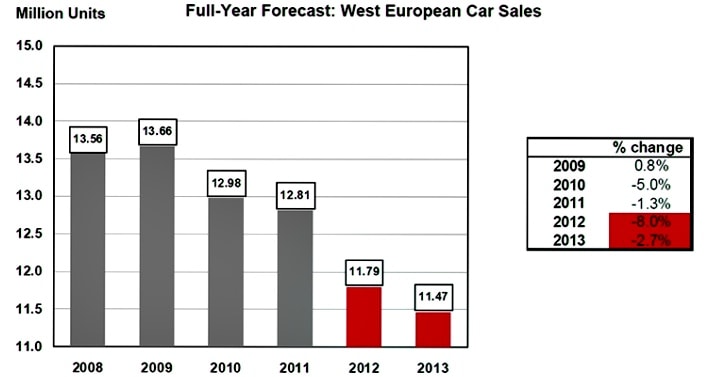

Weak Economy Dampens European Car Sales Figures

Table of Contents

Economic Factors Fueling the Decline in European Car Sales

Several intertwined economic factors are driving this slump in European car sales. The current economic climate is characterized by several key pressures:

-

Soaring Inflation: Rampant inflation across Europe is eroding purchasing power. With prices for essential goods and services rising sharply, consumers are increasingly hesitant to make large, discretionary purchases like new cars. For example, inflation in [Insert Country] reached [Insert Percentage]% in [Insert Month, Year], significantly impacting consumer spending.

-

Increased Interest Rates: Central banks across Europe have responded to inflation by raising interest rates. This makes car loans considerably more expensive, further dampening demand for new vehicles. Higher interest rates increase the monthly payments on auto loans, making car ownership less affordable for many potential buyers. The European Central Bank's recent interest rate hike of [Insert Percentage]% is a prime example of this trend.

-

Low Consumer Confidence: The combination of inflation and rising interest rates has led to a significant drop in consumer confidence across much of Europe. Consumers are feeling less secure about their financial future and are therefore postponing major purchases like cars. Consumer confidence indices in several key European markets have fallen to [Insert Data] reflecting this trend.

-

Energy Crisis and Increased Running Costs: The ongoing energy crisis in Europe is increasing the cost of fuel, electricity, and other essential resources. This impacts not only the purchase price of a car but also the cost of running it, adding further strain on household budgets. The increased cost of charging electric vehicles also negatively affects their appeal.

-

Recession Fears: Growing fears of a potential recession are adding to the uncertainty, making consumers even more cautious about their spending. The prospect of job losses or reduced income further discourages major purchases, including new cars.

Impact on Different Car Segments

The decline in European car sales is not impacting all vehicle segments equally. We are seeing a varied impact across the board:

-

Luxury Cars: Luxury car sales are experiencing a steeper decline than other segments, as these are particularly vulnerable to economic downturns. Consumers are more likely to postpone luxury purchases during times of economic uncertainty.

-

Electric Vehicles (EVs): While the long-term outlook for EVs remains positive, the current economic climate is slowing down their adoption rate. Higher upfront costs and range anxiety continue to be barriers, compounded by economic uncertainty.

-

Used Car Market: In contrast, the used car market is experiencing a surge in demand. Consumers are opting for more affordable pre-owned vehicles as an alternative to buying new.

-

SUVs and Compact Cars: The resilience of SUV sales is being tested, while compact cars, known for fuel efficiency, might demonstrate more sustained demand. However, rising fuel costs are impacting even budget-conscious consumers.

-

New Car Sales: The overall decline in new car sales is impacting manufacturers' production lines, requiring adjustments to output and sales strategies.

Geographical Variations in European Car Sales

The impact of the weak economy on car sales varies significantly across different European countries.

-

Germany: The German car market, a major player in the European automotive industry, is experiencing a considerable decline due to a combination of factors including inflation, energy costs, and concerns about the global economy.

-

France: Similar to Germany, France is seeing reduced car sales due to economic uncertainty and rising living costs.

-

United Kingdom: The UK car market is also significantly affected, impacted by Brexit-related issues and high inflation.

-

Italy and Spain: These southern European markets are facing similar challenges, with inflation and reduced consumer confidence driving the decline in car sales.

Regional differences in economic performance play a significant role. Countries with stronger economic fundamentals and higher consumer confidence are likely to experience a less pronounced decline in car sales compared to those facing more severe economic headwinds.

Industry Response to Weak European Car Sales

The automotive industry is responding to the downturn in several ways:

-

Production Cuts: Many manufacturers are announcing production cuts to align their output with reduced demand.

-

Job Losses: The reduced production could lead to job losses across the sector, potentially impacting thousands of employees.

-

Government Incentives: Several European governments are considering or implementing incentives to stimulate demand, such as tax breaks or subsidies for purchasing new vehicles.

-

Investment in EVs: Despite the current slowdown, manufacturers are continuing to invest in electric vehicle technology to meet future demand and comply with stricter emission regulations.

-

Industry Consolidation: We might see increased industry consolidation as smaller players struggle to cope with the challenging market conditions.

Conclusion

The weak European economy is significantly dampening car sales figures across the continent. Rising inflation, higher interest rates, low consumer confidence, the energy crisis, and recession fears are all contributing to this downturn. The impact varies across different car segments and geographical regions, with luxury cars particularly affected and the used car market thriving. The automotive industry is reacting with production cuts, potential job losses, and increased focus on EVs. Staying updated on the latest European car sales figures is crucial to understanding the ongoing impact of this weak economy and the evolving landscape of the European automotive market. Further research into specific national markets and the long-term implications of the energy transition will prove vital in navigating this challenging period. Continue to monitor the situation closely to understand the implications for the future of European car sales.

Featured Posts

-

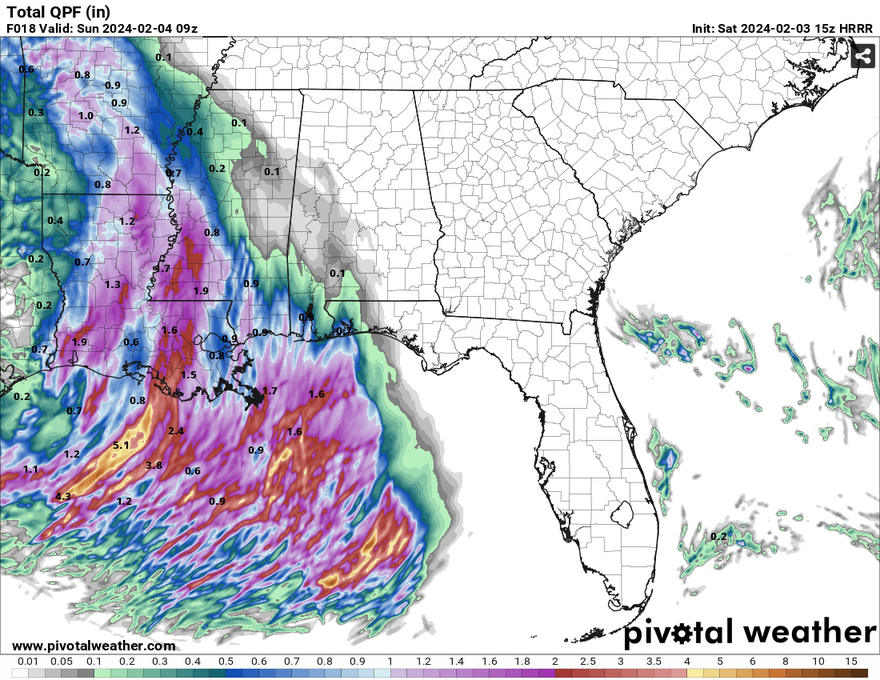

Seattle Rain Forecast Soggy Conditions To Last Through Saturday And Sunday

May 28, 2025

Seattle Rain Forecast Soggy Conditions To Last Through Saturday And Sunday

May 28, 2025 -

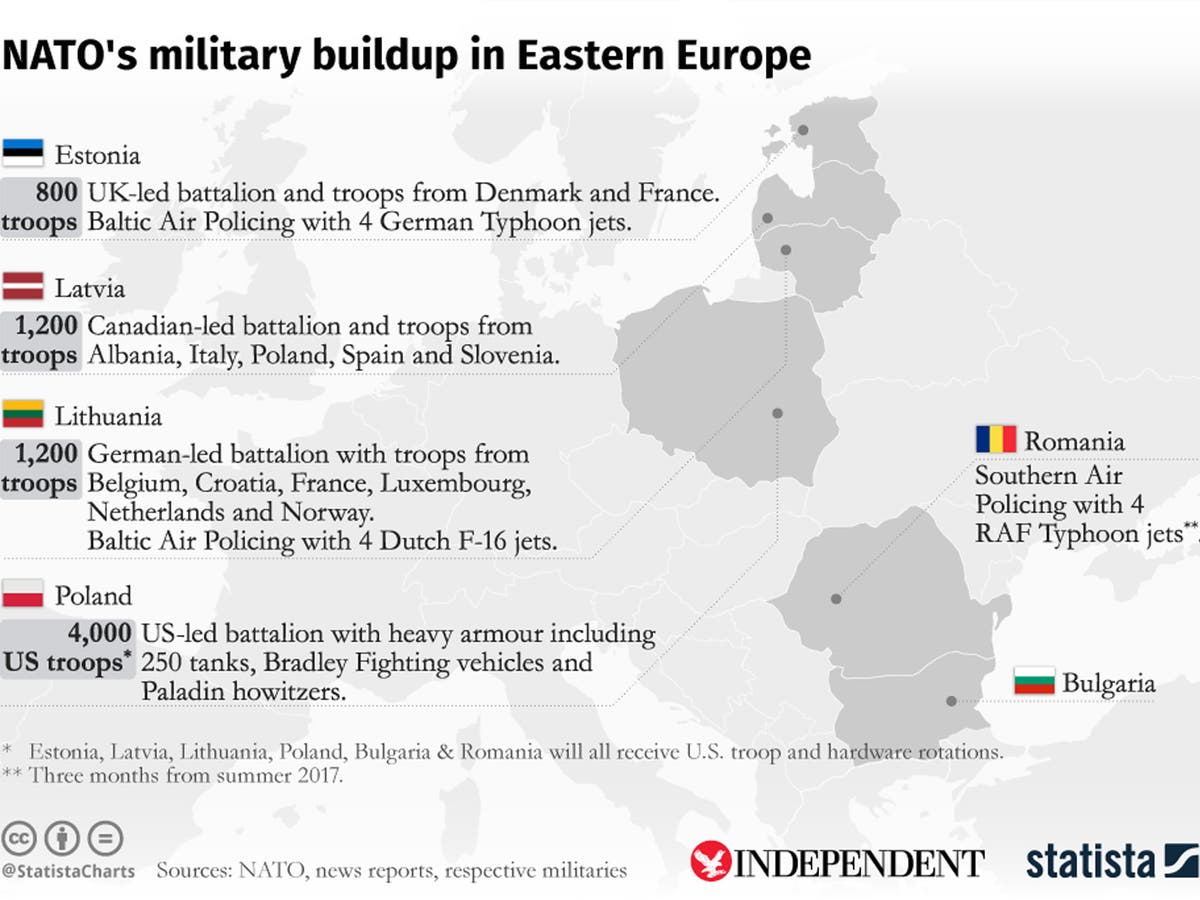

Natos Northern Flank Strengthened Increased U S Presence Deters Russia

May 28, 2025

Natos Northern Flank Strengthened Increased U S Presence Deters Russia

May 28, 2025 -

The Rome Champions Journey Dedication And Future Goals

May 28, 2025

The Rome Champions Journey Dedication And Future Goals

May 28, 2025 -

The Phoenician Scheme A Look At The Worlds Creation

May 28, 2025

The Phoenician Scheme A Look At The Worlds Creation

May 28, 2025 -

French Open 2025 See The Complete Draw For Raducanu Draper And Djokovic

May 28, 2025

French Open 2025 See The Complete Draw For Raducanu Draper And Djokovic

May 28, 2025