XRP: ETF Approvals, SEC Developments, And Ripple's Future

Table of Contents

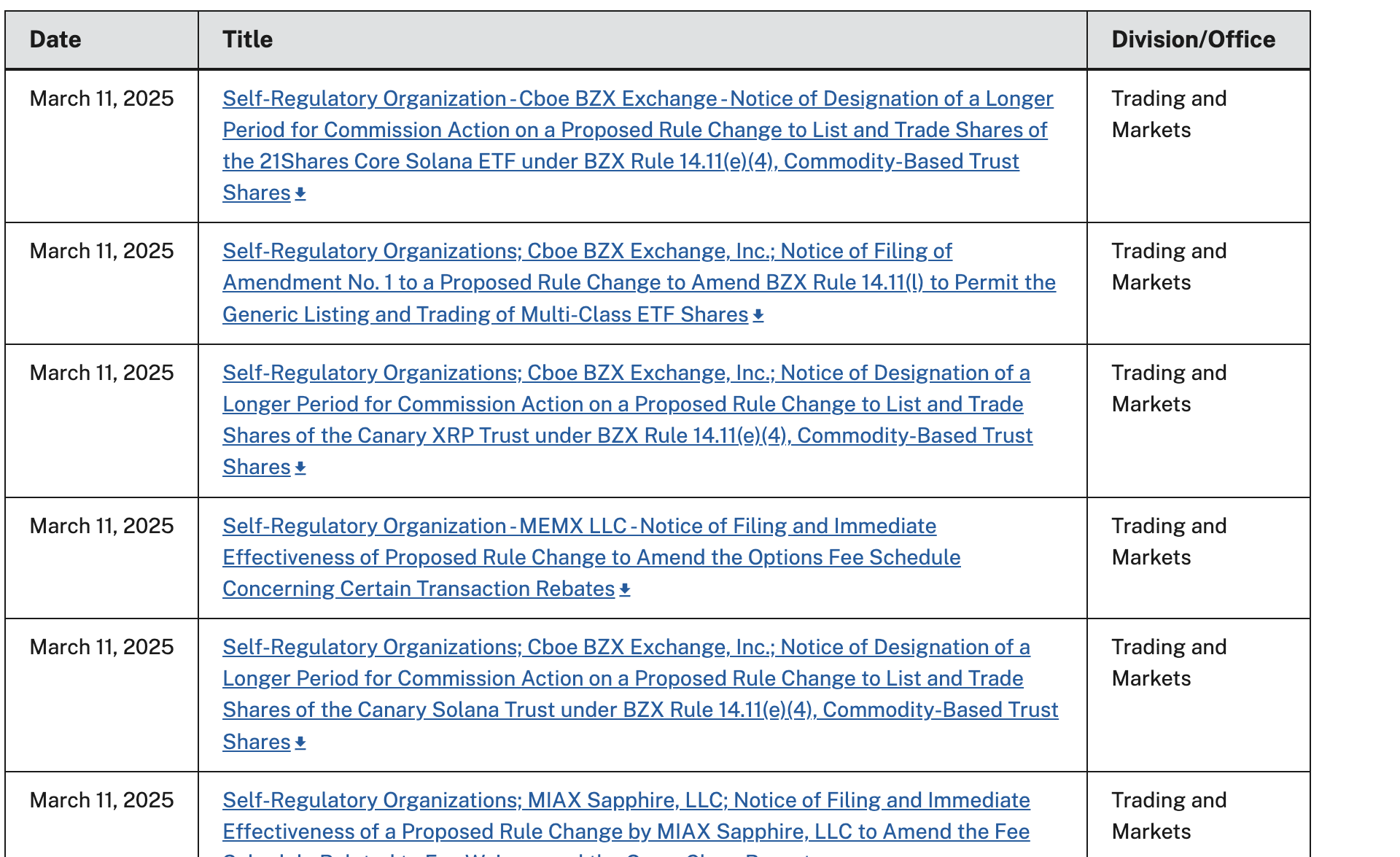

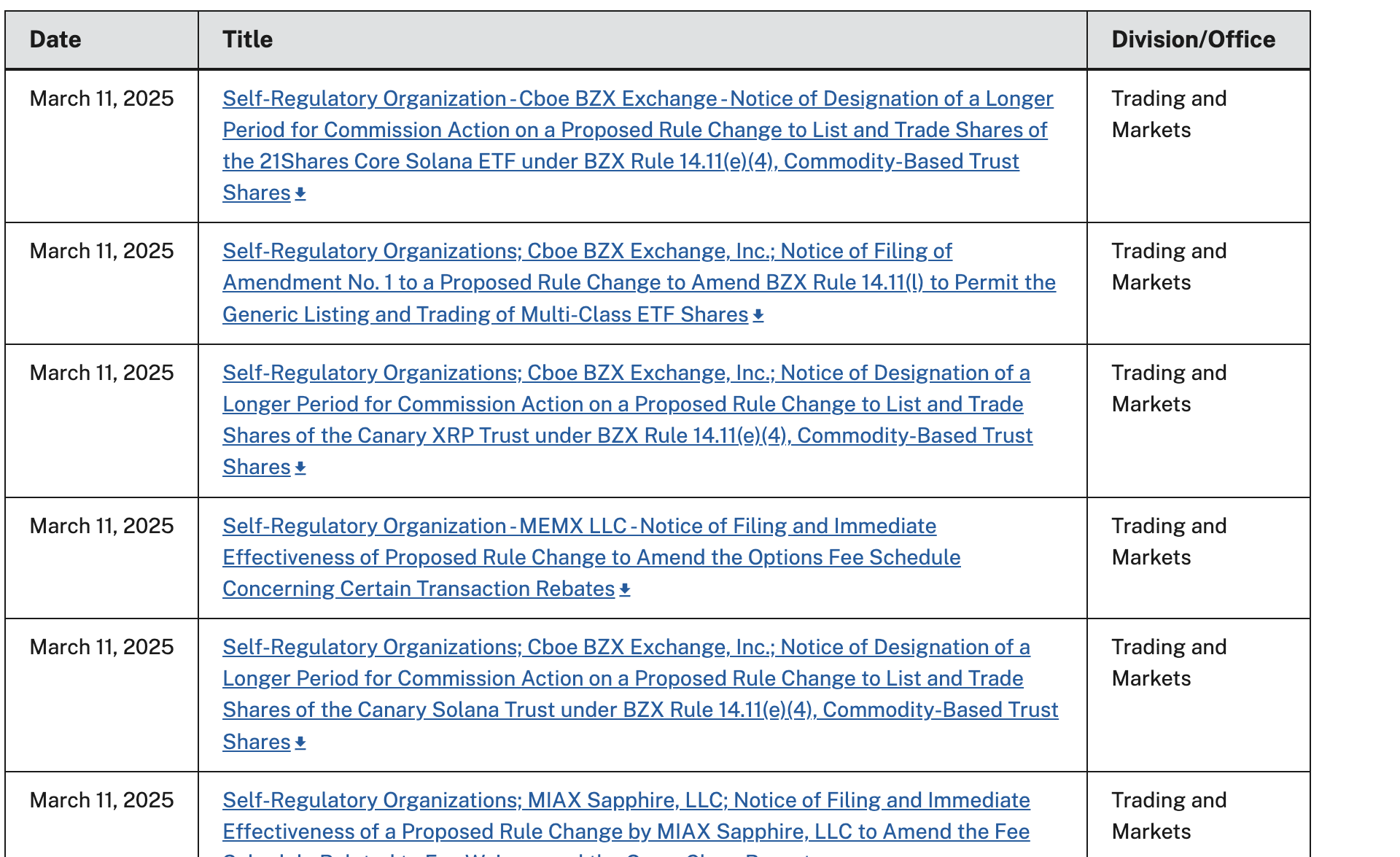

The Potential Impact of XRP ETFs

The approval of an XRP ETF (Exchange-Traded Fund) would be a watershed moment for the cryptocurrency, potentially altering its trajectory significantly. Several key impacts are anticipated:

Increased Liquidity and Accessibility

XRP ETF approval would dramatically increase XRP's liquidity and accessibility for mainstream investors. This translates to:

- Increased trading volume on regulated exchanges: Currently, XRP trading is spread across numerous exchanges, some with varying levels of regulation. An ETF would centralize trading on regulated markets, leading to higher trading volumes.

- Reduced reliance on less regulated exchanges: The availability of an XRP ETF would reduce the need for investors to navigate less regulated and potentially riskier exchanges.

- Simplified investment for institutional and retail investors: ETFs offer a straightforward investment vehicle, making XRP accessible to a broader range of investors, including those who may be unfamiliar with cryptocurrency exchanges. This increased accessibility could significantly boost demand.

Price Volatility and Market Capitalization

A surge in demand fueled by ETF listings could significantly impact XRP's price volatility and market capitalization.

- Potential for substantial price appreciation: Increased demand often leads to price increases, potentially driving significant price appreciation for XRP.

- Increased scrutiny and regulatory oversight: The increased attention and trading volume associated with an ETF listing would bring XRP under even greater regulatory scrutiny.

- Attracting new investors and increasing trading volume: The ease of access through an ETF could attract a large influx of new investors, further increasing trading volume and potentially driving price upward.

Regulatory Precedents and Challenges

The SEC's approval process for crypto ETFs will set a precedent for future digital asset approvals.

- Comparison with other approved crypto ETFs (if any): The SEC's decision on an XRP ETF will be heavily influenced by its approach to other crypto ETFs. The approval (or rejection) of similar assets will shape the regulatory landscape.

- Analysis of the SEC's ongoing review of XRP's classification: The SEC's ongoing classification of XRP as a security or a commodity is paramount. A favorable classification is crucial for ETF approval.

- Discussion of the potential impact of the Ripple lawsuit outcome: The resolution of the Ripple lawsuit will heavily influence the SEC's decision regarding an XRP ETF. A favorable outcome for Ripple would significantly improve the chances of approval.

The Ripple-SEC Lawsuit and its Implications for XRP

The ongoing legal battle between Ripple Labs and the SEC has cast a long shadow over XRP's price and future. Understanding the lawsuit's intricacies is crucial for assessing XRP's prospects.

The Core Issues of the Case

The SEC alleges that Ripple sold XRP as an unregistered security, violating federal laws. Ripple counters that XRP is a decentralized digital asset and not a security. Key points include:

- Focus on whether XRP is a security or a currency: This is the central question at the heart of the case. The legal definition and interpretation of “security” are key to the outcome.

- Analysis of the legal arguments presented by both sides: Both parties have presented complex legal arguments, focusing on various aspects of XRP's functionality, distribution, and market dynamics.

- Examination of previous legal precedents and their relevance to the case: Both sides will draw upon past legal rulings to support their claims.

Potential Outcomes and their Market Impact

The lawsuit's outcome will drastically affect XRP's price and market sentiment.

- Scenario analysis for a favorable ruling for Ripple: A win for Ripple could lead to a surge in XRP's price, reflecting increased investor confidence and renewed interest.

- Scenario analysis for a ruling against Ripple: An unfavorable ruling could severely impact XRP's price and potentially lead to delistings from major exchanges.

- Impact on investor confidence and trading activity: Regardless of the outcome, the legal uncertainty surrounding XRP will affect investor confidence and trading activity in the short term.

The Ripple Defense and Future Strategies

Ripple's defense strategy centers on demonstrating XRP's decentralization and its utility as a currency.

- Focus on Ripple’s ongoing commitment to regulatory compliance: Ripple is actively engaging with regulators globally to promote responsible innovation and compliance.

- Analysis of their efforts to foster global adoption of XRP: Ripple continues to seek partnerships and collaborations to expand XRP's reach and use cases.

- Discussion of their ongoing technological developments and partnerships: Ripple continues to develop and improve the XRP Ledger, enhancing its capabilities and efficiency.

The Future of XRP: Growth Opportunities and Challenges

Despite the uncertainty surrounding the SEC lawsuit, XRP possesses considerable potential for growth.

Technological Advancements and Ecosystem Development

XRP's underlying technology, the XRP Ledger, offers several advantages:

- Analysis of XRP Ledger's scalability and efficiency: The XRP Ledger is designed for high throughput and low transaction costs.

- Examination of XRP's potential in decentralized finance (DeFi): XRP is increasingly being integrated into DeFi applications, expanding its utility.

- Focus on collaborations and partnerships that are strengthening the XRP ecosystem: Ripple's collaborations are driving adoption and enhancing XRP’s functionality.

Global Adoption and Market Penetration

XRP's use cases in cross-border payments and remittances are driving its adoption:

- Discussion of XRP's use cases in remittance and international payments: XRP offers faster and cheaper cross-border payments compared to traditional methods.

- Analysis of market penetration strategies employed by Ripple and its partners: Ripple is actively expanding its network of partners to increase XRP's reach.

- Potential for increased adoption in emerging markets: XRP could find significant traction in emerging markets with limited access to traditional financial services.

Regulatory Landscape and Future Outlook

The evolving regulatory landscape for cryptocurrencies will significantly influence XRP's future.

- Discussion of potential regulatory changes that could affect XRP: The global regulatory environment is constantly changing, and these changes will directly affect XRP's trajectory.

- Analysis of the global regulatory landscape and its influence on XRP’s adoption: The varying regulatory approaches globally will impact XRP's adoption in different jurisdictions.

- Prediction of the long-term outlook for XRP based on current trends and potential future developments: While uncertain, XRP's long-term prospects remain potentially strong, contingent upon several factors.

Conclusion

The future of XRP is inextricably linked to the outcome of the Ripple-SEC lawsuit and the potential approval of XRP ETFs. While uncertainty remains, the potential for significant growth is undeniable. A positive resolution to the lawsuit and subsequent ETF approvals could propel XRP to new heights, increasing its liquidity, accessibility, and market capitalization. However, navigating the complexities of the regulatory landscape remains a crucial challenge. Staying informed about SEC developments, Ripple's legal strategy, and technological advancements within the XRP ecosystem is paramount for investors. Continue researching and understanding the potential of XRP, and consider its place in your diversified investment portfolio.

Featured Posts

-

Bkpm Bidik Rp 3 6 Triliun Investasi Di Pekanbaru Tahun 2024

May 01, 2025

Bkpm Bidik Rp 3 6 Triliun Investasi Di Pekanbaru Tahun 2024

May 01, 2025 -

Caso Becciu Risarcimento Agli Accusatori E Conseguenze Della Sentenza

May 01, 2025

Caso Becciu Risarcimento Agli Accusatori E Conseguenze Della Sentenza

May 01, 2025 -

From Scratch To Seven Seas A Northumberland Mans Circumnavigation

May 01, 2025

From Scratch To Seven Seas A Northumberland Mans Circumnavigation

May 01, 2025 -

Dragons Den Airs Repeat Episode Leaving Viewers Disoriented

May 01, 2025

Dragons Den Airs Repeat Episode Leaving Viewers Disoriented

May 01, 2025 -

Police Watchdogs Concerns Ofcom Investigation Into Chris Kaba Panorama

May 01, 2025

Police Watchdogs Concerns Ofcom Investigation Into Chris Kaba Panorama

May 01, 2025