Wall Street Banks Sell Final Portion Of Elon Musk's X Debt: Exclusive

Table of Contents

The Final Sale of Elon Musk's X Debt

The sale of the final tranche of Elon Musk's X debt concludes a months-long process of divestment by several prominent Wall Street institutions. While the precise buyer and exact sale price remain undisclosed due to confidentiality agreements, reliable sources within the financial sector confirm the completion of the transaction. This follows previous sales of portions of the debt, which began shortly after the initial acquisition. The timeline of these sales suggests a strategic effort by the banks to mitigate risk and recover their investment.

- Confirmation of the sale: Sources close to Morgan Stanley, Goldman Sachs, and Bank of America, key players in the initial financing, confirm the final sale of Elon Musk's X debt.

- Total amount involved: While the exact figure remains confidential, estimates place the final portion of the debt in the hundreds of millions of dollars. The total debt originally acquired for the Twitter purchase was significantly higher.

- Type of debt: The debt sold is primarily considered secured debt, backed by X's assets. This likely facilitated a smoother and quicker sale compared to unsecured debt.

- Impact on Musk's financial position: The successful offloading of the remaining debt significantly reduces the financial pressure on Elon Musk, freeing up capital for other ventures and reducing his overall financial risk.

Implications for Elon Musk and X

The complete sale of Elon Musk's X debt holds profound implications for both Musk's personal finances and X's future trajectory. The reduced debt burden represents a significant milestone, potentially impacting future investment decisions and the platform's long-term strategy.

- Reduced financial pressure: This allows Musk to focus on other priorities, including Tesla and SpaceX, without the weight of substantial X-related debt.

- Future funding and expansion: The financial flexibility gained from this sale could enable X to pursue new growth initiatives, including product development, increased hiring, and potential acquisitions.

- Future business ventures: This successful debt management might encourage investors to support Musk's future projects, showcasing his ability to navigate challenging financial landscapes.

- Shift in financial strategies: The strategic sale suggests a potential shift towards more sustainable debt management practices in Musk's future endeavors. The sale might signal a more cautious approach to future large-scale acquisitions.

Impact on the Financial Markets

The successful sale of Elon Musk's X debt has broader implications for the financial markets, impacting investor sentiment and risk assessment within the technology sector.

- Market reaction: The news has generally been received positively, reflecting a reduction in perceived risk associated with Musk's ventures.

- Investor confidence: The successful sale reinforces investor confidence in the ability to manage and divest from high-risk, high-reward ventures.

- Ripple effects in tech investment: The efficient management of this high-profile debt could influence future investment strategies within the technology sector.

- Comparison to similar sales: This deal can be compared to other high-profile tech acquisitions, providing valuable insights into debt management and risk mitigation strategies in the industry.

Analysis of the Deal and Future Predictions

Analyzing this transaction and considering expert opinions allows for some speculation on the future of X and its financial stability.

- X's future performance: The reduced debt burden increases the likelihood of X achieving profitability and sustainable growth in the coming years.

- Potential challenges: Competition from other social media platforms remains a key challenge, along with ongoing concerns about content moderation and user engagement.

- Expert opinions: Financial analysts predict that X's future will largely depend on its ability to innovate and adapt to changing market dynamics.

- Comparison to other tech acquisitions: Examining the successes and failures of comparable tech acquisitions informs the outlook for X's long-term performance.

Conclusion

The successful sale of the final portion of Elon Musk's X debt marks a significant turning point, relieving financial pressure on Musk and potentially paving the way for future growth and development of X. The implications extend beyond Musk's personal finances, impacting investor confidence and shaping future investment strategies in the tech sector. This transaction offers valuable insights into the complexities of managing substantial debt in high-profile acquisitions. Stay tuned for further updates on Elon Musk's X debt and other financial news affecting the tech industry. Subscribe to our newsletter for exclusive insights into the future of X and its financial landscape.

Featured Posts

-

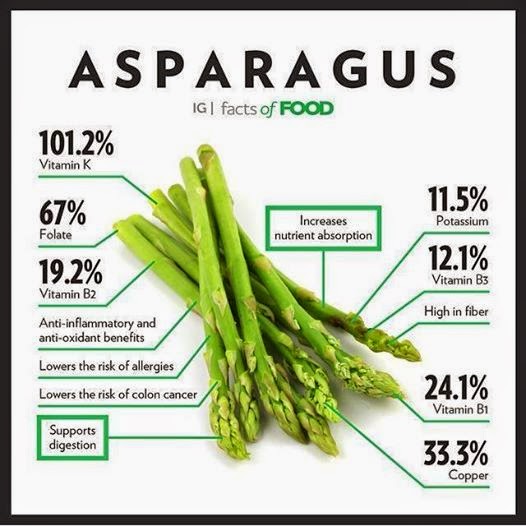

How Healthy Is Asparagus Unveiling The Nutritional Benefits

May 01, 2025

How Healthy Is Asparagus Unveiling The Nutritional Benefits

May 01, 2025 -

Ljubavni Zivot Zdravka Colica Detalji O Prvoj Ljubavi I Pesmi Kad Sam Se Vratio

May 01, 2025

Ljubavni Zivot Zdravka Colica Detalji O Prvoj Ljubavi I Pesmi Kad Sam Se Vratio

May 01, 2025 -

Cardinal Beccius Trial New Evidence Suggests Injustice

May 01, 2025

Cardinal Beccius Trial New Evidence Suggests Injustice

May 01, 2025 -

Dragons Den Backs Omnis Innovative Plant Based Dog Food Brand

May 01, 2025

Dragons Den Backs Omnis Innovative Plant Based Dog Food Brand

May 01, 2025 -

Real Or Fake How To Identify Authentic Steven Bartlett Videos

May 01, 2025

Real Or Fake How To Identify Authentic Steven Bartlett Videos

May 01, 2025