Why Investors Shouldn't Be Alarmed By Elevated Stock Market Valuations: A BofA Analysis

Table of Contents

BofA's Key Arguments Against Immediate Concern

BofA's analysis points to several factors that justify, at least partially, the current elevated stock prices. These factors suggest that a cautious, rather than panicked, approach is warranted.

Strong Corporate Earnings Growth

Robust corporate earnings are a significant pillar supporting current valuations. While price-to-earnings ratios might appear high historically, they're being fueled by impressive profit growth across various sectors.

- Examples of strong earnings growth: The technology sector, particularly companies involved in cloud computing and artificial intelligence, have shown phenomenal earnings growth. Similarly, the healthcare sector, driven by advancements in pharmaceuticals and medical technology, continues to deliver strong results.

- Projected future earnings: Analysts predict continued earnings growth in many sectors, particularly those benefiting from technological advancements and evolving consumer behavior. This sustained growth outlook helps justify higher valuation multiples.

- Relationship between earnings growth and valuation multiples: High earnings growth typically leads to higher valuation multiples. While seemingly counterintuitive, this reflects investor confidence in future profitability and the potential for increased returns. Strong earnings are a key driver of investor sentiment and support higher stock prices. Consequently, strong earnings growth counteracts concerns about high valuations.

Keywords: Strong earnings, earnings growth, profit margins, revenue growth, corporate profitability

Low Interest Rates and Abundant Liquidity

The current low interest rate environment and abundant liquidity play a crucial role in elevated stock valuations. This monetary policy has significant implications for the stock market.

- Inverse relationship between interest rates and stock valuations: Low interest rates make borrowing cheaper for companies, allowing for increased investment and expansion. Simultaneously, low bond yields make stocks relatively more attractive to investors seeking higher returns.

- Role of quantitative easing: Central banks' quantitative easing programs have injected significant liquidity into the financial system, further boosting stock prices. This increased liquidity has driven up demand for assets, including stocks.

- Impact of low interest rates on borrowing costs: Lower borrowing costs reduce the cost of capital for companies, contributing to increased profitability and higher stock valuations. This makes expansion more feasible and profitable.

Keywords: Low interest rates, monetary policy, quantitative easing, liquidity, bond yields, discount rates

Technological Innovation and Long-Term Growth Potential

Technological innovation is a major driver of long-term growth, and the potential for disruptive technologies justifies higher valuations for many companies.

- Examples of innovative sectors and companies: The electric vehicle industry, renewable energy, and biotechnology represent sectors experiencing rapid technological advancements, leading to substantial future growth prospects. Many innovative companies within these sectors command premium valuations reflective of their expected growth trajectories.

- Potential for disruptive technologies: The potential for new technologies to disrupt existing industries creates significant long-term growth opportunities. Investors are willing to pay higher prices for companies positioned to benefit from this technological disruption.

- Long-term growth potential of the economy: The overall long-term growth potential of the global economy contributes to higher valuations. This signifies confidence that the underlying economy will support increased corporate earnings and stock prices over the long term.

Keywords: Technological innovation, disruptive technology, growth stocks, future growth, long-term investment strategy

Addressing Common Investor Concerns about High Valuations

While BofA's analysis offers a reassuring perspective, it's crucial to address common investor anxieties.

The Risk of a Market Correction

Market corrections are a normal part of the market cycle. While a correction is possible, current valuations don't automatically predict an imminent crash.

- Historical examples of market corrections: History is replete with examples of market corrections followed by periods of significant growth. Corrections are a natural process of risk adjustment within the market, not necessarily an indication of a systemic failure.

- Factors that could trigger a correction: Unexpected economic downturns, geopolitical events, or shifts in monetary policy could trigger a correction. However, these are unpredictable occurrences.

- How investors can mitigate risk: Diversification, prudent risk management strategies, and a long-term investment horizon can significantly mitigate the risk associated with market corrections. Holding a diversified portfolio helps to reduce the impact of any single event on your portfolio.

Keywords: Market correction, market volatility, risk management, investment risk, diversification

Identifying Overvalued vs. Fairly Valued Stocks

Not all stocks are created equal. Some may be overvalued, while others are fairly valued given their fundamentals.

- Different valuation metrics: Investors should utilize various valuation metrics, such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Price-to-Book (P/B) ratio, to assess individual stocks. These ratios help in comparing a stock's value to others in its industry and to its historical value.

- Fundamental analysis: Thorough fundamental analysis, which focuses on a company's financial health and future prospects, is crucial for identifying overvalued and undervalued stocks. This allows for a deeper understanding of the company's performance relative to its valuations.

- Qualitative factors to consider: Beyond quantitative measures, qualitative factors such as management quality, competitive landscape, and innovation potential should also be considered. A comprehensive evaluation will provide a clearer understanding of potential risk and rewards.

Keywords: Stock valuation, overvalued stocks, undervalued stocks, fundamental analysis, stock screening, valuation metrics

Conclusion

BofA's analysis highlights that while stock market valuations appear high, several factors, including strong earnings growth, low interest rates, and technological innovation, justify them to a significant extent. Focusing on long-term growth potential and employing a diversified investment strategy is crucial. Don't let elevated stock market valuations deter you from a well-informed investment strategy. Before making any hasty decisions, carefully consider BofA's perspective and conduct thorough research into individual companies and sectors to determine their fair value and long-term prospects. Seeking professional investment advice is always recommended, especially during periods of market uncertainty.

Featured Posts

-

Support The Lexington Family Biker Charity Rides Following House Explosion

May 07, 2025

Support The Lexington Family Biker Charity Rides Following House Explosion

May 07, 2025 -

Golden State Warriors Pursuit Of Kevon Looney Nba Free Agency Update

May 07, 2025

Golden State Warriors Pursuit Of Kevon Looney Nba Free Agency Update

May 07, 2025 -

Tigers Dominant 9 6 Win Against Mariners Marks Season Opener

May 07, 2025

Tigers Dominant 9 6 Win Against Mariners Marks Season Opener

May 07, 2025 -

Las Vegas Aces Center Megan Gustafsons Leg Injury Out Indefinitely

May 07, 2025

Las Vegas Aces Center Megan Gustafsons Leg Injury Out Indefinitely

May 07, 2025 -

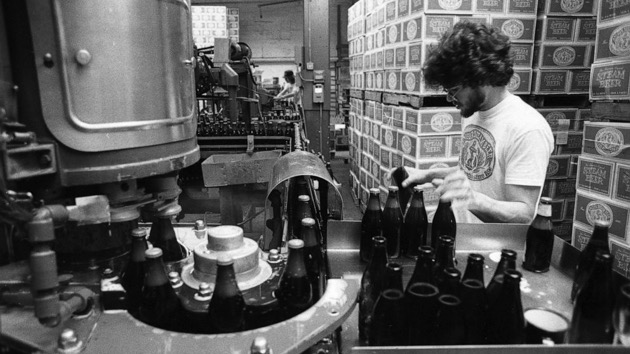

127 Years Of Brewing History Anchor Brewing Companys Closure Announced

May 07, 2025

127 Years Of Brewing History Anchor Brewing Companys Closure Announced

May 07, 2025