Why Did Investors Abandon Leveraged Semiconductor ETFs Before The Surge?

Table of Contents

The Volatility Factor: Why the Risk Was Too High

Leveraged ETFs, by their very nature, amplify both gains and losses. This inherent volatility is particularly pronounced in sectors like semiconductors, known for their cyclical nature and susceptibility to market swings. The semiconductor industry is heavily influenced by global economic conditions, technological advancements, and geopolitical events – all factors that contribute to significant price fluctuations.

- Daily resetting of leverage: Leveraged ETFs reset their leverage daily, meaning that even small daily losses can compound significantly over time. This daily compounding magnifies losses, resulting in a greater decline than a simple proportional decrease in the underlying asset.

- Semiconductor industry sensitivity: The semiconductor industry is particularly sensitive to market downturns. Geopolitical tensions, trade wars, and supply chain disruptions can all severely impact semiconductor stock prices, leading to substantial losses in leveraged ETFs tracking these assets.

- Increased risk of substantial losses: During market corrections or periods of uncertainty, investors in leveraged semiconductor ETFs face a heightened risk of substantial capital losses. The amplified effect of negative market movements can lead to significant drawdowns, quickly eroding invested capital.

For example, the market downturn in early 2022 saw a significant decline in semiconductor stocks. Investors holding leveraged semiconductor ETFs during this period experienced amplified losses, significantly exceeding the losses seen in the underlying semiconductor index. This volatility scared away many risk-averse investors.

The Decay of Returns in Leveraged ETFs: Time's Impact

Another critical factor contributing to the investor exodus is the concept of "decay" in leveraged ETFs. This refers to the erosion of returns over time, even in relatively stable or slightly upward-trending markets.

- Daily compounding of returns: The daily compounding of returns inherent in leveraged ETFs works against investors over longer periods. Even small daily losses, compounded daily, can lead to significant overall losses, especially in sideways or slightly declining markets.

- Hypothetical Example: Imagine a leveraged ETF aiming for 2x daily returns. If the underlying index declines by 1% one day and rises by 1% the next, the leveraged ETF will show a net loss, highlighting the effect of daily compounding. Over several weeks or months, these small daily losses can compound into a substantial overall loss.

- Time Horizon Importance: Understanding the time horizon is crucial when investing in leveraged products. These ETFs are generally designed for short-term trading strategies, and long-term holding can result in substantial decay, negating any potential gains.

Prolonged periods of sideways trading, common in the semiconductor industry, can significantly impact leveraged semiconductor ETF performance, leading to a gradual erosion of investor capital even without major market downturns. This decay effect is a major factor in why many investors chose to exit their positions before the recent surge.

Alternative Investment Opportunities: Where the Money Went

The attractiveness of leveraged semiconductor ETFs diminished as investors considered alternative options.

- Traditional semiconductor stocks: Many investors opted for traditional semiconductor stocks, offering better diversification and less leverage. This approach allowed them to participate in the semiconductor sector's growth without the amplified risk.

- Broader market ETFs: Investors sought safety in broader market ETFs, reducing their exposure to the specific volatility of the semiconductor sector. These ETFs provide diversification across multiple sectors, minimizing risk during periods of market uncertainty.

- Alternative asset classes: Some investors shifted their investments to alternative asset classes such as bonds or real estate, considered safer havens during periods of market volatility. These options offered more stability and less risk compared to leveraged semiconductor ETFs.

The Impact of Negative News and Market Sentiment

Negative news cycles and overall market sentiment significantly impacted investor decisions.

- Trade wars and supply chain disruptions: Trade wars and supply chain disruptions created uncertainty and negatively impacted investor confidence in the semiconductor sector. This fear led to a sell-off in leveraged ETFs as investors sought to minimize their exposure to potential losses.

- Negative analyst reports and media coverage: Negative analyst reports and negative media coverage further fueled the pessimism surrounding the sector, pushing investors away from leveraged investments.

- General market pessimism: The overall market sentiment preceding the recent semiconductor surge was quite pessimistic. This general negativity contributed to the decline in demand for riskier assets such as leveraged semiconductor ETFs.

These factors combined to create a negative outlook on leveraged investments in the semiconductor sector, further contributing to the investor exodus before the recent price surge.

Conclusion

The abandonment of leveraged semiconductor ETFs before the recent surge was driven by a confluence of factors: the inherent volatility of leveraged products, the decay of returns over time, the availability of alternative investment options, and negative market sentiment fueled by news cycles and general pessimism. Investors need to carefully assess the risks associated with leveraged ETFs, especially in volatile sectors like semiconductors. While the recent gains in semiconductor stocks may be tempting, understanding leverage, volatility, and decay is crucial before investing in leveraged semiconductor ETFs. Thoroughly research and understand the implications before making any investment decisions involving leveraged semiconductor ETFs.

Featured Posts

-

Leonardo Di Caprio 30 Eve Bucsut Intett A Heroinnak

May 13, 2025

Leonardo Di Caprio 30 Eve Bucsut Intett A Heroinnak

May 13, 2025 -

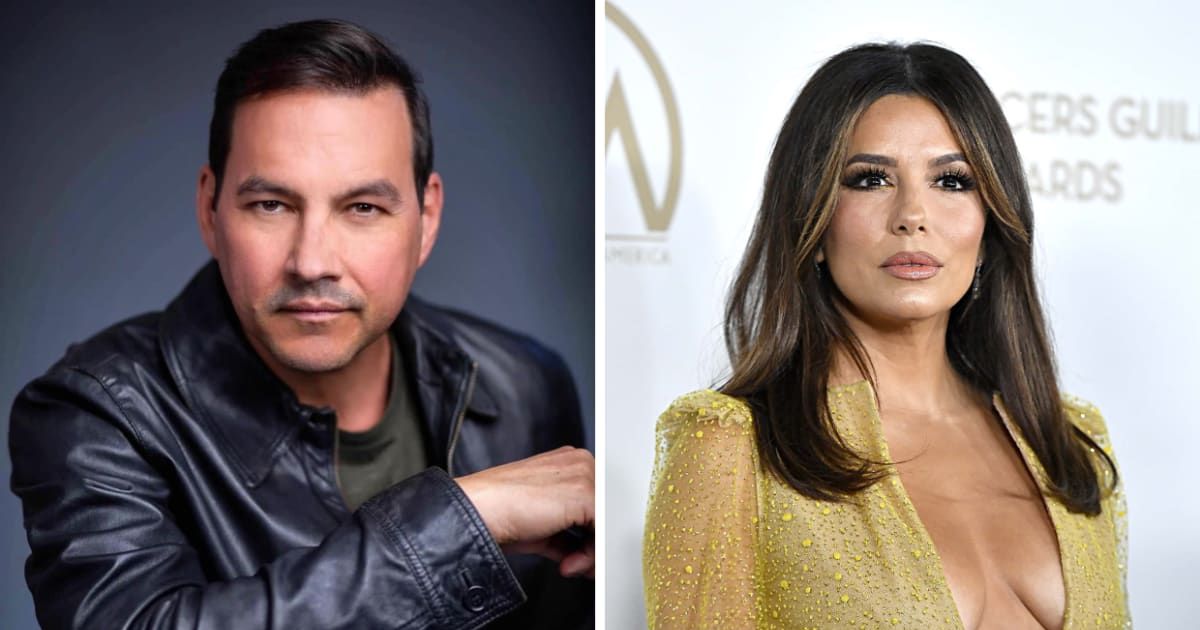

Eva Longorias Travel Adventures Release Date And Trailer Unveiled

May 13, 2025

Eva Longorias Travel Adventures Release Date And Trailer Unveiled

May 13, 2025 -

Season 2 Of Landman First Look At Ali Larter On Set

May 13, 2025

Season 2 Of Landman First Look At Ali Larter On Set

May 13, 2025 -

Watch The Texas Rangers Vs Boston Red Sox Game Online Free

May 13, 2025

Watch The Texas Rangers Vs Boston Red Sox Game Online Free

May 13, 2025 -

Ncaa Tournament Oregon Ducks Lose To Duke

May 13, 2025

Ncaa Tournament Oregon Ducks Lose To Duke

May 13, 2025