Wall Street's Palantir Prediction: Buy Or Sell Before May 5th?

Table of Contents

Analyzing Wall Street's Palantir Predictions

Wall Street analysts are sharply divided on Palantir's future. Understanding these diverging opinions is crucial for making an informed investment decision. The Palantir stock prediction landscape is a complex mix of bullish and bearish sentiments.

Bullish Arguments for Buying Palantir Stock

The bullish case for PLTR rests on several key pillars:

-

Strong Government Contracts Pipeline: Palantir enjoys a significant presence in the government sector, with a robust pipeline of potential contracts. This consistent revenue stream provides a degree of stability, mitigating some risks associated with the company's growth trajectory. Recent contract awards suggest continued growth in this area. The securing of large government contracts can significantly impact the Palantir stock price.

-

Increasing Adoption of Palantir's Foundry Platform: Palantir's Foundry platform is gaining traction across various industries, demonstrating its versatility and potential for widespread adoption. This expansion beyond the government sector represents a significant growth opportunity, boosting PLTR stock forecast and Palantir growth prospects.

-

Potential for Significant Revenue Growth: Analysts who are bullish on Palantir point to the company's substantial growth potential, particularly as its commercial business expands and the Foundry platform gains wider acceptance. This potential for significant revenue growth fuels positive analyst upgrades and contributes to a more optimistic Palantir stock price prediction.

-

Undervalued Stock Price Compared to Competitors: Some analysts argue that Palantir's current stock price undervalues its technological capabilities and future growth potential relative to its competitors in the big data analytics market. This undervaluation provides a compelling entry point for long-term investors.

Bearish Arguments for Selling Palantir Stock

Conversely, the bearish perspective highlights several potential risks:

-

High Valuation Concerns: Despite its growth potential, Palantir's valuation remains a concern for some investors. Compared to established tech giants, its high valuation might be considered unsustainable, leading to concerns about PLTR stock risks.

-

Dependence on Government Contracts: While a stable revenue source, Palantir's heavy reliance on government contracts exposes it to potential political and budgetary shifts, posing a significant risk to its future revenue.

-

Competition in the Big Data Analytics Market: The big data analytics market is highly competitive, with established players and emerging startups vying for market share. Palantir faces intense competition, which could slow its revenue growth and impact the Palantir stock price.

-

Potential for Slowing Revenue Growth: Although Palantir exhibits growth, some analysts predict a potential slowdown in revenue growth in the coming years, fueled by increased competition and market saturation. This concern influences the negative analyst reports contributing to a pessimistic Palantir valuation.

Key Factors Influencing the May 5th Deadline

The May 5th deadline likely refers to an upcoming earnings report or other significant event. Several key factors will heavily influence the Palantir stock prediction around this date:

Upcoming Earnings Report and its Implications

The upcoming Palantir earnings date will be crucial. The report's contents—revenue figures, profit margins, guidance for the next quarter, and any significant developments regarding new contracts—will heavily influence the market's sentiment and, subsequently, the PLTR stock price. The PLTR earnings forecast varies widely among analysts.

Recent Contract Wins and Losses

Recent contract wins or losses can significantly impact Palantir's trajectory. Large contract wins bolster investor confidence, while losses can negatively impact the Palantir stock price and overall market sentiment. Analyzing these contract announcements is vital for understanding the near-term outlook.

Overall Market Conditions and their Effect on PLTR

Broader market trends and stock market volatility will undoubtedly influence Palantir's stock performance. A strong overall market tends to benefit even riskier stocks like PLTR, while a downturn can significantly impact its price regardless of its underlying performance.

Technical Analysis of Palantir Stock

Technical analysis provides another lens through which to view Palantir stock:

Chart Patterns and Support/Resistance Levels

Examining Palantir technical analysis, including chart patterns (such as head and shoulders or triangles), support and resistance levels, and other technical indicators, can offer insights into potential price movements. Identifying key support and resistance levels can help investors anticipate potential price reversals.

Moving Averages and Trading Volume

Analyzing moving averages (e.g., 50-day, 200-day) and trading volume can provide insights into the underlying momentum of Palantir's stock and the overall market sentiment. High trading volume often accompanies significant price movements.

Conclusion: Making Informed Decisions on Palantir Stock Before May 5th

The decision of whether to buy or sell Palantir before May 5th hinges on a careful assessment of both bullish and bearish arguments. While Palantir offers significant growth potential thanks to its Foundry platform and government contracts, it also faces challenges such as high valuation concerns and intense competition. The upcoming earnings report and prevailing market conditions will play a crucial role in shaping Palantir's short-term future. Therefore, understanding Wall Street's Palantir prediction should be only one factor in your decision-making process. Ultimately, the decision of whether to buy or sell Palantir before May 5th is yours. Use this analysis of Wall Street's Palantir prediction as a starting point for your own due diligence, and remember to make decisions based on your individual risk tolerance and financial goals. Consider consulting a financial advisor before making any investment decisions related to Palantir stock or other securities.

Featured Posts

-

Dijon Rue Michel Servet Explication D Un Accident Impliquant Un Vehicule Et Un Mur

May 10, 2025

Dijon Rue Michel Servet Explication D Un Accident Impliquant Un Vehicule Et Un Mur

May 10, 2025 -

Us Tariffs French Minister Pushes For Stronger Eu Retaliation

May 10, 2025

Us Tariffs French Minister Pushes For Stronger Eu Retaliation

May 10, 2025 -

Strictly Fallout Wynne Evans No Longer Featured In Go Compare Ads

May 10, 2025

Strictly Fallout Wynne Evans No Longer Featured In Go Compare Ads

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Analysis

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Wall Street Analysis

May 10, 2025 -

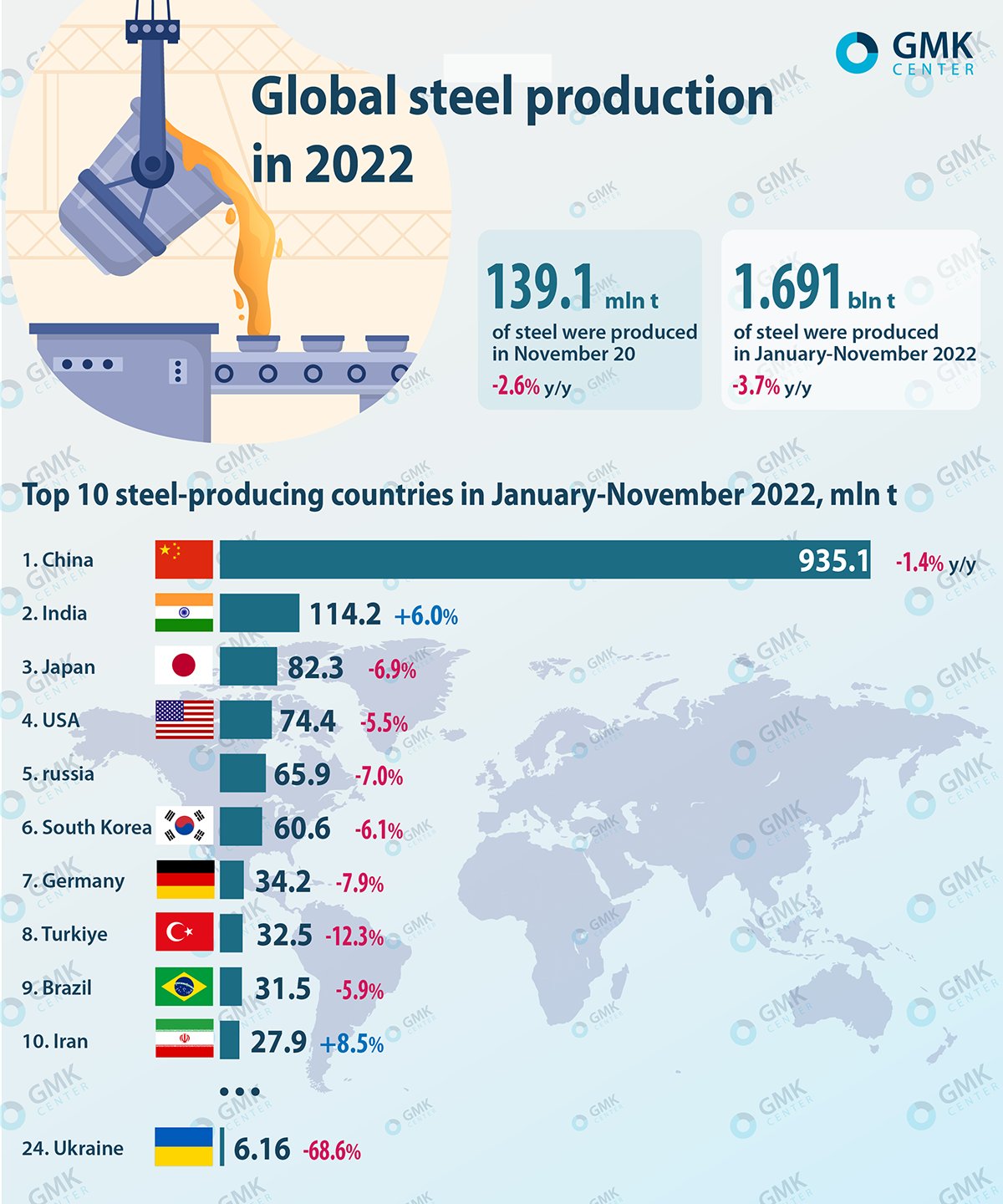

Falling Iron Ore Prices Analysis Of Chinas Steel Production Curbs

May 10, 2025

Falling Iron Ore Prices Analysis Of Chinas Steel Production Curbs

May 10, 2025