Why Current Stock Market Valuations Aren't A Cause For Investor Alarm (BofA)

Table of Contents

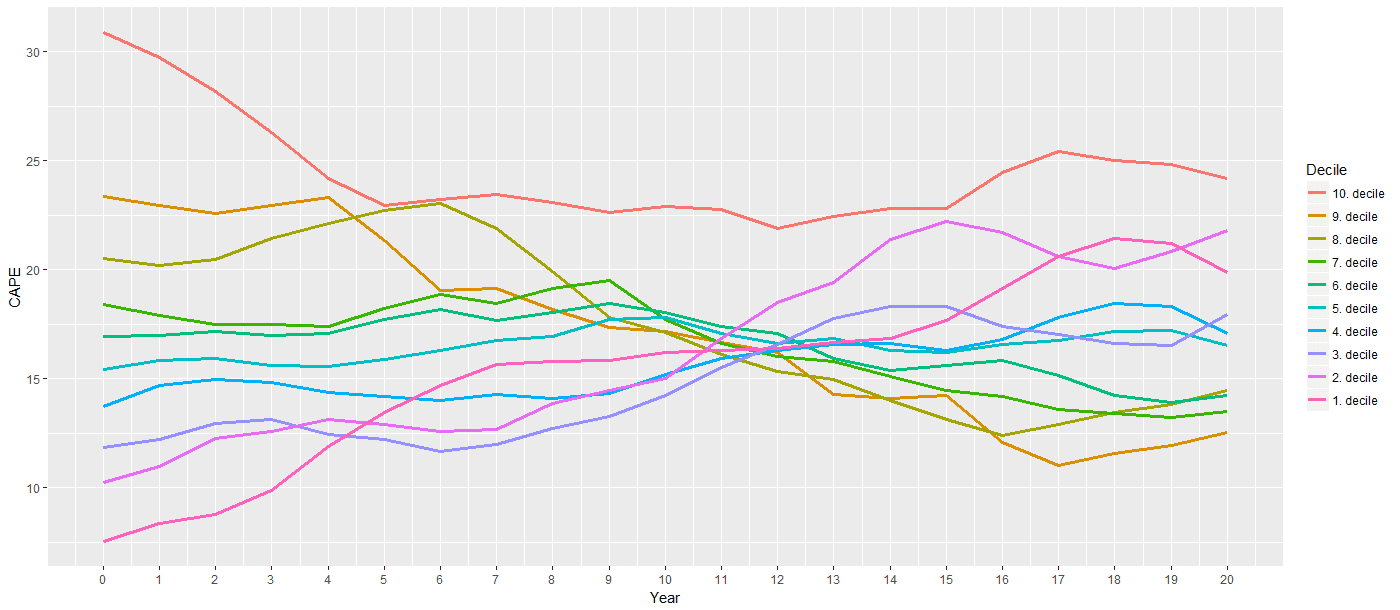

The Influence of Low Interest Rates on Stock Valuations

A crucial factor influencing stock market valuations is the prevailing interest rate environment. There's an inverse relationship between interest rates and stock valuations. When interest rates are low, the attractiveness of bonds diminishes, pushing investors towards higher-yielding assets like equities.

Historically low interest rates, maintained by central banks for years, play a significant role in justifying higher Price-to-Earnings (P/E) ratios. This is because:

- Lower discount rates increase the present value of future earnings. A lower discount rate, directly linked to interest rates, means that future earnings are worth more today, increasing the present value of a company and its stock price.

- Bonds become less attractive, driving capital into equities. With bond yields low, investors seek higher returns, shifting capital towards the stock market, thus pushing up valuations.

- Quantitative easing (QE) has significantly impacted market liquidity and valuations. Central bank injections of liquidity into the financial system have boosted asset prices, including stocks.

BofA's analysis of historical data consistently shows a correlation between low interest rates and elevated stock valuations. Their research, available on their website, provides detailed insights into this relationship.

Strong Corporate Earnings and Profitability: A Foundation for Higher Valuations

Beyond interest rate dynamics, the robust financial performance of many companies provides a strong underpinning for current valuations. Many sectors have reported impressive earnings growth, driven by a number of factors, including:

- Technological innovation: Companies leveraging technological advancements to improve efficiency and expand markets often demonstrate higher profitability.

- Efficient supply chains: Companies with effective supply chain management are better positioned to navigate global disruptions and maintain profit margins.

Examples of high-performing sectors include technology, healthcare, and certain consumer staples. Analysis of revenue growth and profit margins across various sectors further supports this trend. Mergers and acquisitions also contribute to boosted earnings for some companies.

BofA's research highlights specific companies exhibiting strong earnings growth and healthy profit margins, providing compelling evidence for this argument. Access their financial reports for detailed breakdowns of corporate performance.

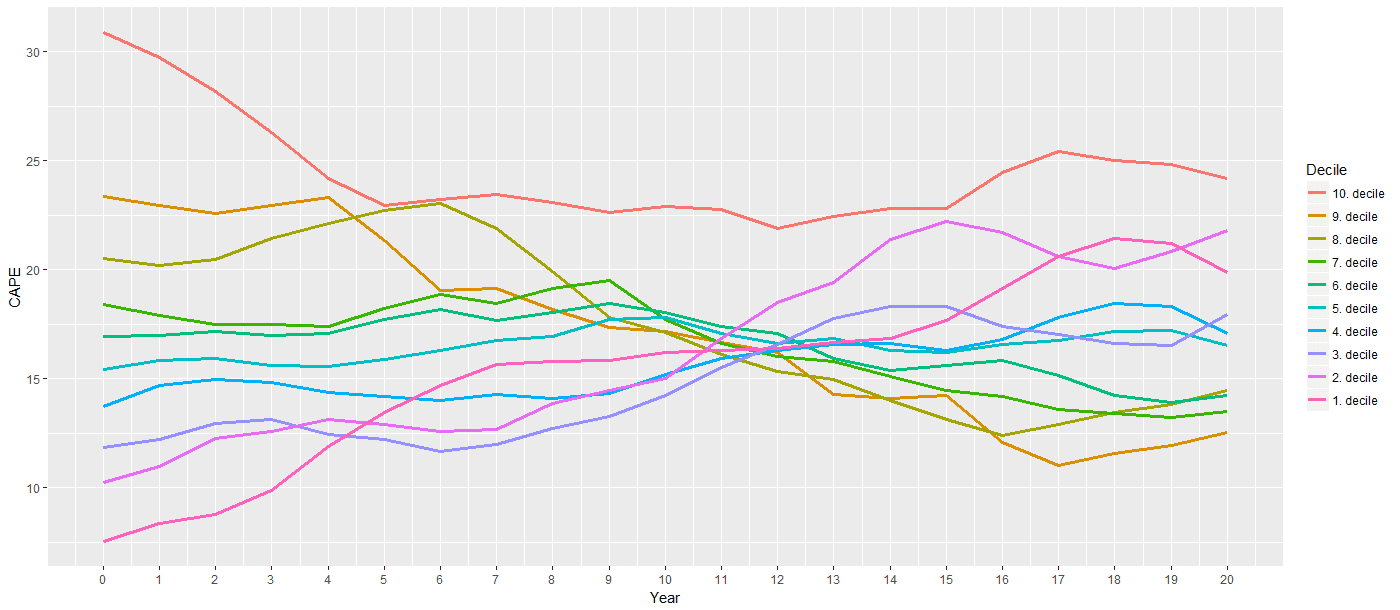

Analyzing Key Valuation Metrics Beyond Simple P/E Ratios

While the P/E ratio is a widely used metric, relying solely on it can be misleading. A more nuanced understanding requires consideration of other key valuation metrics:

- PEG ratio: This metric considers the relationship between P/E ratio and earnings growth rate, providing a more comprehensive view.

- Price-to-Sales ratio: Useful for valuing companies with negative earnings or those in early stages of growth, it compares a company’s market capitalization to its revenue.

- Discounted cash flow analysis (DCF): This method estimates the present value of future cash flows, offering a more detailed valuation.

These alternative metrics provide a more comprehensive and robust assessment of a company's valuation, avoiding the pitfalls of using P/E ratios in isolation. BofA's analysts regularly utilize these methods in their valuation assessments.

Long-Term Growth Potential and Future Market Expectations

Current stock valuations inherently reflect future expectations. The market’s current pricing anticipates long-term economic growth and sector-specific expansion.

Several factors contribute to this positive outlook:

- Technological advancements: Continued innovation in areas like artificial intelligence, biotechnology, and renewable energy is poised to fuel significant economic growth.

- Increased consumer spending: As economies recover and consumer confidence improves, increased spending will stimulate further growth.

- Government policies and regulations: Supportive government policies, such as infrastructure investments or tax incentives, can further boost economic growth and corporate profitability.

BofA's economic forecasts and industry analyses predict continued long-term growth, supporting the contention that current valuations are not necessarily overblown. Their projections are available in their regular market reports.

Conclusion: Why Current Stock Market Valuations Shouldn't Scare You (BofA Insights)

In conclusion, while seemingly high, current stock market valuations aren't necessarily a cause for alarm. BofA's analysis reveals that factors such as historically low interest rates, strong corporate earnings, and positive long-term growth potential all contribute to justifying current levels. While volatility is a natural part of the market, a long-term investment perspective, coupled with a diversified portfolio and thorough understanding of current stock market valuations is key. For a deeper dive into this analysis, explore BofA's detailed market reports on current stock market valuations and refine your investment strategy accordingly.

Featured Posts

-

Vermisste Person Im Bodensee Aktuelle Informationen Zur Suchaktion In Bregenz

May 31, 2025

Vermisste Person Im Bodensee Aktuelle Informationen Zur Suchaktion In Bregenz

May 31, 2025 -

American Universities Face Financial Challenges Amidst Changing Chinese Student Demographics

May 31, 2025

American Universities Face Financial Challenges Amidst Changing Chinese Student Demographics

May 31, 2025 -

Jaime Munguias Rematch Victory Strategic Adjustments Pay Off Against Bruno Surace

May 31, 2025

Jaime Munguias Rematch Victory Strategic Adjustments Pay Off Against Bruno Surace

May 31, 2025 -

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025

Duncan Bannatynes Support For Life Changing Childrens Charity In Morocco

May 31, 2025 -

Fox19 Meteorologist Moves To Cleveland For Part Time Role

May 31, 2025

Fox19 Meteorologist Moves To Cleveland For Part Time Role

May 31, 2025