Will XRP Reach $5? An XRP Price Prediction Analysis Post-SEC Lawsuit.

Table of Contents

The Impact of the SEC Lawsuit on XRP's Price

The SEC lawsuit against Ripple, alleging that XRP is an unregistered security, significantly impacted XRP's price. The initial filing caused a sharp price drop, creating uncertainty and fear among investors. Both sides presented compelling arguments. The SEC highlighted Ripple's sales of XRP, arguing these constituted unregistered securities offerings. Ripple countered that XRP is a decentralized digital asset, not a security, and that its sales were not subject to SEC regulations.

The potential outcomes range from a complete victory for the SEC, potentially severely impacting XRP's value, to a complete dismissal of the case, leading to a potential surge in price. A settlement could also result in a mixed outcome, influencing XRP price prediction in a way that's difficult to predict definitively.

- Price drops immediately following the lawsuit filing: The initial impact was a significant price decline, impacting investor confidence.

- Recovery periods and price fluctuations since the lawsuit: Since the filing, XRP's price has shown periods of recovery and significant volatility, reflecting the ongoing legal battle.

- Impact on investor confidence and trading volume: The lawsuit undeniably affected investor confidence, leading to fluctuating trading volumes.

- Potential for positive price action following a favorable ruling: A positive outcome for Ripple could potentially trigger a substantial price increase, boosting investor confidence and driving demand.

Technical Analysis and Market Sentiment

Analyzing XRP's chart patterns reveals key support and resistance levels that influence price movements. Trading volume and market capitalization are crucial indicators of market strength and potential for future price action. Currently, market sentiment toward XRP is mixed, with opinions varying based on the perceived outcome of the SEC lawsuit and its broader utility within the financial sector.

- Review of historical price performance: Examining XRP's past performance helps identify trends and potential future price movements based on past behaviour.

- Analysis of key technical indicators (e.g., moving averages, RSI): Technical indicators provide signals about potential price reversals, trends, and momentum.

- Discussion of social media sentiment and news coverage: Social media sentiment and news coverage can influence market perception and drive price fluctuations.

- Assessment of institutional investor interest: Growing interest from institutional investors could significantly boost XRP's price.

XRP's Utility and Future Development

XRP's primary utility lies within Ripple's payment solutions, enabling fast and low-cost cross-border transactions for financial institutions. The XRP Ledger, the underlying technology, continues to evolve, enhancing its scalability, security, and overall efficiency. Increased adoption by financial institutions and businesses could fuel substantial price appreciation.

- Ongoing improvements to XRP Ledger technology and scalability: Continuous improvements contribute to greater efficiency and broader applicability.

- Expansion of partnerships and integrations with financial institutions: Strategic partnerships expand XRP's reach and utility, driving adoption.

- Potential for increased demand from businesses and consumers: Growing consumer adoption adds to the overall network effect and drives demand.

- The impact of CBDCs and XRP's role in cross-border payments: The rise of Central Bank Digital Currencies (CBDCs) might create opportunities for XRP in facilitating cross-border transactions.

Factors Affecting the $5 XRP Price Target

Reaching a $5 XRP price requires specific market conditions. This includes a substantial increase in market capitalization, widespread adoption, and positive market sentiment. However, unforeseen events, such as regulatory changes or broader market downturns, could significantly impact XRP's price. Reaching this target within a reasonable timeframe depends on several interacting factors.

- Required market capitalization for a $5 XRP price: Calculating the necessary market capitalization provides perspective on the scale of adoption needed.

- Potential for widespread adoption and increased demand: Mass adoption is crucial for driving price appreciation.

- The influence of Bitcoin and other major cryptocurrencies: The performance of other major cryptocurrencies can influence XRP's price.

- Risk assessment and potential for price volatility: Investing in XRP carries inherent risks due to its volatility.

Conclusion

Predicting XRP's future price with certainty is impossible. However, analyzing the impact of the SEC lawsuit, market sentiment, technical indicators, technological advancements, and overall market conditions provides a clearer picture. Whether XRP will reach $5 depends on the successful resolution of the lawsuit, widespread adoption, and positive market conditions. While a $5 price target might seem ambitious at present, technological improvements and increasing utility could contribute to significant price appreciation over time.

While predicting the future price of XRP with certainty is impossible, understanding the factors outlined in this XRP price prediction analysis can help you make informed decisions about your investment strategy. Continue your research and stay updated on the latest developments surrounding XRP. Conduct thorough due diligence before investing in any cryptocurrency, including XRP.

Featured Posts

-

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025

Will Xrp Etfs Disappoint Assessing Supply Headwinds And Institutional Interest

May 08, 2025 -

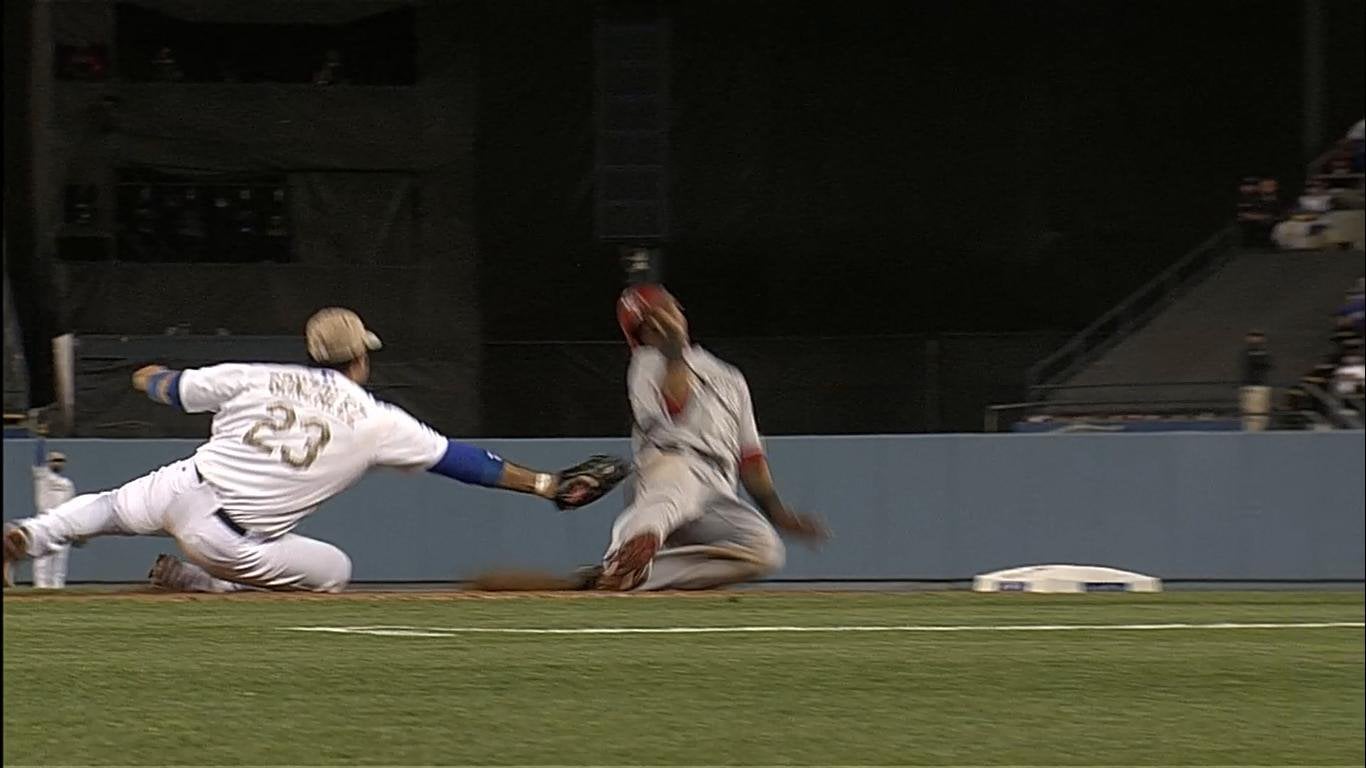

Angels Farm System Receives Scathing Review From Baseball Insiders

May 08, 2025

Angels Farm System Receives Scathing Review From Baseball Insiders

May 08, 2025 -

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025

Dont Miss Out Psl 10 Tickets On Sale

May 08, 2025 -

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025

Pressure Mounts For Economic Reform Amidst Taiwan Dollars Rise

May 08, 2025 -

Disfruta De La Autentica Cocina Mexicana En Cantina Canalla Malaga

May 08, 2025

Disfruta De La Autentica Cocina Mexicana En Cantina Canalla Malaga

May 08, 2025

Latest Posts

-

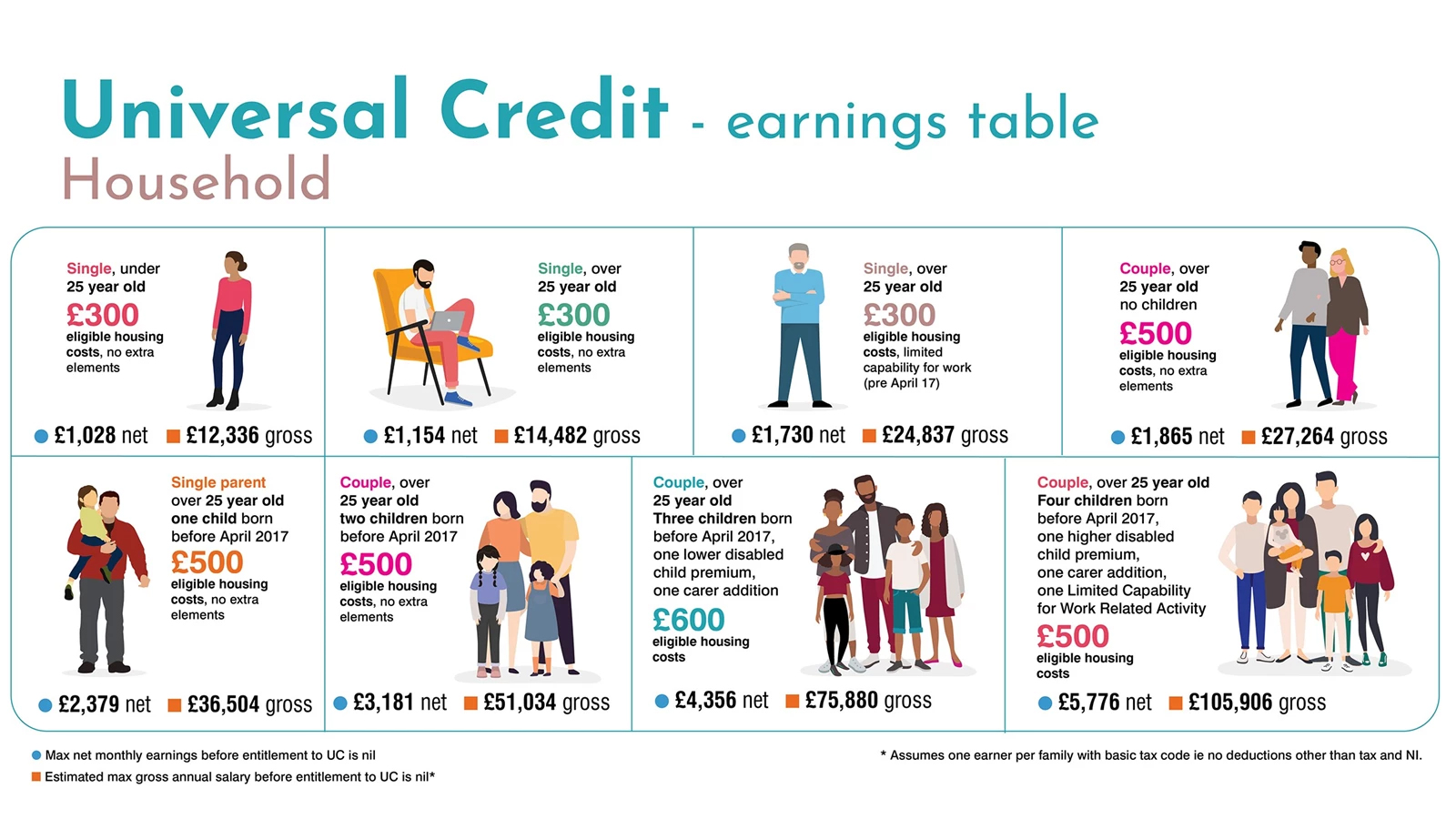

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025 -

The Scholar Rock Stock Drop On Monday What Happened

May 08, 2025

The Scholar Rock Stock Drop On Monday What Happened

May 08, 2025 -

Impact Of Dwps New Six Month Universal Credit Regulation

May 08, 2025

Impact Of Dwps New Six Month Universal Credit Regulation

May 08, 2025 -

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025 -

Analyzing Scholar Rock Stocks Unexpected Monday Fall

May 08, 2025

Analyzing Scholar Rock Stocks Unexpected Monday Fall

May 08, 2025