White House Rejects Moody's US Credit Downgrade: Analysis And Response

Table of Contents

Moody's Downgrade Rationale

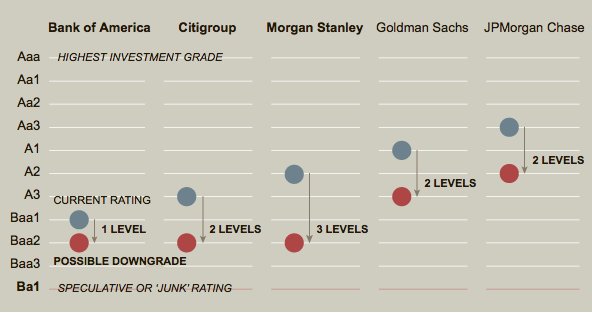

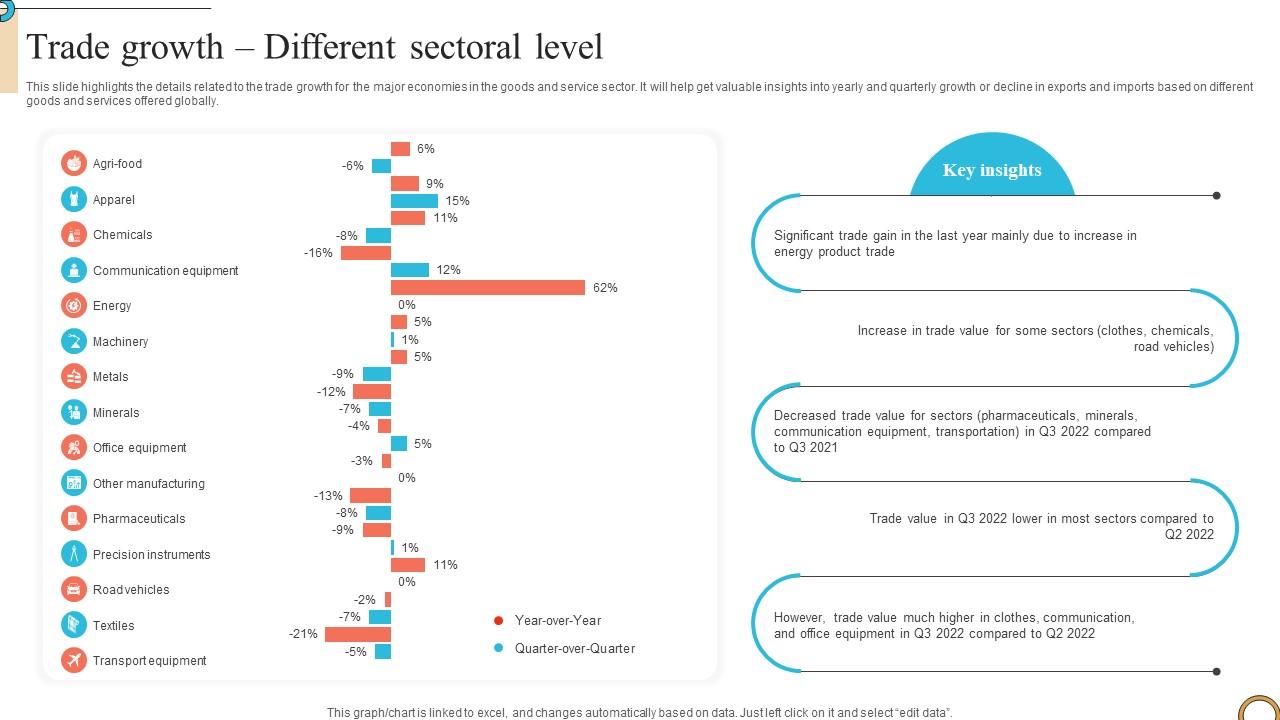

Moody's cited several key factors in its decision to downgrade the US credit rating. Their concerns center around the deterioration of fiscal strength, driven primarily by rising government debt and the ongoing political gridlock surrounding the debt ceiling. The agency expressed worries about the increasing likelihood of further debt accumulation and the erosion of the US government's governance strength and effectiveness.

- Soaring National Debt: The US national debt has reached unprecedented levels, placing a significant strain on the nation's finances. Moody's highlighted the projected trajectory of this debt, indicating a continuing upward trend without significant fiscal reforms.

- Political Gridlock and Debt Ceiling Debates: The repeated near-misses on the debt ceiling, coupled with the intense political polarization surrounding fiscal policy, contributed significantly to the downgrade. Moody's expressed concerns about the predictability and effectiveness of the US government's ability to manage its finances.

- Erosion of Governance: The agency pointed to a weakening in the overall effectiveness of US governance, emphasizing the repeated brinkmanship around the debt ceiling as evidence of this decline.

These concerns, according to Moody's, increase the risk of future defaults or significant fiscal crises and negatively impact the US Treasury bonds market. The downgrade is expected to lead to higher interest rates on US government debt, increasing borrowing costs for the federal government and potentially impacting mortgage rates and other interest-sensitive sectors.

The White House's Response and Counterarguments

The White House swiftly rejected Moody's assessment, issuing a statement that characterized the downgrade as "misguided" and "out of step with the reality of the US economy." The administration emphasized several key points in its defense:

- Strong Economic Fundamentals: The White House highlighted positive economic indicators, such as job growth and declining unemployment rates, as evidence of the underlying strength of the US economy.

- Successful Debt Ceiling Negotiation: The administration pointed to the eventual agreement to raise the debt ceiling as a demonstration of its ability to navigate difficult political situations and avoid a catastrophic default.

- Long-Term Economic Prospects: Officials stressed the long-term potential of the US economy, emphasizing the country's innovative capacity and robust private sector.

Quotes from President Biden and Treasury Secretary Janet Yellen underscored these points, emphasizing the administration's commitment to responsible fiscal management and its confidence in the resilience of the US economy. They argued that Moody's analysis failed to adequately reflect the ongoing economic strength and the administration's efforts to address the nation's fiscal challenges.

Analysis of the Disagreement

The disagreement between Moody's and the White House highlights a fundamental difference in perspectives on the US fiscal situation. Moody's focuses on the trajectory of the national debt and the political risks associated with the debt ceiling debates, emphasizing the potential for future fiscal crises. The White House, on the other hand, emphasizes the current economic performance and the administration's efforts to address long-term fiscal challenges. This divergence underscores the role of partisan politics in shaping interpretations of economic data and the complexities of forecasting future economic trends. The political implications are significant, with both sides using the downgrade as a tool to advance their own narratives and agendas.

Potential Economic Consequences

The Moody's US credit downgrade, and the subsequent White House response, carries significant potential economic consequences. In the short term, it could lead to increased volatility in financial markets and higher borrowing costs for the US government. Investor confidence could be impacted, potentially leading to capital flight and a decline in the value of the dollar.

- Increased Borrowing Costs: Higher interest rates on US Treasury bonds will translate into higher borrowing costs for businesses and consumers.

- Impact on Investor Confidence: The downgrade could erode investor confidence, leading to reduced investment and economic slowdown.

- Global Market Implications: The effects of the downgrade will likely extend beyond the US, impacting global markets and potentially destabilizing the international financial system.

Economists and financial analysts offer varying opinions on the severity of the potential consequences, with some suggesting a muted impact while others warn of more significant risks. The long-term implications remain uncertain, depending heavily on future fiscal policy decisions and the evolution of the global economic landscape.

Conclusion: Understanding the Fallout from the Moody's US Credit Downgrade

The disagreement between Moody's and the White House regarding the Moody's US credit downgrade highlights a crucial debate about the US fiscal situation. While the White House emphasizes the strength of the current economy, Moody's points to the growing national debt and the risks of political gridlock. The potential economic consequences range from increased borrowing costs and reduced investor confidence to wider instability in global markets. Understanding the implications of this US credit downgrade is critical for both policymakers and individuals. Stay informed about further developments by following updates from the US Treasury Department website, the Congressional Budget Office, and reputable financial news sources like the Wall Street Journal and Bloomberg. Understanding the implications of this Moody's US credit downgrade is vital for making informed personal finance and investment decisions.

Featured Posts

-

Watch Damiano David Of Maneskins Electrifying Jimmy Kimmel Live Performance

May 18, 2025

Watch Damiano David Of Maneskins Electrifying Jimmy Kimmel Live Performance

May 18, 2025 -

Amanda Bynes Steps Out New Only Fans Content And Recent Photos

May 18, 2025

Amanda Bynes Steps Out New Only Fans Content And Recent Photos

May 18, 2025 -

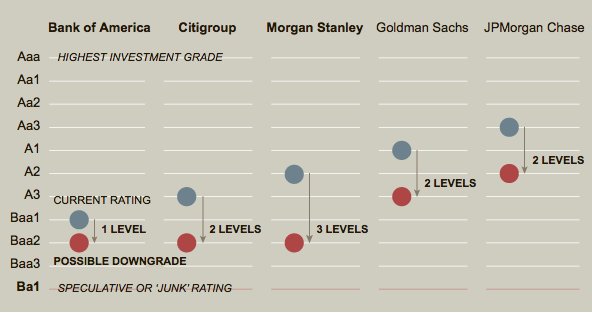

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025

Gambling On Disaster The Case Of The Los Angeles Wildfires

May 18, 2025 -

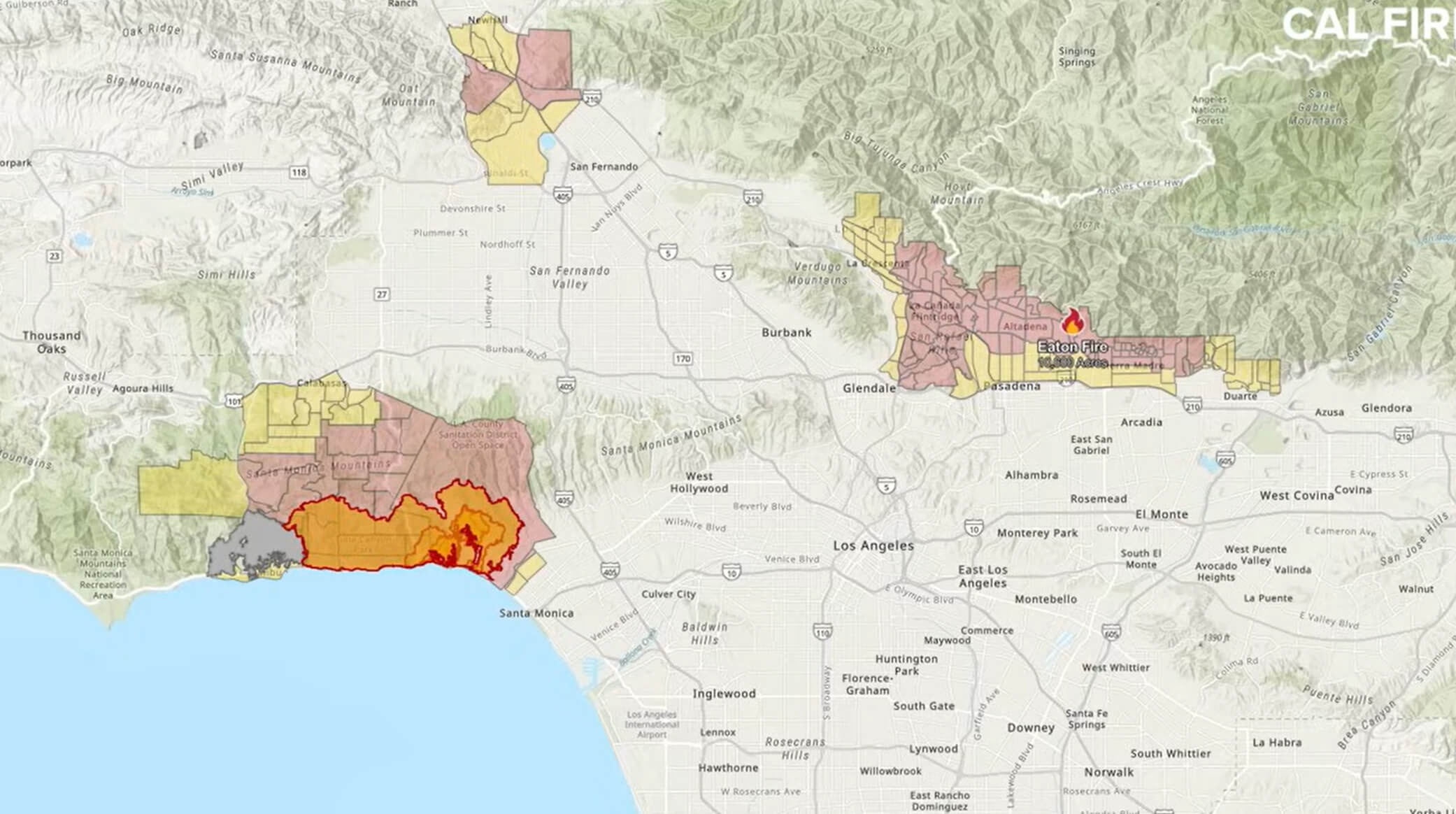

Identifying The Countrys Next Business Growth Areas

May 18, 2025

Identifying The Countrys Next Business Growth Areas

May 18, 2025 -

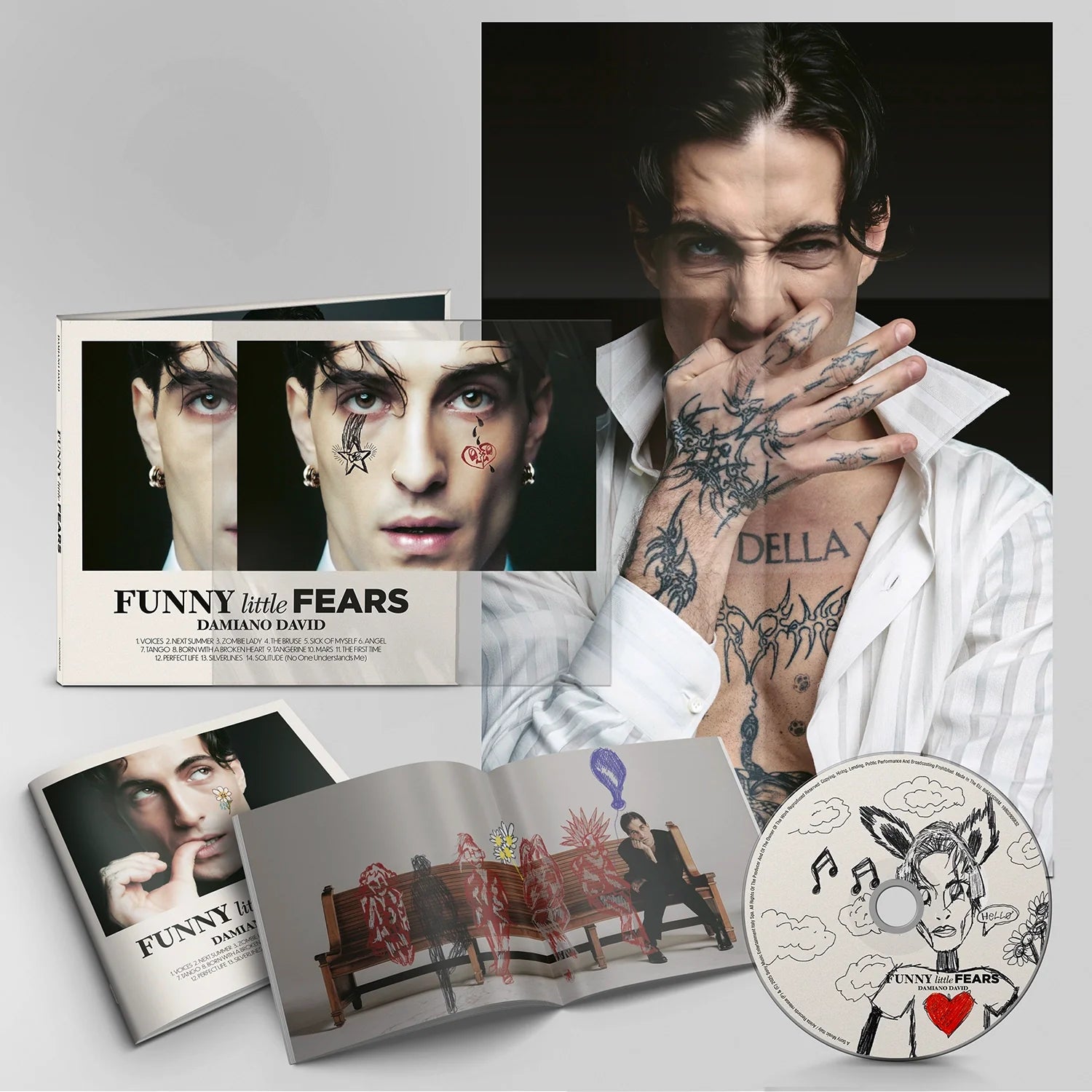

Maneskins Damiano David Funny Little Fears Solo Album Debut

May 18, 2025

Maneskins Damiano David Funny Little Fears Solo Album Debut

May 18, 2025

Latest Posts

-

Amanda Bynes Only Fans Debut Challenges And Opportunities

May 18, 2025

Amanda Bynes Only Fans Debut Challenges And Opportunities

May 18, 2025 -

Amanda Bynes Joins Only Fans A Look At Her Content Policy

May 18, 2025

Amanda Bynes Joins Only Fans A Look At Her Content Policy

May 18, 2025 -

Amanda Bynes Only Fans A Post Hollywood Career Move

May 18, 2025

Amanda Bynes Only Fans A Post Hollywood Career Move

May 18, 2025 -

Amanda Bynes Spotted With Friend Following Only Fans Launch

May 18, 2025

Amanda Bynes Spotted With Friend Following Only Fans Launch

May 18, 2025 -

Amanda Bynes Only Fans Account What To Expect And What Not To

May 18, 2025

Amanda Bynes Only Fans Account What To Expect And What Not To

May 18, 2025