Will The Bank Of Canada Cut Rates Again? Tariff-Driven Job Losses Fuel Speculation

Table of Contents

The Current Economic Climate in Canada and the Impact of Tariffs

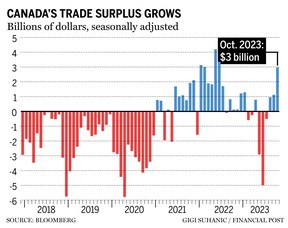

The Canadian economy is currently navigating a complex landscape. While GDP growth remains positive, it has slowed in recent quarters. Inflation rates are hovering near the Bank of Canada's target, but unemployment figures are cause for concern, particularly in sectors heavily impacted by tariffs. The imposition of tariffs has created significant uncertainty, impacting various industries and leading to substantial job losses.

-

Sectors Hit Hardest: The manufacturing and agricultural sectors have been particularly vulnerable. The automotive industry, for example, has experienced significant production slowdowns and layoffs due to trade disputes. Farmers have also faced challenges due to retaliatory tariffs on Canadian exports.

-

Specific Examples of Job Losses: Reports from Statistics Canada indicate a considerable loss of manufacturing jobs in Ontario and Quebec, directly attributable to reduced exports and increased input costs caused by tariffs. Similarly, the agricultural sector has seen farm closures and reduced employment in certain regions.

-

Statistical Data: While precise figures fluctuate, available data from Statistics Canada consistently shows a correlation between the implementation of tariffs and a negative impact on employment numbers, particularly within the aforementioned sectors. This data reinforces the link between tariffs and economic uncertainty, contributing to slower growth.

Bank of Canada's Recent Actions and Policy Statements

The Bank of Canada has maintained a cautious stance in recent months. While they haven't implemented a rate cut recently, their statements have acknowledged the challenges facing the Canadian economy, including the impact of global trade uncertainties and tariff-related job losses in Canada. Their recent policy decisions suggest a willingness to act if the economic situation deteriorates further.

-

Key Statements from the Bank of Canada: The Bank's communications emphasize a close monitoring of economic data and a commitment to maintaining price stability. They've highlighted the need to assess the persistence of economic weakness before taking significant action.

-

Inflation Target Canada: The Bank of Canada maintains an inflation target of 2%, and their recent statements indicate they will closely monitor inflation trends before considering a rate cut. A significant dip in inflation could provide justification for lowering interest rates.

-

Factors Impacting Their Decision-Making Process: The Bank will consider various factors, including GDP growth, inflation, unemployment rates, consumer confidence, and global economic conditions, before determining whether a rate cut is warranted.

Alternative Scenarios and Their Implications

Several scenarios are possible regarding future Bank of Canada interest rates.

-

Scenario 1: Rate Cut Further job losses due to prolonged trade disputes or a significant economic slowdown could prompt the Bank to cut interest rates to stimulate the economy and prevent a deeper recession. This would likely lower borrowing costs, potentially boosting consumer spending and investment.

-

Scenario 2: Rates Remain Unchanged If the economy shows signs of recovery, perhaps through diversification of export markets or a resolution of trade tensions, and inflation rises towards the target, the Bank might choose to maintain interest rates to prevent inflationary pressures.

-

Potential Impacts: A rate cut would likely lower borrowing costs for businesses and consumers, potentially stimulating investment and consumer spending, but could also fuel inflation if not carefully managed. Maintaining current rates could slow economic growth but help maintain price stability.

Expert Opinions and Market Predictions

Economists and financial experts hold varying opinions regarding the likelihood of a Bank of Canada rate cut. Some believe a cut is imminent given the current economic climate and the negative impact of tariffs on employment, while others believe the Bank will wait to see clearer signs of a sustained economic slowdown before acting. Market predictions reflect this uncertainty, with some forecasts suggesting a rate cut within the next few months, while others predict no change.

-

Quotes from Experts: [Insert quotes from relevant economists and financial analysts here, citing their sources.]

-

Market Forecasts: [Insert summaries of market forecasts and predictions from reputable financial institutions here.]

-

Analysis of Potential Biases: It's crucial to acknowledge potential biases in these predictions. For example, certain analysts might have industry-specific concerns that influence their outlook, or political considerations could impact their forecasts.

Conclusion: The Future of Interest Rates in Canada and What to Expect

The decision regarding a potential Bank of Canada rate cut remains complex. The significant impact of tariff-driven job losses undeniably plays a critical role in the Bank's deliberations. While a rate cut could boost the economy, it carries the risk of increased inflation. The Bank of Canada will need to carefully weigh these risks and consider various economic indicators before making a decision. The likelihood of a rate cut remains uncertain, dependent on the evolving economic landscape.

To stay informed, monitor the Bank of Canada's announcements and keep an eye on key economic indicators like GDP growth, inflation, and unemployment figures. Understanding these factors will provide a clearer picture of the future direction of interest rates in Canada and their impact on your personal finances and the broader Canadian economy. Stay tuned for updates on Bank of Canada interest rate decisions and their impact on the Canadian economy.

Featured Posts

-

Three Years After Retirement Bradley Wiggins Fight Against Addiction And Financial Crisis

May 12, 2025

Three Years After Retirement Bradley Wiggins Fight Against Addiction And Financial Crisis

May 12, 2025 -

Nba Award Race Boston Celtics Guard Opts Out Of Campaigning

May 12, 2025

Nba Award Race Boston Celtics Guard Opts Out Of Campaigning

May 12, 2025 -

The Next Chapter Former Singapore Airlines Stewardesss Journey

May 12, 2025

The Next Chapter Former Singapore Airlines Stewardesss Journey

May 12, 2025 -

Who Is Debbie Elliott A Detailed Profile

May 12, 2025

Who Is Debbie Elliott A Detailed Profile

May 12, 2025 -

John Wicks True Form Appearances Across The Film Series

May 12, 2025

John Wicks True Form Appearances Across The Film Series

May 12, 2025