Where To Invest: Mapping The Country's Top Business Growth Areas

Table of Contents

Analyzing Key Economic Indicators for Investment Decisions

Making sound investment decisions requires a thorough understanding of the underlying economic landscape. Several key indicators can help pinpoint areas ripe for growth.

GDP Growth and Regional Variations

Regional disparities in GDP growth are significant. Some areas consistently outperform others, driven by specific factors. Examining these variations is crucial for identifying high-potential investment zones.

- Region X: Boasting a consistently high GDP growth rate, exceeding the national average by 5% annually for the past five years. This is fueled by a thriving technology sector and substantial government investment in infrastructure.

- Region Y: Experiencing a tourism boom, leading to substantial job creation and increased economic activity. The development of new tourist attractions and improved accessibility are key contributors.

- Region Z: Shows strong agricultural growth due to innovative farming techniques and favorable government policies supporting the sector. This creates opportunities for investment in agricultural technology and related industries.

Understanding these regional differences in GDP growth, alongside the contributing factors, is crucial for investors looking for significant returns. Analyzing regional economics provides a solid foundation for investment strategies.

Employment Rates and Sector-Specific Growth

Analyzing employment trends reveals sectors experiencing rapid job creation, indicating strong economic momentum. These sectors usually attract further investment and create a positive feedback loop.

- Technology Sector (Region X): This region is a burgeoning tech hub, attracting numerous startups and established tech companies. High employment rates in software development, data analytics, and related fields point to a robust and expanding market.

- Renewable Energy Sector (Region Y): Significant government investment in renewable energy infrastructure, along with abundant natural resources, has led to high job growth in this sector.

- Healthcare Sector (Region Z): An aging population and increased focus on healthcare infrastructure have created significant employment opportunities in this area.

By focusing on regions with booming sectors and high employment rates, investors can minimize risk and maximize potential returns. Sector-specific growth is a powerful indicator of future economic strength.

Infrastructure Development and its Impact on Investment

Robust infrastructure is the backbone of a thriving economy. Regions with significant investments in transportation, communication, and utilities are generally more attractive to businesses and investors.

- Improved Transportation Networks: New highways, upgraded ports, and expanded airports facilitate the efficient movement of goods and services, attracting businesses and reducing logistics costs. Region X’s new high-speed rail link exemplifies this.

- Advanced Communication Networks: Reliable and high-speed internet access is essential for modern businesses. Regions with state-of-the-art communication infrastructure are more competitive. Region Y's recent fiber optic network rollout demonstrates this commitment.

- Reliable Utility Infrastructure: Consistent electricity supply and access to clean water are crucial for industrial operations and business continuity. Region Z's investments in renewable energy have significantly improved its utility infrastructure.

These infrastructure improvements create a favorable environment for business expansion, making these regions attractive investment destinations.

Identifying High-Growth Industry Clusters and Emerging Markets

Beyond broad economic indicators, focusing on specific industry clusters and emerging markets can reveal particularly lucrative investment opportunities.

Technological Hubs and Innovation Ecosystems

Regions with thriving tech ecosystems, supported by universities, research institutions, and venture capital, are likely to experience rapid growth.

- Region X's Tech Hub: This region houses several prominent universities, attracting talented graduates and fostering a culture of innovation. The presence of numerous venture capital firms further fuels this ecosystem.

- Silicon Valley-esque Clusters: While few regions may reach the scale of Silicon Valley, several emerging tech hubs are demonstrating impressive growth, attracting significant investment in research and development.

Renewable Energy and Sustainable Development

The growing global focus on sustainability is creating substantial investment opportunities in renewable energy and related businesses.

- Region Y's Renewable Energy Focus: Government incentives and abundant natural resources (solar, wind) are attracting significant investments in renewable energy projects.

- Green Investments and ESG Considerations: Investors are increasingly incorporating Environmental, Social, and Governance (ESG) factors into their investment decisions, creating a strong demand for sustainable investments.

Tourism and Hospitality Hotspots

The tourism sector is a major driver of economic growth in many regions. Identifying areas with high growth potential in tourism is crucial for investors.

- Region Z's Tourist Attractions: Unique cultural heritage sites, stunning natural landscapes, and improved tourism infrastructure are attracting a growing number of tourists.

These factors contribute to the attractiveness of this region for investment in the tourism and hospitality sector.

Assessing Investment Risks and Mitigation Strategies

While high-growth areas offer attractive investment opportunities, it's essential to assess potential risks and develop effective mitigation strategies.

Political and Regulatory Landscape

Political stability and a favorable regulatory environment are critical for successful investments.

- Political Risk Assessment: Investors should assess the political stability and potential for policy changes that could affect their investments.

- Regulatory Compliance: Understanding and complying with local regulations is essential to avoid legal issues and penalties.

Economic Volatility and Market Fluctuations

Economic volatility and market fluctuations can significantly impact investment returns.

- Diversification: Diversifying investments across different sectors and regions helps to mitigate risk.

- Risk Management Strategies: Implementing risk management strategies, such as hedging and insurance, can help protect investments from market fluctuations.

By carefully considering these risks and implementing appropriate mitigation strategies, investors can significantly improve their chances of success.

Conclusion

This analysis of key economic indicators, high-growth industry clusters, and potential risks provides a framework for identifying the most promising areas for investment. Regions exhibiting strong GDP growth, high employment rates, robust infrastructure, and thriving industry clusters present the most attractive opportunities. However, remember to thoroughly assess political and economic risks before committing to any investment. By understanding these key growth areas and employing sound investment strategies, you can confidently navigate the landscape and find the best place to invest in the country's booming economy. For more detailed regional economic data, please refer to [Link to relevant resource].

Featured Posts

-

Ai Chip Exports Nvidia Ceos Appeal To The Trump Administration

May 03, 2025

Ai Chip Exports Nvidia Ceos Appeal To The Trump Administration

May 03, 2025 -

Fortnite Issues Refunds A Sign Of Cosmetic Policy Shifts

May 03, 2025

Fortnite Issues Refunds A Sign Of Cosmetic Policy Shifts

May 03, 2025 -

The Urgent Mental Health Needs Of Young People In Canada A Global Commissions Lessons

May 03, 2025

The Urgent Mental Health Needs Of Young People In Canada A Global Commissions Lessons

May 03, 2025 -

Nigel Farage Press Conference My Eyewitness Account

May 03, 2025

Nigel Farage Press Conference My Eyewitness Account

May 03, 2025 -

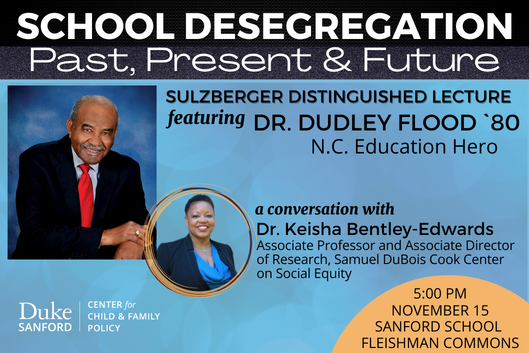

The Justice Departments Decision The Future Of School Desegregation

May 03, 2025

The Justice Departments Decision The Future Of School Desegregation

May 03, 2025