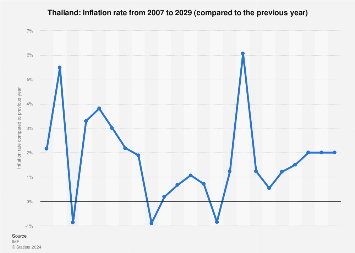

Will Negative Inflation In Thailand Lead To More Rate Cuts?

Table of Contents

Understanding Negative Inflation in Thailand

Negative inflation, also known as deflation, occurs when the general price level of goods and services in an economy decreases. For Thailand, this presents a significant challenge. Deflation can stifle economic growth as consumers delay purchases anticipating further price drops, leading to decreased consumer spending and a potential downward spiral. Several factors could contribute to deflationary pressures in Thailand: weakened consumer demand following the pandemic, falling global commodity prices, and a relatively strong Thai Baht.

Recent data from the BOT reveals a concerning trend. While official figures require careful scrutiny, anecdotal evidence and certain economic indicators suggest that deflationary pressures are mounting.

- Falling consumer prices: Prices for various goods, particularly electronics and certain imported items, have been declining.

- Decreased consumer spending: Consumer confidence remains subdued, contributing to lower overall spending.

- Potential impact on business investment: Businesses might postpone investment plans due to uncertainty and reduced demand.

- Impact on debt repayment: While lower prices benefit consumers, deflation increases the real value of debt, making it harder for borrowers to repay loans.

The Bank of Thailand's Response to Deflationary Pressures

The Bank of Thailand (BOT) has a mandate to maintain price stability and support sustainable economic growth. Historically, the BOT has responded to economic downturns and inflation fluctuations with a combination of monetary policy tools, including interest rate adjustments. Given the current negative inflation scenario, the likelihood of further interest rate cuts is a key focus for economists and market analysts.

- Analysis of current interest rates: Currently, interest rates in Thailand are [insert current interest rate data here].

- Historical data on BOT rate cuts: [Insert historical data on BOT interest rate cuts and their effectiveness].

- Potential economic effects of further rate cuts: Lower interest rates could stimulate borrowing and investment, potentially boosting economic activity.

- Risks associated with further easing: Aggressive rate cuts could weaken the Thai Baht, potentially leading to imported inflation and impacting Thailand's competitiveness in the global market.

Economic Implications of Further Rate Cuts in Thailand

Further interest rate cuts by the BOT could offer several potential benefits, but also carry inherent risks.

Potential Benefits:

- Stimulating economic growth: Lower borrowing costs could encourage businesses to invest and expand, creating jobs and boosting overall economic activity.

- Boosting investment: Reduced interest rates make borrowing more attractive for businesses and individuals, potentially leading to increased investment in new projects.

- Supporting consumer spending: Lower interest rates can make loans cheaper, potentially encouraging consumers to spend more.

Potential Drawbacks:

- Increased risk of currency depreciation: Lower interest rates can make the Thai Baht less attractive to foreign investors, leading to potential depreciation.

- Potential inflation in the future: While combating deflation is crucial, overly stimulative monetary policy can lead to inflation down the line.

- Other policy options: The BOT might explore alternative measures like quantitative easing or targeted fiscal stimulus alongside interest rate adjustments.

Global Economic Factors Influencing the Decision

Thailand's economy is deeply integrated into the global system, making it vulnerable to external shocks. Global economic conditions significantly influence the BOT's decision-making process regarding interest rates.

- Impact of global recessionary fears: Concerns about a global recession can dampen investor confidence and affect Thailand's exports.

- Influence of US Federal Reserve policy: Decisions by the US Federal Reserve regarding interest rates have a ripple effect on global financial markets and the Thai Baht.

- Regional economic trends: Economic performance in neighboring countries and regional trade dynamics impact Thailand's growth trajectory.

Conclusion

The possibility of negative inflation in Thailand presents a significant challenge, requiring careful consideration by the BOT. While further rate cuts could stimulate the economy, they also pose risks, including currency depreciation and potential future inflation. The BOT's decision will likely be influenced by a complex interplay of domestic and global factors. A balanced approach, considering both the benefits and drawbacks of further easing, is crucial. Staying updated on the latest developments regarding negative inflation and potential rate cuts in Thailand is essential for understanding the evolving economic landscape. Follow our analysis to understand the implications of negative inflation in Thailand and the Bank of Thailand's response. Understanding the nuances of Negative Inflation Thailand Rate Cuts is key to navigating this critical juncture in the Thai economy.

Featured Posts

-

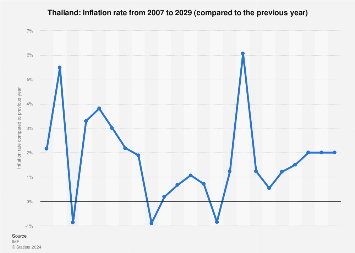

Exploring The Phenomenon Of The Glossy Mirage

May 07, 2025

Exploring The Phenomenon Of The Glossy Mirage

May 07, 2025 -

Talking Heads Ashley Holder Interviews Donovan Mitchell And Poses A Fan Question

May 07, 2025

Talking Heads Ashley Holder Interviews Donovan Mitchell And Poses A Fan Question

May 07, 2025 -

Celebrity Special Behind The Scenes Of Who Wants To Be A Millionaire

May 07, 2025

Celebrity Special Behind The Scenes Of Who Wants To Be A Millionaire

May 07, 2025 -

Edwards Challenges Obama On His Presidential Achievements

May 07, 2025

Edwards Challenges Obama On His Presidential Achievements

May 07, 2025 -

Daily Lotto Results Sunday May 4th 2025

May 07, 2025

Daily Lotto Results Sunday May 4th 2025

May 07, 2025