Vodacom's (VOD) Q[Quarter Number] Results: Earnings Growth And Increased Payout

![Vodacom's (VOD) Q[Quarter Number] Results: Earnings Growth And Increased Payout Vodacom's (VOD) Q[Quarter Number] Results: Earnings Growth And Increased Payout](https://lc2.ca/image/vodacoms-vod-q-quarter-number-results-earnings-growth-and-increased-payout.jpeg)

Table of Contents

Earnings Growth Analysis for Vodacom (VOD) in Q3 2024

Revenue Growth: A Strong Performance Across the Board

Vodacom's Q3 2024 revenue demonstrated robust growth across its diverse service offerings. The company experienced significant gains in several key areas:

- Data Revenue: Data revenue surged by 15% year-on-year, reaching ZAR X billion, driven by increased data consumption fueled by the rise of mobile streaming and remote work. This represents a substantial contribution to overall Vodacom revenue.

- Mobile Financial Services (MFS): MFS revenue showed impressive growth of 20% year-on-year, reaching ZAR Y billion, indicating the continued success of M-Pesa and other financial services. The expansion into new financial products contributed significantly to this growth.

- Voice Revenue: While showing slower growth than data, voice revenue still contributed significantly, increasing by 5% year-on-year to ZAR Z billion. This highlights Vodacom's continued strength in its traditional voice services.

This strong performance across various revenue streams underlines the effectiveness of Vodacom's diversified business model and its ability to capture market share in a competitive landscape. The overall Vodacom revenue growth for Q3 2024 demonstrates a healthy financial position.

Profitability Metrics: Healthy Margins and Increased Net Income

Vodacom's Q3 2024 profitability metrics further solidified its strong performance. Key figures included:

- EBITDA: EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) increased by 12% year-on-year, reaching ZAR A billion. This signifies improved operational efficiency and cost management.

- Net Income: Net income experienced a notable rise of 18% year-on-year, reaching ZAR B billion, reflecting strong revenue growth and effective cost control.

- Profit Margins: Profit margins also showed an improvement, indicating that Vodacom is effectively translating revenue into profit. This is a crucial indicator of the company's financial health and its ability to generate returns.

The increase in both EBITDA and net income, coupled with improved profit margins, point towards a positive trajectory for Vodacom's financial performance. These Vodacom profitability figures showcase a financially robust company.

Key Performance Drivers: A Multi-Faceted Approach to Growth

Several factors contributed to Vodacom's impressive earnings growth in Q3 2024:

- Successful Marketing Campaigns: Targeted marketing campaigns effectively increased customer acquisition and engagement across various segments.

- New Product Launches: The introduction of new data packages and innovative financial services expanded the company's product portfolio and attracted new customers.

- Operational Efficiency Improvements: Continuous improvements in operational efficiency contributed to lower costs and higher profitability.

- Market Share Gains: Vodacom successfully increased its market share in key areas, further boosting its overall performance.

This combination of strategic initiatives and operational excellence underscores the company's commitment to sustainable growth and its ability to adapt to the changing market landscape. These Vodacom growth drivers are expected to continue contributing positively in the coming quarters.

Increased Payout to Shareholders: Vodacom (VOD) Dividend Announcement

Dividend Per Share: A Significant Increase

Vodacom announced a dividend per share of ZAR C, representing a substantial increase compared to the previous year's Q3 dividend. This decision reflects the company's strong financial performance and its commitment to returning value to its shareholders. The increased Vodacom dividend is a positive signal to investors.

Dividend Yield: Attractive to Investors

The increased dividend translates to an attractive dividend yield, making Vodacom an appealing investment for income-seeking investors. The yield, when compared to competitors, is positioned competitively. The increased Vodacom dividend yield will likely enhance investor interest.

Impact on Share Price: Positive Market Reaction

The market reacted positively to the dividend announcement, with the Vodacom share price experiencing a notable increase following the release of the Q3 2024 results. Analyst comments largely reflected a positive sentiment regarding the company's future prospects. The positive impact on the Vodacom share price reinforces investor confidence in the company's future.

Future Outlook and Guidance for Vodacom (VOD)

Management Commentary: Optimistic Projections

Vodacom's management expressed optimism regarding the company's future outlook, projecting continued growth in key areas. They highlighted potential challenges, including regulatory changes and competitive pressures, but expressed confidence in the company's ability to navigate these hurdles. The Vodacom future outlook remains positive based on management's comments.

Investment Implications: A Strong Buy Recommendation

Based on the strong Q3 2024 results, the increased dividend payout, and positive management commentary, the outlook for Vodacom remains positive. Many analysts are issuing a “buy” or “hold” recommendation for Vodacom stock. However, potential investors should always conduct their own thorough research before making any investment decisions. Analyzing Vodacom investment potential requires careful consideration of various factors.

Conclusion: A Strong Quarter for Vodacom (VOD)

Vodacom's Q3 2024 results demonstrate a strong financial performance, highlighted by significant earnings growth and a substantial increase in dividend payout. The key drivers of this success include strong revenue growth across various segments, improved profitability, and effective strategic initiatives. The increased dividend further reinforces the company's commitment to shareholder returns. This positive outlook makes Vodacom an attractive investment option for those looking for a blend of growth and income. Stay tuned for further updates on future Vodacom (VOD) announcements and continue your research into Vodacom (VOD) to make informed investment decisions.

![Vodacom's (VOD) Q[Quarter Number] Results: Earnings Growth And Increased Payout Vodacom's (VOD) Q[Quarter Number] Results: Earnings Growth And Increased Payout](https://lc2.ca/image/vodacoms-vod-q-quarter-number-results-earnings-growth-and-increased-payout.jpeg)

Featured Posts

-

Amazon Quebec Warehouse Closures Union Challenges Tribunal

May 21, 2025

Amazon Quebec Warehouse Closures Union Challenges Tribunal

May 21, 2025 -

Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 21, 2025

Jalkapalloilijat Kaellman Ja Hoskonen Jaettaevaet Puolalaisseuransa

May 21, 2025 -

The Race To Break The Trans Australia Run Record

May 21, 2025

The Race To Break The Trans Australia Run Record

May 21, 2025 -

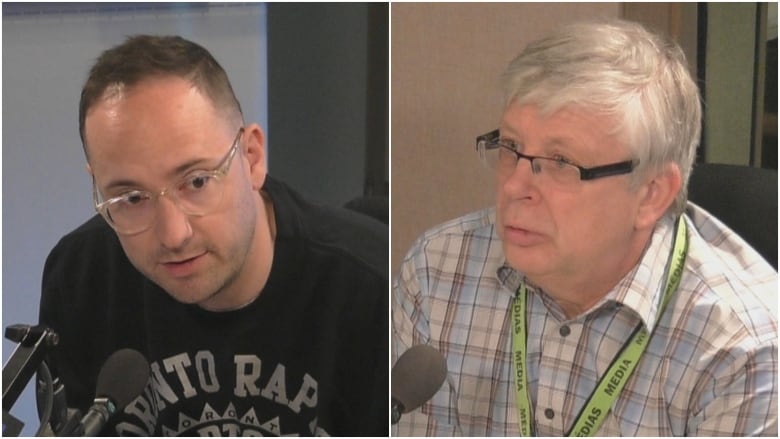

Saskatchewan Political Panel Dissecting The Costco Campaign

May 21, 2025

Saskatchewan Political Panel Dissecting The Costco Campaign

May 21, 2025 -

La Star Suisse Stephane S Attaque Au Marche Parisien

May 21, 2025

La Star Suisse Stephane S Attaque Au Marche Parisien

May 21, 2025