Why Current Stock Market Valuations Shouldn't Deter Investors: BofA

Table of Contents

BofA's Bullish Outlook: Understanding the Underlying Rationale

BofA maintains a positive outlook on the stock market, supported by several key factors outlined in their recent reports and analyses. Their bullish stance isn't blind optimism; it's grounded in tangible data and projections.

-

Strong Corporate Earnings Growth Projections: BofA anticipates robust earnings growth for many companies in the coming quarters and years, driven by factors such as technological advancements, increasing consumer spending, and global economic recovery. This projected growth helps justify current valuations.

-

Positive Economic Indicators Supporting Continued Growth: Several key economic indicators, including GDP growth, employment figures, and consumer confidence, point towards continued economic expansion. This positive macroeconomic environment fosters a favorable climate for stock market performance.

-

Low Interest Rates Sustaining Market Strength: The prevailing low-interest-rate environment continues to support higher valuations by making borrowing cheaper for companies and encouraging investors to seek higher returns in the stock market.

-

Specific Sectors Identified by BofA as Having Strong Growth Potential: BofA's research highlights specific sectors, such as technology, healthcare, and renewable energy, as possessing particularly strong growth potential. Investing in these sectors can offer exposure to above-average returns.

-

Specific Metrics BofA Uses to Justify Their Outlook (e.g., P/E Ratios in Context): While acknowledging elevated Price-to-Earnings (P/E) ratios in some sectors, BofA emphasizes the context of these metrics. They argue that robust future earnings growth can offset seemingly high current valuations, making them less of a concern in the long run.

Addressing Valuation Concerns: A Deeper Dive into Market Metrics

The perception of high stock market valuations is undeniable. However, a closer examination reveals a more nuanced picture.

-

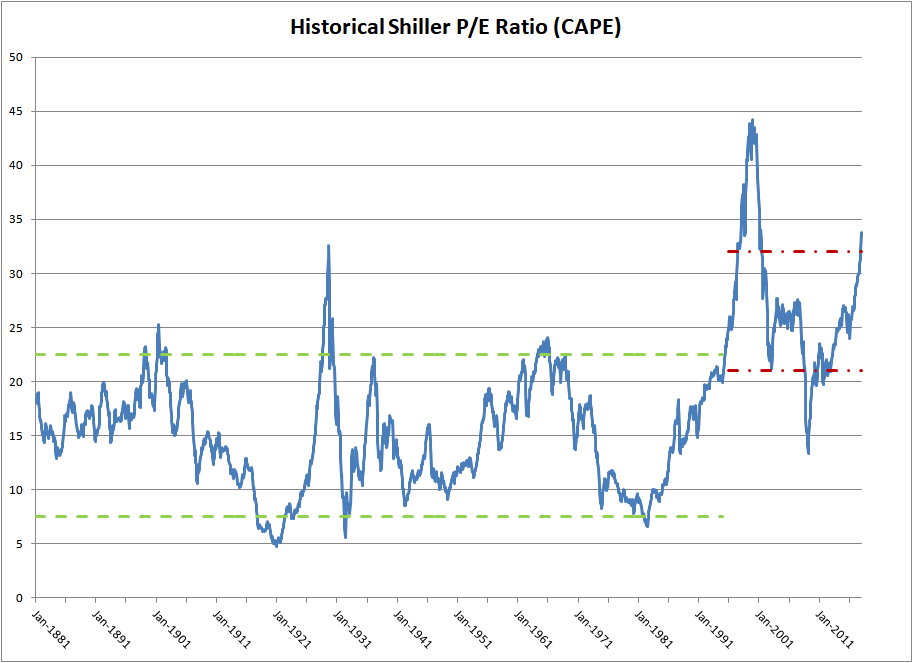

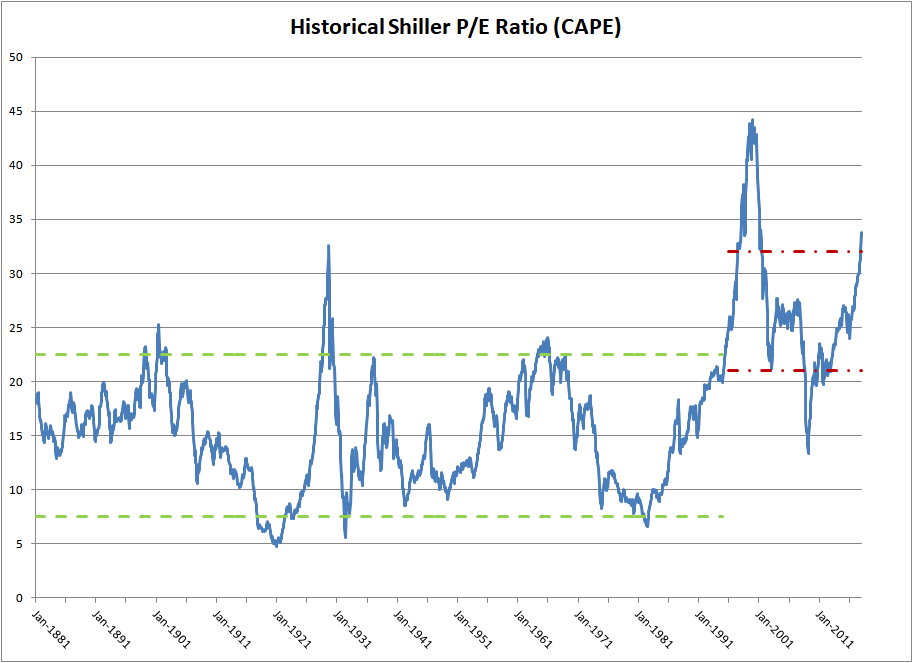

How Inflation Impacts Valuation Metrics and Why Those Metrics Might Be Misleading: Inflation can distort valuation metrics like P/E ratios. If inflation is not adequately accounted for, current valuations may appear higher than they actually are when compared to historical data.

-

The Role of Low Interest Rates in Supporting Higher Valuations: Low interest rates reduce the opportunity cost of investing in stocks, allowing investors to accept higher valuations in exchange for potentially higher returns.

-

Potential for Future Earnings Growth to Justify Current Prices: BofA's projections suggest that future earnings growth will likely justify current stock prices. This outlook is based on strong corporate fundamentals and anticipated economic expansion.

-

Comparing Current Valuations to Historical Averages, Adjusting for Inflation and Economic Context: Comparing current valuations to historical averages, adjusted for inflation and the prevailing economic climate, provides a more accurate assessment of whether valuations are truly excessive.

-

Mention Alternative Valuation Metrics That Might Paint a Different Picture (e.g., Cyclically Adjusted P/E Ratio – CAPE): Alternative valuation metrics, such as the CAPE ratio (Cyclically Adjusted Price-to-Earnings ratio), which smooths out earnings fluctuations over a longer period, can offer a more comprehensive view of market valuations.

Strategic Investment Approaches for the Current Market

Based on BofA's outlook, investors can adopt several strategic approaches to navigate the current market effectively.

-

Diversification Strategies: Sector Allocation, Geographic Diversification: Diversification across different sectors and geographic regions is crucial to mitigate risk and capitalize on growth opportunities in various areas.

-

Long-Term Investment Horizon Emphasized: A long-term investment horizon is vital to weather short-term market fluctuations and realize the potential for long-term growth.

-

Focus on Quality Companies with Sustainable Growth Potential: Focusing on companies with strong fundamentals, sustainable competitive advantages, and a history of consistent growth is paramount.

-

Importance of Risk Management: Implementing appropriate risk management strategies, including setting stop-loss orders and diversifying investments, is essential to protect your portfolio.

-

Consideration of Alternative Asset Classes to Balance Portfolio: Including alternative asset classes, such as bonds or real estate, can provide portfolio balance and reduce overall risk.

Beyond BofA: Independent Verification and Market Analysis

While BofA's analysis provides valuable insights, it's crucial to consider independent perspectives. Other reputable financial analysts and institutions offer their own assessments of the market and its valuations.

-

Mention Any Supporting or Contrasting Views from Other Analysts: While many concur with BofA's overall positive outlook, some may express caution about specific sectors or potential risks.

-

Include Links to Relevant Research Reports or Articles: Providing links to relevant research enhances credibility and allows readers to further explore the topic.

-

Maintain a Balanced Perspective, Acknowledging Both Potential Risks and Opportunities: It's important to acknowledge both the potential upside and downside of investing in the current market. A balanced approach is key.

Conclusion

In summary, while current stock market valuations may appear elevated, BofA's analysis, along with corroborating research from other sources, points towards a compelling case for continued investment. The projected earnings growth, favorable economic indicators, and low-interest-rate environment contribute to a relatively optimistic market outlook. Don't let perceived high stock market valuations deter you. Conduct thorough research, diversify your portfolio, and consider a long-term investment strategy based on your risk tolerance. Learn more about navigating current stock market valuations and develop a robust investment plan tailored to your financial goals.

Featured Posts

-

Stock Market Pain Investors Push Prices Higher Despite Risks

Apr 22, 2025

Stock Market Pain Investors Push Prices Higher Despite Risks

Apr 22, 2025 -

A Compassionate Shepherd Reflecting On The Life Of Pope Francis

Apr 22, 2025

A Compassionate Shepherd Reflecting On The Life Of Pope Francis

Apr 22, 2025 -

Joint Effort South Sudan And Us To Manage Deportees Return

Apr 22, 2025

Joint Effort South Sudan And Us To Manage Deportees Return

Apr 22, 2025 -

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025

Trump Administration To Slash Another 1 Billion In Harvard Funding

Apr 22, 2025 -

Hollywood Shut Down Actors And Writers On Strike

Apr 22, 2025

Hollywood Shut Down Actors And Writers On Strike

Apr 22, 2025