Why Investors Shouldn't Fear High Stock Market Valuations: A BofA Perspective

Table of Contents

BofA's View on Current Market Conditions

Bank of America's recent market analysis paints a picture more complex than a simple "high valuation = impending crash" narrative. While acknowledging the elevated levels of certain valuation metrics, BofA's perspective incorporates a broader context, considering factors often overlooked in simplistic analyses.

-

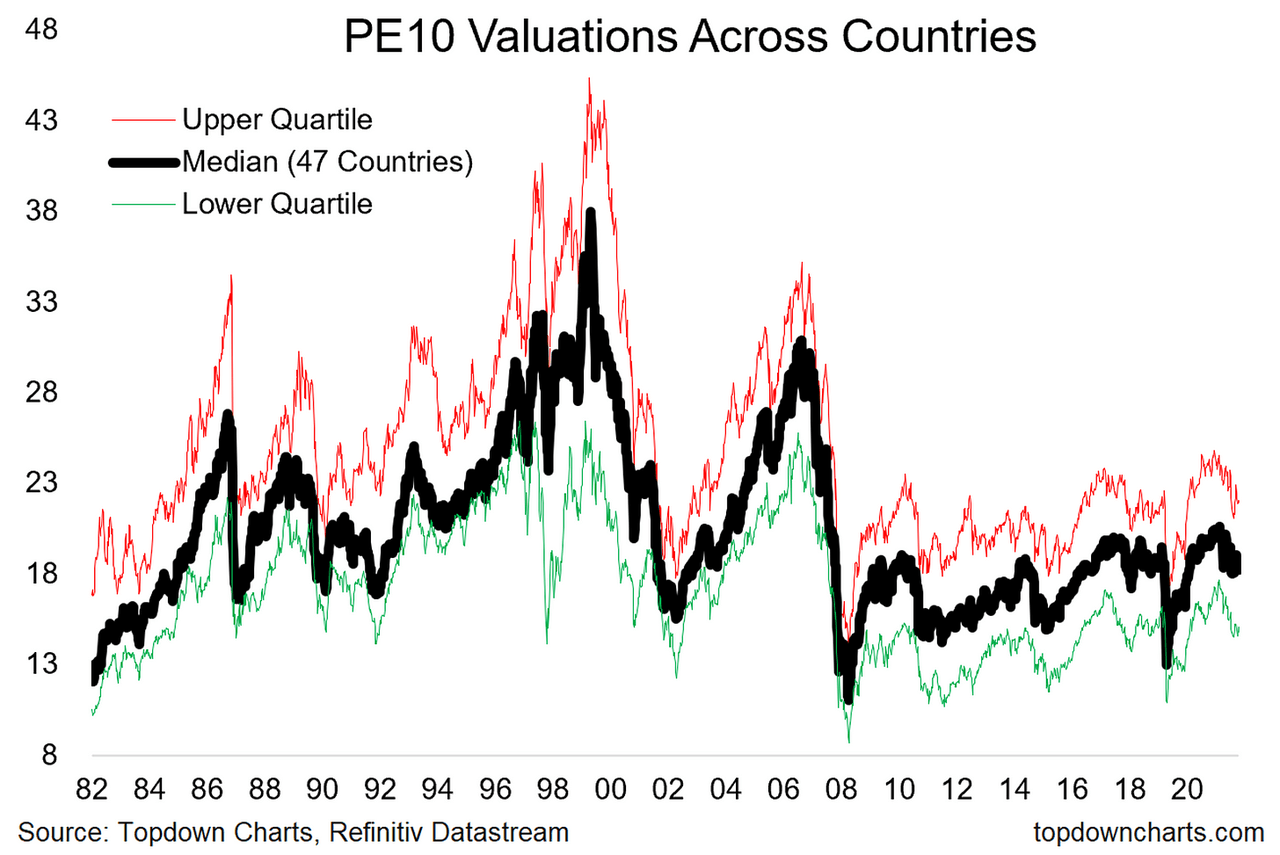

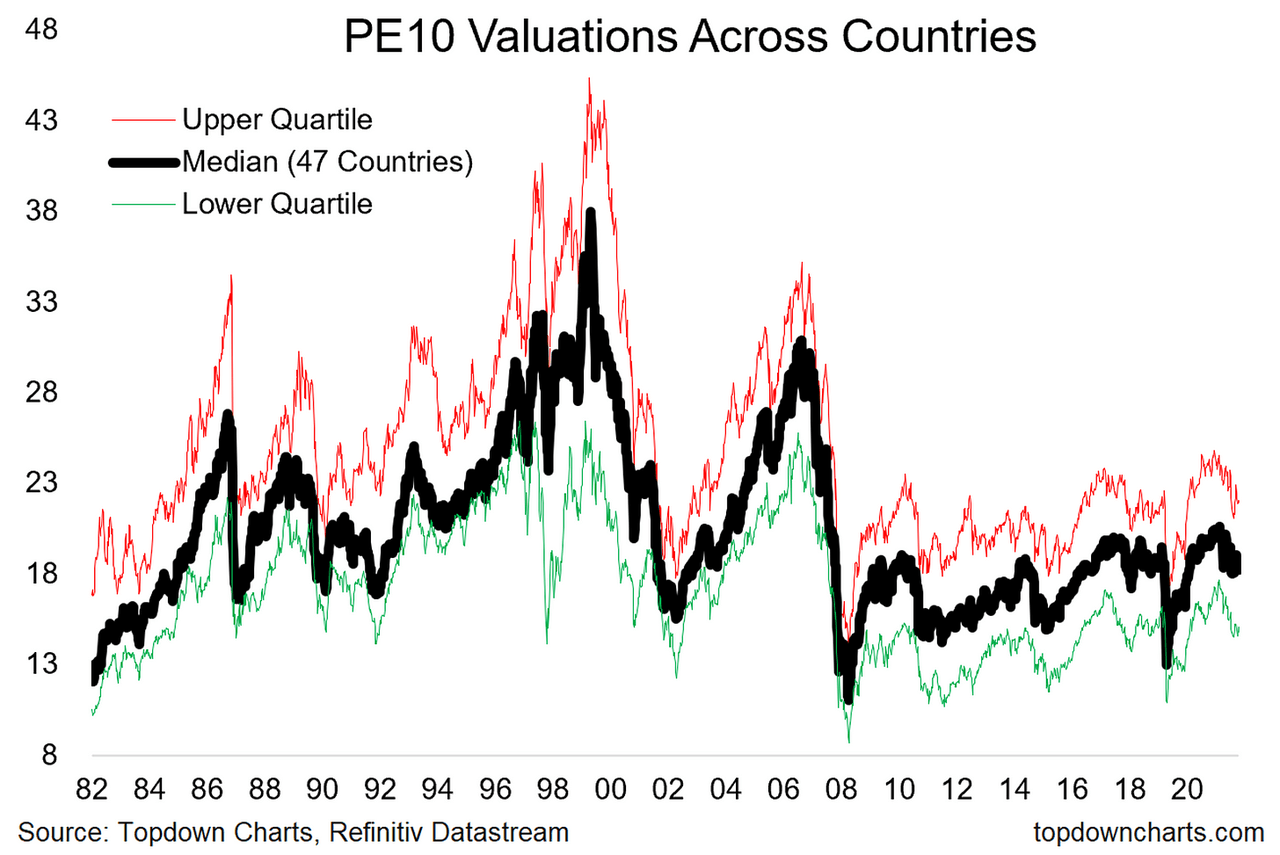

Valuation Metrics: BofA utilizes a range of metrics to assess market valuation, including the price-to-earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking measures. These aren't viewed in isolation but compared against historical data, considering the prevailing economic climate and expected future growth.

-

Historical Context: BofA's analysts compare current P/E ratios to their historical averages, acknowledging periods of similarly elevated valuations in the past. They emphasize that while high, current valuations aren't unprecedented and haven't automatically translated into immediate market collapses in the past. This historical perspective is crucial in tempering excessive fear.

-

Justification for Current Valuations: BofA's reasoning often centers on the expectation of continued corporate earnings growth, fueled by technological advancements and global economic expansion. They may also point to low interest rates, which can support higher valuations by reducing the discount rate applied to future cash flows.

Factors Beyond Traditional Valuation Metrics

Traditional valuation metrics, while important, offer an incomplete picture. Several crucial factors often overlooked contribute to the current market landscape and justify, to some extent, the higher valuations.

-

Low Interest Rates: Persistently low interest rates globally impact valuations significantly. Lower borrowing costs enable companies to finance expansion, increasing future earnings potential and supporting higher stock prices. Investors also seek higher returns in a low-yield environment, driving demand for equities.

-

Technological Innovation: The relentless pace of technological innovation fuels significant growth opportunities. Disruptive technologies create entirely new markets and redefine existing ones, boosting the profitability and potential of many companies, which in turn justifies higher valuations compared to traditional industries.

-

Global Economic Growth: The contributions of emerging markets to global economic growth are substantial. These markets present significant investment opportunities and contribute to sustained corporate earnings growth, which supports higher market valuations.

-

Inflationary Pressures: While inflation can erode corporate profits and reduce valuations, moderate inflation can also reflect a healthy economy. BofA's analysis would weigh the impact of inflation on specific sectors and individual companies. It's important to understand how inflation influences both the numerator (earnings) and denominator (discount rate) in valuation calculations.

Long-Term Investment Strategies in a High-Valuation Environment

Navigating a high-valuation environment requires a long-term perspective and a strategic approach. Panicking and selling off assets is rarely the optimal response. Instead, consider these strategies:

-

Diversification: Spread your investments across various asset classes (stocks, bonds, real estate, etc.) to reduce risk. This diversification mitigates the impact of any single asset class underperforming.

-

Focus on Quality: Prioritize companies with strong fundamentals – robust balance sheets, consistent earnings growth, and a competitive moat. These high-quality companies are better positioned to withstand market volatility.

-

Value Investing: Actively seek undervalued opportunities. Value investing involves identifying companies whose stock prices don't fully reflect their intrinsic worth, offering potentially higher returns.

-

Dollar-Cost Averaging: Invest a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy reduces the impact of buying high and helps average your purchase price over time.

Addressing Common Investor Concerns About High Stock Market Valuations

Addressing investor anxieties is crucial. Many fears surrounding high stock market valuations are based on misunderstandings.

-

High Valuations Don't Always Precede Crashes: While high valuations can be a risk factor, they don't automatically predict an imminent market crash. History shows periods of high valuations followed by sustained growth, albeit with periods of correction.

-

Individual vs. Broad Market Overvaluation: It's essential to distinguish between individual overvalued stocks and a broadly overvalued market. Careful analysis and diversification can mitigate the risk associated with individual stock overvaluation.

-

Past Examples: Examining historical periods with high valuations that didn't immediately result in major crashes provides valuable perspective. Analyzing what differentiated those periods from the current situation is crucial.

-

Risk Tolerance: Understanding your own risk tolerance is paramount. Investors with a longer time horizon can tolerate higher market volatility and are better positioned to benefit from long-term growth, even during periods of high valuations.

Conclusion

BofA's perspective on the current high stock market valuations suggests that fear shouldn't dictate investment decisions. While acknowledging the elevated valuation metrics, BofA's analysis incorporates a broader context, emphasizing factors like low interest rates, technological innovation, and global economic growth. By adopting long-term investment strategies, diversifying your portfolio, and focusing on quality companies, investors can navigate this environment effectively.

Don't let fear of high stock market valuations paralyze your investment decisions. Take a balanced approach, informed by BofA's insights and develop a robust, long-term investment strategy that accounts for current market conditions. Learn more about managing your portfolio in a high-valuation environment by [link to relevant BofA resources or further reading]. Consult a financial advisor to discuss your individual investment strategy and risk tolerance concerning high stock market valuations.

Featured Posts

-

Mississippi Deltas Immense Scale A Cinematographers Perspective From Sinners

Apr 26, 2025

Mississippi Deltas Immense Scale A Cinematographers Perspective From Sinners

Apr 26, 2025 -

The Rise Of Disaster Betting Analyzing The Los Angeles Wildfire Example

Apr 26, 2025

The Rise Of Disaster Betting Analyzing The Los Angeles Wildfire Example

Apr 26, 2025 -

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 26, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 26, 2025 -

Trumps First 100 Days A Rural Schools 2700 Mile Perspective

Apr 26, 2025

Trumps First 100 Days A Rural Schools 2700 Mile Perspective

Apr 26, 2025 -

A Conservative Professors Prescription For Harvards Revitalization

Apr 26, 2025

A Conservative Professors Prescription For Harvards Revitalization

Apr 26, 2025