Wall Street's Prediction: This BlackRock ETF Could Surge 110% By 2025

Table of Contents

Why Wall Street Believes in This BlackRock ETF's Potential

Several key factors contribute to Wall Street's optimistic 2025 prediction for this BlackRock ETF (let's assume, for the sake of this example, the ticker symbol is IHYG, representing a hypothetical high-yield corporate bond ETF).

Underlying Asset Strength: The Power of High-Yield Bonds

IHYG, in this hypothetical example, focuses on high-yield corporate bonds. This sector is predicted to experience significant growth fueled by several factors:

- Strong Corporate Earnings: Many companies are projected to see robust earnings growth in the coming years, bolstering their ability to service their debt.

- Rising Interest Rates (with a caveat): While rising interest rates can initially negatively impact bond prices, the current environment suggests a potential for future rate stabilization and eventual decline, thereby boosting bond prices in the long run. This is particularly true for high-yield bonds whose prices are more sensitive to changes in interest rates.

- Increased Demand for Yield: In a low-interest-rate environment, investors often seek higher yields, driving up demand for high-yield bonds.

These factors, supported by various industry reports and analyst forecasts from reputable firms like Moody's and S&P, paint a picture of potential growth within the high-yield corporate bond market. This strong underlying asset class is a cornerstone of the positive 2025 prediction for IHYG. The investment strategy of focusing on this sector positions the ETF for potential capital appreciation.

BlackRock's Track Record and Expertise: A Giant in Asset Management

BlackRock's reputation precedes it. As a leading global asset management firm, they possess unparalleled expertise in managing diverse investment portfolios, including ETFs. Their decades of experience, combined with rigorous research and sophisticated risk management strategies, inspire confidence among investors. BlackRock’s proven track record in managing similar ETFs further strengthens the case for IHYG's projected growth. Their award-winning strategies and consistent investment performance contribute to the positive outlook for this specific ETF.

Favorable Macroeconomic Factors: Riding the Wave of Global Growth

Several favorable macroeconomic factors contribute to the 110% growth prediction by 2025. A sustained global economic recovery, coupled with potentially lower inflation in the future, is expected to drive corporate growth and subsequently increase demand for high-yield bonds. While risks remain, such as geopolitical instability or unexpected inflation spikes, analysts believe the positive trends are likely to outweigh these risks in the long run. A well-diversified investment portfolio can help mitigate these risks. Smart asset allocation is key.

Understanding the Risks and Potential Drawbacks

While the 110% growth prediction is alluring, it’s crucial to acknowledge the inherent risks involved:

Market Volatility: The Unpredictable Nature of Investments

The market is inherently volatile. Unexpected events, from economic downturns to geopolitical crises, can significantly impact investment returns. No investment is without risk. IHYG, despite its potential, is subject to these market fluctuations.

ETF-Specific Risks: Understanding the Fine Print

IHYG's investment strategy (focusing on high-yield corporate bonds) presents specific risks:

- Interest Rate Risk: Changes in interest rates directly impact bond prices.

- Credit Risk: The possibility of issuers defaulting on their debt obligations.

- Inflation Risk: Unexpected inflation can erode the real return of bond investments.

These risks must be carefully considered before investing.

Time Horizon: Patience is Key

It's vital to remember that the 110% growth prediction is a long-term forecast, extending to 2025. Short-term market fluctuations might cause temporary setbacks. Investing in IHYG requires patience and a long-term perspective.

How to Invest in This Promising BlackRock ETF

Investing in ETFs like IHYG is relatively straightforward:

- Open a Brokerage Account: Choose a reputable online brokerage firm like Fidelity, Schwab, or TD Ameritrade.

- Fund Your Account: Deposit the necessary funds to purchase the ETF shares.

- Place Your Order: Search for IHYG (or the actual ETF ticker) and execute your trade.

Remember to research and compare brokerage platforms before selecting one. Minimum investment requirements vary depending on the broker. Always consult a financial advisor before making any investment decisions. You can find more information on how to invest in ETFs on BlackRock's website [link to BlackRock's website].

Conclusion: Capitalize on the Potential of this BlackRock ETF

The 2025 prediction of a 110% surge for this hypothetical BlackRock ETF (IHYG) presents a compelling investment opportunity. However, it’s essential to understand the underlying factors driving this prediction and the potential risks involved. Thorough research, a long-term perspective, and a well-diversified investment portfolio are critical for mitigating risks. Consider this BlackRock ETF investment as part of a broader strategy. Don't hesitate to consult with a financial advisor to determine if this investment aligns with your personal financial goals and risk tolerance. Invest wisely, and potentially reap the rewards of this promising BlackRock ETF investment.

Featured Posts

-

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025

Post 2025 Nhl Trade Deadline Playoff Predictions And Analysis

May 09, 2025 -

Imalaia Elaxista Xionia Se 23etia Anisyxia Gia To Mellon

May 09, 2025

Imalaia Elaxista Xionia Se 23etia Anisyxia Gia To Mellon

May 09, 2025 -

Stiven King Novaya Ataka Na Trampa I Maska

May 09, 2025

Stiven King Novaya Ataka Na Trampa I Maska

May 09, 2025 -

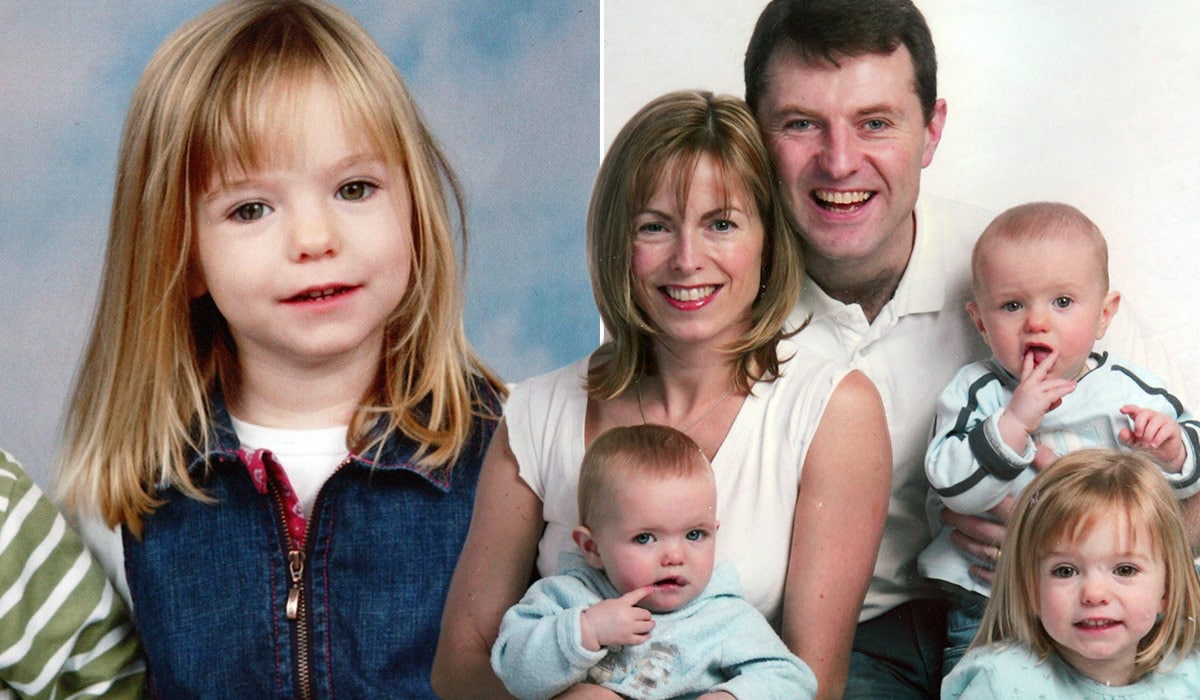

New Dna Evidence In Madeleine Mc Cann Case A 23 Year Olds Story

May 09, 2025

New Dna Evidence In Madeleine Mc Cann Case A 23 Year Olds Story

May 09, 2025 -

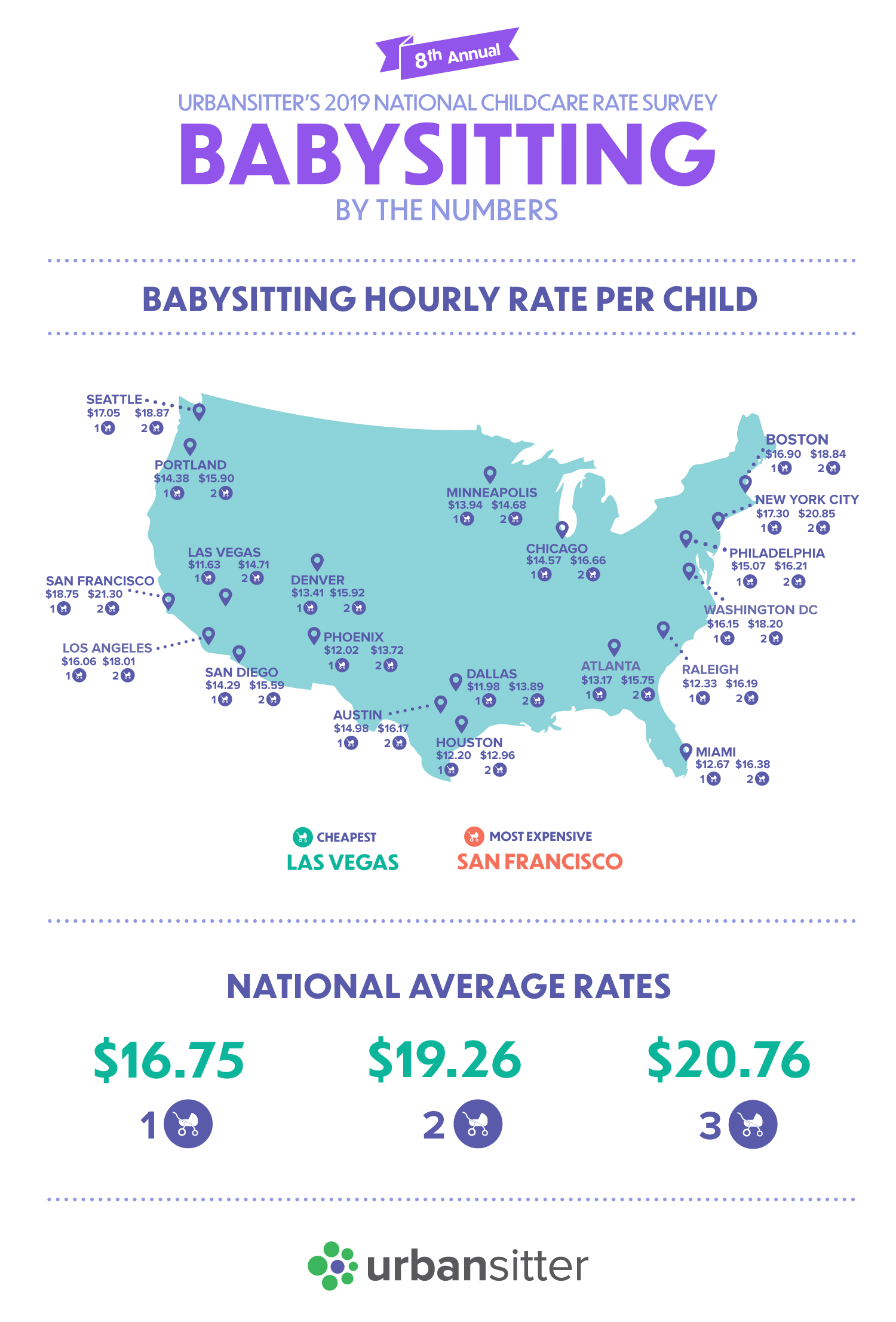

Expensive Babysitting Costs Father A Fortune In Daycare Fees

May 09, 2025

Expensive Babysitting Costs Father A Fortune In Daycare Fees

May 09, 2025

Latest Posts

-

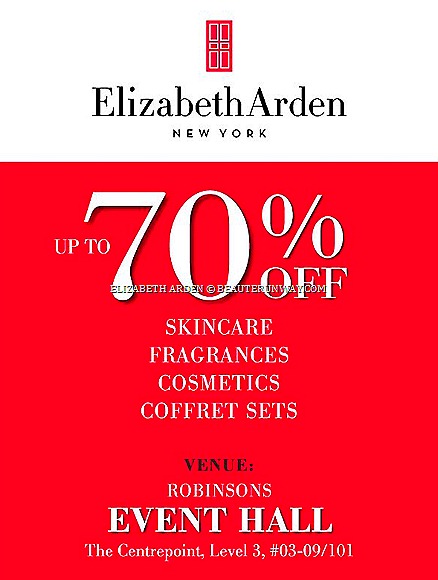

How To Find Cheap Elizabeth Arden Skincare

May 09, 2025

How To Find Cheap Elizabeth Arden Skincare

May 09, 2025 -

Discounted Elizabeth Arden Skincare Walmart And More

May 09, 2025

Discounted Elizabeth Arden Skincare Walmart And More

May 09, 2025 -

Elizabeth Arden Products Budget Friendly Options

May 09, 2025

Elizabeth Arden Products Budget Friendly Options

May 09, 2025 -

Affordable Elizabeth Arden Skincare Where To Buy

May 09, 2025

Affordable Elizabeth Arden Skincare Where To Buy

May 09, 2025 -

Find Elizabeth Arden Skincare At Walmart Prices

May 09, 2025

Find Elizabeth Arden Skincare At Walmart Prices

May 09, 2025