Why Did D-Wave Quantum (QBTS) Stock Soar This Week? Analysis And Insights

Table of Contents

Recent News and Catalysts Driving QBTS Stock Increase

Several factors likely contributed to the recent spike in D-Wave Quantum's stock price. Pinpointing the exact cause requires examining recent company announcements and broader market trends affecting the quantum computing sector. The increase isn't solely attributable to one event; rather, it's likely a confluence of positive developments.

- Strategic Partnerships: D-Wave has been actively forging alliances with major players in various industries. New partnerships, especially those with large enterprises, can significantly boost investor confidence and signal a growing demand for D-Wave's quantum annealing technology. These collaborations often lead to increased revenue streams and further technological advancements.

- Product Launches and Technological Breakthroughs: Any announcements regarding new product releases or significant improvements in D-Wave's quantum annealing systems would undoubtedly generate positive market sentiment. Improvements in processing speed, scalability, or the development of new applications could all drive stock prices higher.

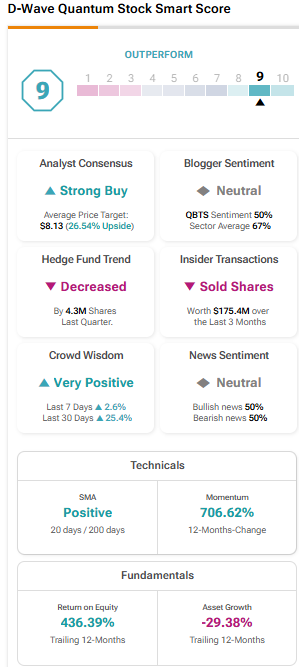

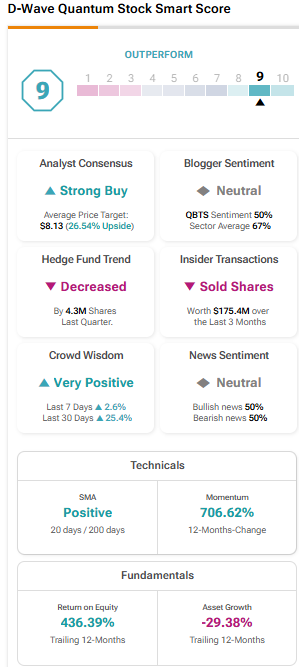

- Positive Analyst Reports and Ratings Upgrades: Favorable analyst reports and upward revisions of ratings by financial institutions can significantly impact investor perception and fuel stock price increases. These reports often provide detailed analysis and forecasts, which can influence investment decisions.

- Securing Significant Contracts: Landing large-scale contracts with prominent clients in sectors such as finance, logistics, or materials science is a strong indicator of market acceptance and future revenue growth for D-Wave Quantum. These contracts serve as tangible proof of the technology's value proposition.

- Positive Industry Trends: The overall growth and interest in the quantum computing sector can create a ripple effect, boosting the stock prices of companies like D-Wave Quantum. Increased venture capital funding, government initiatives, and media coverage contribute to a more optimistic outlook for the entire industry.

Understanding D-Wave Quantum's Business Model and Technology

D-Wave Quantum specializes in quantum annealing, a specific approach to quantum computing distinct from gate-based models. Understanding this technology is crucial for assessing the company's potential.

- Quantum Annealing Explained: Unlike gate-based quantum computers that perform computations sequentially, quantum annealing leverages the principles of quantum mechanics to find the lowest energy state of a system, effectively solving optimization problems. This approach is particularly well-suited for specific types of complex problems.

- Target Markets: D-Wave's technology finds applications in various sectors, including logistics (optimization of supply chains), finance (portfolio optimization, risk management), and materials science (drug discovery, materials design). The breadth of potential applications contributes to the company's growth potential.

- Competitive Advantages and Disadvantages: D-Wave's advantage lies in its established infrastructure and experience in building and deploying quantum annealing systems. However, quantum annealing is not a universal solution, and its applicability is limited compared to the potential of more general-purpose gate-based quantum computers.

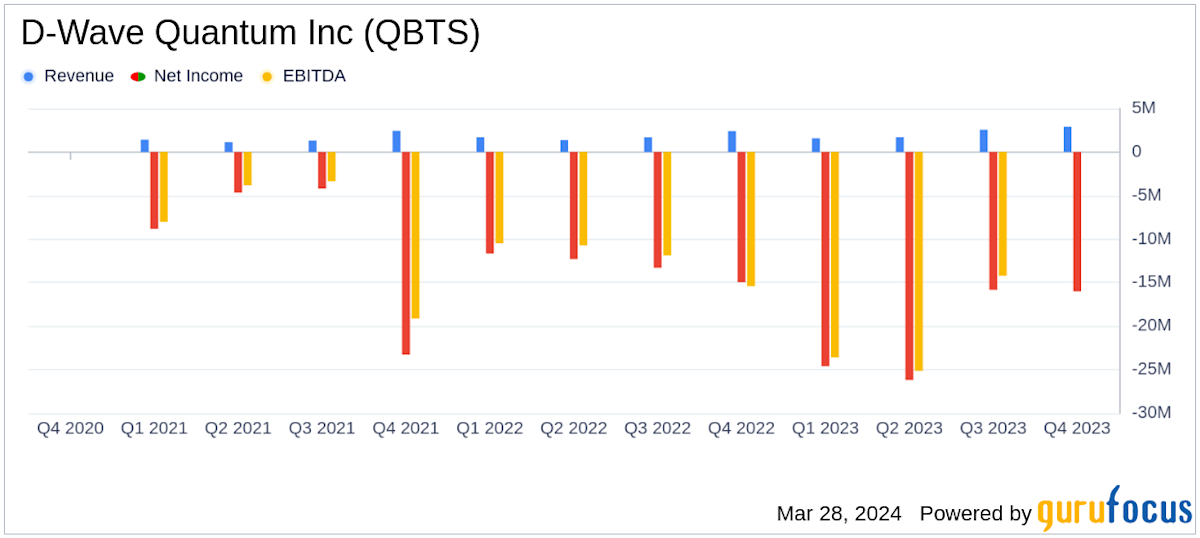

- Revenue Streams and Growth Potential: D-Wave generates revenue through the sale of its quantum computers and cloud access to its systems. The company's growth potential hinges on the continued adoption of its technology across various industries and the development of new applications.

Market Sentiment and Investor Confidence in QBTS

The overall market sentiment towards quantum computing stocks, and specifically QBTS, plays a significant role in its price fluctuations.

- Investor Interest in Quantum Computing: The quantum computing sector is attracting considerable investor interest, fueled by the potential for disruptive technological advancements. This general enthusiasm can benefit companies like D-Wave, even if their specific technology isn't universally applicable.

- Risk Assessment: Investing in QBTS, like any investment in a relatively young technology company, involves significant risk. The technology is still developing, and the company's financial performance is subject to market forces and technological advancements.

- Trading Volume and Price Fluctuations: Closely monitoring trading volumes and price movements can help gauge market sentiment and potential speculative activities. Sharp increases in volume coupled with price spikes might suggest a speculative bubble, while stable growth could indicate sustainable investor interest.

- Analyst Recommendations: Changes in analyst recommendations and price targets are strong indicators of market sentiment and should be carefully considered when analyzing stock price movements.

Analyzing the Long-Term Potential of D-Wave Quantum

Assessing D-Wave's long-term viability requires a balanced perspective considering both opportunities and challenges.

- Technological Challenges: D-Wave faces challenges in scaling its technology and demonstrating its superiority over alternative quantum computing approaches. Maintaining a competitive edge in a rapidly evolving field is crucial for long-term success.

- Future Technological Advancements: D-Wave's future growth depends on its ability to continue innovating and improving its quantum annealing systems. Breakthroughs in qubit performance, system scalability, and error correction are essential for long-term market competitiveness.

- Market Size and Adoption: The overall market size for quantum computing solutions is still developing, but its potential is vast. D-Wave's success hinges on its ability to capture a significant market share as the technology matures.

- Competition: The quantum computing landscape is becoming increasingly competitive, with multiple companies pursuing different approaches to quantum computing. D-Wave needs to maintain its technological leadership and market position to ensure long-term viability.

Conclusion

The recent surge in D-Wave Quantum (QBTS) stock price is likely a result of multiple factors: positive news regarding partnerships and technological advancements, improving market sentiment toward quantum computing, and potentially speculative trading. While the long-term outlook for D-Wave Quantum is promising given the potential of quantum annealing, investors should proceed with caution, understanding the inherent risks associated with investing in emerging technologies. Conduct thorough research before making any investment decisions. Stay informed on the latest developments in D-Wave Quantum (QBTS) and the broader quantum computing sector to make informed investment decisions. Continue to monitor the D-Wave Quantum (QBTS) stock price and news to better understand the factors impacting its valuation. Learn more about D-Wave Quantum (QBTS) and the exciting world of quantum computing.

Featured Posts

-

Analyzing The D Wave Quantum Qbts Stock Market Rally

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Market Rally

May 20, 2025 -

Druga Vagitnist Dzhennifer Lourens Pidtverdzhennya Vid Predstavnikiv Aktrisi

May 20, 2025

Druga Vagitnist Dzhennifer Lourens Pidtverdzhennya Vid Predstavnikiv Aktrisi

May 20, 2025 -

Big Bear Ai Stock A Comprehensive Investment Analysis

May 20, 2025

Big Bear Ai Stock A Comprehensive Investment Analysis

May 20, 2025 -

Highfield Rugby Club Appoints James Cronin As Head Coach

May 20, 2025

Highfield Rugby Club Appoints James Cronin As Head Coach

May 20, 2025 -

Chinas Space Supercomputer Engineering And Deployment

May 20, 2025

Chinas Space Supercomputer Engineering And Deployment

May 20, 2025