XRP Commodity Classification Looms As Ripple, SEC Near Settlement

Table of Contents

The Ripple-SEC Lawsuit and its Significance for XRP's Future

The Ripple-SEC lawsuit, filed in December 2020, centers around the SEC's allegation that Ripple sold XRP as an unregistered security. This case is monumental, as it directly challenges the SEC's authority over the classification of cryptocurrencies. The SEC's classification of digital assets has profound implications for the entire cryptocurrency ecosystem, influencing investor confidence, regulatory clarity, and the overall growth of the market.

-

Ripple's argument for XRP as a commodity: Ripple contends that XRP is a decentralized digital asset, functioning similarly to other cryptocurrencies like Bitcoin and Ethereum, which are generally considered commodities. They emphasize XRP's utility in its payment network and its decentralized nature.

-

The SEC's argument for XRP as a security: The SEC argues that XRP's sale constituted an unregistered securities offering, based on the Howey Test, which determines whether an investment contract exists. They focus on Ripple's control over XRP's distribution and the expectation of profit from the investment by purchasers.

-

Potential implications of each classification: If XRP is classified as a security, it could face significant trading restrictions, impacting its price and liquidity. Conversely, commodity classification would bring more regulatory certainty and potentially boost its market value. This decision will create a precedent for the future classification of other cryptocurrencies.

Potential Outcomes of a Ripple-SEC Settlement

A settlement between Ripple and the SEC could manifest in several ways, each with significant implications. The outcome hinges on the SEC's willingness to compromise and Ripple's ability to negotiate favorable terms.

-

XRP classified as a security: This outcome would likely involve significant financial penalties for Ripple and potentially restrict XRP's trading on major US exchanges. It would also establish a precedent for stricter regulation of other cryptocurrencies.

-

XRP classified as a commodity: This would be a victory for Ripple and could lead to increased investor confidence in XRP and the broader crypto market. It might also provide a more favorable regulatory environment for other crypto projects.

-

A more nuanced outcome: The settlement might involve a compromise, perhaps defining certain XRP sales as securities while classifying others as commodities. This would offer a degree of regulatory clarity but could still leave ambiguity for future legal interpretations.

-

Potential financial penalties for Ripple: Regardless of the classification, Ripple could face substantial financial penalties for past unregistered sales.

-

Impact on XRP trading platforms and exchanges: Exchanges may delist XRP if it's classified as a security to avoid regulatory violations.

-

Future regulatory clarity for the crypto industry: The settlement, whatever the outcome, will provide some degree of clarity regarding the SEC's approach to cryptocurrency regulation, although it will likely leave many open questions.

The Impact of XRP's Classification on the Crypto Market

The Ripple-SEC case is not isolated. The classification of XRP will inevitably influence the regulatory landscape for other cryptocurrencies, potentially triggering a domino effect.

-

Effect on other altcoins: The outcome could set a precedent for how other altcoins are regulated, leading to increased regulatory scrutiny or potentially a more defined framework for cryptocurrency classification.

-

Influence on future ICOs and STOs: The ruling will significantly impact the structure and legal compliance requirements for future Initial Coin Offerings (ICOs) and Security Token Offerings (STOs).

-

Impact on institutional investment in crypto: Institutional investors are closely monitoring the case, as the outcome will influence their confidence in the cryptocurrency market's regulatory environment and investment decisions.

Analyzing the Legal Arguments and Precedents

The core of the legal battle revolves around the application of the Howey Test, which is used to determine whether an investment constitutes a security. Both sides present compelling arguments, and understanding the legal precedents is crucial to predicting the outcome.

-

Key legal arguments used by both sides: Ripple emphasizes XRP's decentralized nature and utility, while the SEC highlights Ripple's control over XRP's distribution and investors' expectation of profit.

-

Relevant court precedents and their implications: The court will likely refer to past cases involving securities and investment contracts to inform its decision.

-

Expert opinions on the likely outcome: Legal experts offer diverse opinions, reflecting the complexity of the case and the lack of clear legal precedents specifically addressing cryptocurrencies. Some believe a settlement is likely, while others anticipate a protracted legal battle.

Conclusion: The Future of XRP and Commodity Classification

The Ripple-SEC settlement will undoubtedly reshape the cryptocurrency landscape. The classification of XRP as a security or a commodity will have profound implications for Ripple, XRP investors, and the future of digital asset regulation. The potential outcomes range from significant penalties and trading restrictions to increased regulatory clarity and a more favorable environment for the crypto industry. The decision's ripple effects will extend far beyond XRP, influencing the classification and regulation of other cryptocurrencies and shaping investor sentiment for years to come. Stay tuned for updates on the XRP commodity classification and the Ripple-SEC settlement. Understanding the implications of this landmark case is crucial for anyone invested in the cryptocurrency market.

Featured Posts

-

Euroleague 2024 I Pari Sen Zermen Epivevaionei Ti Symmetoxi Tis

May 01, 2025

Euroleague 2024 I Pari Sen Zermen Epivevaionei Ti Symmetoxi Tis

May 01, 2025 -

Michael Sheens 1 Million Giveaway Who Are The Winners

May 01, 2025

Michael Sheens 1 Million Giveaway Who Are The Winners

May 01, 2025 -

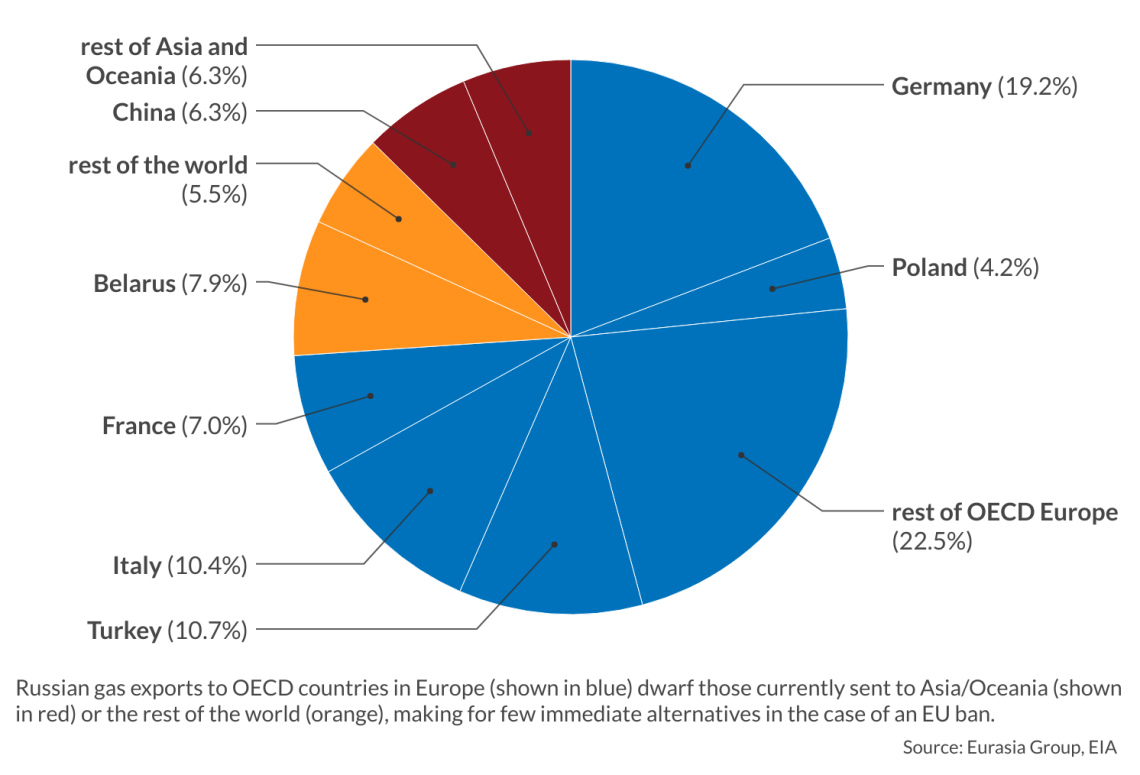

German Politics Klingbeil On Russian Gas Import Debate

May 01, 2025

German Politics Klingbeil On Russian Gas Import Debate

May 01, 2025 -

Beyond The Dragons Den Scaling Your Business After Investment

May 01, 2025

Beyond The Dragons Den Scaling Your Business After Investment

May 01, 2025 -

England Vs France Six Nations Dalys Match Winning Performance

May 01, 2025

England Vs France Six Nations Dalys Match Winning Performance

May 01, 2025