Which Cryptocurrency Will Weather The Trade War Storm?

Table of Contents

Decentralized Cryptocurrencies: A Potential Safe Haven?

Decentralized cryptocurrencies, by their very nature, are often touted as potential safe havens during times of economic and geopolitical turmoil. Their inherent resistance to centralized control makes them attractive to investors seeking to protect their assets from government intervention or manipulation.

Bitcoin's Role in a Trade War

Bitcoin, the original and most established cryptocurrency, often stands as a benchmark for the entire market. Its decentralized nature, limited supply (only 21 million Bitcoin will ever exist), and proven track record make it a compelling candidate for a safe haven asset. Historically, Bitcoin has demonstrated periods of resilience during times of economic uncertainty, although its price is still highly volatile.

- Increased adoption by institutional investors: Major financial institutions are increasingly acknowledging Bitcoin's potential, leading to greater market stability.

- Reduced susceptibility to government regulation: Compared to centralized assets, Bitcoin's decentralized nature makes it less vulnerable to direct government control.

- Long-term price predictions during economic downturns: While short-term fluctuations are inevitable, many analysts predict Bitcoin's long-term value will increase even amidst economic uncertainty.

Ethereum and Smart Contracts

Ethereum, the second-largest cryptocurrency by market capitalization, offers something beyond simple value storage. Its smart contract functionality and the thriving Decentralized Finance (DeFi) ecosystem built upon it present a compelling alternative to traditional financial systems, which can be heavily impacted by trade wars.

- Growth of DeFi projects: The decentralized finance sector continues to expand, offering innovative financial tools and services that are less susceptible to centralized control.

- Potential for disruption of traditional finance: DeFi’s ability to bypass traditional banking systems makes it attractive during periods of economic instability and stricter regulations.

- Resilience based on its underlying technology: Ethereum’s underlying blockchain technology provides a secure and transparent foundation for the DeFi ecosystem.

Privacy Coins and Trade War Anonymity

Privacy coins, such as Monero (XMR) and Zcash (ZEC), offer enhanced anonymity compared to Bitcoin and Ethereum. This characteristic could become increasingly valuable during times of heightened government scrutiny and potential capital controls triggered by trade wars. However, it's crucial to acknowledge the inherent risks.

- Increased privacy concerns due to trade restrictions: Investors may seek privacy coins to protect their assets and transactions from government oversight.

- Potential for capital flight through anonymous transactions: Privacy coins could facilitate the movement of capital across borders, bypassing trade restrictions.

- Regulatory challenges and legal implications: The anonymity offered by these coins attracts regulatory scrutiny and raises concerns about their use in illicit activities.

Centralized Cryptocurrencies and the Trade War

Centralized cryptocurrencies and exchanges present a different picture. While they offer convenience and ease of use, they also carry significant risks during times of geopolitical instability.

The Vulnerability of Centralized Exchanges

Centralized cryptocurrency exchanges are vulnerable to various risks, including hacking, regulatory crackdowns, and operational failures. These risks are amplified during periods of economic uncertainty and heightened geopolitical tension.

- Security risks on exchanges: Centralized exchanges hold significant amounts of cryptocurrency, making them attractive targets for hackers.

- Governmental regulation and compliance: Centralized exchanges are subject to varying levels of government regulation, which can change rapidly during a trade war.

- Dependence on centralized infrastructure: Their reliance on centralized servers and systems makes them vulnerable to outages and disruptions.

Stablecoins and Their Role

Stablecoins, pegged to fiat currencies like the US dollar, aim to minimize volatility. They might appear appealing during market turbulence. However, their reliance on external assets introduces its own set of risks.

- Reduced volatility compared to other cryptocurrencies: Stablecoins offer relative price stability compared to other crypto assets.

- Potential for easier trading during uncertainty: They can facilitate smoother transactions during market downturns.

- Risks related to the underlying asset peg: The stability of a stablecoin depends on the stability of the underlying asset, which can be affected by macroeconomic factors.

Factors Influencing Cryptocurrency Performance During Trade Wars

Several factors beyond the inherent characteristics of specific cryptocurrencies influence their performance during trade wars.

- Global economic indicators: Macroeconomic factors like inflation, interest rates, and global economic growth significantly impact cryptocurrency markets.

- Regulatory landscape of different jurisdictions: Government regulations and policies toward cryptocurrencies vary widely across countries and can change rapidly in response to geopolitical events.

- Market sentiment and investor behavior: Investor confidence and overall market sentiment play a crucial role in determining cryptocurrency prices.

- Technological development and innovation: Advancements in blockchain technology and the adoption of new cryptocurrencies can influence market dynamics.

Conclusion

Predicting which cryptocurrency will definitively "weather the storm" of a trade war is an impossible task. The cryptocurrency market remains highly volatile and influenced by numerous interconnected factors. However, by carefully considering the strengths and weaknesses of different cryptocurrencies—decentralized options like Bitcoin and Ethereum, privacy-focused coins, and stablecoins—along with broader macroeconomic factors, investors can make more informed decisions. Diversification remains crucial for mitigating risk. Continue your research to determine which cryptocurrency best aligns with your risk tolerance and investment goals amidst ongoing trade tensions. Remember to always conduct thorough research before investing in any cryptocurrency.

Featured Posts

-

Sonos And Ikeas Symfonisk Speakers The End Of An Era

May 08, 2025

Sonos And Ikeas Symfonisk Speakers The End Of An Era

May 08, 2025 -

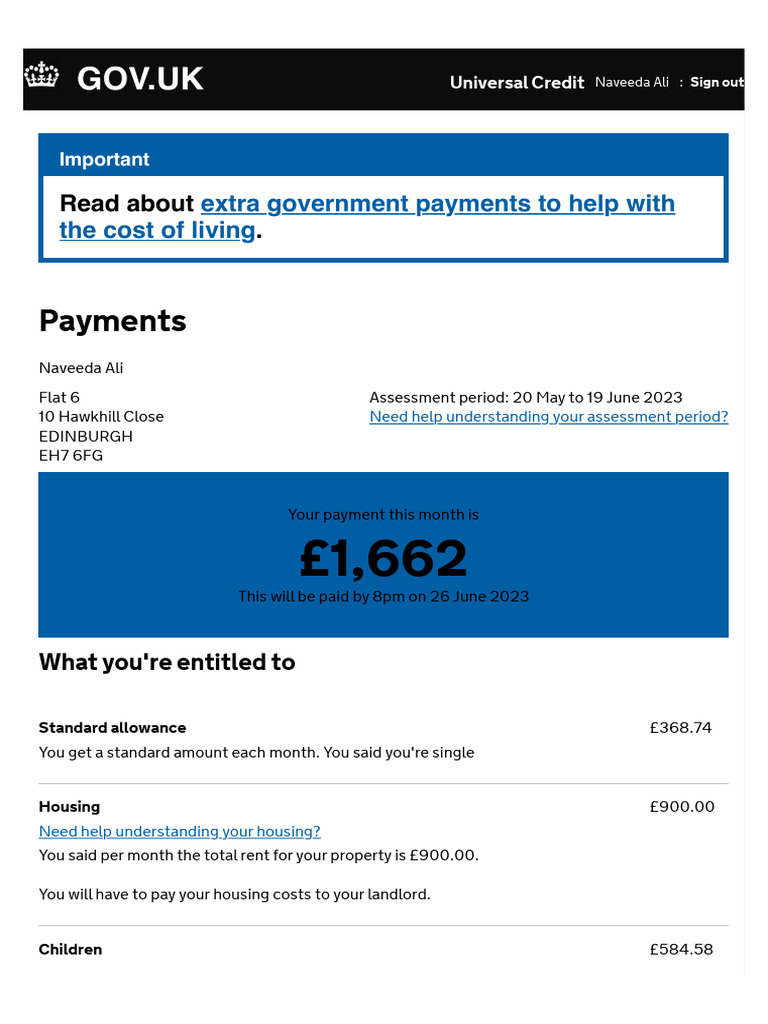

Missed Universal Credit Payments How To Claim A Refund

May 08, 2025

Missed Universal Credit Payments How To Claim A Refund

May 08, 2025 -

Possible Canada Post Strike In Late October What To Expect

May 08, 2025

Possible Canada Post Strike In Late October What To Expect

May 08, 2025 -

Alsdmt Fy Marakana Barbwza Ykhsr Asnanh

May 08, 2025

Alsdmt Fy Marakana Barbwza Ykhsr Asnanh

May 08, 2025 -

March 29th Nba Game Thunder Vs Pacers Injury Update

May 08, 2025

March 29th Nba Game Thunder Vs Pacers Injury Update

May 08, 2025

Latest Posts

-

Jayson Tatum Faces Ongoing Criticism From Colin Cowherd

May 08, 2025

Jayson Tatum Faces Ongoing Criticism From Colin Cowherd

May 08, 2025 -

Jayson Tatums Personal Journey Grooming Confidence And Coach Essence

May 08, 2025

Jayson Tatums Personal Journey Grooming Confidence And Coach Essence

May 08, 2025 -

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Experience

May 08, 2025

Jayson Tatum On Grooming Confidence And A Full Circle Coaching Experience

May 08, 2025 -

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025

Jayson Tatum Grooming Confidence And His Essence Filled Coaching Moment

May 08, 2025 -

Celtics Vs Lakers Abc Promo Tnt Announcers Tatum Commentary

May 08, 2025

Celtics Vs Lakers Abc Promo Tnt Announcers Tatum Commentary

May 08, 2025