When Professionals Sold, Individuals Bought: Understanding Recent Market Shifts

Table of Contents

H2: The Retreat of Institutional Investors

The decreased presence of institutional investors in the market is a multifaceted issue stemming from several interconnected factors. Understanding why "When Professionals Sold, Individuals Bought" requires examining these contributing elements.

H3: Increased Interest Rates and Economic Uncertainty

Rising interest rates have significantly impacted institutional investment strategies. Higher borrowing costs make large-scale investments less attractive, reducing potential returns and increasing risk.

- Higher borrowing costs: The increased cost of capital makes it more expensive for institutional investors to finance large-scale real estate acquisitions.

- Reduced investment returns: Higher interest rates often lead to lower overall returns on investment, making real estate less competitive compared to other asset classes.

- Increased risk aversion: Economic uncertainty and potential recessionary pressures encourage institutional investors to adopt a more conservative approach, reducing their appetite for riskier investments like real estate.

For instance, a recent report from [cite a relevant financial news source] indicated a significant drop in commercial real estate investment by institutional funds due to increased borrowing costs.

H3: Profit-Taking and Portfolio Rebalancing

Many institutional investors may be taking profits from previous real estate investments, particularly those made during periods of lower interest rates and increased market optimism. This profit-taking contributes to the observed shift.

- Realization of gains: Institutional investors are capitalizing on the gains accumulated from previous investments, leading to a reduction in their holdings.

- Diversification strategies: Institutional investors might be rebalancing their portfolios to diversify their investments across different asset classes to mitigate risk.

- Shifting investment priorities: The changing economic climate and market outlook may be prompting institutional investors to shift their investment priorities towards other sectors perceived as offering better returns or lower risk.

News outlets frequently report on large-scale portfolio rebalancing by major financial institutions, further supporting this observation.

H3: Shifting Market Sentiment and Predictions

Changes in market sentiment and predictions play a vital role in influencing institutional investment decisions. A negative outlook or anticipation of market corrections can lead to a significant decrease in investment activity.

- Negative market outlooks: Concerns about inflation, recession, or other economic headwinds can lead institutional investors to delay or reduce their investments.

- Potential for corrections: Anticipating a market correction, institutional investors may choose to wait for more favorable market conditions before making significant investments.

- Preference for more liquid assets: During periods of uncertainty, institutional investors may favor more liquid assets that can be easily converted to cash, reducing their exposure to less liquid real estate markets.

Many market analysis firms, such as [cite a relevant market analysis firm], have published reports reflecting the cautious sentiment among institutional investors.

H2: The Rise of the Individual Buyer

Simultaneously, the individual buyer has stepped into the market, significantly impacting the dynamics of "When Professionals Sold, Individuals Bought."

H3: Increased Savings and Affordability (in specific niches)

Several factors have empowered individual buyers. The pandemic, for example, led to increased savings for many, while specific market segments offered increased affordability.

- Increased disposable income: Lockdowns and reduced spending during the pandemic allowed many individuals to accumulate significant savings.

- Remote work enabling relocation: The rise of remote work has given individuals greater flexibility to relocate to more affordable areas.

- Attractive pricing in certain areas: While prices are high in some areas, others offer more competitive pricing, making homeownership more accessible.

Smaller towns and rural areas, for example, have seen a surge in individual buyer activity due to lower property prices and a desire for a more tranquil lifestyle.

H3: Low Inventory and Competition

Low inventory levels have created fierce competition among individual buyers, driving up prices in certain sectors.

- Limited supply: A shortage of available properties has increased demand, pushing prices higher.

- Bidding wars: Many properties are now subject to multiple offers, leading to bidding wars and inflated prices.

- Higher purchase prices compared to previous years: The increased competition has resulted in significantly higher purchase prices in many markets compared to previous years.

Real estate market data consistently shows a significant increase in the average sale price of homes in many regions, driven by the competition between individual buyers.

H3: Changing Attitudes Towards Homeownership

The pandemic and its aftermath have significantly impacted attitudes towards homeownership.

- Desire for stability: The uncertainty of the pandemic has reinforced the desire for stability and security that homeownership provides.

- Long-term investment prospects: Many individuals view homeownership as a long-term investment, potentially offering greater returns than other investments.

- Impact of the pandemic on housing preferences: The pandemic has shifted preferences towards larger homes with more outdoor space, further fueling demand.

Data from [cite a relevant source on homeownership rates] show a noticeable increase in homeownership rates in several countries, indicating a shift in attitudes towards homeownership.

H2: Analyzing the Impact of This Shift

The changing balance between institutional and individual buyers has profound implications for the real estate market.

H3: Implications for Market Prices

The shift towards individual buyers has contributed to price fluctuations and increased market volatility.

- Price fluctuations: The interplay between supply and demand driven by individual buyers has created greater price volatility.

- Regional variations: The impact on prices varies significantly depending on the specific geographic location and market conditions.

- Impact on market stability: The increased reliance on individual buyers can potentially make the market more susceptible to shifts in consumer confidence and economic conditions.

Analyzing price trends in various real estate markets reveals the significant impact of this shift.

H3: Effects on Market Liquidity

The shift has also impacted market liquidity and accessibility.

- Increased competition: Increased competition among individual buyers can make it harder to purchase properties.

- Longer selling times (potentially): While not always the case, increased competition for buyers could lead to longer selling times for sellers.

- Changes in market accessibility: The shift could potentially make the market less accessible to first-time homebuyers or those with limited financial resources.

Real estate market data provides insights into the changing dynamics of market liquidity.

H3: Predictions for the Future

Predicting the future is inherently challenging, however, considering the current trends:

- Potential for market correction: The current market conditions suggest a potential for a market correction in the future, driven by economic factors or shifts in buyer behavior.

- Future investor behavior: The behavior of institutional investors may shift again depending on economic conditions and market opportunities.

- Evolving market dynamics: The real estate market will likely continue to evolve, adapting to the changing balance between individual and institutional buyers.

The long-term consequences of "When Professionals Sold, Individuals Bought" remain to be seen, but careful observation of market trends is crucial.

3. Conclusion

The recent real estate market shift, characterized by "When Professionals Sold, Individuals Bought," is a complex phenomenon driven by a combination of factors, including rising interest rates, economic uncertainty, and changes in investor behavior and buyer attitudes. This shift has significantly impacted market prices, liquidity, and overall stability. Understanding these dynamics is essential for navigating the current market landscape. To stay informed about these ongoing shifts, continue your research by exploring resources like [link to relevant real estate market reports] and [link to relevant financial news websites]. Understanding the implications of "When Professionals Sold, Individuals Bought" is crucial for making informed investment decisions in today’s dynamic real estate market.

Featured Posts

-

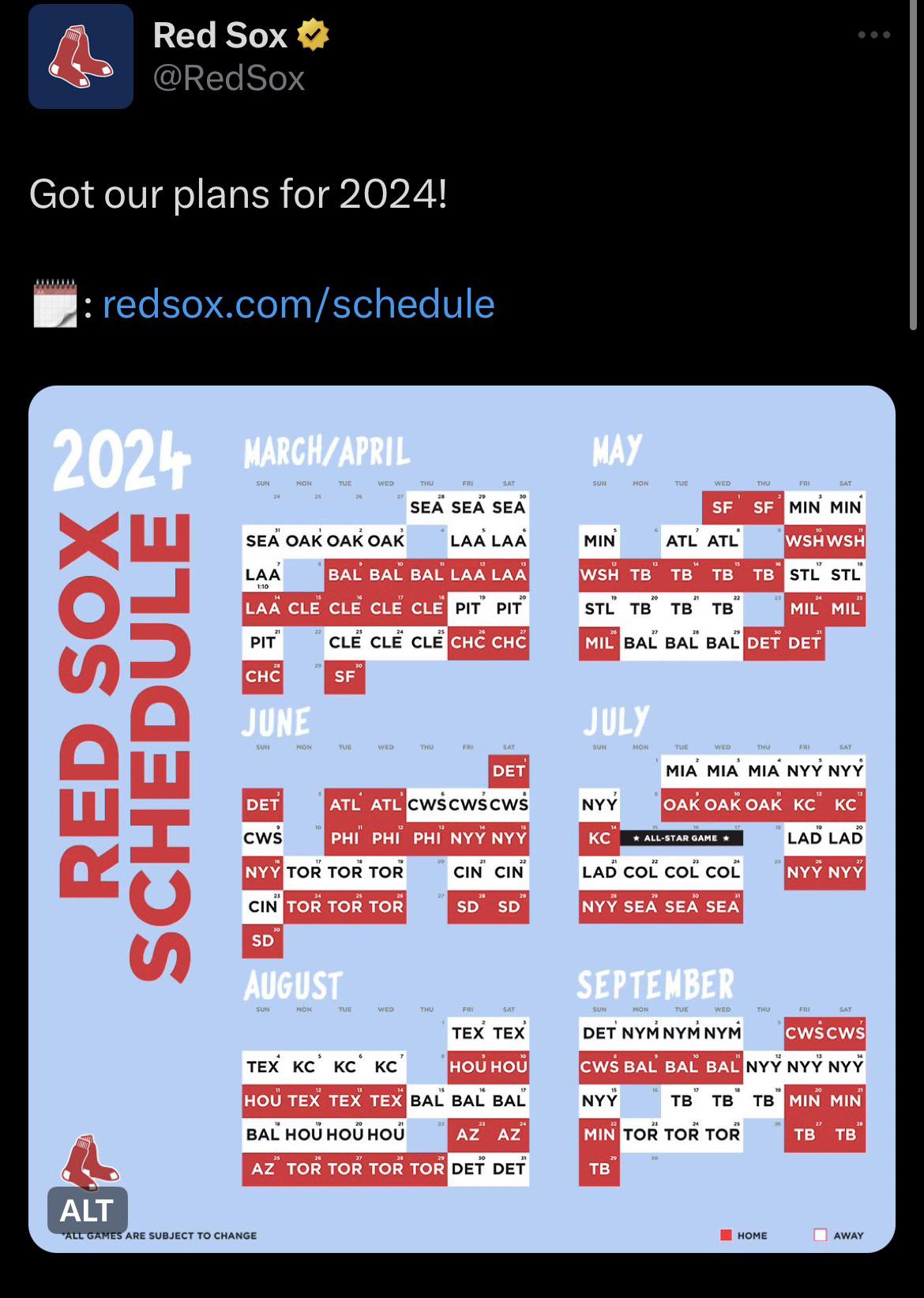

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025

Espns Bold Prediction Red Sox 2025 Season Outlook

Apr 28, 2025 -

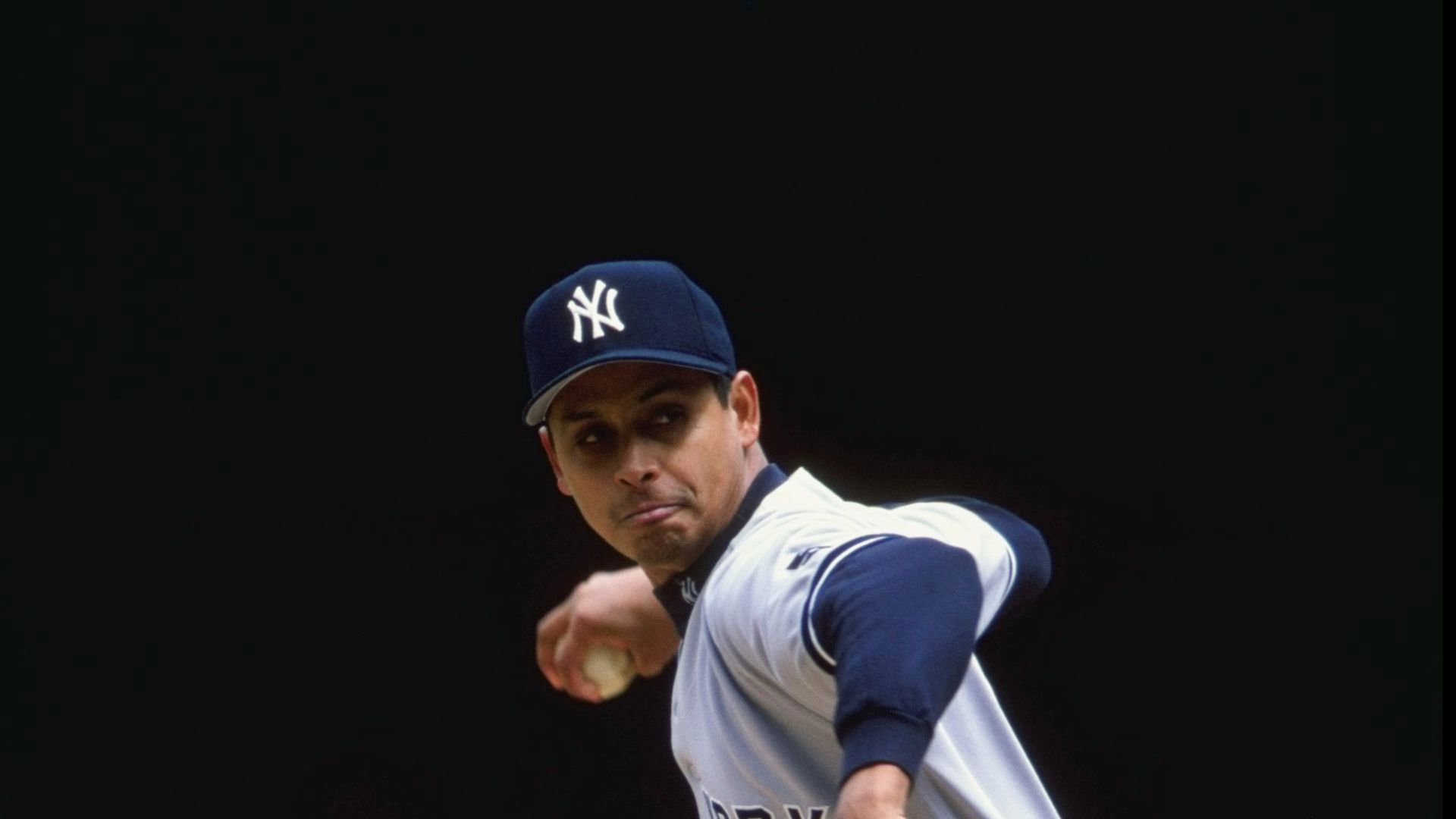

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025

2000 Yankees Diary Bombers Defeat Royals In Thrilling Victory

Apr 28, 2025 -

Nba Legend Dwyane Wade Lauds Doris Burkes Thunder Vs Timberwolves Game Coverage

Apr 28, 2025

Nba Legend Dwyane Wade Lauds Doris Burkes Thunder Vs Timberwolves Game Coverage

Apr 28, 2025 -

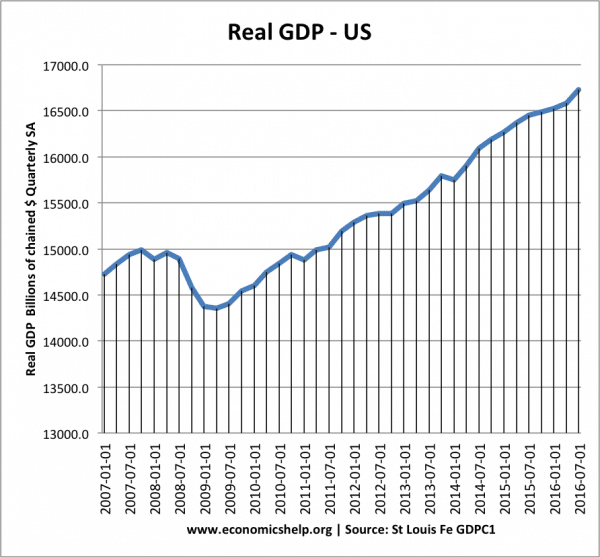

The Us Economy Under Pressure Examining The Impact Of The Canadian Travel Boycott

Apr 28, 2025

The Us Economy Under Pressure Examining The Impact Of The Canadian Travel Boycott

Apr 28, 2025 -

E Ink Spectra

Apr 28, 2025

E Ink Spectra

Apr 28, 2025

Latest Posts

-

Yankee Star Aaron Judge And Samantha Bracksieck Welcome Baby

Apr 28, 2025

Yankee Star Aaron Judge And Samantha Bracksieck Welcome Baby

Apr 28, 2025 -

New York Yankees Aaron Judge Becomes A Father

Apr 28, 2025

New York Yankees Aaron Judge Becomes A Father

Apr 28, 2025 -

Aaron Judge And Wife Welcome First Child

Apr 28, 2025

Aaron Judge And Wife Welcome First Child

Apr 28, 2025 -

Espns Moving Tribute To Departing Anchor Cassidy Hubbarth

Apr 28, 2025

Espns Moving Tribute To Departing Anchor Cassidy Hubbarth

Apr 28, 2025 -

Cassidy Hubbarths Final Espn Broadcast A Touching Tribute

Apr 28, 2025

Cassidy Hubbarths Final Espn Broadcast A Touching Tribute

Apr 28, 2025