Worries Over US Fiscal Policy Lead To Stock Market Drop

Table of Contents

The Looming Debt Ceiling Crisis and its Market Impact

The US debt ceiling is the legal limit on the amount of money the federal government can borrow. Reaching this limit without raising it creates a debt ceiling crisis, potentially causing a government shutdown and a default on US debt. The implications are severe. Failing to raise the debt ceiling could trigger a cascade of negative consequences, severely impacting investor confidence and causing stock market volatility.

- Government Shutdown: A shutdown could disrupt essential government services, harming economic activity and further eroding investor confidence.

- Credit Rating Downgrade: A default on US debt could lead to a credit rating downgrade, increasing borrowing costs for the government and potentially impacting the entire economy.

- Increased Uncertainty: The uncertainty surrounding the debt ceiling negotiations creates a climate of fear among investors, leading to sell-offs and market volatility.

- Reduced Business Investment: Businesses, facing uncertainty, may postpone investments, slowing economic growth and negatively impacting corporate profits, leading to lower stock prices.

- Higher Interest Rates: The increased risk associated with US debt could lead to higher interest rates, impacting borrowing costs for businesses and consumers.

- Negative Impact on Consumer Spending: Economic uncertainty can lead to decreased consumer confidence and spending, which further weakens the economy.

Inflationary Pressures and Fiscal Policy Decisions

The current inflationary environment adds another layer of complexity to the fiscal policy debate. High inflation erodes purchasing power and impacts both consumer and business confidence. Fiscal policy decisions, such as tax cuts or increased government spending, can either exacerbate or mitigate inflationary pressures.

- Government Spending and Inflation: Increased government spending can fuel inflation if it outpaces the economy's productive capacity. Conversely, fiscal austerity measures can help curb inflation but may also slow economic growth.

- Tax Cuts and Inflation: Tax cuts can stimulate economic growth but can also increase inflation if they lead to increased consumer spending without a corresponding increase in supply.

- Impact on Corporate Profits: High inflation can squeeze corporate profit margins, as companies face increased costs for raw materials and labor. This can negatively impact investor expectations and stock prices.

- Monetary Policy Interaction: The Federal Reserve's monetary policy, often used to combat inflation, interacts significantly with fiscal policy. Raising interest rates to fight inflation can negatively impact economic growth and potentially trigger a recession.

Investor Sentiment and Market Reaction to Fiscal Policy Uncertainty

Investor sentiment—a collective measure of investor fear, uncertainty, and doubt—is a significant driver of stock market trends. Negative news and speculation regarding US fiscal policy directly influence investor sentiment, often leading to market corrections.

- Media Influence: Negative media coverage amplifies anxieties, potentially leading to a sell-off in the stock market.

- Social Media Impact: Social media platforms can quickly spread information, both accurate and inaccurate, impacting investor decisions and contributing to market volatility.

- Flight to Safety: During times of uncertainty, investors often move from riskier assets (like stocks) to safer assets (like government bonds), causing stock prices to decline.

- Analyst Predictions: Market analysts’ predictions and interpretations of fiscal policy news significantly influence investor behavior and market reactions.

Potential Mitigation Strategies and Future Outlook

Addressing fiscal concerns requires careful coordination between the legislative and executive branches. Potential mitigation strategies include:

- Debt Ceiling Compromise: Reaching a bipartisan agreement to raise the debt ceiling is crucial to avoid a default and maintain investor confidence.

- Responsible Spending Measures: Implementing responsible spending measures can help control the national debt and reduce inflationary pressures.

- Central Bank Actions: The Federal Reserve can use monetary policy tools to manage inflation, but these actions can have unintended consequences.

- Long-term Economic Projections: Accurate economic forecasts are needed to make informed fiscal policy decisions.

The outlook remains uncertain, given the complexities of US fiscal policy and market dynamics. However, responsible fiscal management and clear communication are critical for stabilizing the market and fostering long-term economic growth.

Conclusion: Understanding the Link Between US Fiscal Policy and Stock Market Performance

This article highlights the significant impact of US fiscal policy uncertainties on stock market performance. The interconnectedness of the debt ceiling crisis, inflationary pressures, and investor sentiment underscores the need for responsible fiscal management. Understanding the nuances of US fiscal policy is vital for navigating market volatility. To make informed investment decisions, stay informed about upcoming US fiscal policy decisions and their potential impacts. By understanding US fiscal policy impacts and navigating US fiscal policy uncertainty, you can better protect your investments.

Featured Posts

-

Council Addressing Fewer Send Concerns Raised By Parliamentarians

May 23, 2025

Council Addressing Fewer Send Concerns Raised By Parliamentarians

May 23, 2025 -

Understanding The Big Rig Rock Report 3 12 97 1 Double Q Data

May 23, 2025

Understanding The Big Rig Rock Report 3 12 97 1 Double Q Data

May 23, 2025 -

Who Drummer Breaks Silence On Royal Albert Hall Sacking

May 23, 2025

Who Drummer Breaks Silence On Royal Albert Hall Sacking

May 23, 2025 -

The Rising Tide Of Global Forest Loss Wildfires And The Fight For Conservation

May 23, 2025

The Rising Tide Of Global Forest Loss Wildfires And The Fight For Conservation

May 23, 2025 -

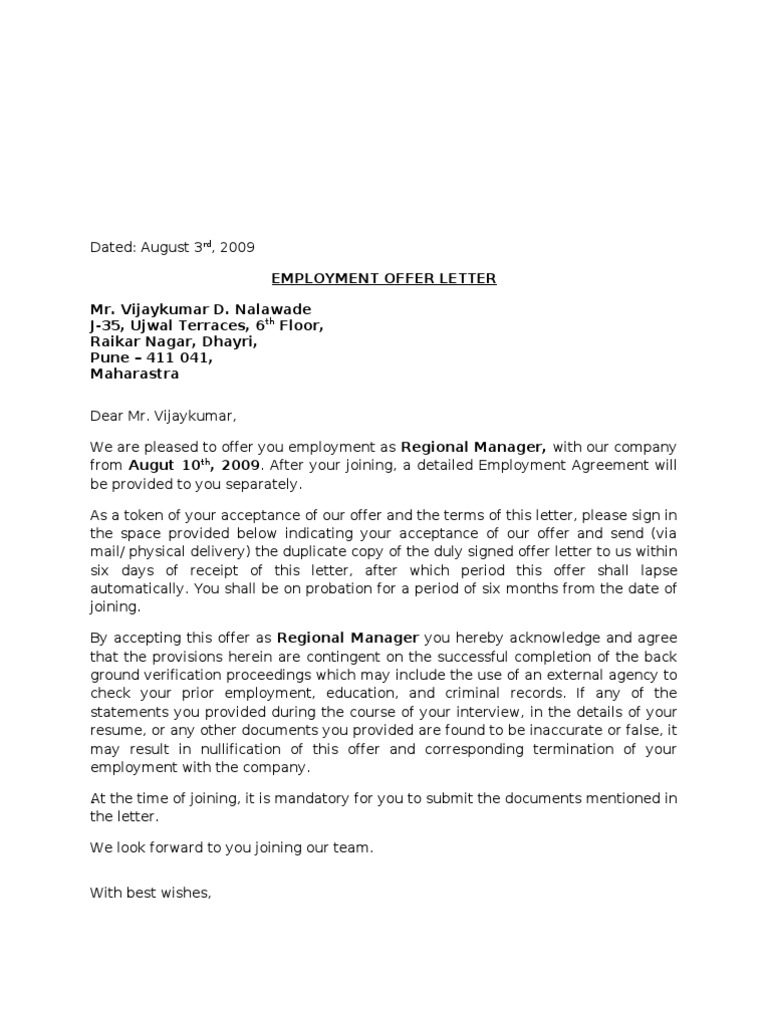

Negotiating Your Salary Addressing A Best And Final Job Offer

May 23, 2025

Negotiating Your Salary Addressing A Best And Final Job Offer

May 23, 2025