Why 10-Year Mortgages Aren't Popular In Canada

Table of Contents

Higher Initial Payments and Interest Rates

One of the primary deterrents to 10-year mortgages is the significantly higher upfront cost and potential interest rate. Compared to shorter-term mortgages, such as the prevalent 5-year mortgage, 10-year options often demand larger down payments. This immediately increases the financial burden on borrowers. Furthermore, lenders may charge slightly higher interest rates for longer-term mortgages to compensate for the increased risk associated with a longer loan period.

- Increased financial burden for borrowers: Securing a 10-year mortgage requires a more substantial financial commitment upfront, potentially impacting savings and limiting other investments.

- Higher monthly payments impacting cash flow: Even with a larger down payment, monthly payments on a 10-year mortgage are typically higher than those of a shorter-term mortgage with the same principal, affecting monthly cash flow.

- Potential difficulties qualifying for a larger loan: The stringent lending requirements associated with longer-term mortgages can make it challenging for some borrowers to qualify for the loan amount they need.

This contrasts sharply with the often more accessible 5-year mortgage, which usually requires a smaller down payment and may offer a slightly lower interest rate, at least initially. The flexibility of adjusting the interest rate every five years offers a significant advantage.

Risk of Long-Term Commitment

The Canadian economy, like any other, is subject to fluctuations. Committing to a 10-year mortgage means locking into a fixed interest rate and payment schedule for a decade. This presents a significant risk, especially given the potential for unexpected life events.

- Risk of being locked into unfavorable interest rates: If interest rates rise during the 10-year term, the borrower remains locked into their initial, potentially less favourable, rate.

- Difficulty adjusting to changing circumstances: Job loss, unexpected medical expenses, or other unforeseen circumstances can severely impact the ability to maintain mortgage payments over such a long period.

- Potential for significant penalties upon early repayment: Breaking a 10-year mortgage early typically incurs substantial penalties, making it a financially risky proposition if circumstances change unexpectedly.

This inherent risk contributes significantly to the reluctance of many Canadian borrowers to opt for a 10-year mortgage. The predictability and shorter commitment of a 5-year mortgage, with the opportunity to refinance and potentially secure a lower rate, provides a sense of security absent in a longer-term arrangement.

Limited Flexibility and Refinancing Options

Refinancing a mortgage allows borrowers to take advantage of lower interest rates, access home equity, or adjust the terms of their loan. However, refinancing a 10-year mortgage is significantly more challenging than refinancing a shorter-term mortgage. The longer commitment period reduces opportunities for adjusting the mortgage to changing market conditions.

- Difficulty securing better interest rates later on: If interest rates decline during the 10-year term, the borrower cannot benefit from those lower rates until the mortgage matures.

- Limited opportunities to access equity: Refinancing often allows borrowers to access their home equity. This option is limited with a 10-year mortgage, particularly in the early years.

- Increased stress related to a longer-term financial commitment: The lack of flexibility inherent in a 10-year mortgage can lead to increased financial stress and anxiety for borrowers.

The Preference for Amortization Flexibility

Canadian borrowers often prioritize flexibility in their mortgage amortization. The ability to refinance every 5 years, common with 5-year terms, provides the opportunity to reassess their financial situation and market conditions.

- Advantage of regularly reassessing the market: Short-term mortgages allow borrowers to adjust their mortgage strategy to changing interest rates and market conditions.

- Opportunity to secure better rates and terms: Refinancing provides opportunities to secure better interest rates and potentially more favourable mortgage terms.

- Greater control over long-term financial planning: The flexibility offered by shorter-term mortgages allows for greater control and adaptability in long-term financial planning.

This adaptability is a key factor in the widespread preference for shorter-term mortgages in the Canadian housing market.

The Role of Canadian Mortgage Regulations

Canadian mortgage regulations, including stress test requirements, indirectly influence the popularity of different mortgage terms. These regulations aim to ensure financial stability and prevent borrowers from taking on excessive debt. While not directly targeting 10-year mortgages, these rules make it more challenging to qualify for longer-term loans with higher payments.

Conclusion: Making Informed Decisions about Your Canadian Mortgage

In summary, the unpopularity of 10-year mortgages in Canada stems from several interconnected factors: higher initial payments and potential interest rates, the inherent risk of a long-term commitment, limited flexibility and refinancing options, and a strong preference for the adaptability offered by shorter-term mortgages. Understanding these factors is crucial for making an informed decision about your mortgage term. Consider your financial situation, long-term goals, and risk tolerance before committing to a 10-year mortgage. Learn more about finding the right mortgage term for your needs, and explore the options beyond 10-year mortgages to find the best fit for your Canadian homeownership journey. [Link to mortgage calculator/financial advisor].

Featured Posts

-

The Librarians Next Chapter Tnt Announces Premiere Date With New Trailer And Poster

May 06, 2025

The Librarians Next Chapter Tnt Announces Premiere Date With New Trailer And Poster

May 06, 2025 -

Reaktsiya Stivena Kinga Na Diyi Trampa Ta Maska U X

May 06, 2025

Reaktsiya Stivena Kinga Na Diyi Trampa Ta Maska U X

May 06, 2025 -

Office365 Breach Nets Millions Insider Reveals Extensive Cybertheft

May 06, 2025

Office365 Breach Nets Millions Insider Reveals Extensive Cybertheft

May 06, 2025 -

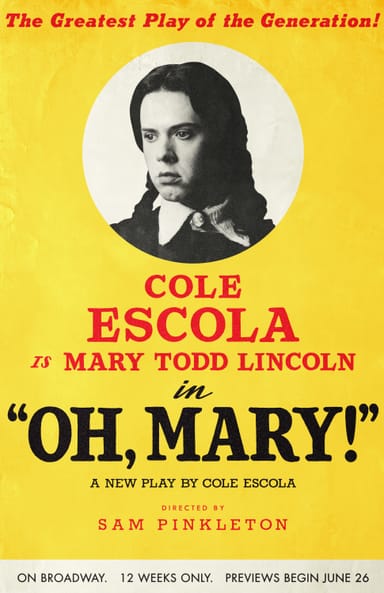

Betty Gilpins Broadway Debut Oh Mary A 100 Commitment

May 06, 2025

Betty Gilpins Broadway Debut Oh Mary A 100 Commitment

May 06, 2025 -

Is Gypsy Rose Blanchard Ready For Marriage With Ken Urker Exploring The Reasons Behind The Delay

May 06, 2025

Is Gypsy Rose Blanchard Ready For Marriage With Ken Urker Exploring The Reasons Behind The Delay

May 06, 2025