Will The Bank Of Canada Cut Rates Again? Tariffs And Job Losses Fuel Speculation

Table of Contents

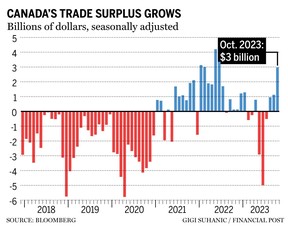

The Impact of Tariffs on the Canadian Economy

Tariffs, often a result of trade wars and protectionist policies, significantly impact the Canadian economy. They act as a tax on imported and exported goods, creating a ripple effect across various sectors. Canadian tariffs, particularly those imposed by major trading partners, disrupt established trade relationships and negatively affect several key industries.

-

Reduced export opportunities: Higher tariffs on Canadian goods make them less competitive in international markets, leading to a decline in exports and impacting businesses reliant on foreign sales. This export decline directly affects GDP growth and employment in export-oriented sectors.

-

Increased input costs for businesses: Many Canadian businesses rely on imported components or raw materials. Tariffs increase the cost of these inputs, leading to higher production costs and potentially squeezing profit margins. This can force businesses to raise prices, potentially fueling inflation.

-

Potential for inflation: Increased input costs, coupled with reduced competition due to trade barriers, can contribute to higher prices for consumers. This inflationary pressure can erode purchasing power and further dampen economic growth.

-

Negative impact on GDP growth: The combined effect of reduced exports, increased costs, and potentially lower consumer spending due to inflation negatively impacts Canada's overall Gross Domestic Product (GDP) growth.

-

Examples of specific industries affected: The Canadian agriculture sector, particularly producers of canola and pork, have faced significant challenges due to tariffs imposed by other countries. Similarly, the manufacturing sector, reliant on global supply chains, has also experienced considerable strain. (Links to relevant news articles would be inserted here). This highlights the broad-ranging consequences of Canadian tariffs on the overall economy. The ongoing trade war has a significant impact.

Rising Job Losses and Unemployment

The Canadian unemployment rate and its trends are crucial indicators of economic health. A rising unemployment rate often signals an economic slowdown, reduced consumer confidence, and decreased spending. This, in turn, puts further downward pressure on economic growth.

-

Sectors experiencing significant job losses: Manufacturing and resource-based sectors, particularly sensitive to global trade conditions, have seen significant job losses in recent periods. The impact of tariffs and reduced exports is clearly felt in these areas.

-

Regional disparities in unemployment: The impact of job losses isn't evenly distributed across Canada. Some regions, more heavily reliant on specific industries affected by tariffs, experience higher unemployment rates than others.

-

Impact of job losses on consumer spending: When people lose their jobs, consumer spending declines, which further dampens economic activity and creates a vicious cycle. This reduced consumer confidence becomes a critical factor in overall economic health.

-

Statistics and data from reliable sources: Data from Statistics Canada will be included here to substantiate the claims made regarding unemployment rates, job losses in specific sectors, and regional disparities.

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's monetary policy, including its interest rate target, is a crucial tool for managing the economy. The central bank considers various factors to determine its course of action.

-

Current interest rate target: [Insert current Bank of Canada interest rate target here].

-

Factors considered by the Bank of Canada: The Bank of Canada carefully considers inflation rates, economic growth projections, and the unemployment rate when setting its monetary policy. Maintaining price stability is a primary mandate.

-

Analysis of the Bank of Canada's recent policy statements: [Links to official Bank of Canada statements and announcements would be inserted here]. These statements offer crucial insight into their current thinking and potential future actions. This analysis would be included here, interpreting the statements and explaining their implications for the possibility of a Bank of Canada interest rate cut.

Arguments for a Bank of Canada Interest Rate Cut

A rate cut could be seen as a necessary measure to stimulate the Canadian economy amidst current challenges.

-

Stimulate economic growth: Lower interest rates can encourage borrowing and investment, leading to increased economic activity. This monetary easing aims to counteract the negative effects of the factors mentioned above.

-

Boost consumer spending and investment: Lower borrowing costs can incentivize consumers to spend more and businesses to invest in expansion, boosting overall demand and creating jobs.

-

Counteract the negative effects of tariffs and job losses: A rate cut could help offset the negative impact of tariffs and job losses by stimulating economic growth and supporting consumer confidence.

Arguments Against a Bank of Canada Interest Rate Cut

However, lowering interest rates also carries risks.

-

Risk of fueling inflation: Lower interest rates can increase borrowing and spending, potentially leading to increased demand and inflationary pressures if the economy is already operating near its capacity.

-

Potential for increased borrowing and debt: Lower interest rates can encourage excessive borrowing by both consumers and businesses, potentially increasing overall debt levels and creating financial vulnerabilities.

-

Concerns about the long-term effectiveness of rate cuts: The effectiveness of interest rate cuts in stimulating economic growth can diminish over time, particularly if other underlying structural issues remain unresolved.

Conclusion

The decision of whether the Bank of Canada will cut rates again is complex and multifaceted. The interplay between rising tariffs, resulting job losses, and the current economic conditions makes the situation challenging to predict. While a rate cut could offer a much-needed economic stimulus, it also carries the risk of increased inflation and unsustainable debt levels. The Bank of Canada must carefully weigh these competing considerations in determining its future course of action regarding a Bank of Canada interest rate cut. Stay informed about the Bank of Canada's upcoming announcements and continue to monitor the evolving economic situation to understand the potential implications of a future Bank of Canada interest rate decision and future interest rate cuts.

Featured Posts

-

Mask Singer 2025 L Autruche Revelee La Surprise De Chantal Ladesou Et La Deception De Laurent Ruquier

May 11, 2025

Mask Singer 2025 L Autruche Revelee La Surprise De Chantal Ladesou Et La Deception De Laurent Ruquier

May 11, 2025 -

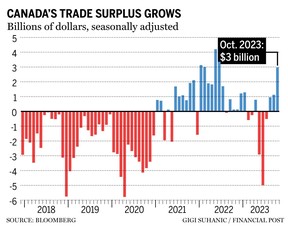

2024 Senior Calendar Trips Activities And Events Or Relevant Year

May 11, 2025

2024 Senior Calendar Trips Activities And Events Or Relevant Year

May 11, 2025 -

The Challenge Season 41 Spoilers Fan Favorite Eliminated Champs Remain

May 11, 2025

The Challenge Season 41 Spoilers Fan Favorite Eliminated Champs Remain

May 11, 2025 -

Declaraciones Del Piloto Argentino De F1 Generan Controversia Es Provincia Nuestra

May 11, 2025

Declaraciones Del Piloto Argentino De F1 Generan Controversia Es Provincia Nuestra

May 11, 2025 -

Thomas Muellers Allianz Arena Farewell 25 Years Of Dedication

May 11, 2025

Thomas Muellers Allianz Arena Farewell 25 Years Of Dedication

May 11, 2025