What's The Real Safe Bet? A Comparative Analysis Of Investment Vehicles

Table of Contents

Understanding Your Risk Tolerance

Before exploring specific investments, defining your risk profile is paramount. Determining your risk tolerance is crucial for choosing the right "safe bet investment." Are you a conservative, moderate, or aggressive investor? Your answer will significantly influence the types of investments suitable for you.

-

Conservative: Prioritize capital preservation over high returns. You're comfortable with slow, steady growth and minimizing potential losses. Low-risk investments are your priority.

-

Moderate: You aim to balance risk and reward, seeking steady growth while accepting some potential for fluctuations. You're comfortable with moderate risk for potentially higher returns.

-

Aggressive: You're willing to accept higher risk for potentially higher returns. You have a longer time horizon and are comfortable with market volatility.

High-Yield Savings Accounts and Money Market Accounts

These offer FDIC insurance (up to $250,000 per depositor, per insured bank), providing a high degree of security. While offering lower returns, these options represent a very "safe bet" for your short-term savings needs.

- Low returns compared to other investments: Expect modest interest rates, typically lower than inflation.

- Excellent for emergency funds and short-term savings goals: Ideal for maintaining readily accessible funds for unexpected expenses or near-future purchases.

- Liquidity is a key advantage: You can access your money quickly and easily without penalties. This makes them a perfect "safe bet investment" for short-term needs.

Certificates of Deposit (CDs)

CDs offer fixed interest rates for a specified term. Longer terms generally yield higher returns, but remember that there's a trade-off between return and access to your funds. CDs provide a "safe bet" investment strategy for those with a medium-term horizon and lower risk tolerance.

- Penalty for early withdrawal: Withdrawing funds before maturity typically incurs a penalty, reducing your overall return.

- FDIC insured (up to $250,000): Your principal is protected by federal insurance, offering peace of mind.

- Predictable returns: The fixed interest rate provides certainty about your earnings over the CD's term, making them a relatively "safe bet" investment.

Bonds

Bonds are debt instruments issued by corporations or governments. They generally offer lower risk than stocks, making them a popular choice for conservative investors. Government bonds are often considered a "safe bet" investment, offering relative stability.

- Varying levels of risk depending on the issuer's creditworthiness: Government bonds are typically considered less risky than corporate bonds.

- Regular interest payments (coupons): You receive periodic interest payments throughout the bond's life.

- Potential for capital appreciation: Bond prices can fluctuate, offering the possibility of capital gains if you sell before maturity.

Real Estate Investment Trusts (REITs)

REITs invest in income-producing real estate. They offer diversification and potential for income generation but come with a higher risk than some other options. While not as "safe a bet" as some others, REITs can offer diversification within a broader investment strategy.

- Higher risk than some other options listed: REITs are subject to market fluctuations and can be impacted by economic downturns.

- Potential for higher returns: REITs can offer potentially higher returns than more conservative investments.

- Diversifies investment portfolio: REITs provide exposure to the real estate market, diversifying your overall holdings.

Diversification: The Ultimate Safe Bet Strategy

Diversifying your portfolio across multiple asset classes is a crucial component of mitigating risk. A well-diversified portfolio is the ultimate "safe bet" approach to long-term investing. Don't put all your eggs in one basket!

- Don't put all your eggs in one basket: Spreading your investments across different asset classes reduces your overall risk.

- Balance high-risk, high-reward investments with lower-risk options: A balanced approach helps manage volatility while still aiming for growth.

- Consult a financial advisor to create a personalized diversified portfolio: A professional can tailor a strategy to your specific needs and risk tolerance.

Conclusion

Determining the ideal "safe bet investment" depends entirely on your personal circumstances, financial goals, and risk tolerance. While high-yield savings accounts and CDs provide security, bonds and even REITs can play a role in a diversified portfolio. Remember, there's no single "safe bet" investment that guarantees riches, but by carefully considering your risk profile and diversifying your holdings, you can significantly reduce risk and increase your chances of achieving your financial objectives. Consult a financial advisor to help you find the right "safe bet investment" strategy for your needs.

Featured Posts

-

What Did Franco Colapinto Say In His Deleted Drive To Survive Message

May 09, 2025

What Did Franco Colapinto Say In His Deleted Drive To Survive Message

May 09, 2025 -

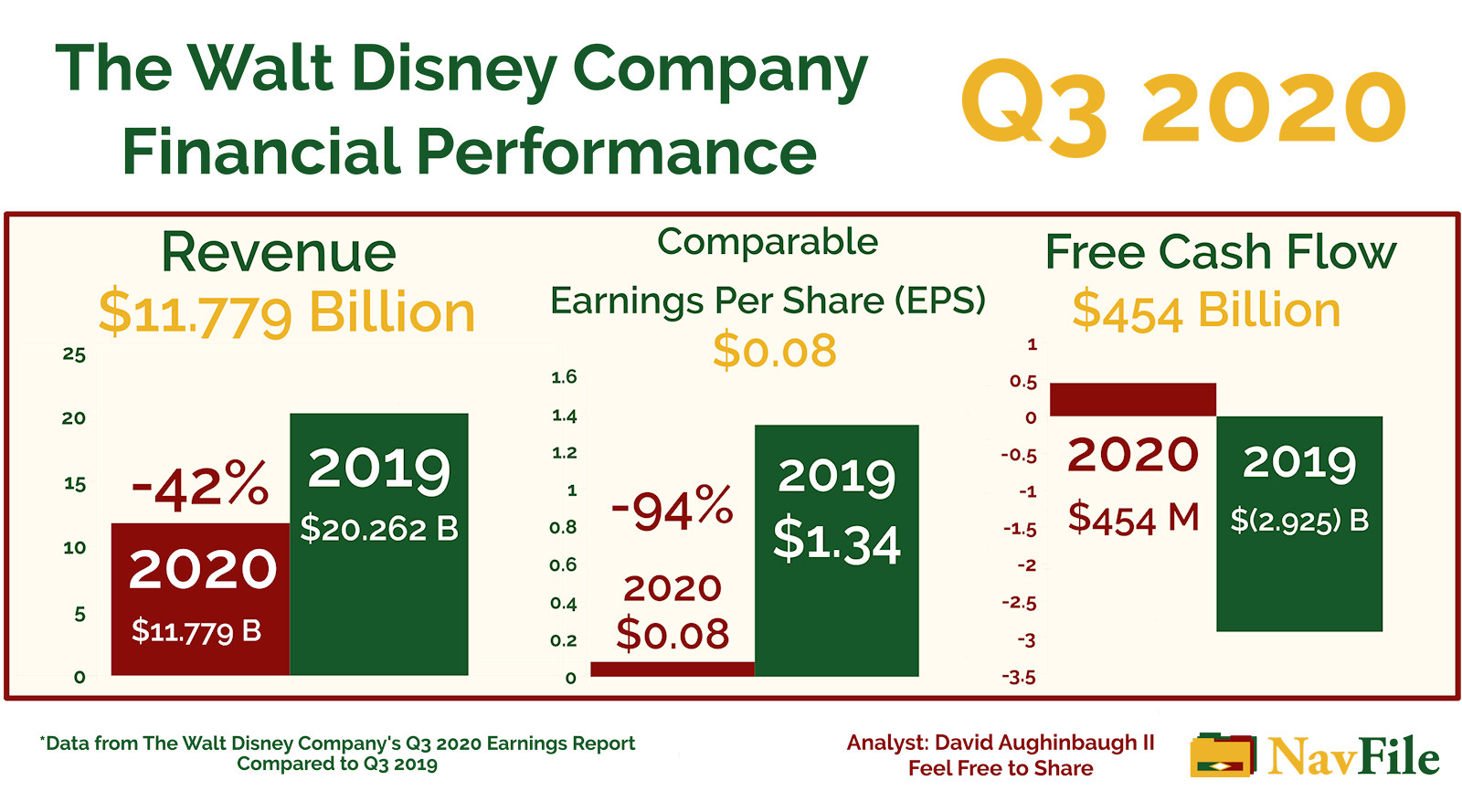

Increased Disney Profits A Result Of Strong Theme Park And Streaming Performance

May 09, 2025

Increased Disney Profits A Result Of Strong Theme Park And Streaming Performance

May 09, 2025 -

Bitcoin Madenciliginin Gelecegi Azalan Karlilik Ve Yeni Stratejiler

May 09, 2025

Bitcoin Madenciliginin Gelecegi Azalan Karlilik Ve Yeni Stratejiler

May 09, 2025 -

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025

110 Potential Why Billionaires Are Investing In This Black Rock Etf

May 09, 2025 -

Elizabeth Line A Review Of Wheelchair Accessibility And Improvements

May 09, 2025

Elizabeth Line A Review Of Wheelchair Accessibility And Improvements

May 09, 2025

Latest Posts

-

Arkema Premiere Ligue Paris Saint Germain Met Fin A La Serie De Dijon

May 09, 2025

Arkema Premiere Ligue Paris Saint Germain Met Fin A La Serie De Dijon

May 09, 2025 -

Participer A Une Collecte De Cheveux A Dijon

May 09, 2025

Participer A Une Collecte De Cheveux A Dijon

May 09, 2025 -

Dijon Ou Donner Ses Cheveux

May 09, 2025

Dijon Ou Donner Ses Cheveux

May 09, 2025 -

Lac Kir Dijon Enquete Apres Une Triple Agression

May 09, 2025

Lac Kir Dijon Enquete Apres Une Triple Agression

May 09, 2025 -

Cheveux Faire Un Don A Dijon

May 09, 2025

Cheveux Faire Un Don A Dijon

May 09, 2025