Weihong Liu: The Billionaire Behind The Hudson's Bay Lease Purchases

Table of Contents

Weihong Liu's Business Empire and Investment Strategy

Weihong Liu's business interests extend far beyond real estate, encompassing a diverse portfolio of ventures. However, his investment approach consistently demonstrates a strong preference for large-scale commercial properties, reflecting a long-term vision for capital appreciation and potential redevelopment opportunities. His investment strategy appears to be primarily long-term, focusing on acquiring strategically valuable assets with the potential for significant returns over an extended period. While his risk tolerance remains largely unpublicized, his track record suggests a calculated approach with a focus on securing stable, high-yield assets.

- Successful Real Estate Ventures: Liu has a history of successful real estate investments, including [insert examples of previous successful ventures with details and locations]. These projects showcase his ability to identify and capitalize on opportunities in prime locations.

- Key Partnerships: His partnerships with other prominent investors and companies remain largely undisclosed, suggesting a preference for discreet, strategic collaborations. This network likely contributes significantly to his ability to secure major deals.

- Business Reputation: Weihong Liu maintains a relatively low public profile. However, within the business community, he is recognized for his shrewd investment acumen and his ability to navigate complex real estate transactions.

The Hudson's Bay Lease Purchases: A Deep Dive

Weihong Liu, or entities closely associated with him, has secured lease purchases on several key Hudson's Bay properties across Canada. While precise financial details remain largely confidential, reports suggest the transactions involve significant lease terms with options for future outright purchases. These acquisitions involve prime retail and potentially office spaces located in major urban centers across the country.

- Property Locations: Acquired properties include locations in [list specific cities and addresses, if available, otherwise describe the general locations].

- Property Types and Sizes: The properties consist primarily of [specify retail, office, or mixed-use spaces, and estimated square footage].

- Transaction Values: The estimated value of these transactions is substantial, representing a significant investment in the Canadian real estate market. Precise figures remain undisclosed for confidentiality reasons.

- Impact on Hudson's Bay Company: These lease purchases represent a significant financial transaction for the Hudson's Bay Company, potentially allowing them to free up capital for other initiatives while maintaining a presence in strategically important locations.

Implications and Future Outlook for the Canadian Real Estate Market

Weihong Liu's substantial investments in Hudson's Bay properties are expected to have a significant ripple effect on the Canadian real estate market. His actions may influence other investors to re-evaluate their strategies and potentially seek similar opportunities. The future developments stemming from these lease purchases could significantly alter the landscape of Canadian commercial real estate.

- Impact on Property Values: The acquisitions are likely to impact property values in the affected areas, potentially driving prices upwards due to increased demand and investor confidence.

- Future Development: There's potential for future development and redevelopment of these properties. Liu’s long-term strategy might involve renovations, expansions, or even complete transformations of the acquired spaces.

- Market Trends: This activity signals a shift in investment focus towards prime commercial real estate in major Canadian cities. It underscores a trend towards strategic lease purchases as a means of acquiring valuable properties in a competitive market.

Potential Challenges and Risks Associated with the Investments

While Weihong Liu's investment strategy appears sound, certain challenges and risks are inherent in such large-scale real estate ventures. Economic downturns, market fluctuations, and unforeseen regulatory hurdles could all potentially impact the success of these investments.

- Economic Factors: Economic recession or a significant downturn in the retail sector could affect the value and profitability of these properties.

- Regulatory Hurdles: Potential regulatory changes or legal challenges related to zoning, development permits, or environmental regulations could cause delays or complications.

- Market Competition: Increased competition from other investors seeking to acquire similar properties could impact the profitability of Liu’s investments.

Conclusion: Understanding the Impact of Weihong Liu's Hudson's Bay Lease Purchases

Weihong Liu's strategic acquisition of Hudson's Bay lease purchases represents a significant development in the Canadian real estate market. These transactions underscore his shrewd investment strategy and will likely have far-reaching implications for property values, future developments, and overall market trends. The long-term impact of these investments remains to be seen, but they undoubtedly mark a key moment in the evolution of Canadian commercial real estate. To stay updated on Weihong Liu's future investments and their impact on the Canadian real estate landscape, follow [link to relevant website/social media]. Further research into "Weihong Liu," "Hudson's Bay lease purchases," and "Canadian real estate investment" will provide a more complete understanding of this evolving situation.

Featured Posts

-

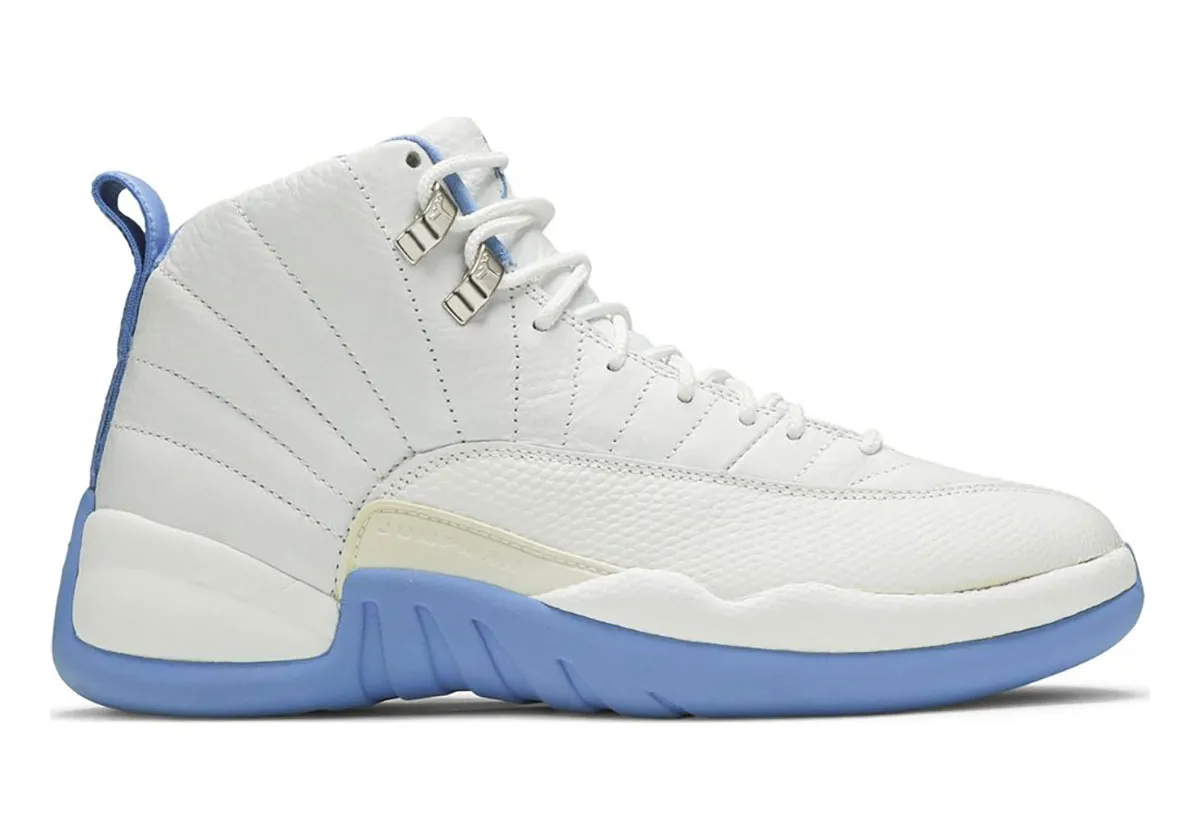

June 2025 Air Jordan Releases Everything You Need To Know

May 29, 2025

June 2025 Air Jordan Releases Everything You Need To Know

May 29, 2025 -

Is Tate Mc Rae Republican Fan Reaction To Morgan Wallen Collaboration

May 29, 2025

Is Tate Mc Rae Republican Fan Reaction To Morgan Wallen Collaboration

May 29, 2025 -

Real Madrid Wins Against Celta Vigo Mbappes Brace Keeps La Liga Fight Open

May 29, 2025

Real Madrid Wins Against Celta Vigo Mbappes Brace Keeps La Liga Fight Open

May 29, 2025 -

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025

Aj Odudu Responds To Mickey Rourkes Inappropriate Comment On Celebrity Big Brother

May 29, 2025 -

Increased Rent In La After Fires Are Landlords Price Gouging

May 29, 2025

Increased Rent In La After Fires Are Landlords Price Gouging

May 29, 2025