Where To Invest: Identifying The Country's Busiest New Business Areas

Table of Contents

Analyzing Key Economic Indicators for Identifying Promising Areas

Before diving into specific sectors or locations, understanding the broader economic landscape is crucial. Analyzing key economic indicators provides a macro-level view, helping you identify areas experiencing robust growth and those showing signs of stagnation. These indicators act as a compass, guiding your investment decisions toward areas with a higher probability of success. Key indicators to consider include:

-

Gross Domestic Product (GDP) Growth Rates: Analyzing GDP growth rates in different regions helps pinpoint areas experiencing significant economic expansion. Faster growth often translates to more investment opportunities and higher potential returns. Look for consistent, above-average growth over several quarters.

-

Unemployment Rates: Low unemployment rates indicate a strong workforce, a crucial factor for business success. A healthy labor pool ensures businesses can easily find and retain skilled employees, contributing to their overall productivity and profitability.

-

Inflation Levels: Monitoring inflation provides insights into purchasing power and market stability. While some inflation is expected, excessively high inflation can erode purchasing power and create economic uncertainty, impacting investment returns.

-

Foreign Direct Investment (FDI) Inflows: FDI is a strong indicator of investor confidence. Significant FDI inflows suggest that international investors see potential in a particular area, validating its growth prospects and attractiveness.

-

Consumer Spending Patterns: Analyzing consumer spending patterns provides a direct measure of market demand. Areas with robust consumer spending show greater potential for businesses catering to diverse needs and preferences.

Identifying High-Growth Sectors and Emerging Industries

Pinpointing high-growth sectors is paramount for successful investment. Focusing your resources on dynamic industries increases your chances of capital appreciation. Several sectors are currently experiencing rapid expansion within the country, including:

-

The Booming Tech Sector: The technology sector, encompassing Artificial Intelligence (AI), Software as a Service (SaaS), and cybersecurity, continues to be a powerful engine of economic growth. Investment opportunities abound in innovative startups and established tech giants.

-

Renewable Energy and Sustainable Technologies: Growing environmental awareness and government regulations are driving substantial growth in renewable energy and sustainable technologies. This includes solar, wind, and other clean energy solutions, presenting attractive investment possibilities.

-

The Expanding Healthcare Sector: An aging population and advancements in medical technology are fueling expansion in the healthcare sector. Investment opportunities range from pharmaceutical companies to healthcare IT and medical device manufacturers.

-

The Ever-Growing E-commerce Market: The e-commerce market continues its rapid expansion, creating opportunities in online retail, logistics, and related services. This sector's growth is driven by increasing internet penetration and changing consumer behavior.

-

The Potential of Fintech: Financial technology (Fintech) is revolutionizing traditional finance with innovative solutions in payments, lending, and investment management. This sector provides high-growth potential for early investors.

Geographic Location and Infrastructure as Key Investment Factors

While sector selection is vital, geographic location and infrastructure play a crucial role in investment success. Areas with well-developed infrastructure attract more businesses, offering a more conducive environment for growth and profitability. Key factors to consider include:

-

Access to Efficient Transportation Networks: Efficient road, rail, and air transportation networks are crucial for smooth supply chains and efficient logistics.

-

Reliable Utilities: Reliable access to electricity, water, and high-speed internet is essential for business operations and productivity.

-

Skilled Workforce: The availability of a skilled and readily available workforce is a significant competitive advantage.

-

Proximity to Key Markets and Supply Chains: Location near major markets and supply chains reduces transportation costs and improves efficiency.

-

Government Support for Infrastructure Development: Government initiatives aimed at infrastructure development signal a commitment to economic growth and create a more favorable investment climate.

Case Studies: Examining Successful New Business Areas

Consider the recent success of [Insert Example 1: e.g., a tech startup in a specific city thriving due to access to talent and government incentives]. This illustrates the importance of a skilled workforce and supportive government policies. Similarly, [Insert Example 2: e.g., a renewable energy company in a region with abundant resources] demonstrates how access to raw materials and a favorable regulatory environment can drive growth. These case studies highlight the synergistic relationship between sector selection, location, and infrastructure.

Mitigating Risks and Due Diligence in Investment Decisions

Investing always involves risk. Thorough research and a comprehensive due diligence process are essential to mitigating these risks and making informed decisions. Key steps include:

-

Conducting Comprehensive Market Research: Gather data on market size, competition, and consumer demand to understand the investment opportunity's potential.

-

Understanding the Regulatory Environment and Legal Compliance: Ensure your investment complies with all relevant laws and regulations to avoid potential legal issues.

-

Assessing Political and Economic Risks: Analyze potential political instability, economic downturns, and other factors that could negatively impact your investment.

-

Developing a Robust Investment Strategy: Define clear investment goals, risk tolerance, and exit strategies to guide your investment decisions.

-

Seeking Professional Financial Advice: Consult with experienced financial advisors to gain insights and guidance on your investment strategy.

Conclusion

Identifying the country's busiest new business areas requires a multifaceted approach. Analyzing economic indicators, focusing on high-growth sectors, and considering geographic location and infrastructure are critical steps. Remember to conduct thorough due diligence to mitigate risks. By understanding these factors and following a well-defined investment strategy, you can significantly increase your chances of success.

Start your journey to discover the best places to invest your capital today. Identify the most promising new business areas and seize the opportunities that await in the country's thriving economy. Learn more about profitable where to invest opportunities by exploring our resources and further research.

Featured Posts

-

Report Biden Aide Advises Against Political Involvement

May 16, 2025

Report Biden Aide Advises Against Political Involvement

May 16, 2025 -

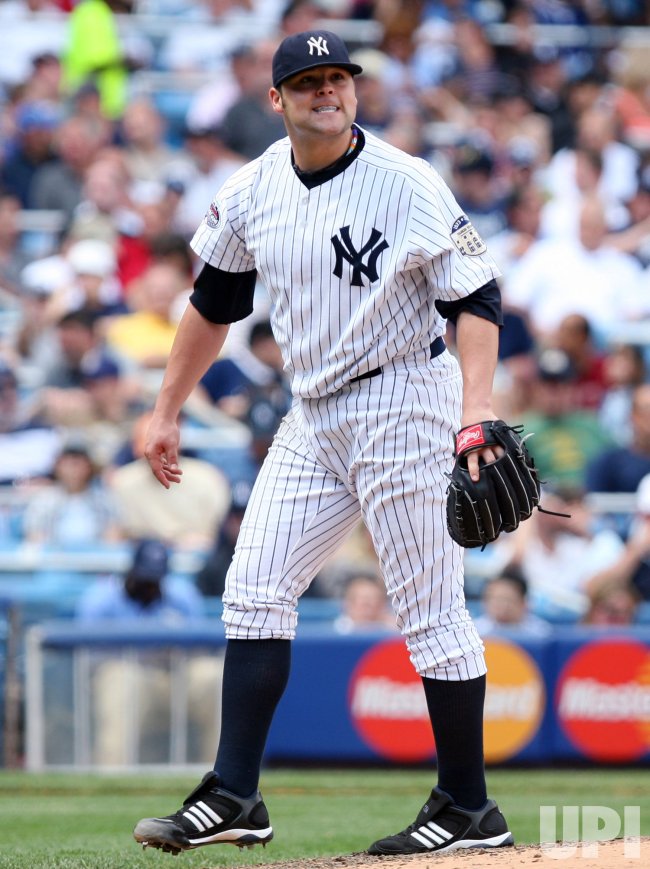

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 16, 2025

Padres Vs Yankees Prediction Will San Diego Continue Their Winning Streak In New York

May 16, 2025 -

Understanding Public Confidence In Evanstons Water Supply The Role Of Demographics And Experience

May 16, 2025

Understanding Public Confidence In Evanstons Water Supply The Role Of Demographics And Experience

May 16, 2025 -

Ver Venezia Napoles En Vivo Guia Completa

May 16, 2025

Ver Venezia Napoles En Vivo Guia Completa

May 16, 2025 -

The Growing Market For Betting On Natural Disasters A Look At The La Wildfires

May 16, 2025

The Growing Market For Betting On Natural Disasters A Look At The La Wildfires

May 16, 2025