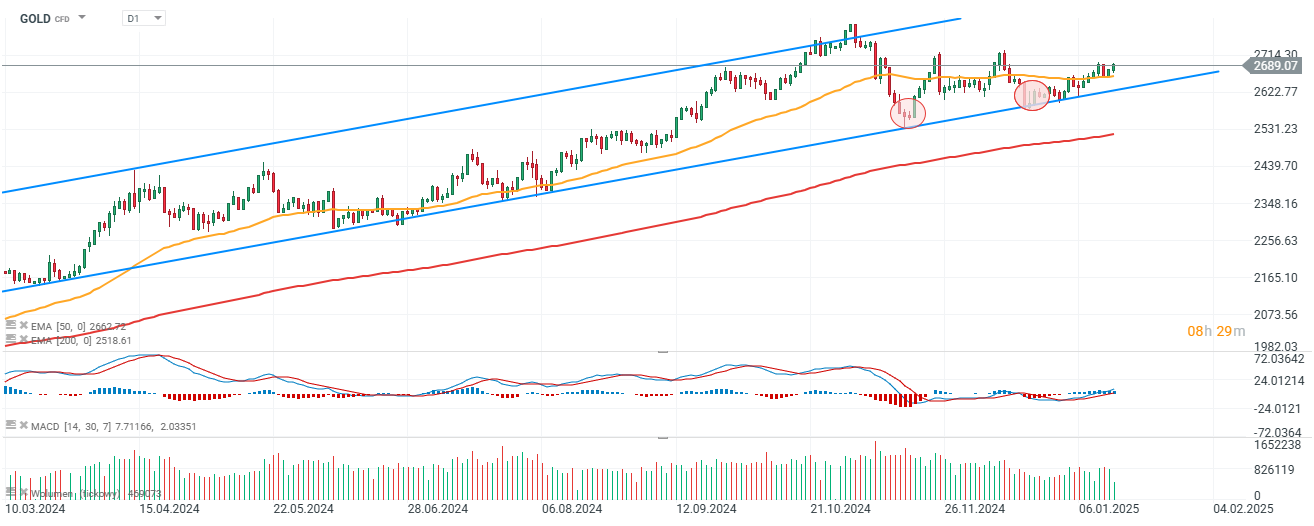

XAUUSD Rally: Gold Price Gains Momentum On Weakening US Economy

Table of Contents

Weakening US Economic Indicators Fuel Gold's Rise

Recent economic data paints a picture of slowing growth in the US economy, significantly impacting the XAUUSD. This weakening is boosting demand for gold as investors seek safety. Key indicators contributing to this trend include:

- GDP Growth: Recent reports show a slowdown in GDP growth, fueling recession fears. Lower-than-expected growth figures raise concerns about the overall health of the US economy, prompting investors to move towards safer assets like gold.

- Unemployment Rate: Rising unemployment claims signal potential weakness in the job market. A weakening labor market often precedes an economic downturn, further strengthening the appeal of gold as a safe haven.

- Consumer Confidence: Declining consumer confidence indices indicate reduced spending and decreased economic optimism. This diminished consumer spending directly impacts economic growth, making gold a more appealing investment during uncertain times.

- Recession Fears: The confluence of these factors has intensified recession fears, pushing investors towards the perceived safety of gold. The historical correlation between recessions and gold price increases is well-documented, making gold a strategic investment choice for many during times of economic uncertainty.

Supporting Details: The correlation between weakening economic indicators and the rise in gold prices is clearly visible in recent market data. For instance, [Insert Chart/Data showing correlation between GDP growth and XAUUSD]. The decline in consumer confidence directly correlates with the increase in gold prices, reinforcing gold's role as a safe-haven asset.

Falling US Dollar Strengthens Gold's Appeal

A weakening US dollar is another major factor contributing to the XAUUSD rally. Gold is priced in US dollars, so a weaker dollar makes gold cheaper for buyers using other currencies, increasing demand.

- US Dollar Index (DXY): The decline in the US Dollar Index (DXY) is a key driver of the current gold price surge. A weakening dollar typically translates into higher gold prices due to their inverse relationship.

- Dollar Weakness: Several factors are contributing to dollar weakness, including the Federal Reserve's monetary policy and ongoing geopolitical events. These factors create uncertainty in the foreign exchange market, making gold a more attractive investment.

- Inverse Correlation: Historically, there's a strong inverse correlation between the DXY and the gold price. As the dollar weakens, gold prices tend to rise, and vice versa.

Supporting Details: [Insert Chart comparing DXY and gold price movements, illustrating their inverse correlation]. The chart clearly demonstrates that as the dollar weakens, gold prices tend to rise, strengthening the XAUUSD.

Inflationary Pressures and Rising Interest Rates – A Complex Relationship

The relationship between inflation, interest rates, and gold prices is complex. While rising interest rates typically exert downward pressure on gold prices (because it becomes more attractive to hold interest-bearing assets), persistent inflation can offset this effect.

- Federal Reserve (Fed) Policy: The Fed's monetary policy plays a crucial role. Attempts to curb inflation through interest rate hikes can initially dampen gold demand. However, persistently high inflation can ultimately boost gold's appeal as an inflation hedge.

- Inflation Hedge: Gold is often viewed as a hedge against inflation, preserving purchasing power during periods of rising prices. When inflation is high and erodes the value of fiat currencies, gold retains its value, making it a desirable asset.

Supporting Details: [Insert historical data illustrating gold's performance during periods of high inflation and varying interest rate environments]. The data demonstrates gold's resilience as an inflation hedge, even during periods of rising interest rates.

Geopolitical Uncertainty Boosts Safe-Haven Demand for Gold

Geopolitical risks and global uncertainty significantly influence gold prices. During times of uncertainty, investors flock to gold as a safe-haven asset, boosting its demand.

- Geopolitical Events: Ongoing geopolitical tensions and global uncertainty significantly contribute to gold's appeal. [Discuss specific geopolitical events impacting the current market].

- Safe Haven Asset: Gold's status as a safe-haven asset is a key driver of its price appreciation during times of global instability. Investors see it as a reliable store of value during periods of uncertainty, thus driving up demand.

- Diversification: Including gold in an investment portfolio can offer diversification benefits, especially during periods of heightened geopolitical risk.

Supporting Details: [Provide examples of past geopolitical events and their impact on gold prices]. These examples illustrate gold's consistent role as a safe-haven asset during periods of global instability.

Conclusion

The XAUUSD rally is a consequence of a combination of factors: a weakening US economy, a falling US dollar, and ongoing geopolitical uncertainty. These elements have significantly increased demand for gold, solidifying its role as a safe-haven asset. Understanding these dynamics is crucial for investors interested in profiting from gold price fluctuations. Stay informed about economic indicators, monetary policy, and geopolitical developments to make better-informed decisions regarding your XAUUSD investments. Keep a close eye on the XAUUSD for further price movements and potential investment opportunities. Successful XAUUSD trading requires careful monitoring and strategic decision-making.

Featured Posts

-

Weekly Review Identifying And Learning From Failures

May 17, 2025

Weekly Review Identifying And Learning From Failures

May 17, 2025 -

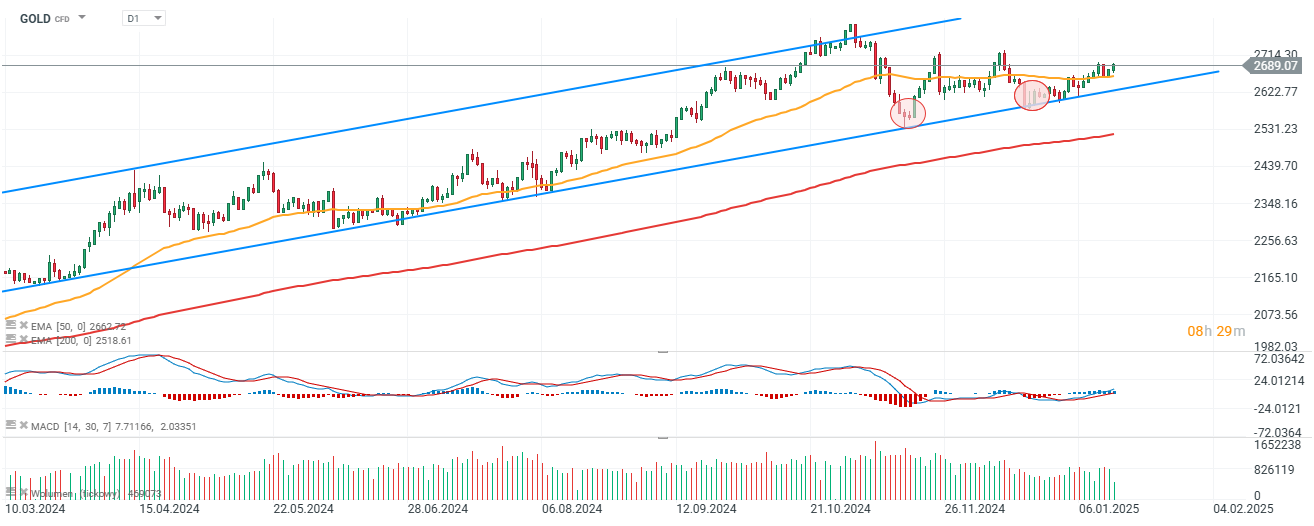

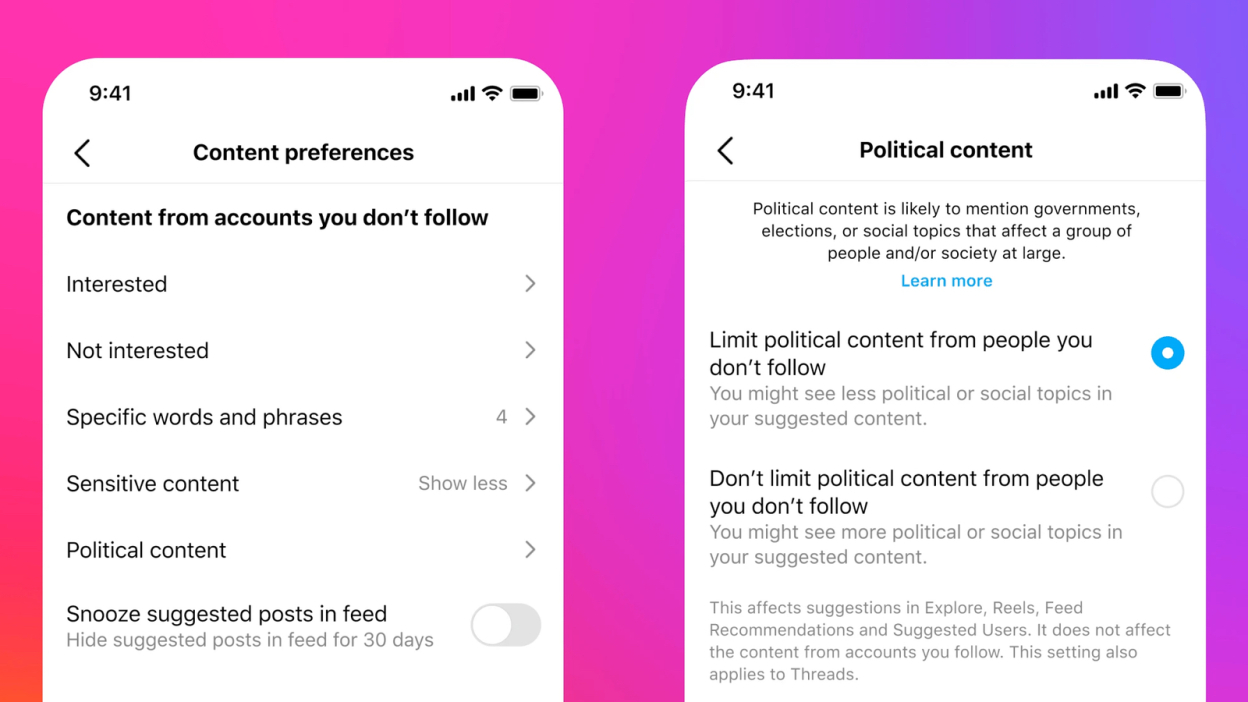

Conservative Uproar Leads To Comey Removing Instagram Post

May 17, 2025

Conservative Uproar Leads To Comey Removing Instagram Post

May 17, 2025 -

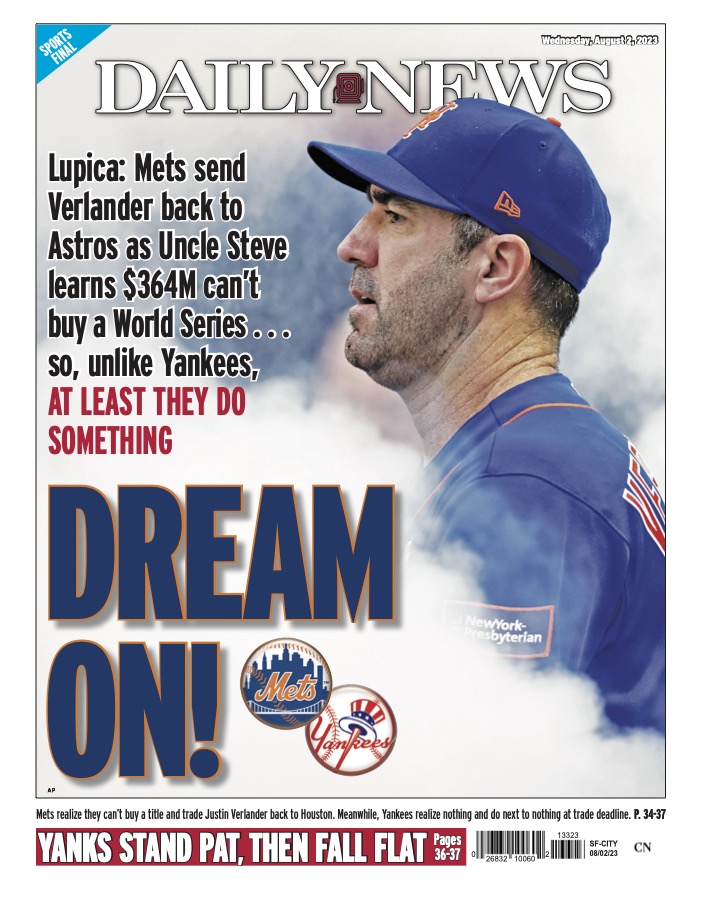

Finding The New York Daily News Back Pages For May 2025

May 17, 2025

Finding The New York Daily News Back Pages For May 2025

May 17, 2025 -

Giants Vs Mariners Updated Injury List For April 4 6 Series

May 17, 2025

Giants Vs Mariners Updated Injury List For April 4 6 Series

May 17, 2025 -

Microsoft Surface Simplification Another Product Cut

May 17, 2025

Microsoft Surface Simplification Another Product Cut

May 17, 2025

Latest Posts

-

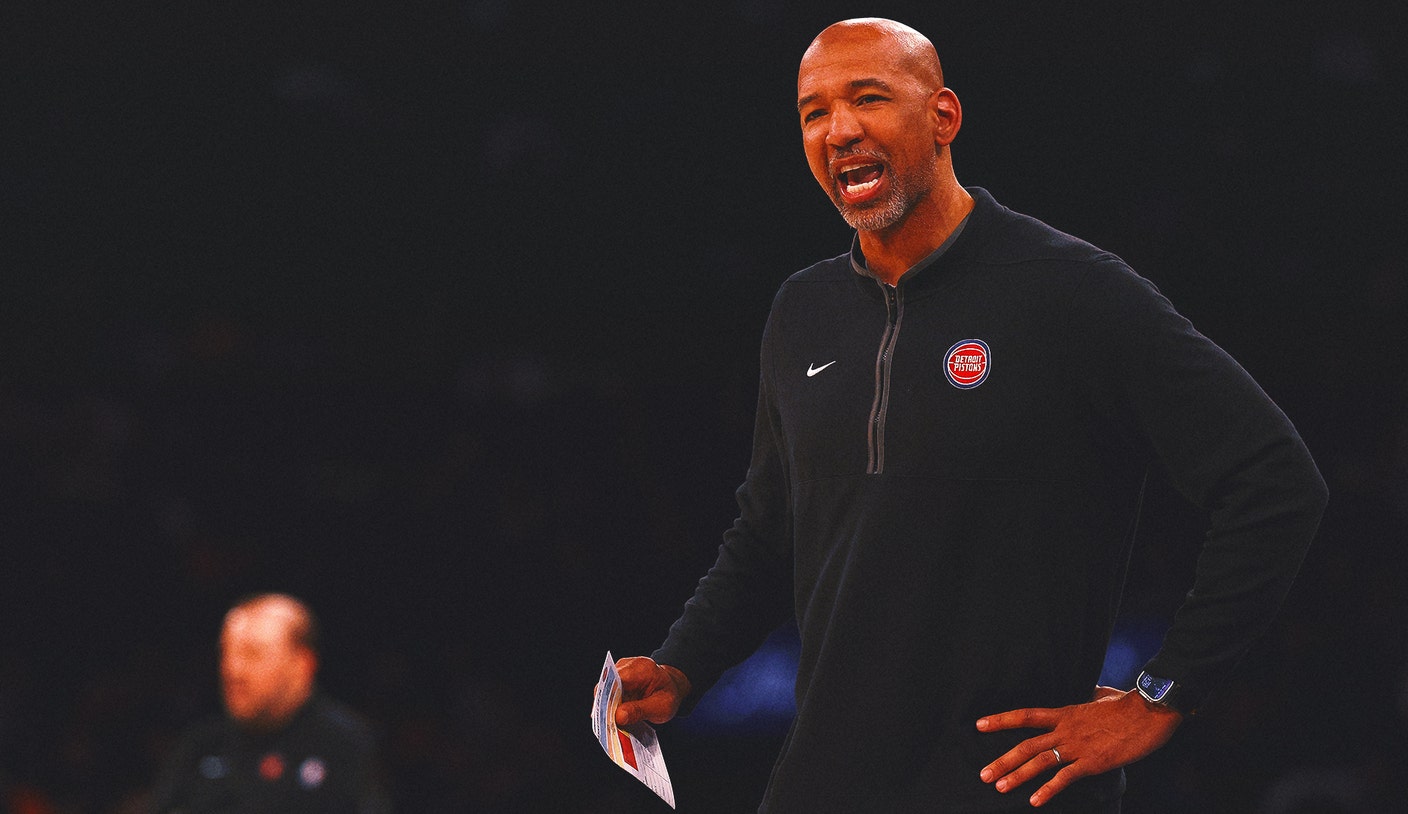

Missed Call Costs Pistons In Crucial Game 4 Loss

May 17, 2025

Missed Call Costs Pistons In Crucial Game 4 Loss

May 17, 2025 -

Nba Game 4 Controversy Pistons No Call Costs Them Victory

May 17, 2025

Nba Game 4 Controversy Pistons No Call Costs Them Victory

May 17, 2025 -

Josh Alexander Discusses Don Callis Aew And His Wrestling Path On 97 1 Double Q

May 17, 2025

Josh Alexander Discusses Don Callis Aew And His Wrestling Path On 97 1 Double Q

May 17, 2025 -

Missed Call Controversy Officials React To Knicks Pistons Game Outcome

May 17, 2025

Missed Call Controversy Officials React To Knicks Pistons Game Outcome

May 17, 2025 -

Knicks Pistons Game Officials Statement On Final Play Controversy

May 17, 2025

Knicks Pistons Game Officials Statement On Final Play Controversy

May 17, 2025