Will Tariffs Replace Income Taxes? Examining The Economic Realities

Table of Contents

The Current State of Income Taxation

The current income tax system in many developed nations is a complex, multi-tiered structure designed to generate revenue based on an individual's or corporation's earnings. However, this system has several inherent shortcomings. It’s often criticized for its complexity, leading to high administrative costs and the need for specialized tax professionals. Loopholes allow some high-income earners to significantly reduce their tax burden, creating perceptions of unfairness.

- Progressive vs. regressive aspects of income tax: Income taxes are generally progressive, meaning higher earners pay a larger percentage of their income in taxes. However, certain deductions and credits can create regressive elements.

- Tax evasion and its impact on government revenue: Tax evasion, both legal and illegal, significantly reduces government revenue and undermines the fairness of the system. This necessitates costly enforcement measures.

- The administrative burden of income tax collection: The complexity of income tax codes necessitates a large bureaucracy for collection and enforcement, adding to the overall cost of the system.

- Examples of countries with different income tax systems: Different countries employ various income tax structures, ranging from flat taxes to highly progressive systems. Comparing these models highlights the diverse approaches to revenue generation.

Tariffs as a Revenue Source

Tariffs, taxes imposed on imported goods, represent an alternative revenue stream. Historically, tariffs played a major role in government finances. They function by increasing the price of imported goods, making domestically produced goods more competitive. However, the impact extends far beyond simple revenue generation.

- Different types of tariffs (e.g., ad valorem, specific): Ad valorem tariffs are a percentage of the value of the imported good, while specific tariffs are a fixed amount per unit. The choice of tariff type influences its impact on different goods and industries.

- The impact of tariffs on international trade and global competitiveness: High tariffs can restrict international trade, leading to retaliatory measures from other countries and potentially harming global economic growth. They can also protect domestic industries but may lead to higher prices for consumers.

- Examples of countries that heavily rely on tariffs for revenue: While less common in developed nations today, some developing countries still rely significantly on tariffs for government revenue. Studying their experiences offers valuable insights.

- Potential for tariff revenue generation based on import volume: The revenue generated through tariffs directly depends on the volume of imported goods. Fluctuations in global trade can significantly affect the reliability of this revenue source.

The Distributional Effects of Tariff-Based Revenue

A tariff-based revenue system would have significant distributional consequences. While it might seem like a simple solution, the impact on different income groups is complex.

- Impact on consumers through increased prices: Tariffs increase the price of imported goods, directly affecting consumers, especially those with lower incomes who spend a larger percentage of their income on essential goods.

- Impact on domestic industries through protectionism: Tariffs can protect domestic industries from foreign competition, potentially leading to job creation in those sectors. However, it could also stifle innovation and efficiency.

- Impact on low-income households who spend a larger portion of their income on imported goods: The regressive nature of tariffs disproportionately impacts lower-income households because they spend a larger proportion of their income on imported goods, making them more vulnerable to price increases.

- Potential for regressive taxation if tariffs are not carefully designed: If not carefully structured, a tariff-based system could lead to regressive taxation, where lower-income households bear a disproportionately larger tax burden.

Economic Feasibility and Challenges of a Tariff-Only System

Relying solely on tariffs for government revenue presents substantial practical challenges. The inherent volatility and potential for international trade conflicts make it a risky proposition.

- Volatility of tariff revenue due to fluctuating import/export volumes: Global economic conditions, trade agreements, and shifts in consumer demand can cause significant fluctuations in import volumes, making tariff revenue unpredictable.

- The risk of trade wars and retaliatory tariffs: Imposing high tariffs can trigger retaliatory measures from other countries, leading to trade wars that harm both domestic and foreign economies.

- Difficulty in balancing revenue needs with the need to promote international trade: Governments must carefully balance the need for revenue generation with the desire to foster international trade and economic cooperation.

- The need for a robust and transparent system for tariff setting and enforcement: A fair and efficient tariff system requires a clear, transparent process for setting tariffs and robust mechanisms for enforcing compliance.

Alternative Revenue Models and Hybrid Approaches

A complete shift to a tariff-only system is unrealistic. Hybrid approaches combining elements of income tax and tariffs, or exploring alternative revenue streams, are more practical.

- Examples of hybrid systems in other countries: Many countries utilize hybrid tax systems, combining various revenue sources to achieve a balance between efficiency, equity, and economic growth.

- Pros and cons of different hybrid approaches: Different hybrid models have varying strengths and weaknesses. Analyzing these trade-offs is crucial in designing optimal tax systems.

- The role of taxation in achieving social and environmental goals: Taxation can be a powerful tool for achieving social and environmental objectives. Well-designed tax systems can incentivize sustainable practices and reduce social inequalities.

Conclusion

While the prospect of replacing income taxes with tariffs is intriguing, a nuanced understanding of the economic realities is crucial. A tariff-only system faces significant challenges concerning revenue volatility, distributional effects, and the potential for trade conflicts. Hybrid approaches, combining elements of income tax and tariffs or incorporating other revenue sources like carbon or land value taxes, offer a more practical and balanced approach. Continue exploring the complexities of “Will Tariffs Replace Income Taxes?” and participate in the debate surrounding optimal revenue models for a thriving economy.

Featured Posts

-

Papa Francesco E Becciu Analisi Delle Preghiere E Delle Richieste Di Dimissioni

Apr 30, 2025

Papa Francesco E Becciu Analisi Delle Preghiere E Delle Richieste Di Dimissioni

Apr 30, 2025 -

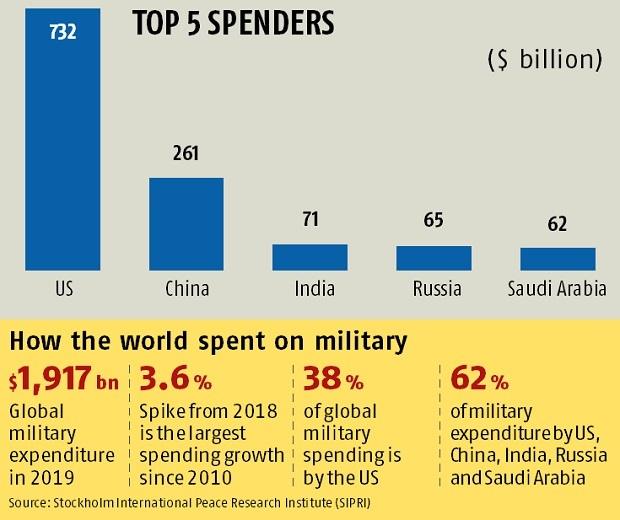

Increased Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025

Increased Global Military Expenditure The Impact Of The Ukraine Conflict

Apr 30, 2025 -

Yankees 5 1 Win Over Guardians Carlos Rodons Masterclass

Apr 30, 2025

Yankees 5 1 Win Over Guardians Carlos Rodons Masterclass

Apr 30, 2025 -

Becciu Proclama La Sua Innocenza Appello Dal 22 Settembre

Apr 30, 2025

Becciu Proclama La Sua Innocenza Appello Dal 22 Settembre

Apr 30, 2025 -

Blue Ivy And Rumi At The Super Bowl Jay Zs Daughters Stylish Appearance And Beyonces Absence

Apr 30, 2025

Blue Ivy And Rumi At The Super Bowl Jay Zs Daughters Stylish Appearance And Beyonces Absence

Apr 30, 2025