2025 -

Willie Nelson Drops New Album Before Turning 92

Apr 29, 2025

Willie Nelson Drops New Album Before Turning 92

Apr 29, 2025 -

How You Tube Caters To Older Viewers Entertainment Needs

Apr 29, 2025

How You Tube Caters To Older Viewers Entertainment Needs

Apr 29, 2025 -

Europe On High Alert Analyzing Recent Russian Military Actions

Apr 29, 2025

Europe On High Alert Analyzing Recent Russian Military Actions

Apr 29, 2025

Latest Posts

-

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025 -

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025 -

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025 -

Analyzing You Tubes Growth Among Older Demographics An Npr Perspective

Apr 29, 2025

Analyzing You Tubes Growth Among Older Demographics An Npr Perspective

Apr 29, 2025 -

Rekindling Nostalgia Older Viewers And You Tubes Retro Content

Apr 29, 2025

Rekindling Nostalgia Older Viewers And You Tubes Retro Content

Apr 29, 2025