Wall Street's Resurgence: How The Market Is Defying Bearish Predictions

Table of Contents

Unexpected Economic Strength

The resilience of the US economy has played a significant role in Wall Street's resurgence. Contrary to pessimistic forecasts, several key indicators point to surprising economic strength.

Resilient Consumer Spending

Despite persistent inflation and economic uncertainty, consumer spending remains remarkably robust. This "consumer spending strength" is a crucial pillar supporting the market rebound.

- Strong Retail Sales: Recent retail sales figures have consistently exceeded expectations, demonstrating continued consumer demand despite rising prices.

- Low Unemployment Rates: The persistently low unemployment rate indicates a healthy labor market, boosting consumer confidence and spending power.

- Positive Consumer Confidence Indicators: Various consumer confidence indices have shown surprising resilience, suggesting a belief in the economy's future prospects. This sustained "economic resilience" is a key factor in the Wall Street recovery.

Strong Corporate Earnings

Many major corporations have reported unexpectedly positive earnings, further fueling the Wall Street resurgence. This "corporate profits" surge is a powerful indicator of economic health.

- Earnings Surprises: Numerous companies have exceeded analysts' expectations, demonstrating the underlying strength of the corporate sector.

- Cost-Cutting Measures and Increased Productivity: Many firms have implemented successful cost-cutting measures and improved productivity, leading to higher profit margins. This contributed to the impressive "earnings surprises" that boosted the market rebound.

Shifting Investor Sentiment

A significant shift in investor sentiment is another crucial factor contributing to Wall Street's surprising comeback.

Easing Inflation Concerns

The easing of inflation fears has significantly boosted investor confidence. The "inflation slowdown" is a major driver of market optimism.

- Decreasing Inflation Rates: Recent data indicates a clear deceleration in inflation rates, reducing concerns about aggressive interest rate hikes.

- Federal Reserve Actions: The Federal Reserve's measured approach to monetary policy, while still aiming to combat inflation, has helped to alleviate some investor anxieties. This "monetary policy impact" has calmed markets and improved investor confidence.

Technological Advancements and Innovation

Breakthroughs in technology and innovation are driving significant investor interest in specific sectors, further fueling the "market optimism." This "technological innovation" is a major force behind sector growth.

- Artificial Intelligence (AI): The rapid advancements in AI are attracting massive investment, driving significant growth in related sectors.

- Renewable Energy: The increasing focus on renewable energy sources is creating new investment opportunities and driving growth in this crucial sector. This "Wall Street investment" in green technologies contributes to the overall market recovery.

Government Policies and Intervention

Government policies and interventions, both fiscal and monetary, have also played a role in shaping the current market landscape.

Fiscal and Monetary Policies

While the impact is debated, government interventions, including fiscal stimulus measures and monetary easing policies in previous years, have contributed to the current economic conditions, indirectly influencing the "market rebound." Analyzing the "fiscal stimulus effect" and "monetary policy impact" is essential for understanding the broader picture.

- Impact of Previous Stimulus Packages: Previous fiscal stimulus packages, while debated, arguably helped prevent a deeper economic downturn, setting the stage for the current recovery.

- Monetary Policy Adjustments: The Federal Reserve's adjustments to monetary policy, although sometimes unpredictable, have had a direct impact on investor behavior and market performance. The effects of government "intervention" are complex and require further study.

Geopolitical Factors

Geopolitical events and global stability (or lack thereof) can have a profound effect on the market. Surprisingly, in the current climate, some events have had a neutral or even positive, unexpected impact on Wall Street's performance. This "geopolitical stability," relative to previous fears, has contributed to the "global market trends" and improved Wall Street's outlook.

- Unexpected Geopolitical Developments: Certain unexpected geopolitical developments have had less negative impact than initially feared, contributing to a more positive market sentiment.

- International Trade Dynamics: Changes in international trade dynamics have, in some instances, benefited certain sectors, contributing to the overall market recovery. The influence of these "geopolitical factors" is often complex and hard to predict.

Conclusion

Wall Street's resurgence is a multifaceted phenomenon driven by a combination of unexpected economic strength, a shift in investor sentiment, and the influence of government policies. The resilience of consumer spending, strong corporate earnings, easing inflation concerns, technological advancements, and the relatively stable geopolitical climate have all contributed to this surprising market turnaround. Understanding the factors driving Wall Street's resurgence is crucial for informed investment decisions. Stay tuned for further analysis and insights into this evolving market dynamic, and don't miss out on the potential opportunities presented by Wall Street's ongoing recovery.

Featured Posts

-

Metas Whats App Spyware Verdict A Costly Setback

May 10, 2025

Metas Whats App Spyware Verdict A Costly Setback

May 10, 2025 -

Behind The Judges Gavel Exploring Jeanine Pirros Fox News Career

May 10, 2025

Behind The Judges Gavel Exploring Jeanine Pirros Fox News Career

May 10, 2025 -

Dakota Johnson Suzalojimai Nuotrauku Analize Ir Faktai

May 10, 2025

Dakota Johnson Suzalojimai Nuotrauku Analize Ir Faktai

May 10, 2025 -

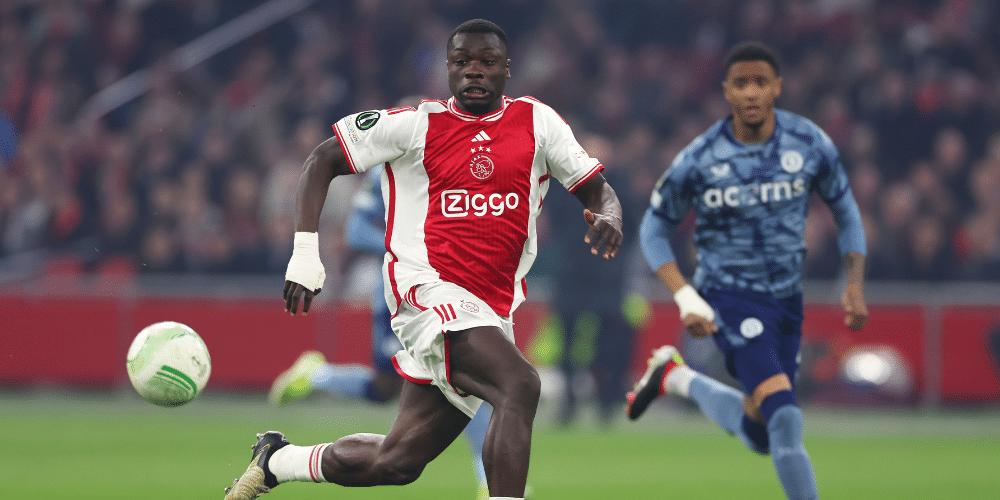

How Brian Brobbeys Strength Will Impact The Europa League

May 10, 2025

How Brian Brobbeys Strength Will Impact The Europa League

May 10, 2025 -

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 10, 2025

Mariah The Scientist And Young Thug A New Song Snippet Hints At Commitment

May 10, 2025