What We Learned About Treasuries On April 8th

Table of Contents

Yield Curve Shifts and Their Implications on April 8th

The shape of the yield curve – the graphical representation of Treasury yields across different maturities – provides valuable insights into market expectations. On April 8th, the yield curve presented [insert actual shape: e.g., a slightly flattened yield curve]. This shape, compared to [mention previous shape, e.g., the steeper curve observed a week prior], suggests [explain implication, e.g., a potential slowdown in economic growth or a decreased expectation of future interest rate hikes].

Several factors contributed to this shift:

- Inflation Expectations: [Discuss how inflation expectations, perhaps based on recent CPI or PPI data releases, influenced the yield curve. Were investors anticipating a slowdown in inflation or a persistence of higher inflation? How did this affect the demand for longer-term Treasuries?]

- Federal Reserve Policy: [Analyze any statements or hints from the Federal Reserve regarding its monetary policy stance. Did the market perceive the Fed as potentially more or less hawkish on April 8th than previously? How did this impact yields at different maturities?]

Here's a breakdown of specific yield changes:

- 2-year Treasury: [Insert yield change percentage]

- 10-year Treasury: [Insert yield change percentage]

- 30-year Treasury: [Insert yield change percentage]

This comparison to previous yield curve shapes suggests [mention potential economic scenarios, e.g., a possible recessionary period or a period of slower but sustained growth].

Impact of Economic Data Releases on Treasury Prices on April 8th

Several significant economic data releases influenced Treasury prices on April 8th. [Specify the data releases, e.g., the Consumer Price Index (CPI) report, the Producer Price Index (PPI) report, or employment data].

- CPI Report: [Insert data point and analysis of market reaction; e.g., "The CPI came in at X%, slightly higher than expected, leading to a risk-off sentiment and a slight increase in demand for safe-haven assets like Treasuries."]

- Employment Report: [Insert data point and analysis of market reaction; e.g., "Stronger-than-expected job growth fueled concerns about persistent inflation, putting upward pressure on Treasury yields."]

The market's reaction to these data releases was largely [mention risk-on/risk-off sentiment]. This impacted investor expectations for future Federal Reserve policy, influencing the demand for Treasuries across various maturities. The resulting price changes and trading volume reflected these shifting expectations.

Federal Reserve Influence and Market Sentiment on April 8th

Federal Reserve actions and statements significantly impact the Treasury market. On April 8th, [mention any relevant Fed announcements or actions, e.g., a statement by a Federal Reserve official, hinting at future interest rate decisions]. This [mention effect on market sentiment, e.g., reinforced market concerns about inflation, leading to a sell-off in Treasuries].

Market sentiment on April 8th was generally [mention bullish, bearish, or neutral, with justification]. Indicators like the VIX index [explain the VIX’s behavior and its correlation to Treasury movements] and [mention other sentiment indicators] contributed to this overall assessment. The interplay between Fed policy, economic data, and investor sentiment shaped the Treasury price movements throughout the day.

Geopolitical Events and Their Influence

Geopolitical events can also significantly affect the Treasury market. On April 8th, [mention specific events and their impact, e.g., escalating geopolitical tensions in [region] increased demand for safe-haven assets like U.S. Treasuries, leading to lower yields]. This highlights the role of Treasuries as a safe haven during times of uncertainty.

- Specific Geopolitical Event 1: [Event details and its impact on Treasury yields and prices]

- Specific Geopolitical Event 2 (if applicable): [Event details and its impact on Treasury yields and prices]

The shift in investor sentiment towards safe-haven assets directly influenced the pricing of Treasuries.

Conclusion: Key Takeaways and Next Steps for Treasury Market Analysis

April 8th offered valuable insights into the dynamics of the Treasury market. The interplay of yield curve shifts, economic data releases, Federal Reserve actions, and geopolitical events significantly shaped Treasury prices and yields. Understanding these interconnected factors is vital for navigating the complexities of the bond market.

To stay informed and improve your Treasury market analysis, consider:

- Closely monitoring key economic indicators like CPI, PPI, and employment data.

- Following Federal Reserve announcements and statements closely.

- Staying abreast of significant geopolitical developments.

By consistently analyzing these factors, you can better predict Treasury market trends and make informed investment decisions. Continue learning about Treasury yield analysis and Treasury market trends to enhance your understanding of this critical market. For further resources on Treasury analysis, visit [insert link to a relevant resource].

Featured Posts

-

Louisville Opens Storm Debris Removal Request System

Apr 29, 2025

Louisville Opens Storm Debris Removal Request System

Apr 29, 2025 -

The Rose Pardon Debate Weighing The Arguments For And Against A Presidential Pardon

Apr 29, 2025

The Rose Pardon Debate Weighing The Arguments For And Against A Presidential Pardon

Apr 29, 2025 -

How Trumps China Tariffs Led To Higher Prices And Potential Shortages In The Us

Apr 29, 2025

How Trumps China Tariffs Led To Higher Prices And Potential Shortages In The Us

Apr 29, 2025 -

Black Hawk Helicopter And Jet Collision A Comprehensive Report On The Tragedy

Apr 29, 2025

Black Hawk Helicopter And Jet Collision A Comprehensive Report On The Tragedy

Apr 29, 2025 -

Winners Of Minnesotas Snow Plow Naming Contest

Apr 29, 2025

Winners Of Minnesotas Snow Plow Naming Contest

Apr 29, 2025

Latest Posts

-

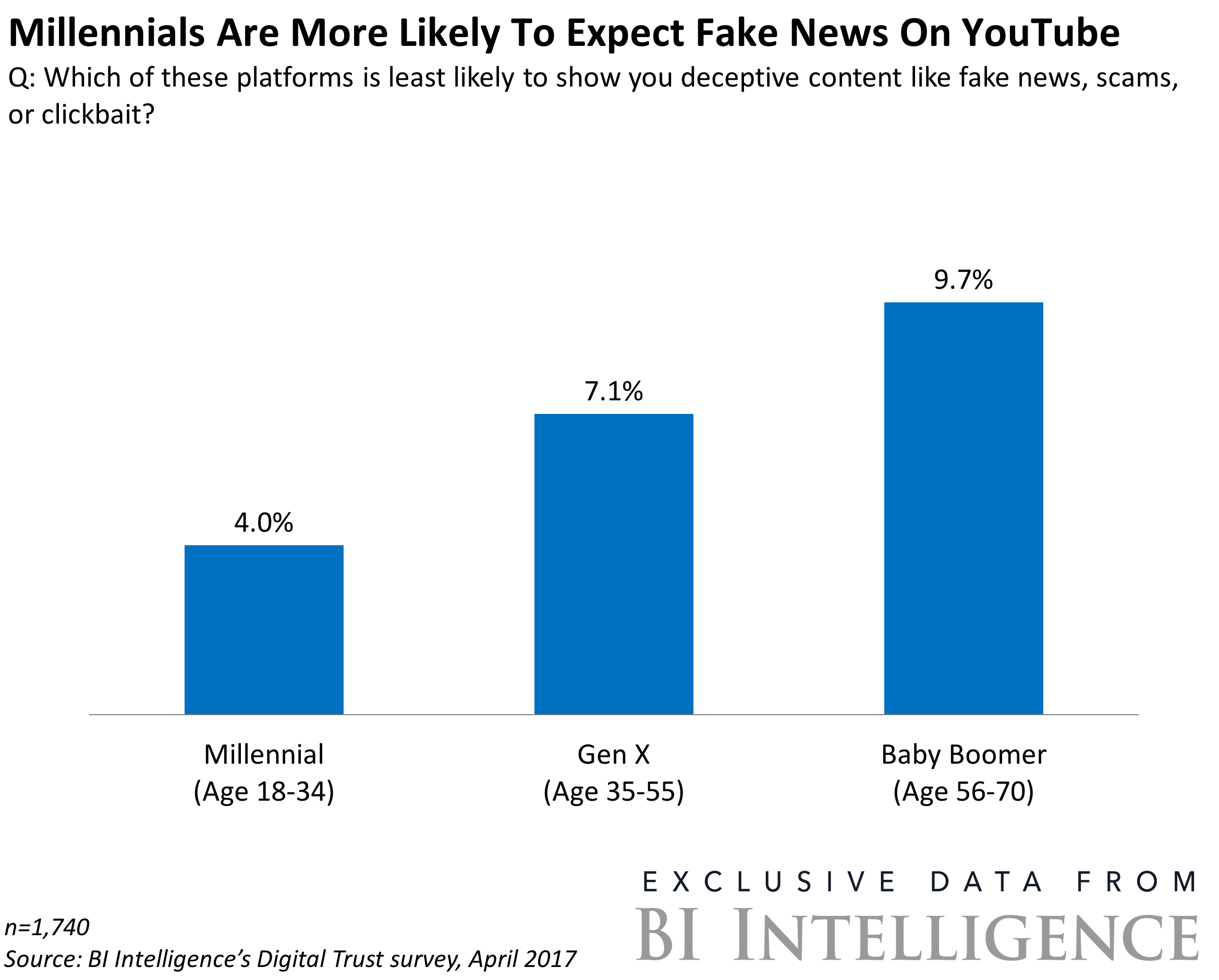

You Tube A Growing Platform For Older Viewers Seeking Familiar Entertainment

Apr 29, 2025

You Tube A Growing Platform For Older Viewers Seeking Familiar Entertainment

Apr 29, 2025 -

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025

You Tubes Growing Popularity Among Older Viewers A Resurgence Of Classic Shows

Apr 29, 2025 -

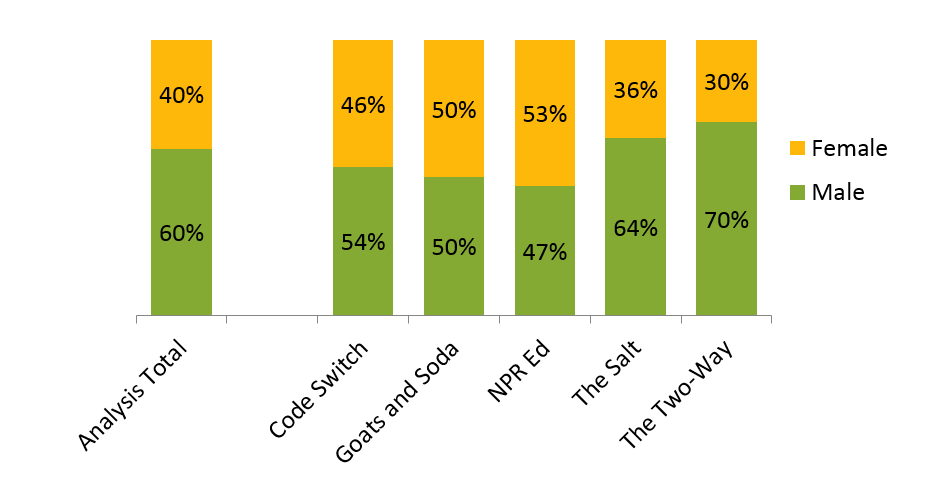

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025

How Npr Explains You Tubes Expanding Older Adult User Base

Apr 29, 2025 -

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025

Is You Tube Becoming A Senior Destination Npr Explores The Shift

Apr 29, 2025 -

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025

The Rise Of Older You Tube Users Data And Insights From Npr

Apr 29, 2025