Why Current Stock Market Valuations Aren't A Worry: A BofA Analysis

Table of Contents

BofA's Perspective on Interest Rates and Their Impact on Valuations

BofA's analysis acknowledges the impact of rising interest rates on stock valuations. Higher rates generally increase the discount rate used in valuation models, potentially lowering the present value of future earnings and thus impacting stock prices. However, BofA's perspective is not one of outright doom and gloom. Their view is more nuanced, incorporating several key considerations:

-

Specific Interest Rate Projections: BofA's projections for interest rate hikes often factor in a gradual increase, not a sharp, immediate jump. This allows companies time to adjust their strategies and financial planning. They may anticipate a peak interest rate before a potential softening.

-

Corporate Earnings Adaptation: BofA anticipates that many corporations possess the financial strength to navigate higher interest rates. Stronger companies can often absorb increased borrowing costs through pricing power or operational efficiencies, mitigating the negative impact on earnings.

-

Discount Rate and Valuation Models: While a higher discount rate does lower present values, BofA emphasizes that this effect is often counterbalanced by other factors, particularly strong earnings growth (discussed below). The impact of interest rates on the discount rate is just one piece of the complex valuation puzzle.

Keyword Optimization: BofA interest rates, stock valuation interest rates, impact of interest rates on stock market, discount rate valuation

Earnings Growth: A Key Factor Supporting Current Valuations (According to BofA)

BofA's analysis points to robust corporate earnings growth as a key justification for current stock market valuations. They highlight several factors contributing to this positive outlook:

-

High-Growth Sectors: BofA identifies specific sectors, such as technology and certain areas within healthcare, poised for significant earnings growth. These sectors are often driving overall market performance.

-

Technological Innovation: The ongoing wave of technological innovation, including AI and automation, is projected to fuel further productivity gains and increased earnings for many companies. BofA sees this as a long-term driver of positive earnings growth.

-

Key Growth Companies: BofA’s analysis points to specific companies—often large-cap tech firms and innovative businesses—as key drivers of overall earnings growth, supporting higher market valuations. These companies are not only growing revenues but also improving profitability.

Keyword Optimization: earnings growth stock market, BofA earnings projections, corporate earnings growth, stock valuation earnings

Long-Term Economic Outlook: BofA's Positive Forecast and Its Influence on Valuations

BofA's positive long-term economic forecast significantly influences their perspective on current valuations. Their analysis suggests that sustained economic growth should support higher stock prices:

-

GDP Growth Predictions: BofA's predictions for GDP growth, while acknowledging potential short-term fluctuations, generally point towards a positive long-term trajectory. This implies a supportive environment for corporate profitability and stock market returns.

-

Risk Assessment: While BofA acknowledges potential risks such as inflation and geopolitical instability, their analysis suggests these are manageable risks, not insurmountable obstacles to long-term economic growth.

-

Higher Valuations Supported by Growth: A positive long-term economic outlook justifies higher valuations, as investors anticipate continued growth in corporate earnings and the overall economy. The forecast directly impacts investor sentiment and willingness to pay higher prices for stocks.

Keyword Optimization: economic outlook stock market, BofA economic forecast, long-term economic growth, stock valuation economic outlook

Addressing Counterarguments: Why Some Concerns Might Be Overblown

Many investors express concerns about high stock market valuations. BofA's analysis addresses these concerns, suggesting that some fears might be overblown:

-

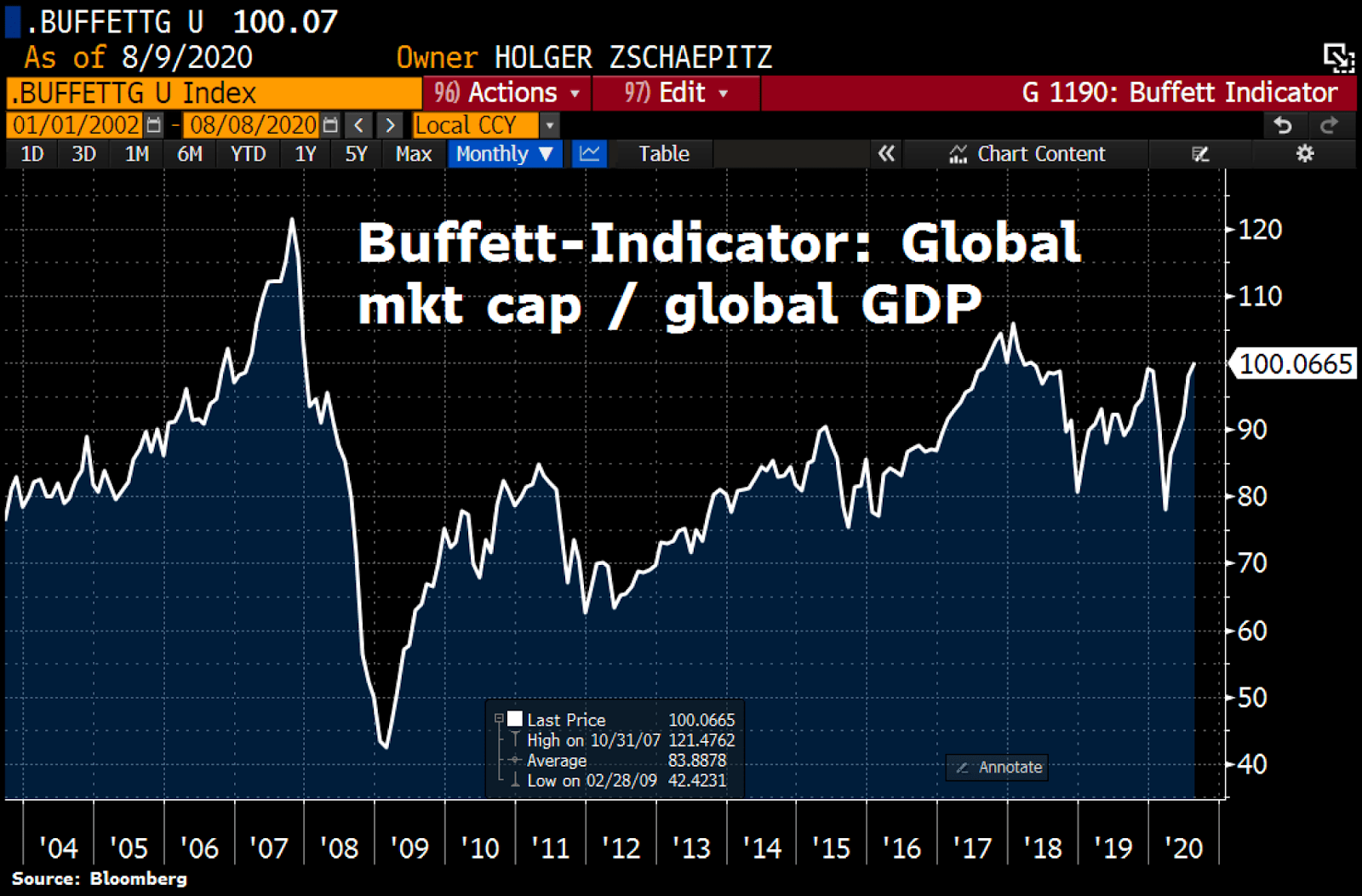

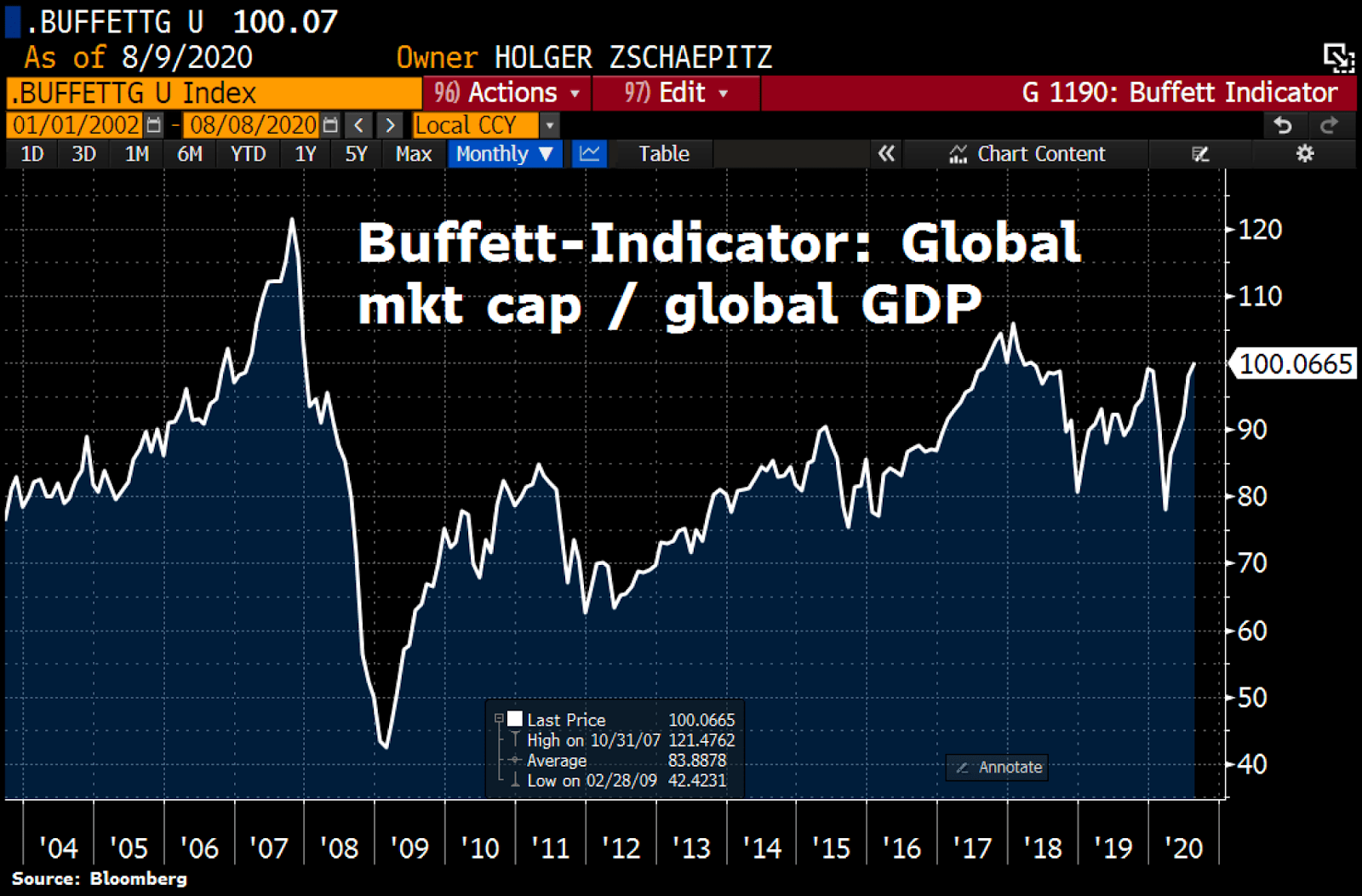

Historical Valuation Multiples: BofA acknowledges that certain valuation metrics might appear high relative to historical averages. However, they argue that comparing current valuations to past periods without considering the unique factors driving current growth (such as technological innovation and evolving industry structures) can be misleading.

-

Misleading Valuation Metrics: Some widely used valuation metrics might not fully capture the dynamic nature of the current market. BofA suggests that a more nuanced approach, incorporating qualitative factors alongside quantitative data, is necessary for a complete assessment.

-

Market Bubble Concerns: While the potential for a market correction always exists, BofA's analysis suggests that the current situation doesn't necessarily indicate an imminent or inevitable market bubble. Their analysis highlights that current valuations are supported by strong fundamentals, such as robust earnings growth and a positive long-term economic outlook.

Keyword Optimization: stock market valuation concerns, overvalued stock market, stock market bubble, refuting stock market valuation concerns

Conclusion: Why Current Stock Market Valuations Aren't Necessarily a Worry

BofA's analysis suggests that while current stock market valuations may appear high to some, they are not necessarily cause for immediate alarm. Their arguments center on three key pillars: a manageable impact from interest rate hikes, strong and sustained corporate earnings growth, and a positive long-term economic outlook. While acknowledging potential risks and market volatility, BofA’s research indicates that the current valuations are, to a significant degree, justified by underlying fundamentals. While market volatility is always a possibility, understanding the detailed analysis offered by BofA can help you make informed decisions regarding your investment strategy and assess whether current stock market valuations are truly a worry. Explore BofA's research to gain a more complete picture.

Featured Posts

-

Atalanta Y Venezia Partido Sin Goles Empate En El Marcador

May 13, 2025

Atalanta Y Venezia Partido Sin Goles Empate En El Marcador

May 13, 2025 -

Tory Lanezs Potential Sentence A Hypothetical Scenario In Chicago

May 13, 2025

Tory Lanezs Potential Sentence A Hypothetical Scenario In Chicago

May 13, 2025 -

Corruption Case Jeopardizes Colombias Pension Law

May 13, 2025

Corruption Case Jeopardizes Colombias Pension Law

May 13, 2025 -

Met Gala 2024 Leonardo Di Caprio And Vittoria Cerettis Red Carpet Arrival

May 13, 2025

Met Gala 2024 Leonardo Di Caprio And Vittoria Cerettis Red Carpet Arrival

May 13, 2025 -

Fiorentina Bungkam Atalanta Berkat Gol Tunggal Moise Kean

May 13, 2025

Fiorentina Bungkam Atalanta Berkat Gol Tunggal Moise Kean

May 13, 2025