X Corp's Financial Restructuring: Insights From Musk's Recent Debt Sale

Table of Contents

The Details of the Debt Sale

The specifics of X Corp's debt sale are crucial to understanding the implications of this financial restructuring. Analyzing the amount, terms, and conditions of the debt provides insight into the company's current financial situation and its future plans.

The Amount and Terms

While precise figures are often initially kept confidential during such major financial transactions, reports suggest a substantial amount of debt was raised. The interest rates associated with this debt are likely to be significant, reflecting the inherent risks involved in lending to a company undergoing such substantial financial restructuring. The maturity date of this debt will determine the timeframe within which X Corp needs to repay the principal amount and the accumulated interest. The type of debt (secured or unsecured) influences the risk profile for lenders. Secured debt typically involves collateral, such as assets of X Corp, to mitigate the lender's risk in case of default.

- Exact amount of debt raised: [Insert estimated amount or range, citing reliable sources if available]

- Interest rate and associated costs: [Insert estimated range or details, citing sources]

- Maturity date of the debt: [Insert date or timeframe if available]

- Type of debt (e.g., secured, unsecured): [Specify if known, and detail any collateral used]

- Potential investors or lenders involved: [Mention any known entities if publicly available]

Reasons Behind the Restructuring

The X Corp debt restructuring wasn't a spontaneous decision. Several factors contributed to the need for this significant financial maneuver. Understanding these underlying reasons is key to assessing the long-term implications.

Addressing High Debt Levels

X Corp, like many rapidly growing technology companies, likely carries a substantial debt burden. This debt might stem from previous acquisitions, ongoing operational costs, or investments in ambitious projects. The current level of debt may have become unsustainable, posing a threat to the company's financial stability and credit rating.

- Previous acquisitions and their financial impact: [Discuss any significant acquisitions and their associated costs]

- Operating costs and profitability challenges: [Analyze X Corp's operational expenses and profit margins]

- Potential cash flow issues: [Examine X Corp's cash flow and its ability to service its debt obligations]

- The need for capital investment in future projects: [Assess X Corp's future investment needs and how the debt restructuring supports them]

Strategic Repositioning

The debt sale may not only be about resolving existing debt issues; it could also serve as a catalyst for strategic repositioning. This might involve pursuing new opportunities for growth and innovation.

- Potential expansion into new markets: [Discuss potential expansion plans and their financial implications]

- Investments in new technologies or features: [Analyze potential investments in research and development]

- Debt reduction to improve credit rating: [Explain how debt reduction could improve X Corp's financial standing]

Impact and Potential Consequences

The X Corp financial restructuring will have far-reaching consequences, both in the short term and long term. Analyzing these impacts is critical for a comprehensive understanding of this significant event.

Short-Term Effects

The immediate aftermath of the debt sale is likely to involve fluctuations in X Corp's stock price and changes in investor sentiment. Employee morale might also be affected, depending on the restructuring's impact on compensation and job security.

- Immediate market reaction to the debt sale: [Analyze the stock price movements following the announcement]

- Impact on employee compensation and benefits: [Discuss potential changes in employee compensation and benefits packages]

- Changes in investor sentiment: [Analyze how the debt sale impacted investor confidence and rating]

Long-Term Implications

The long-term consequences will depend on how effectively X Corp manages its debt, reinvests its capital, and navigates the competitive landscape. The company's credit rating and access to future financing will be significantly impacted.

- Long-term debt servicing costs: [Analyze the long-term financial burden of servicing the debt]

- Potential impact on credit rating and access to future financing: [Discuss potential changes in credit rating and its implications for future funding]

- Impact on X Corp's innovation and growth strategy: [Analyze how the restructuring may affect future growth and innovation]

Conclusion

X Corp's recent financial restructuring, driven by Musk's debt sale, represents a significant turning point for the company. While the short-term consequences are still unfolding, a thorough understanding of the debt sale's terms, underlying reasons, and potential impacts is crucial for investors, employees, and industry observers alike. This restructuring signals a pivotal moment in X Corp’s journey, highlighting the complexities of managing a large, rapidly evolving technology company. Continued monitoring of X Corp's financial performance and strategic decisions will be essential to fully assessing the long-term success of this financial maneuver. Stay informed about future developments in X Corp's financial restructuring and its overall trajectory. Understanding the complexities of X Corp's debt restructuring is vital for navigating this evolving financial landscape.

Featured Posts

-

Chaos And Confusion Before Weezer Bassists Wife Shooting Lapd Video Shows

Apr 28, 2025

Chaos And Confusion Before Weezer Bassists Wife Shooting Lapd Video Shows

Apr 28, 2025 -

Trumps Higher Education Policies Effects On Diverse College Campuses

Apr 28, 2025

Trumps Higher Education Policies Effects On Diverse College Campuses

Apr 28, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Announcements

Apr 28, 2025

Building Voice Assistants Made Easy Open Ais 2024 Announcements

Apr 28, 2025 -

Browns Select Shedeur Sanders In Nfl Draft

Apr 28, 2025

Browns Select Shedeur Sanders In Nfl Draft

Apr 28, 2025 -

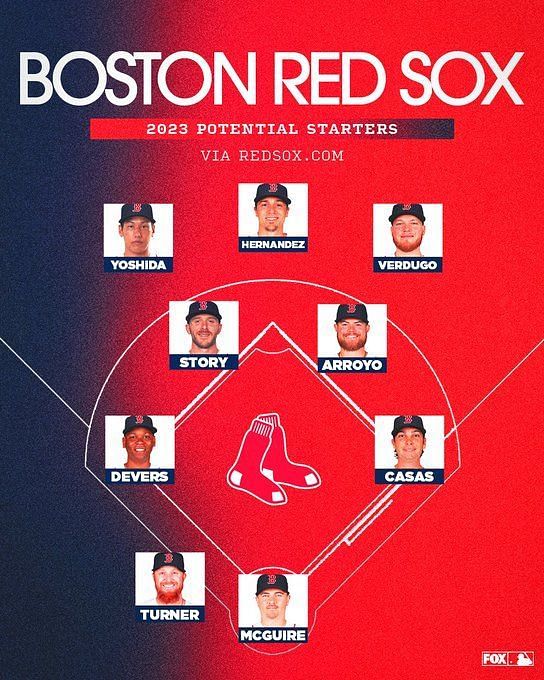

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Red Soxs Shifting Lineup Impact Of Outfielders Return And Casas Lowered Spot

Apr 28, 2025

Latest Posts

-

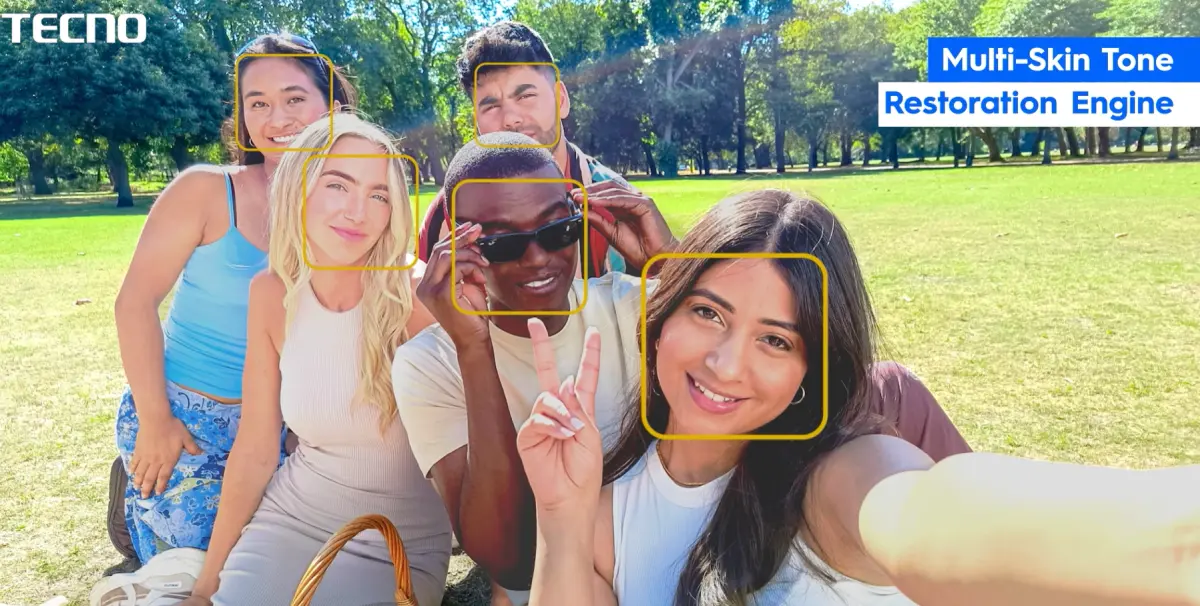

Universal Tone Tecno

Apr 28, 2025

Universal Tone Tecno

Apr 28, 2025 -

Tecno Universal Tone

Apr 28, 2025

Tecno Universal Tone

Apr 28, 2025 -

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025

Boston Red Sox Lineup Modifications For Doubleheaders First Game

Apr 28, 2025 -

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025

Red Sox Game 1 Lineup Coras Minor Adjustments

Apr 28, 2025 -

Coras Subtle Lineup Changes For Red Sox Doubleheader

Apr 28, 2025

Coras Subtle Lineup Changes For Red Sox Doubleheader

Apr 28, 2025