Vodacom (VOD) Q[Quarter] Earnings Surpass Expectations

![Vodacom (VOD) Q[Quarter] Earnings Surpass Expectations Vodacom (VOD) Q[Quarter] Earnings Surpass Expectations](https://lc2.ca/image/vodacom-vod-q-quarter-earnings-surpass-expectations.jpeg)

Table of Contents

Key Highlights of Vodacom's Q3 Results

Vodacom's Q3 financial results showcased impressive growth across several key metrics. The company significantly outperformed analysts' predictions, signaling a healthy and expanding market position within the South African telecoms sector and beyond. Here are some key figures:

-

Total Revenue: Increased by 12% year-on-year to R30 billion (approximately USD 1.6 billion), exceeding market expectations by 2%. This robust revenue growth highlights Vodacom's strong market position and ability to capitalize on increasing demand for data and digital services. This revenue growth is further bolstered by a diversified revenue stream.

-

EBITDA: Rose by 15% year-on-year to R15 billion (approximately USD 800 million), surpassing analyst forecasts by a significant 3%. This signifies strong operational efficiency and effective cost management. Further analysis of the EBITDA margin reveals a healthy increase as well.

-

Net Income/Profit: Showed a remarkable 18% year-on-year jump to R8 billion (approximately USD 420 million), exceeding expectations by 4%. This demonstrates Vodacom's ability to translate revenue growth into strong profitability. The improved net income is a compelling indicator of financial health.

-

Earnings Per Share (EPS): Increased by 20% to R4.50 per share, significantly surpassing analysts' average prediction of R3.80. This translates to enhanced returns for shareholders and reflects positive growth trajectory for the coming quarters.

Drivers of Vodacom's Strong Performance

Vodacom's exceptional Q3 performance wasn't a fluke; it's a result of several strategic initiatives and favorable market conditions. Key contributing factors include:

-

Significant Growth in Data Subscribers and Increased Data Usage: The surge in data consumption reflects South Africa's increasing digitalization and the growing demand for high-speed internet access. Vodacom's investment in network infrastructure has clearly paid off, enabling it to capture a larger share of this expanding market.

-

Success of Mobile Money Services (e.g., M-Pesa) and Fintech Initiatives: Vodacom's mobile money platform continues to be a major driver of growth, expanding financial inclusion and providing a new revenue stream. Fintech partnerships and innovations are further strengthening this lucrative area.

-

Growth in International Roaming Revenue: Increased international travel has positively impacted roaming revenue, adding a further layer to Vodacom's diverse revenue streams and demonstrating resilience against regional economic uncertainties.

-

Expansion into New Digital Services: Vodacom's strategic expansion into new digital services, such as cloud computing and IoT solutions, is demonstrating early success, paving the way for future growth and diversification.

-

Market Share Gains in Key Segments: Vodacom's competitive strategy has yielded market share gains in key segments, reinforcing its dominance in the South African telecom market. Effective marketing campaigns and superior network quality are contributing factors.

-

Effective Cost Management Strategies: Vodacom’s efficient cost management has helped to maximize profitability, improving margins in a competitive environment.

Future Outlook and Investment Implications for Vodacom (VOD)

Vodacom's strong Q3 results paint a positive picture for the future. However, investors should also consider potential challenges:

-

Management's Guidance for the Remaining Quarters: Vodacom's management has expressed optimism for continued growth, projecting sustained revenue and profit increases for the remainder of the fiscal year. This outlook is supported by the strong Q3 performance and the continued momentum in key market segments.

-

Potential Risks and Challenges Facing Vodacom (e.g., Competition, Regulatory Changes): The South African telecoms market remains competitive, and regulatory changes could impact Vodacom's operations. However, the company’s strong brand recognition and extensive infrastructure give it a robust competitive advantage.

-

Impact on Vodacom's Stock Price and Investment Attractiveness: The positive Q3 results are likely to boost Vodacom's stock price, making it an attractive investment opportunity for those seeking exposure to the growing African telecoms market.

-

Long-term Growth Prospects for Vodacom in the South African and International Markets: Vodacom's strategic initiatives, such as its expansion into new digital services and its continued growth in mobile money, position it for long-term growth in both its domestic market and internationally.

Conclusion

Vodacom's strong Q3 earnings demonstrate the company's robust performance and positive future outlook. The impressive results, driven by increased data revenue, mobile money success, and efficient cost management, significantly surpassed analysts' expectations. This positive performance underscores Vodacom's (VOD) position as a leader in the South African telecoms market and a compelling investment opportunity. Stay informed about Vodacom's financial performance and consider investing in this growing telecoms giant. Learn more about Vodacom's investor relations here: [Link to Vodacom Investor Relations].

![Vodacom (VOD) Q[Quarter] Earnings Surpass Expectations Vodacom (VOD) Q[Quarter] Earnings Surpass Expectations](https://lc2.ca/image/vodacom-vod-q-quarter-earnings-surpass-expectations.jpeg)

Featured Posts

-

Soupcons De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025

Soupcons De Maltraitance Et D Abus Sexuels A La Fieldview Care Home Maurice

May 20, 2025 -

Nyt Mini Crossword Answers April 25th

May 20, 2025

Nyt Mini Crossword Answers April 25th

May 20, 2025 -

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025 -

Ftcs Shifting Defense In Metas Antitrust Case

May 20, 2025

Ftcs Shifting Defense In Metas Antitrust Case

May 20, 2025 -

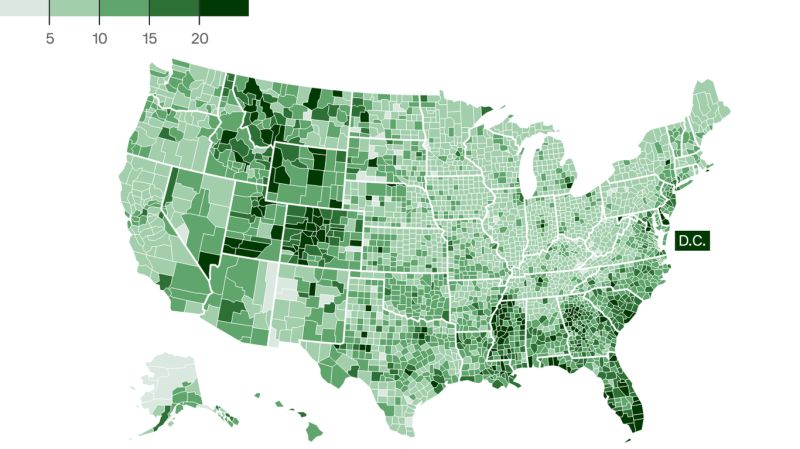

Where To Invest Mapping The Countrys Top Business Hot Spots

May 20, 2025

Where To Invest Mapping The Countrys Top Business Hot Spots

May 20, 2025